The more unpredictable the world, the more emotional the markets

Author

Olivier d’Assier

Lead Principal Investment Decision Research, SimCorp

When fundamental alpha confidence erodes, sentiment signals rise in relevance

When geopolitical uncertainty dominates markets, traditional fundamentals often take a back seat to investor emotion. Sentiment becomes the signal and not just the noise. Therefore, the ability to respond to sentiment shifts systematically becomes more important to the investment process and having the tools to uncover those shifts is crucial. 2025 provided a compelling case study of this dynamic in action.

In 2025, markets were buffeted by fast‑moving geopolitical shifts that mattered more than earnings calls, margin guidance, or FOMC meetings. Investors weren’t asking how companies would perform; they were asking whether global access, supply chains, or regulatory permissions would survive the next policy turn. Blue‑chip valuations increasingly moved on government decisions rather than product specs or profit metrics. A single policy signal could shake a stock more than a pristine balance sheet or technical white paper.

In this environment, the real edge wasn’t spreadsheet mastery, it was intuition. Anticipating the next geopolitical twist became the core skill. Investors had to feel their way through uncertainty, not calculate their way around it. In short, investing became an emotional game, not a rational one. In 2025, your gut made the call, and your head just tried to keep up and execute it. The year belonged to those who could sense what might happen next, not those who could model what should.

In 2025, investor sentiment became a tradable asset

A sentiment‑aware portfolio became the secret weapon of 2025. Traditional approaches like buying the index or traditional stock-picking couldn’t keep up with the speed and severity of geopolitical swings. What made the difference wasn’t just taking more risk or less risk but aligning exposure with investor sentiment in real time. In a year where uncertainty rewired investor’s behavior, sentiment wasn’t a signal; it was the signal.

"In a year where uncertainty rewired investor’s behavior, sentiment wasn’t a signal; it was the signal."

How we uncovered a Sentiment Risk Premium

In this analysis, we used the Axioma ROOF Scores which are sentiment indicators derived directly from the suite of Axioma equity risk models. By analyzing factor exposures within the risk model framework, ROOF Scores detect shifts in market risk appetite and gauge investor sentiment across global markets. Using this portfolio construction methodology, we built Risk‑On and Risk‑Off variants of the STOXX USA 500.

These portfolios rebalance monthly, shifting sector exposures to reflect the latest ROOF readings and stay in sync with evolving sentiment. We then tracked their 2025 performance to measure the existence and strength of a Sentiment Risk Premium (SRP): essentially, whether the market rewarded investors who adapted to sentiment as it changed.

The calm before the storm

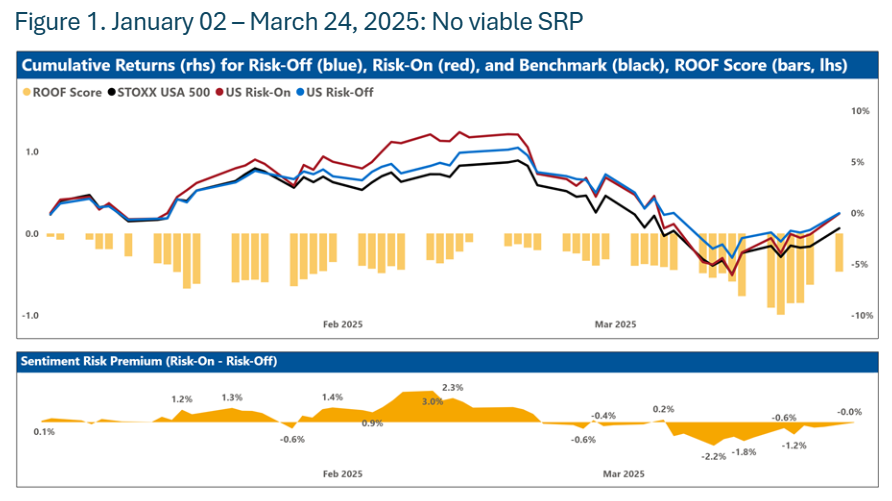

Across 2025, US investor sentiment went through three major regime shifts. In the early part of the year, investors largely stuck to their traditional playbook, even as a mild sense of unease crept in. During this initial phase, from January through March 24 (see Figure 1), markets showed no meaningful Sentiment Risk Premium. Investors had not yet begun reacting emotionally to the emerging “new normal,” and sentiment‑aware positioning offered no advantage…yet.

