EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED JANUARY 23, 2026

Axioma Risk Monitor: US Small Caps lead performance while relative risk remains typical; Lower correlations continue to suppress equity markets’ volatility; As sentiment turns bullish in Emerging Markets, trading volumes swell

US Small Caps lead performance while relative risk remains typical

US Small Caps have emerged as the strongest performers in 2026, delivering substantial outperformance against Large Caps while maintaining a level of relative risk that remains broadly in line with historical norms.

The US equity market closed the shortened trading week modestly lower, as geopolitical tensions surrounding Greenland unsettled investors. Markets sold off sharply on Tuesday following renewed concerns over potential US tariff actions, but losses were pared later in the week after President Trump outlined a potential framework for a Greenland agreement with NATO and walked back the tariff threat. Both the STOXX US and STOXX US Small Cap indices finished the week down roughly 40 basis points, with Monday’s session closed in observance of the Martin Luther King Jr. federal holiday.

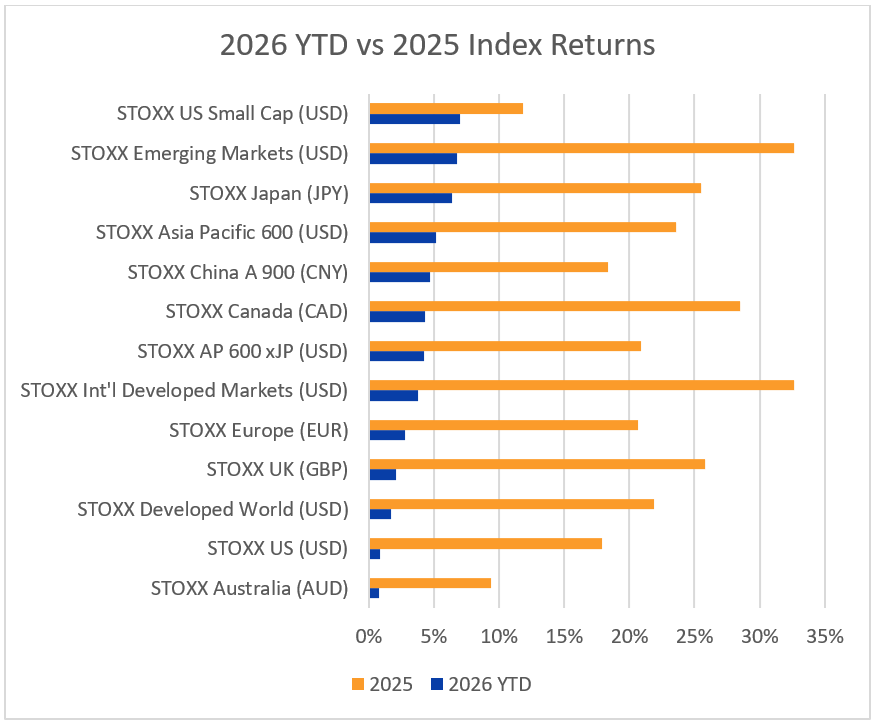

Despite last week’s pullback, the STOXX US Small Cap index has outperformed all major markets so far in 2026, gaining approximately 7% year to date. By contrast, the STOXX US index is among the weakest performers, alongside STOXX Australia, with both markets up less than 1% for the year. Small Caps have outpaced Large Caps by roughly six percentage points so far this year—a sharp reversal from 2025, when the opposite dynamic prevailed and STOXX US Small Cap trailed STOXX US by a similar margin. Last year’s 12% return for Small Caps ranked second lowest among all regions tracked by SimCorp’s Equity Risk Monitors, ahead of only Australia.

