EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED JANUARY 16, 2026

Japan and Korea Rally

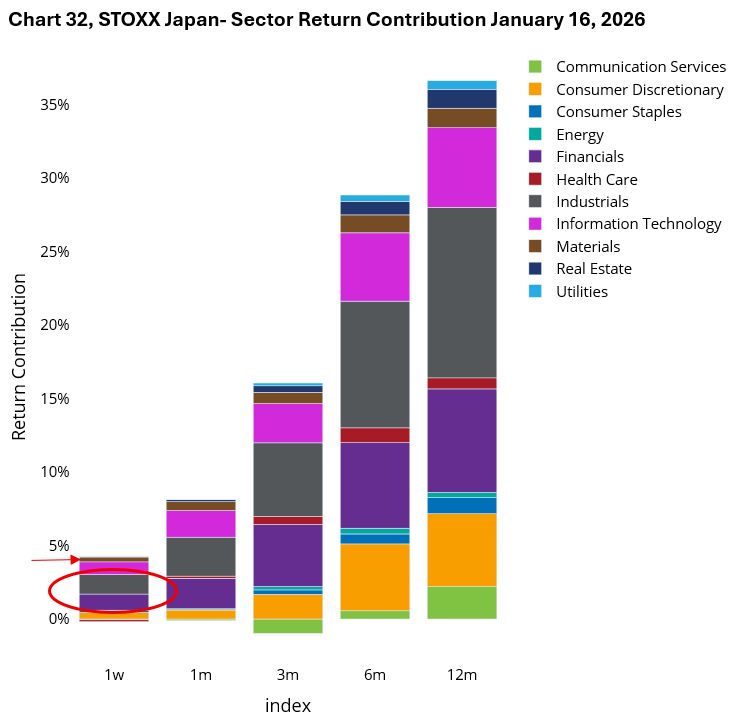

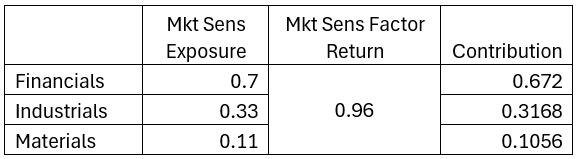

While geopolitical headlines last week mainly concerned themselves with President Trump’s quizzical push to “own” Greenland, other shifts were underway as well. First-year Prime Minister Takaichi’s proposal of snap elections in Japan led to higher expectations of fiscal stimulus, which induced a sell-off in long-end Japanese Government Bonds and consequently a rally in Japanese Financials stocks (+4.97%). While the JPY/USD rate did not change meaningfully over the course of the week, Industrials and Materials rallied as well (due to expectations for political support of a strong export environment (weak Yen):

Industrials were up 3.75% while Materials were up 6.11%. Materials are hard to make out in the stacked column above due to their relatively small index allocation (4.5%) while Industrials and Financials are the largest and second largest (26%, 16.5% respectively) sectors in the STOXX Japan index. All three sectors have meaningful exposure to Market Sensitivity as well and that factor had a 0.96% return for the week:

While we don’t have a stand-alone Korea risk model to give us more concrete insights into market performance in that country, news reports allude to similar “weak” currency support for export focused industries such as semiconductors and automobiles (IT, Industrials sectors, respectively).