Sources: STOXX, SimCorp

Tariffs spark emotional response

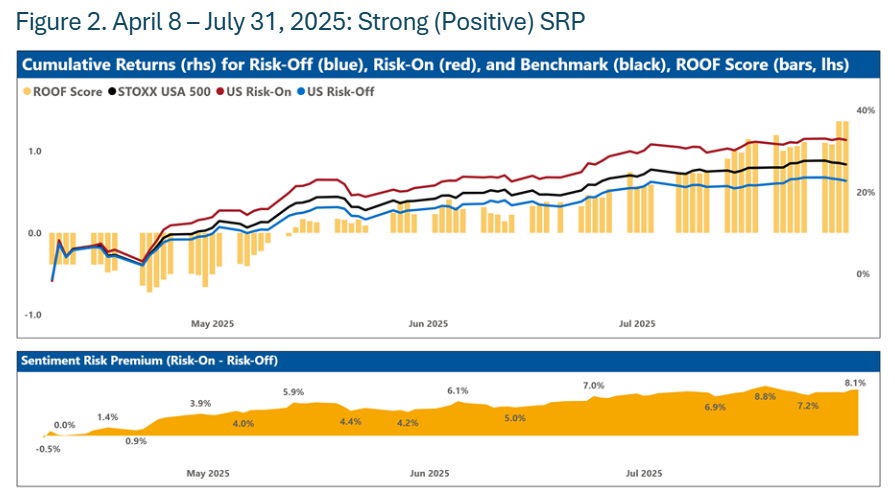

Everything changed in early April. The announcement of new tariffs on April 4 shook markets, and their sudden reversal four days later triggered an equally sharp emotional swing. The sense of relief that followed, a collective exhale after what looked like the start of a global trade confrontation, launched a sustained Risk‑On phase where sentiment clearly took control.

Figure 2 tracks the performance of all three portfolios: the index, the Risk‑On variant, and the Risk‑Off variant, during this sentiment‑driven period from April 8 to July 31, 2025. Across these months, the US market delivered a Sentiment Risk Premium (SRP) of 8.1%, measured as the performance gap between the Risk‑On and Risk‑Off portfolios. In other words, once investors became emotionally engaged, sentiment‑aware positioning materially outperformed.

Sources: STOXX, SimCorp

A summer of deteriorating sentiment

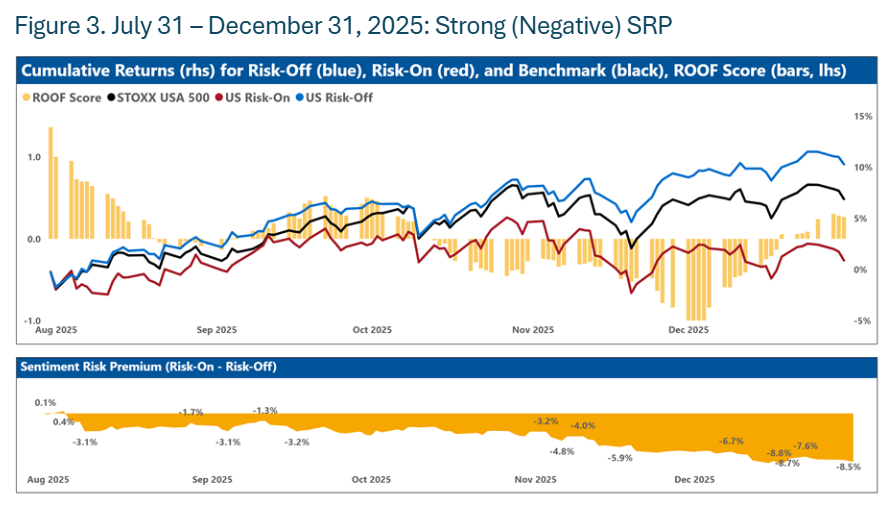

By mid‑summer, cracks began to appear in the apparent détente between the U.S. and China, its largest trading partner. Investor sentiment hit a turning point, peaking and then sliding steadily into bearish territory. This shift unleashed a period of negative Sentiment Risk Premium (SRP), as declining confidence weighed on market behavior for the rest of the year. This was a trend so persistent that even a year‑end return to neutral sentiment failed to reverse it.

