EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED DECEMBER 12, 2025

Axioma Risk Monitor: Emerging Markets lead gains as risk levels normalize in strong year; Info Tech and Financials power global returns; Most countries thrive amid broad US dollar decline

Emerging Markets lead gains as risk levels normalize in strong year

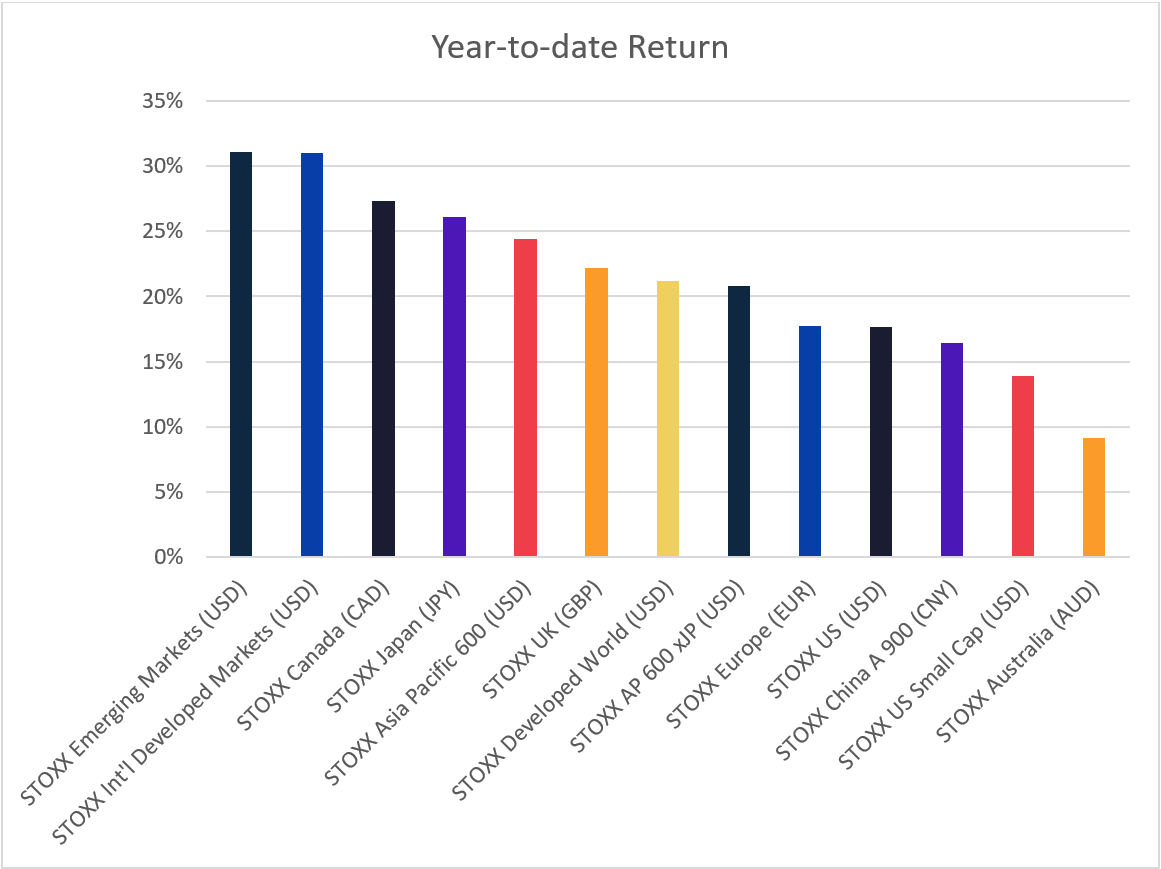

Global stock markets are poised to end the year on a strong note, all in positive territory, with most posting double-digit gains. Year-to-date, STOXX Emerging Markets and STOXX International Developed Markets (representing Developed Markets ex-US) lead the pack, each up 31%. At the opposite end, among regions tracked by the Equity Risk Monitors, STOXX Australia (8%), STOXX US Small Cap (14%), and STOXX China A 900 (16%) delivered the weakest results.

The recent rally in US equities following last week’s interest rate cut—largely anticipated by investors—was abruptly halted by renewed concerns over AI-related spending and lofty valuations in the sector, sparked by Oracle’s perceived overspending on AI infrastructure. Despite last week’s modest decline, STOXX US maintains a year-to-date return of 18%, matching STOXX Europe 600 when measured in local currency.

