EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED NOVEMBER 21, 2025

Axioma Risk Monitor: Asia Pacific ex-Japan bears the brunt of the selloff; Info Tech was not the sole culprit; Risk climbs but remains near long-term medians

Asia Pacific ex-Japan bears the brunt of the selloff

Global equity markets plunged last week as mounting fears of an AI bubble burst and concerns over a slowing global economy rattled investors.

In a surprising twist, Nvidia’s strong earnings report on Wednesday initially fueled a rally early Thursday. However, optimism quickly faded, and global indices reversed course, tumbling sharply. The September jobs report added to the mixed signals: while new job creation exceeded forecasts, the unemployment rate ticked higher. Later, encouraging remarks from New York Fed President John Williams revived hopes for another rate cut, helping US stocks close higher on Friday.

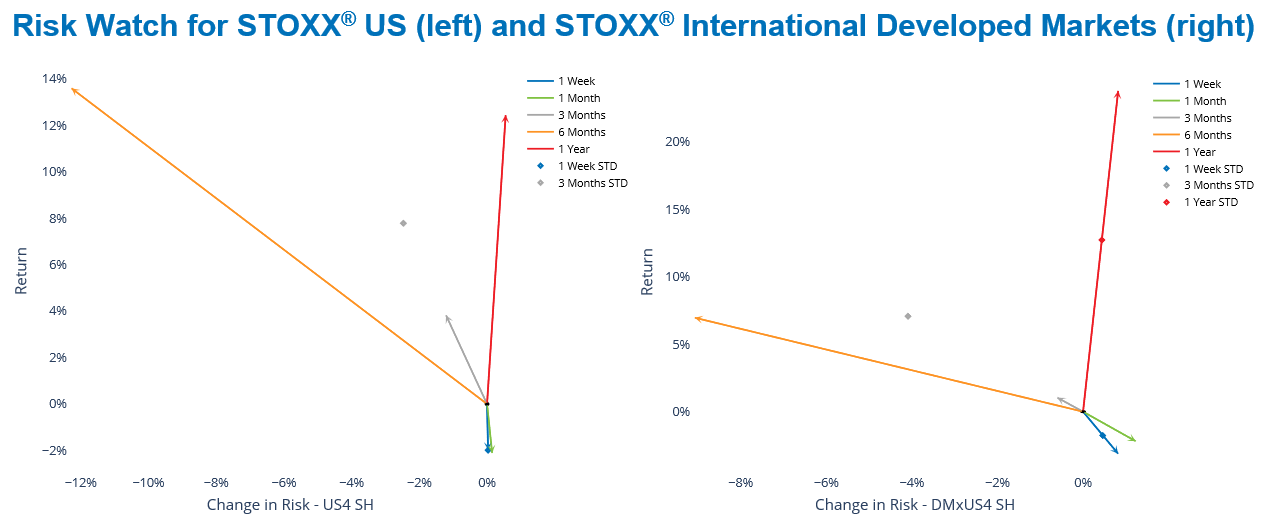

By week’s end, the STOXX US fell 2%, a decline within the bounds of the risk forecast at the end of the prior week. In contrast, Developed Markets ex-US, represented by the STOXX International Developed Markets (-3%), dropped well beyond one standard deviation from anticipated levels, as did the STOXX Europe 600 (-2%). The STOXX Asia Pacific ex-Japan posted the steepest loss (of 4.5%), more than two standard deviations below expectations. Expectation levels are measured by the predicted volatility of each regional Axioma fundamental short-horizon risk model at the beginning of the week.