Figure 3 illustrates the performance of the index, Risk‑On, and Risk‑Off portfolios from July 31 through December 31, 2025. During this stretch, the market delivered a negative Sentiment Risk Premium (SRP) of 8.5%, underscoring how strongly sentiment influenced returns once pessimism took hold.

Sources: STOXX, SimCorp

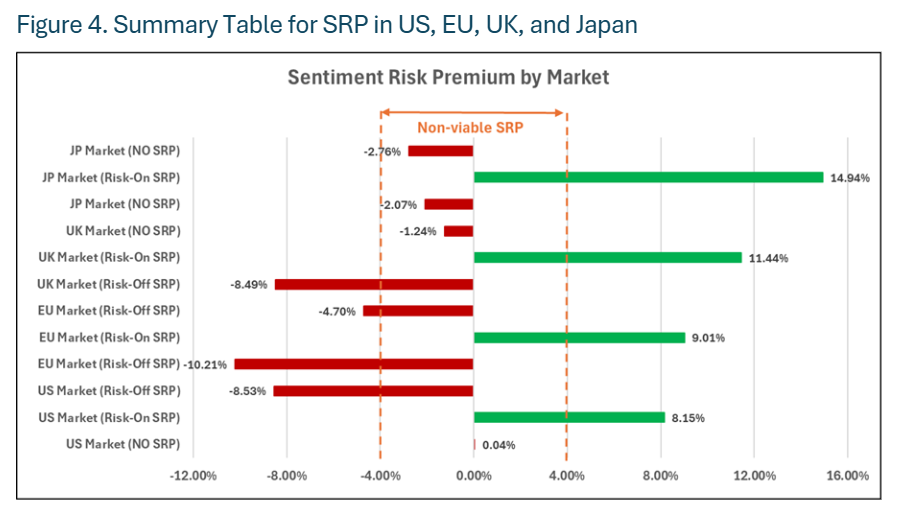

The Sentiment Risk Premium (SRP) wasn’t unique to the US market. We detected the same dynamic across the other three regions where we maintain ROOF Portfolios: Europe (STOXX Europe 600), the UK (STOXX UK), and Japan (STOXX Japan). Figure 4 highlights the periods in 2025 when each market exhibited a positive or negative Sentiment Risk Premium (SRP). Across all four markets, sentiment‑aware portfolios generated meaningful outperformance over their respective benchmarks, and did so with minimal active risk[1], underscoring the global relevance of sentiment as a tradable factor in 2025.

Sources: STOXX, SimCorp

Markets don’t move on facts alone

2025 taught investors a simple but uncomfortable truth, that repeats time and time again: markets don’t move on facts alone; they move on feeling. Fundamentals still matter, but they no longer operate in isolation. Sentiment can become a tradable force, shaping returns across regions, asset classes, and risk regimes.

Sentiment indicators, built from our risk models reveal something that traditional models often miss. When uncertainty spikes, investors don’t respond rationally, they respond emotionally. And those emotional shifts leave footprints, turning sentiment into a genuine source of return.

In a year defined by geopolitical whiplash, the investors who outperformed weren’t the ones who took the most risk. They were the ones who tracked the market’s mood and adapted to it. When sentiment changed, they changed with it. That was the edge.

To learn how to build risk-on and risk-off indicators, contact us.

References/footnotes

[1] ROOF Portfolios are rebalanced monthly to stay within a maximum of 5% of active risk from their respective benchmarks.