Currently, Emerging Markets are outperforming Developed Markets by 10 percentage points, while Developed Markets ex-US are ahead of the US by 13 percentage points.

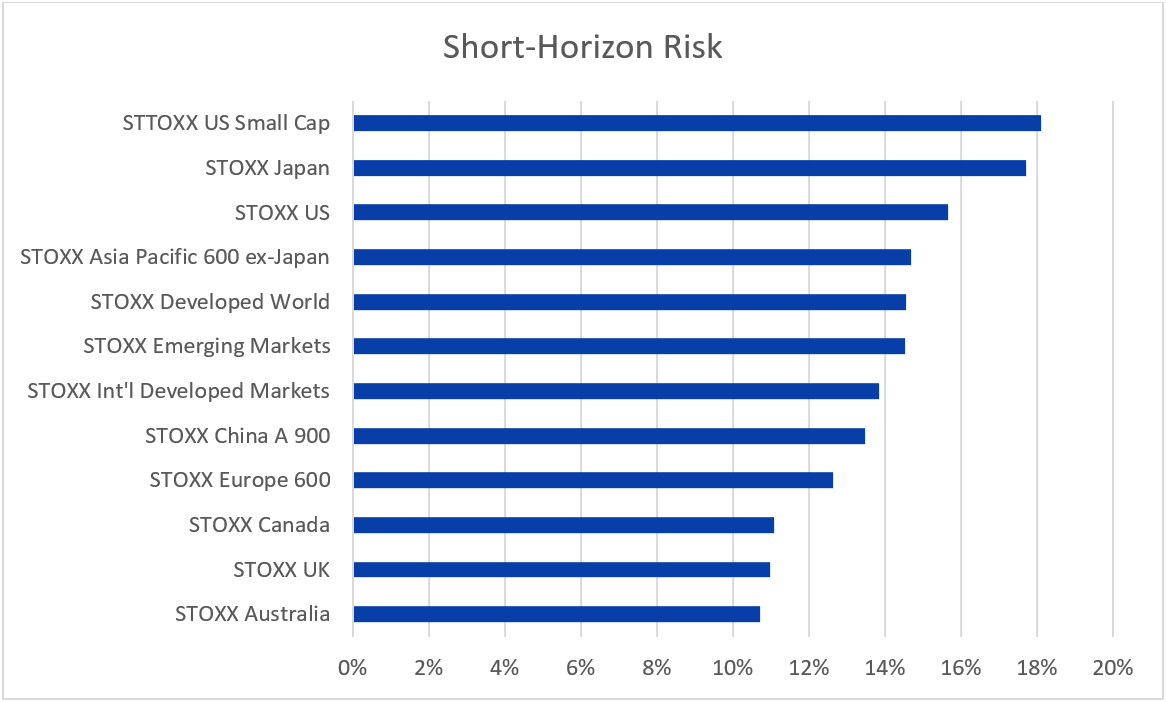

Risk forecasts across all geographies have come full circle this year. After surging in April, they dropped sharply, and although they climbed again in the fourth quarter, most regions are now close to their January levels and near their respective long-term medians.

STOXX US Small Cap ranks as the riskiest index, followed by STOXX Japan and STOXX US, whereas STOXX Australia, UK, and Canada remain the least risky.

The graphs below are not included in the Equity Risk Monitors but are available upon request:

Info Tech and Financials power global returns

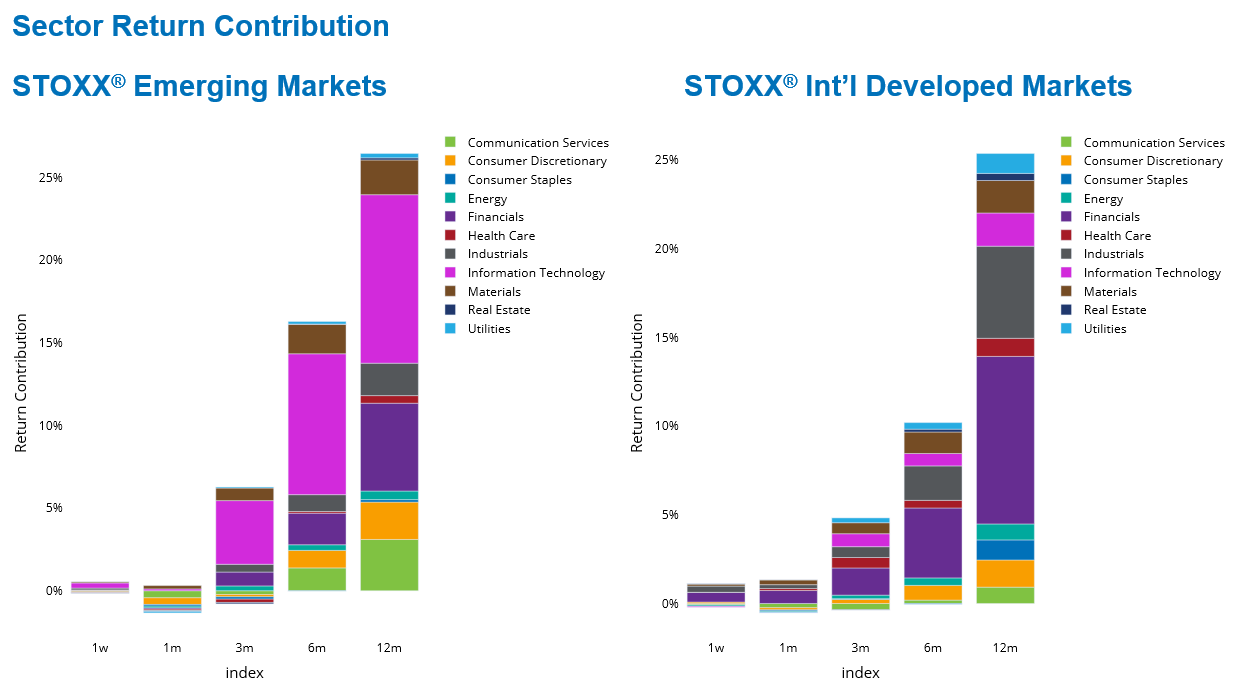

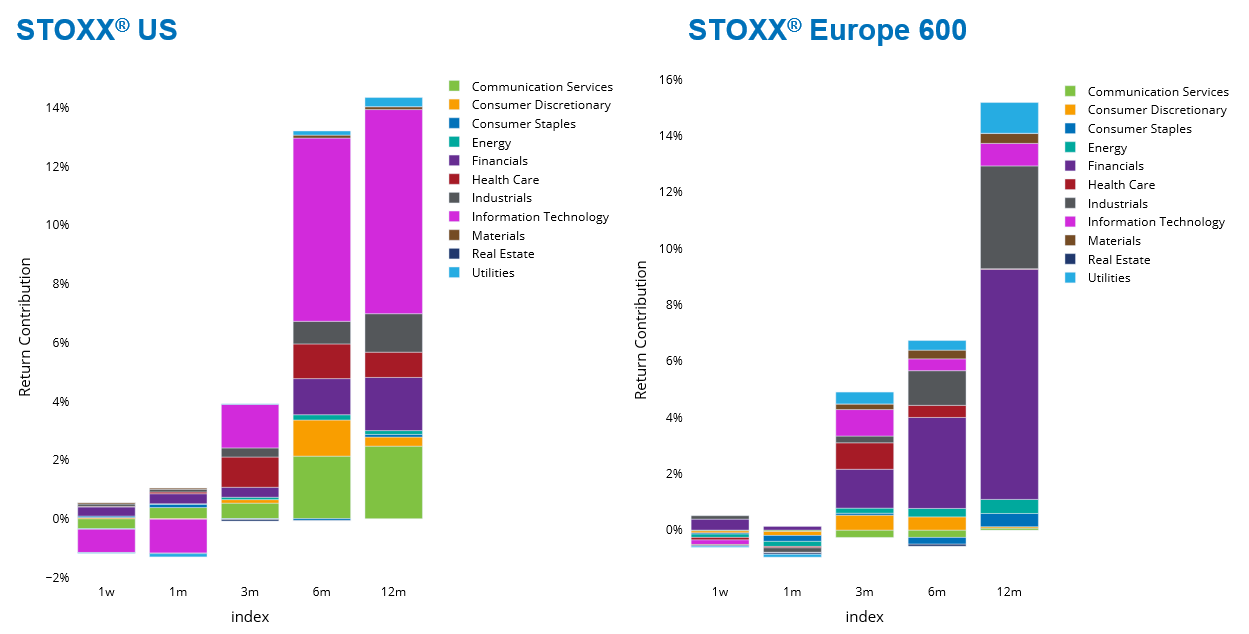

The stellar year-to-date returns in leading regions were fueled by Information Technology and Financials in STOXX Emerging Markets, and by Financials and Industrials in STOXX International Developed Markets. Similarly, Financials and Industrials drove gains in STOXX Europe 600, while in STOXX Asia Pacific ex-Japan, Financials and Materials played the key roles. With attention firmly fixed on tech companies, the widespread influence of Financials across regions is noteworthy.