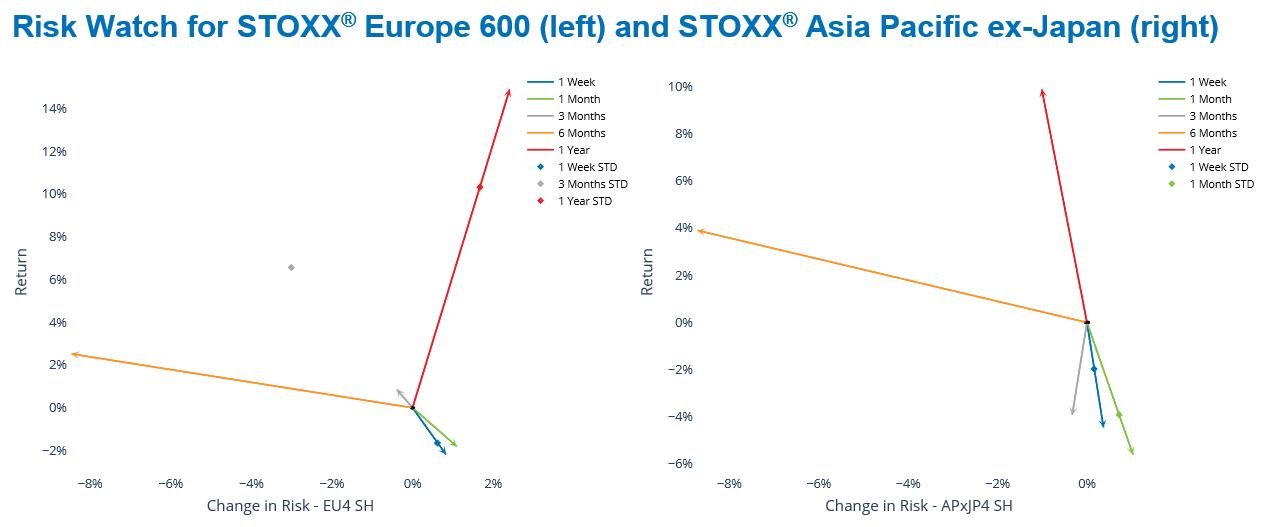

Quarter-to-date, Asia Pacific ex-Japan has suffered the largest decline among major regions tracked by the Equity Risk Monitors, sliding 6%. Following last week’s rout, only Japan, the UK, Europe, and Canada remain in positive territory so far in the fourth quarter.

Year-to-date, most major indices still show gains, led by Emerging Markets and Developed Markets ex-US. Asia Pacific ex-Japan, which had significantly outperformed earlier in the year, now holds only a slight lead over the US and Europe.

See charts from the STOXX US, STOXX International Developed Markets, STOXX Europe 600, STOXX Asia Pacific ex-Japan Equity Risk Monitors as of November 21, 2025:

The chart below is not included in the Equity Risk Monitors but it is available upon request:

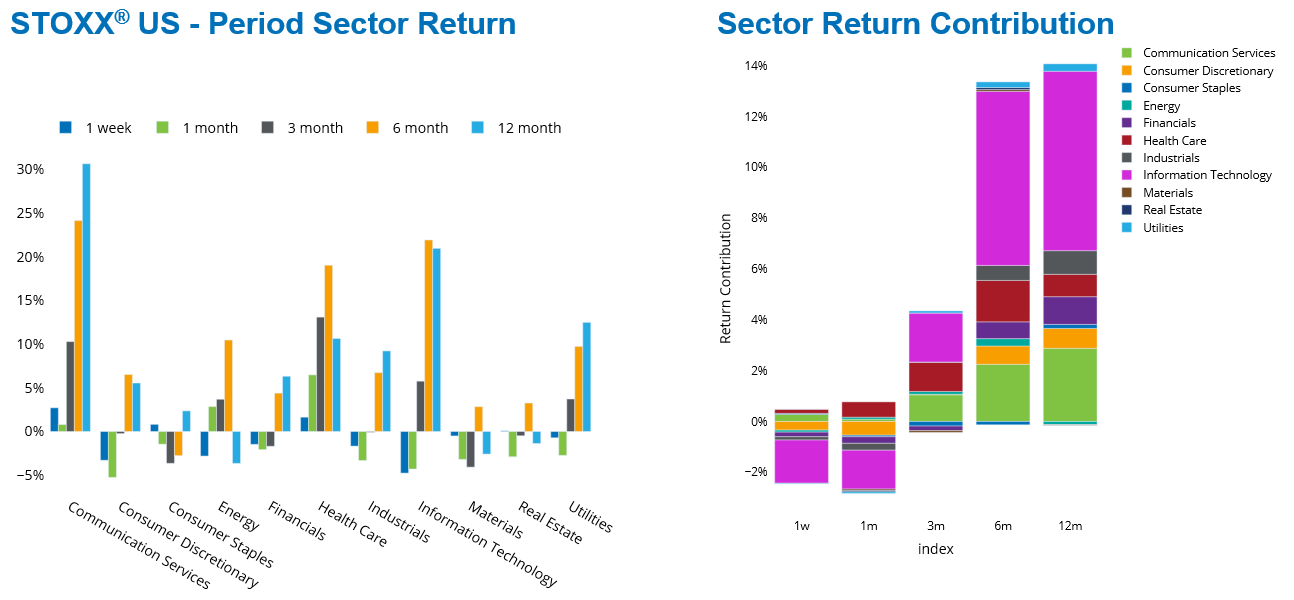

Info Tech was not the sole culprit

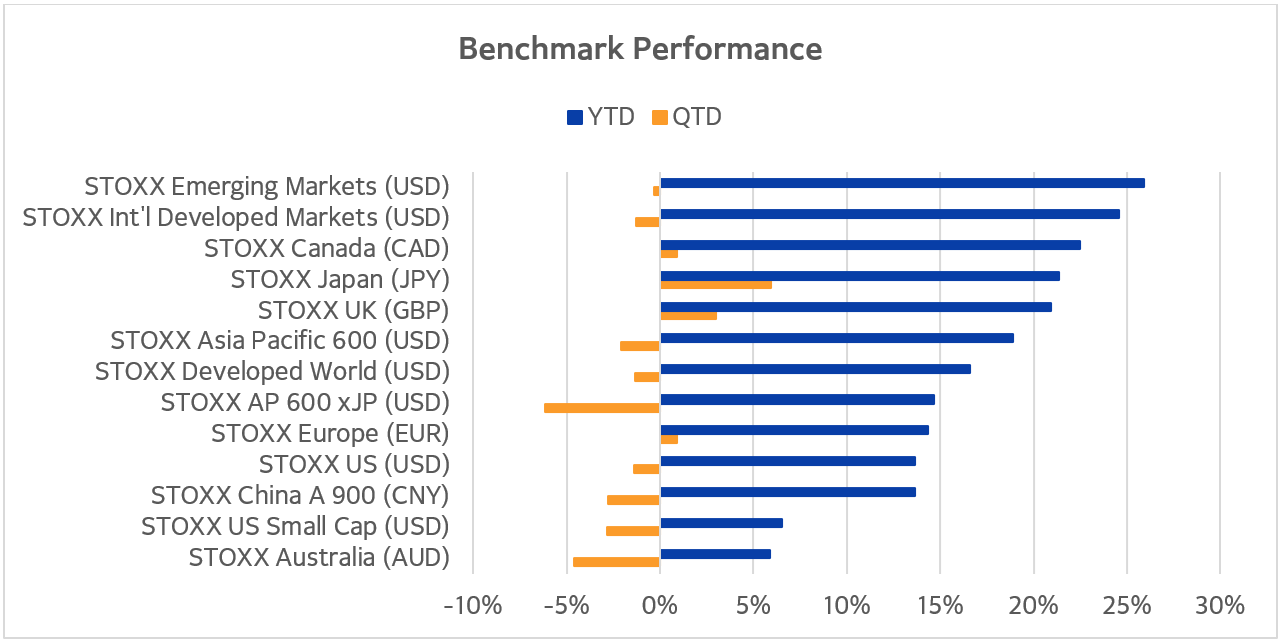

Although the Information Technology (Info Tech) sector has drawn most of the blame, last week’s downturn was broad-based, with nearly all sectors contributing to the decline—sometimes more than the tech sector itself.

