EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED NOVEMBER 28, 2025

Strong Week For Equity Markets Worldwide

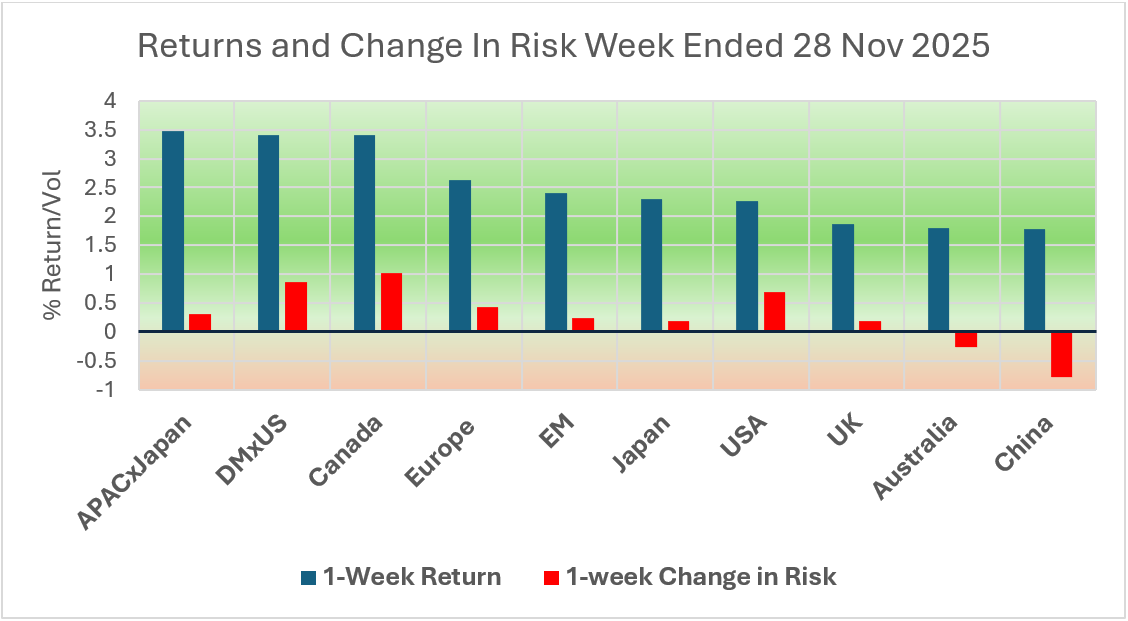

While it was a shortened week in the United States due to the Thanksgiving holiday, Equity markets worldwide had a strong week while most risk forecasts were unchanged or up slightly, with only Australia and China showing falling volatility forecasts:

Source: Axioma

Crowding and Size in the US

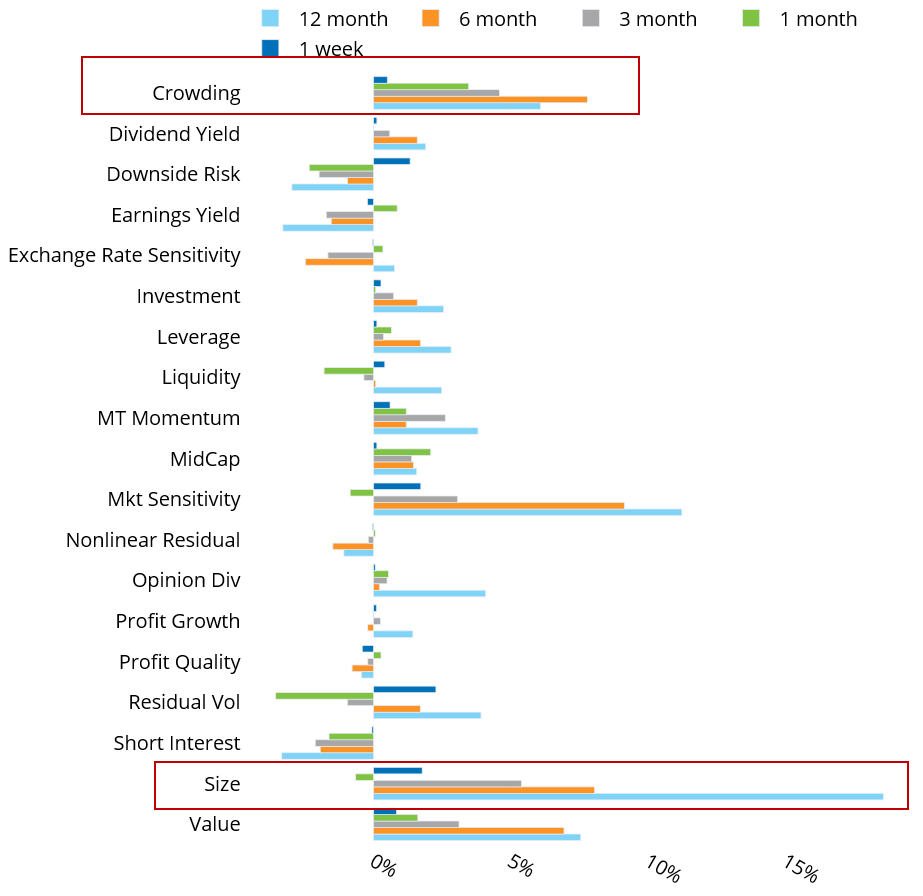

We mentioned the strong returns to Crowding in the US51 model back on the 14th of November but it is worth revisiting as the factor has been on a tear since the first week of October:

Source: Axioma, Arcana

To put that in perspective, the forecast annualized volatility of the Crowding factor is generally between 2-3%. On October 6th, the Medium-Horizon Model forecast for Crowding was 2.56%. The Cumulative factor return since that date is 4.59%, and when we downscale the annualized volatility forecast to a 40-day vol, the factor return looks like a 4.5 standard deviation event. Prior to this latest run, Crowding was within its range of expectation for the year.

Over that same time period, the leading factor YTD in the US by far, Size, petered out somewhat, demonstrating that the crowded stocks are not necessarily the mega-cap stocks that have been driving the index much of the year:

Source: Axioma, Arcana

In case you haven’t been paying attention , the US5.1 Size factor is up almost 22% YTD. To put that in perspective, the geometric average annual return of the Size factor in the US from 1982 to 2024 is -3.7%. Prior to 2025 the largest annual positive return to Size was in 1998 just prior to the peak of our last tech bubble, when it was 12.1%. The second largest was the year we had the emergence of the “Magnificent 7”: 2023, when Size was up 10.6%. In 2025, which has one month to go, we have nearly doubled that record. This will also be the first time that the factor return will be positive for three consecutive years.

We are not making any calls here, but if there were ever a time series that looked ripe for mean reversion, this is it.

See chart from US Equity Risk Monitor dated Friday, November 28, 2025

You may also like