Although tech stocks have faced a downturn over the past month, Information Technology remains the primary contributor to 12-month gains in the US, followed by Communication Services. Information Technology was among the hardest-hit sectors following the announcement of additional US tariffs in April, yet it rebounded from early-year losses and is now on track to finish 2025 with the second-largest gain after Communication Services in STOXX US.

Across global markets, Information Technology stands out as the riskiest sector, Consumer Staples consistently ranks as the least risky, and Financials sits somewhere in the middle.

See graphs from various Equity Risk Monitors as of December 12, 2025:

See graph from the STOXX Developed World Equity Risk Monitor as of December 12, 2025:

Most countries thrive amid broad US dollar decline

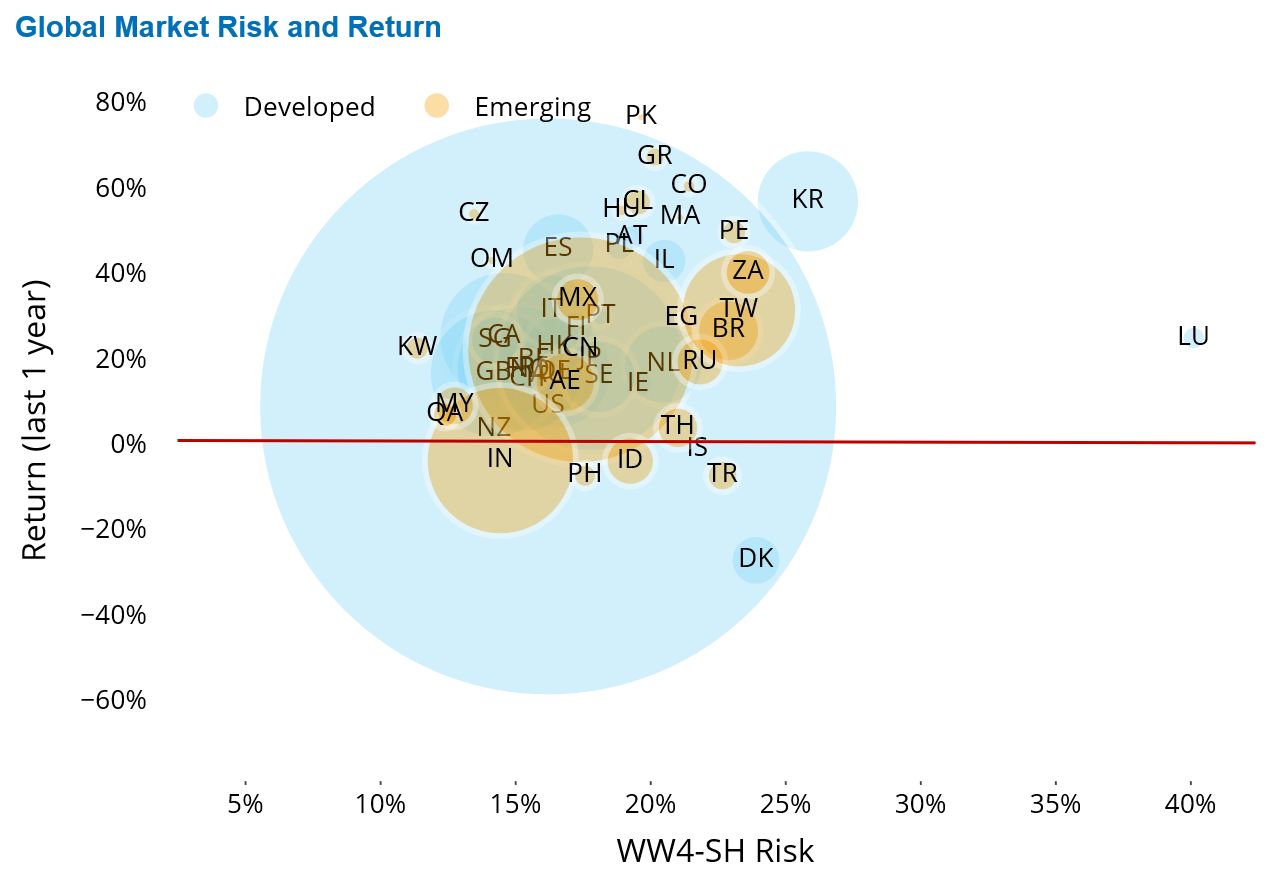

Examining country-level returns in US dollar terms, Greece, Hungary, and the Czech Republic in Europe, along with Colombia, Chile, and Peru in Latin America, are among the emerging markets posting the highest annual gains—each exceeding 50%. In Asia, South Korea (57%) and Taiwan (31%) lead the way, buoyed by semiconductor demand tied to AI-related businesses.