Last week, Info Tech did see the largest losses among all sectors in the US, Europe, and Asia Pacific ex-Japan, but the magnitude of its impact on each market varied with its weight.

Driven by its heavy index weight of 35%, Info Tech accounted for nearly all (86%) of the STOXX US weekly decline. Still, six other US sectors also fell, amplifying the tech-led selloff.

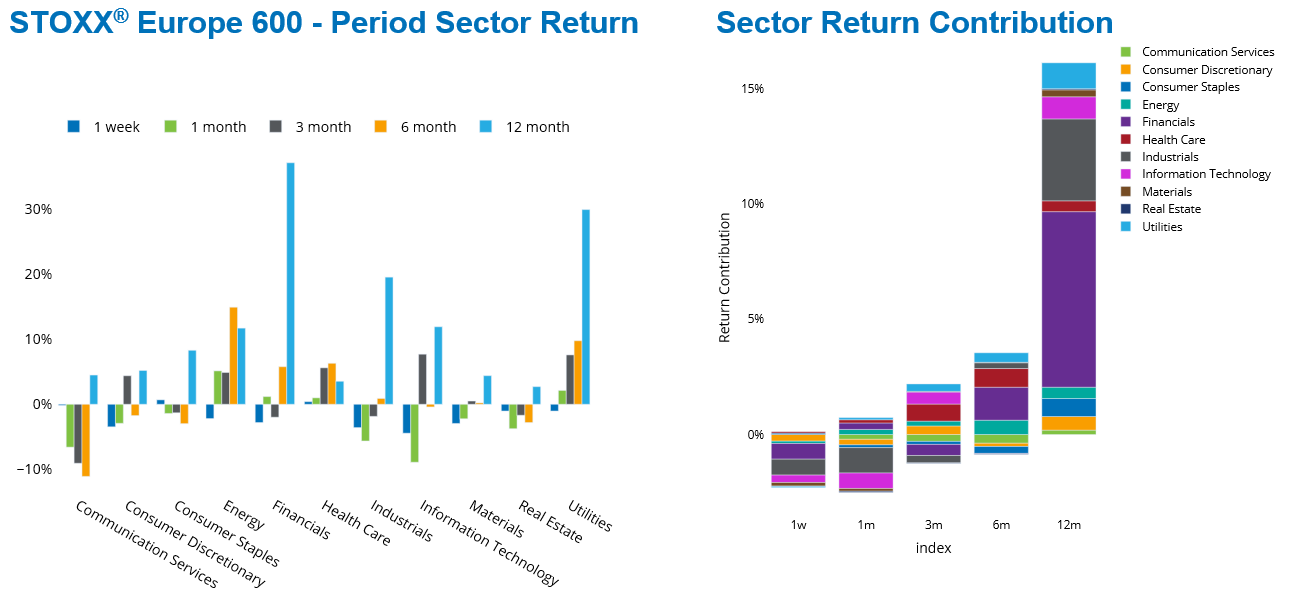

In Europe, Industrials and Financials—the region’s largest sectors—were the primary drivers of the STOXX Europe 600 weekly drop, while Info Tech and Consumer Discretionary ranked third and fourth. Most other European sectors also posted small negative contributions, except Consumer Staples and Health Care.