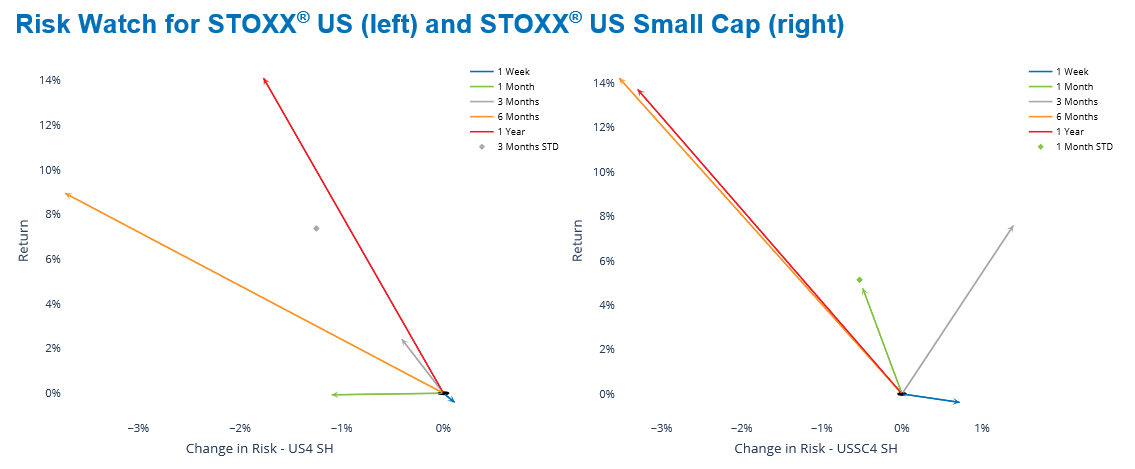

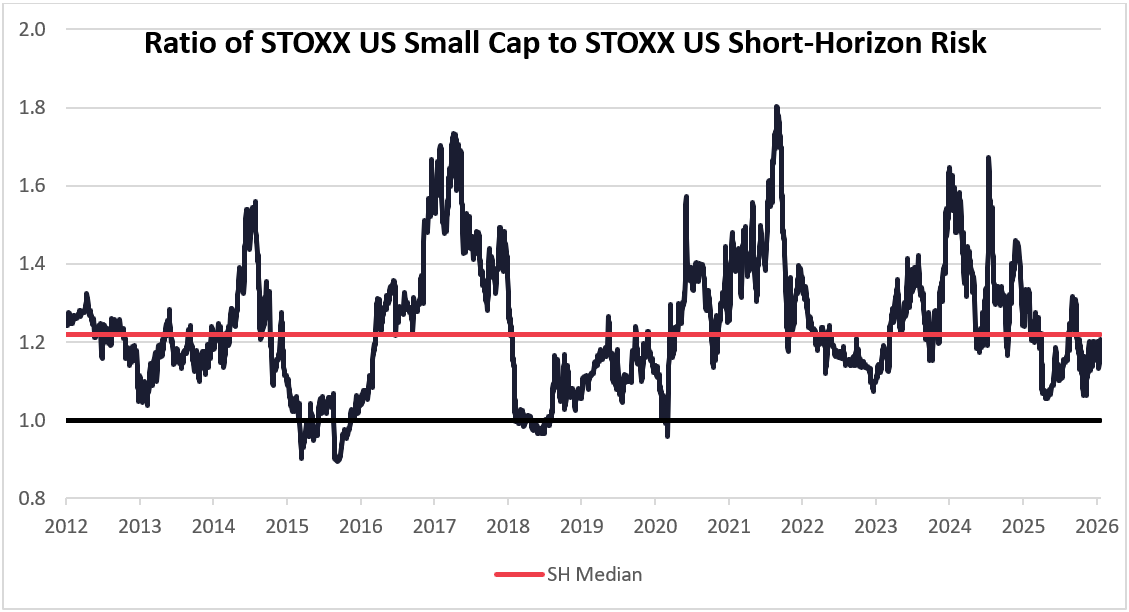

From a risk perspective, forecasted volatility for STOXX US and STOXX US Small Cap indices briefly converged last October, when both reached their lowest levels of the past 12 months, based on Axioma’s US4 All Cap and US4 Small Cap models, respectively. Since then, however, Small Cap risk has climbed more rapidly. The STOXX US Small Cap index is now about 22% riskier than STOXX US index—a typical level of relative riskiness, situated near the long-term median of the ratio between small and large-cap forecasted risk.