Only a handful of major countries recorded losses over the past 12 months: among developed markets, Iceland slipped by 1%, while Denmark suffered a steep 27% decline. In emerging markets, India, Indonesia, the Philippines, and Turkey fell between 4% and 7%.

South Korea and Taiwan rank among the riskiest countries globally, alongside Denmark, despite the former two posting strong gains and the latter enduring sharp losses. A similar contrast appears at the lower end of the risk spectrum, where India and the Czech Republic share comparable risk levels (around 14%) despite an extraordinary 60-percentage-point gap in their 12-month returns.

Middle Eastern nations such as Kuwait and Qatar recorded the lowest risk levels (below 13%), according to Axioma’s Worldwide fundamental short-horizon model. Meanwhile, the US and China’s risk stand squarely in the middle of the global pack.

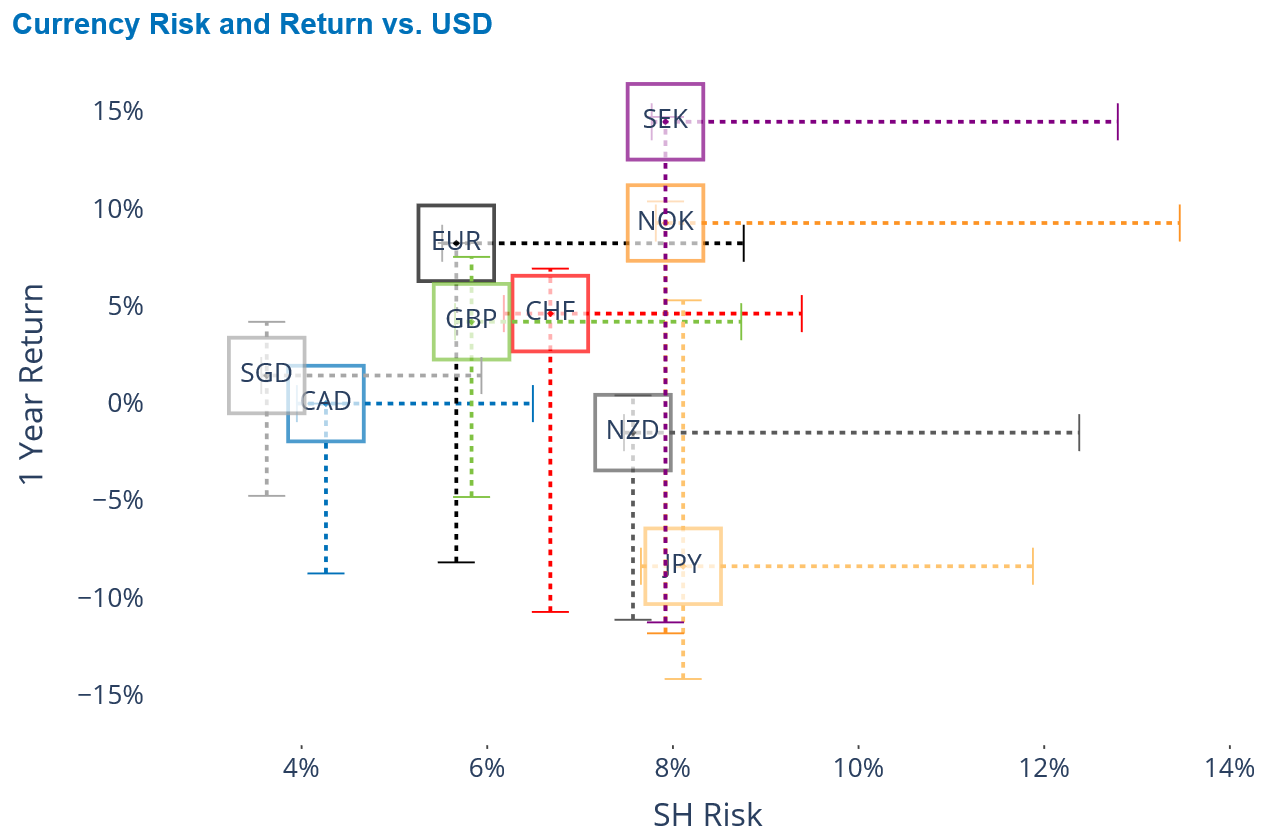

Currency fluctuations played a key role in shaping returns, as the US dollar remained under sustained pressure throughout the year. Major European currencies appreciated against the dollar, led by the Swedish krona and Norwegian krone, followed by the euro. Conversely, the Japanese yen lost the most ground against the greenback.