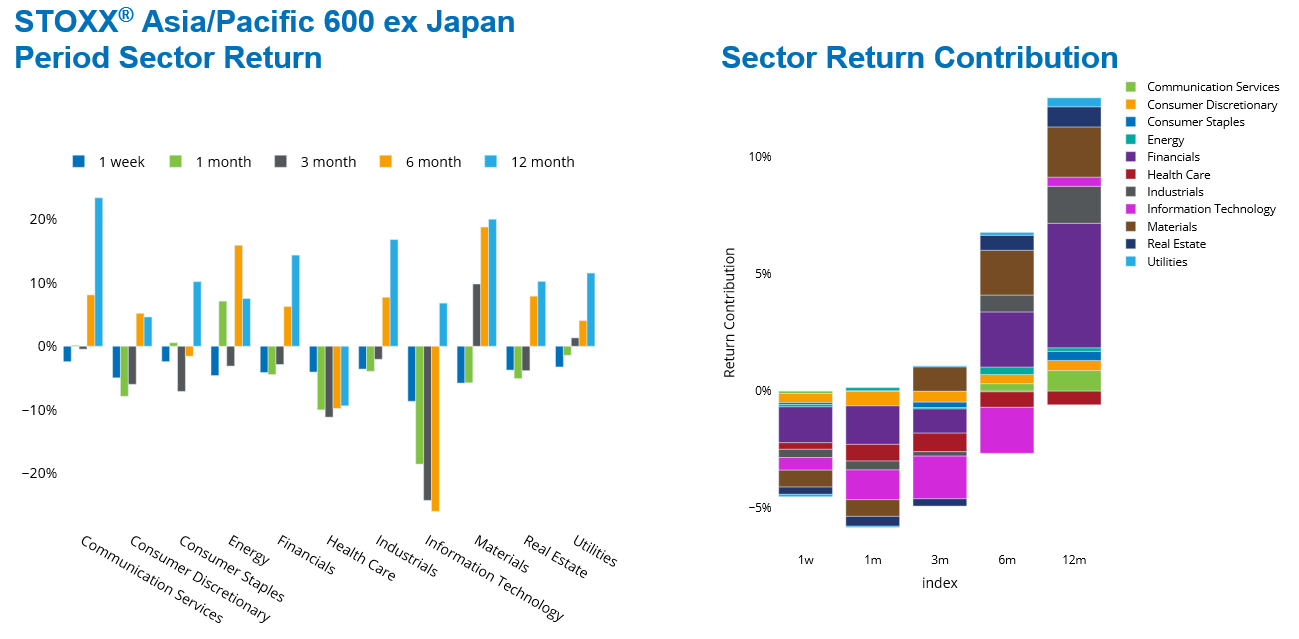

Asia Pacific ex-Japan saw weekly losses across all sectors, with Financials and Materials leading the decline ahead of Info Tech. Yet, Info Tech’s 9% weekly drop was nearly double its losses in the US and Europe. The sector has been sliding sharply in Asia for three months straight, plunging 24% over the period. By contrast, Info Tech remained in positive territory in the US and Europe, with three-month gains exceeding 5%.

Currently, Info Tech is the riskiest sector across all three regions, according to Axioma’s regional fundamental short-horizon models. Info Tech in Asia leads with a risk level of 31%, eight percentage points higher than in Europe and the US.

See graphs from the STOXX US Equity Risk Monitor as of November 21, 2025:

See graphs from the STOXX Europe 600 Equity Risk Monitor, as of November 21, 2025:

See graphs from the STOXX Asia Pacific ex-Japan Equity Risk Monitor as of November 21, 2025:

Risk climbs but remains near long-term medians

Equity market risk edged higher last week, with Europe experiencing the largest proportional increase, while Asia Pacific ex-Japan saw a smaller rise. US risk remained relatively flat despite sharp intraday swings.