See charts from the STOXX US and STOXX US Small Cap Equity Risk Monitors as of January 23, 2026:

The charts below are not included in the Equity Risk Monitors but are available upon request:

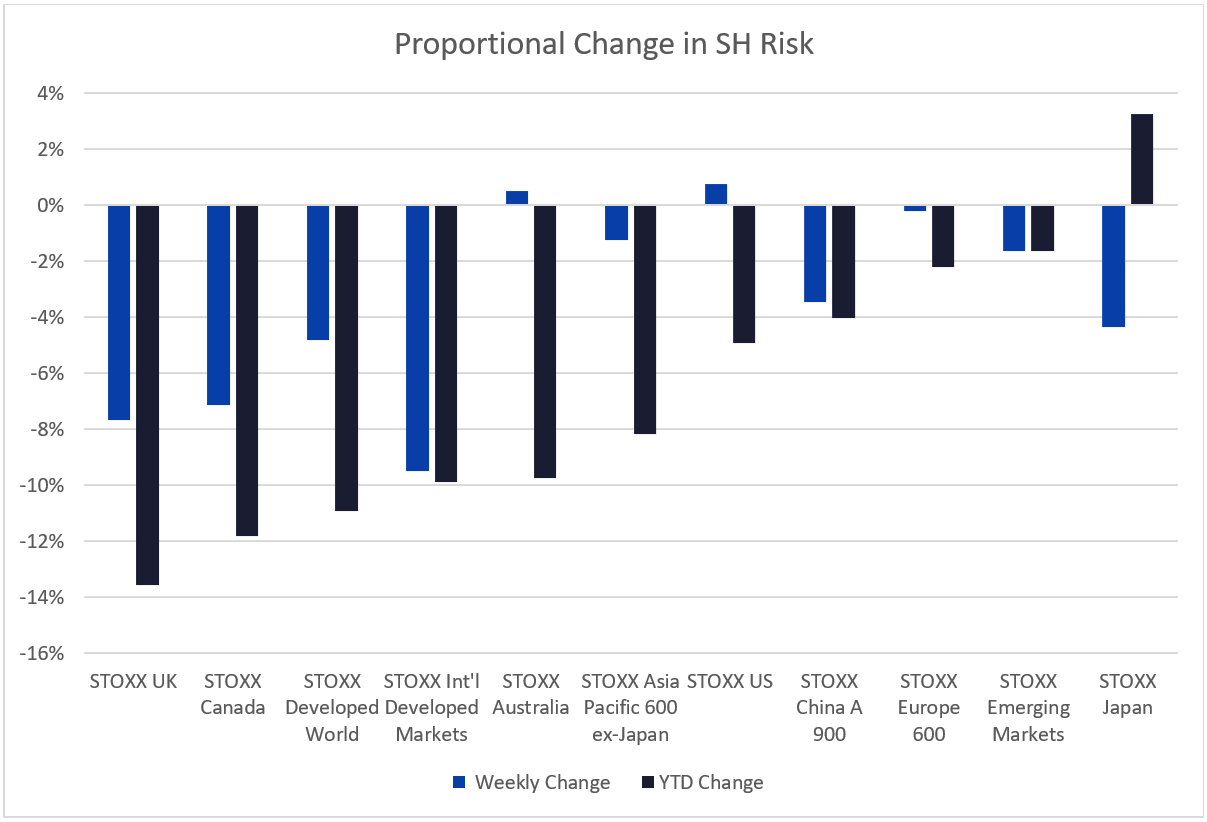

Lower correlations continue to suppress equity markets’ volatility

Against a backdrop of persistent geopolitical and macroeconomic uncertainty, volatility across most global equity markets continued to ease. Even last week, short-horizon predicted risk was down for all geographies with the exception of the US and Australia—where risk ticked modestly higher. Japan remains the only market where risk has risen since the start of the year, driven by domestic political developments. As of last Friday, only the US and Japan exhibited risk levels slightly above their respective long-term medians (going back to 2012), among all regions tracked by SimCorp’s Equity Risk Monitors.