Yet, the top gainer and loser among developed currencies shared similar risk levels (8%), as measured by Axioma’s Worldwide fundamental short-horizon model. The Canadian dollar and Singapore dollar were the least risky.

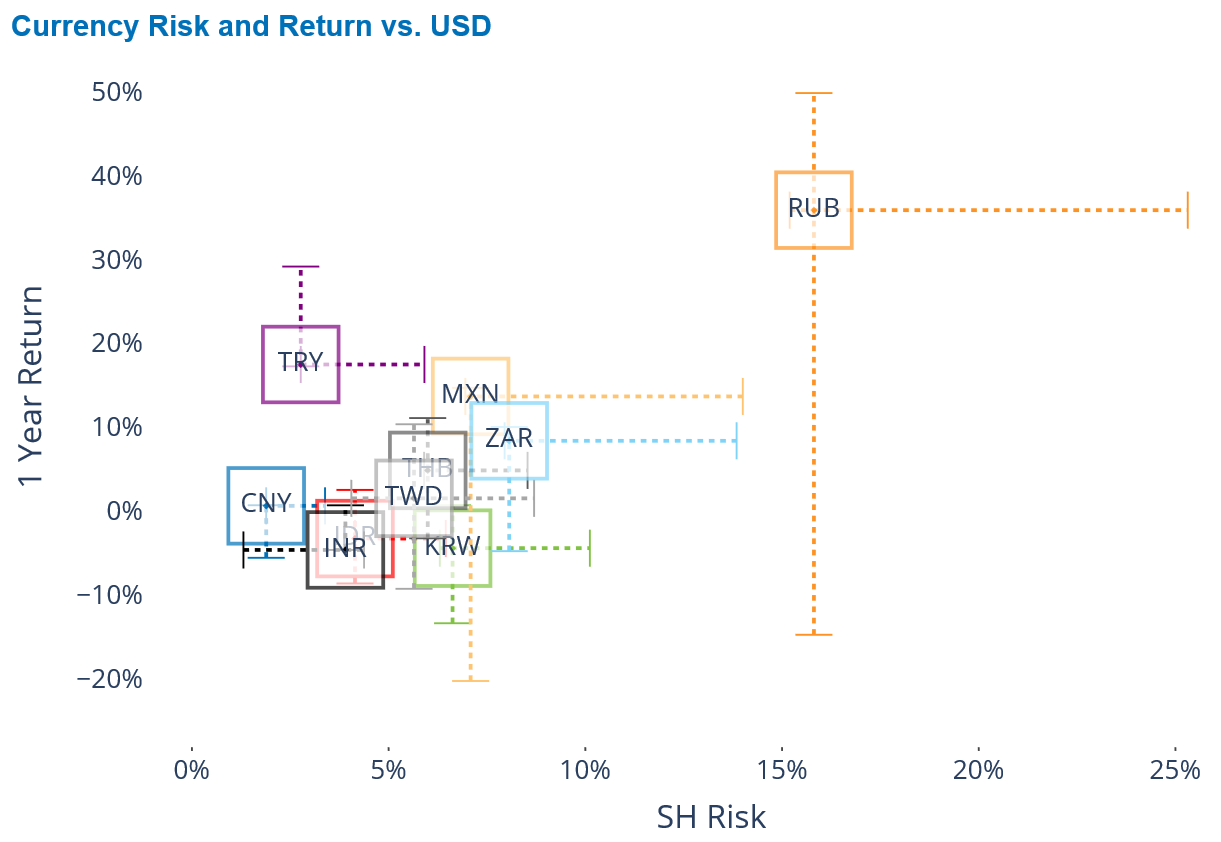

Among emerging-market currencies, the Russian ruble and Turkish lira posted substantial gains, while the Indian rupee and South Korean won each fell nearly 5% against the US dollar. The ruble remained the riskiest currency, whereas the Chinese yuan was the least risky—though its volatility is tightly controlled by Beijing.

See graphs from the STOXX Developed World Equity Risk Monitor as of December 12, 2025:

See graphs from the STOXX Emerging Markets Equity Risk Monitor as of December 12, 2025:

You may also like