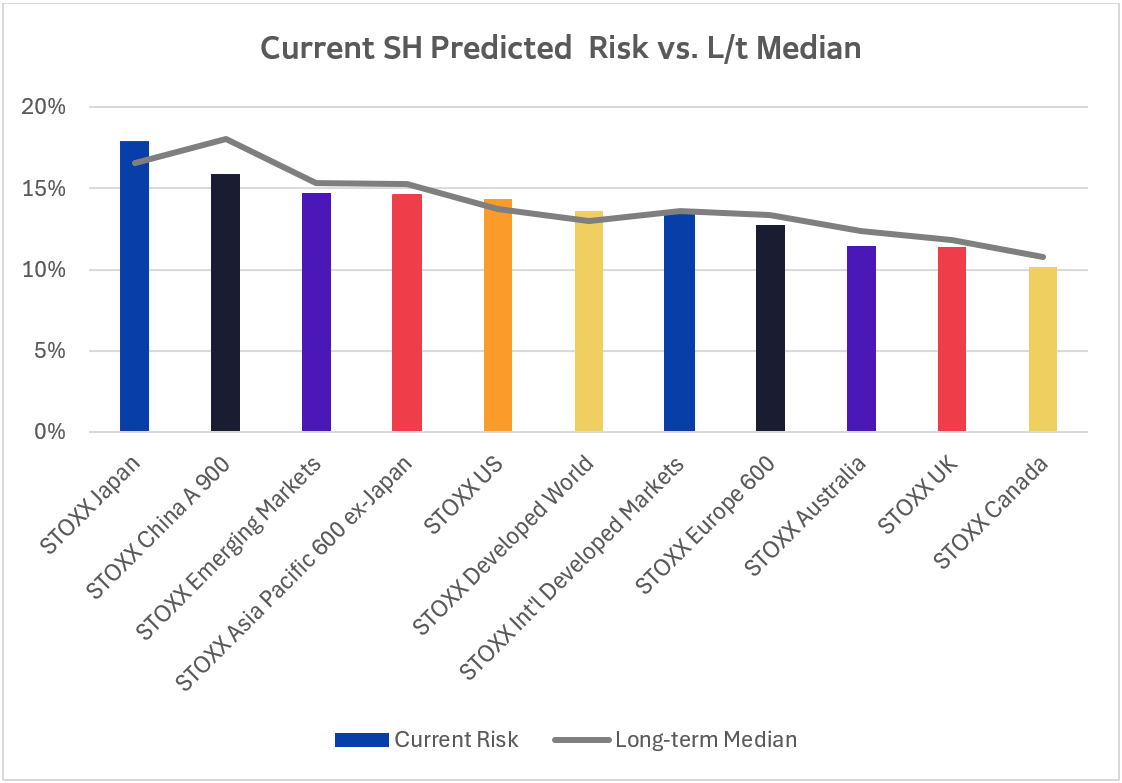

Even with recent increases, risk for most major indices remained below their long-term median since 2012 and below levels seen three months ago, based on Axioma’s fundamental short-horizon regional models. Across the indices tracked by the Equity Risk Monitors, only STOXX US, STOXX Japan, and STOXX Developed World exceed their medians—and by no more than one percentage point.

Japan is now the riskiest geography, followed by China and Emerging Markets, while the UK and Canada remained the least risky. The US is positioned somewhere in the middle of the pack.

Over the past three months, predicted risk has declined for many benchmarks, with reductions (proportional to the beginning level) ranging from -1% for STOXX Japan to -10% for STOXX Developed World. US risk fell 8%. Conversely, risk rose for STOXX Emerging Markets, STOXX Australia, Canada, and especially China A 900, where it surged 22%.

The decomposition of risk changes over the past three months, from the point of view of factor models, reveals factor volatility as the primary driver. Japan was an exception, where shifts in factor exposures drove risk lower, partially offset by changes in factor volatility and index composition.

From a dense matrix perspective, falling asset correlations were the main contributor to risk reduction, as investors increasingly differentiate between winners and losers. Meanwhile, individual stock volatility rose for all indices where risk increased—except Emerging Markets, where the increase in risk was due to the change in portfolio composition, which in turn was likely the result of higher concentration in AI-related names versus three months ago.

The charts below are not included in the Equity Risk Monitors but they are available upon request:

You may also like