US Momentum is SMALL

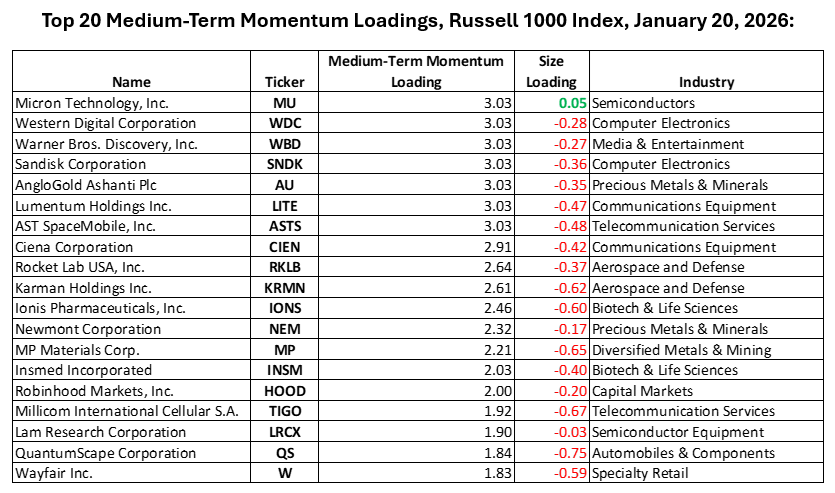

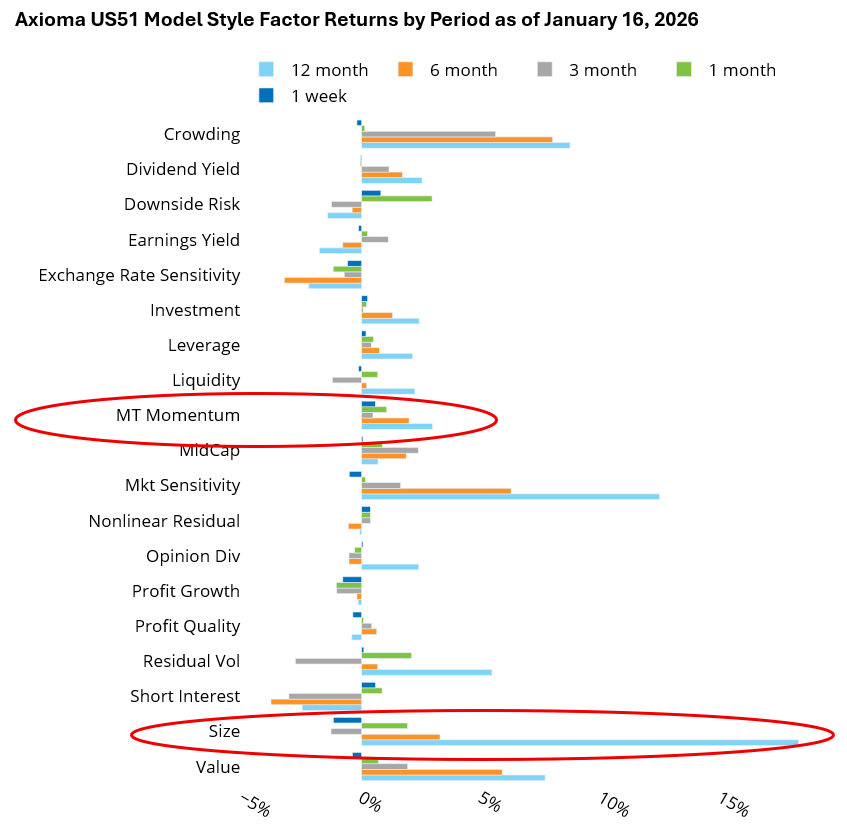

Although the US market as represented by the Russell 1000 was up about 1.6% through Jan. 16th, the Size factor, which had it’s largest annual return ever in 2025, has been no help. Year to date, Size is down 7 basis points (bps), with a stunning reversal last week, falling 118 bps. In the meantime, Medium-Term Momentum is up 90 bps YTD and was up 57 bps last week.

While this Momentum shift to smaller names has been in motion for a while, it is worth pointing out that out of the top 50 stocks by Momentum loading in the Russell 1000 all have negative Size exposures with the exception of MU (Micron Technology), PLTR (Palantir), and AMD (Advanced Micro Devices) whose Size loadings are 0.05, 0.08, and 0.05, respectively. A sample of the top 20:

Source: Russell, Axioma US51-MH

You may like this