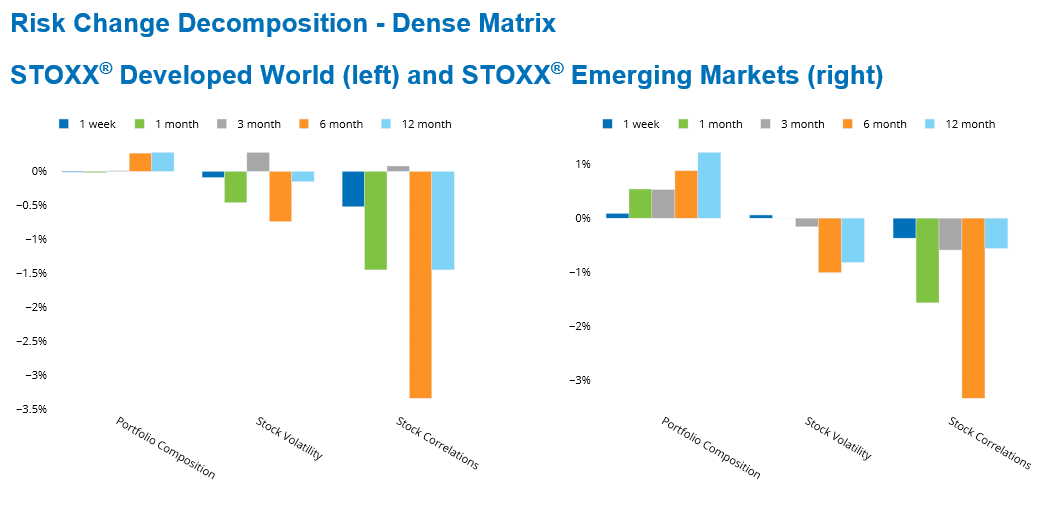

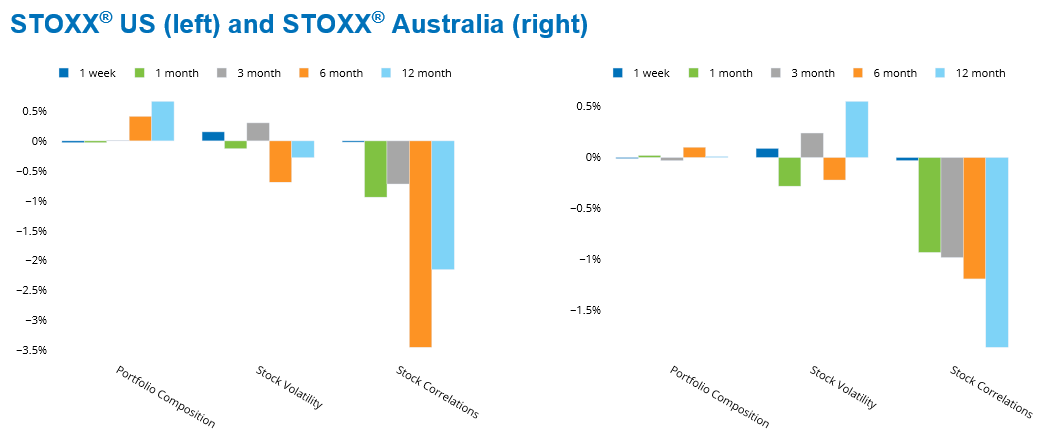

The decomposition of recent risk changes from the perspective of a dense matrix highlights the critical role of declining asset correlations. Lower correlations have been the primary driver of falling risk across both Developed and Emerging Markets over the past week and month. In fact, the reduction in Emerging Markets risk stems entirely from correlation effects during both periods. Conversely, the modest uptick in risk observed in the US and Australia last week was attributable solely to higher stock volatility.

The chart below is not included in the Equity Risk Monitors but is available upon request:

See charts from the STOXX US, STOXX Australia, STOXX Developed World and STOXX Emerging Markets Equity Risk Monitors as of January 23, 2026:

As sentiment turns bullish in Emerging Markets, trading volumes swell

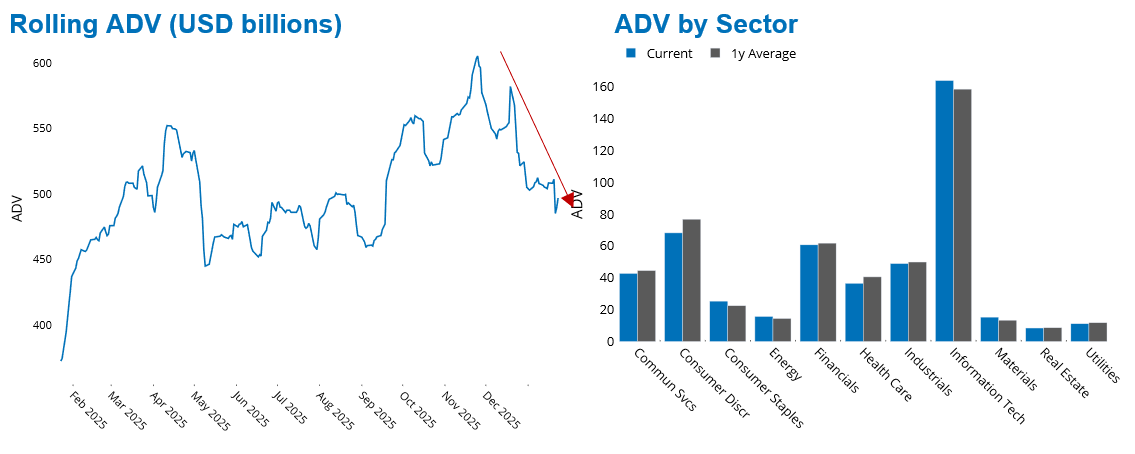

The pronounced decline in Developed Markets risk appears consistent with investors’ hesitation reflected in weakening trading activity. Average daily trading volume (ADV) for the STOXX Developed World index has dropped significantly since peaking in November. Nearly all sectors contributed to the slowdown, with Information Technology and Consumer Staples the only segments currently posting volumes markedly higher than their respective one-year averages.

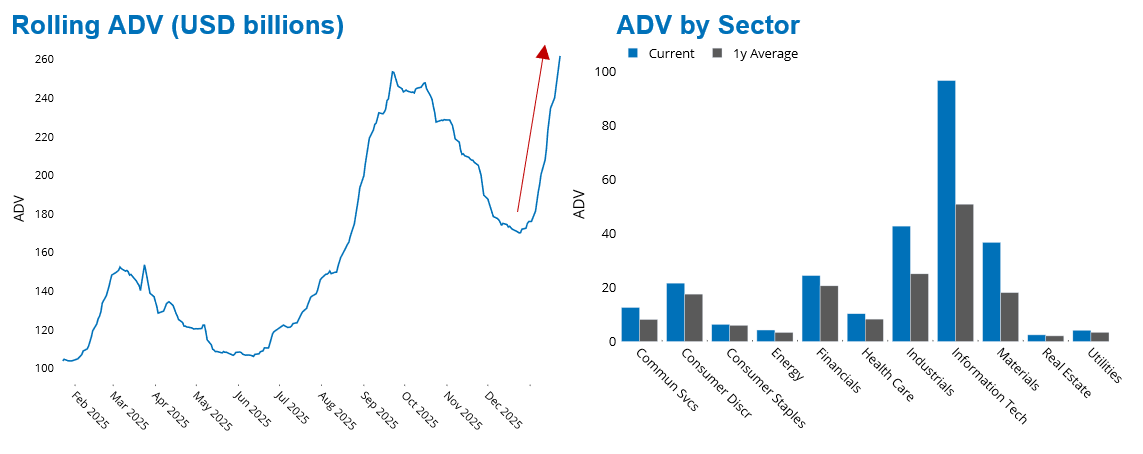

Emerging Markets tell a very different story. The STOXX Emerging Markets index—second only to US Small Caps in year-to-date performance—has experienced a surge in trading activity, with ADV reaching a twelve-month high last week. Information Technology stands out as the primary catalyst, with current trading volumes running at roughly twice their one-year average. Beyond Tech, every Emerging Markets sector is now trading above its historical average, with Industrials and Materials posting the largest relative increases after Information Technology.

While overall market sentiment remains largely neutral across regions, Emerging Markets are a notable exception. According to Axioma’s proprietary Risk-On/Risk-Off (ROOF) scores, investor sentiment in Emerging Markets has shifted firmly into bullish territory.

See graphs from the STOXX Developed World as of January 23, 2026:

See graphs from the STOXX Emerging Markets as of January 23, 2026:

You may also like