MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED AUGUST 15, 2025

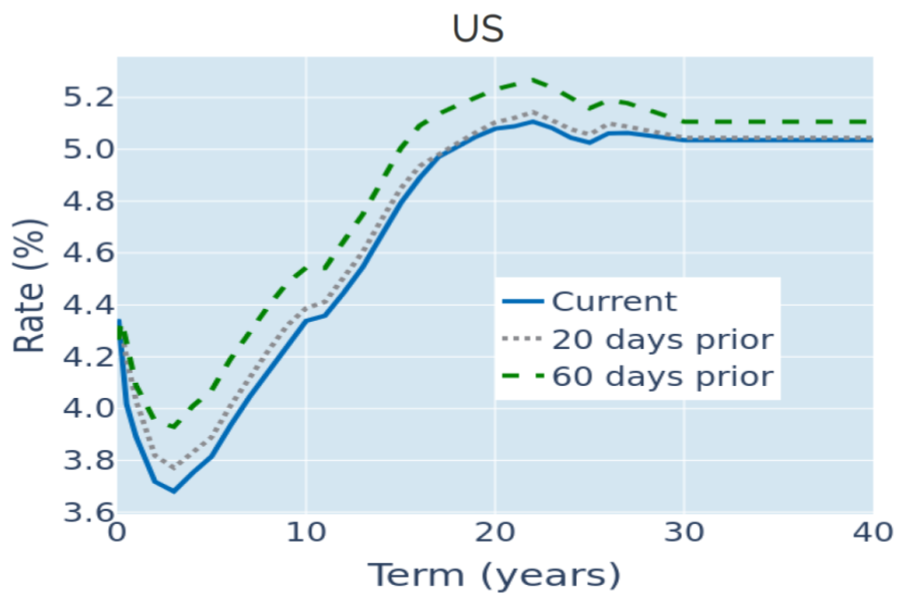

Treasury curve steepens over steady inflation

The term premium of long over short-dated US Treasury yields steepened to a 12-week high in the week ending August 15, 2025, as a steady inflation release solidified expectations that the Federal Reserve will ease monetary conditions next month.

The Bureau of Labor Statistics reported on Tuesday that consumer prices grew by 2.7% in the twelve months to July, the same rate as the previous month and slightly below the 2.8% predicted by economists. The month-over-month price change of 0.15% was consistent with the average monthly rate of 0.17% required for annual inflation to revert to the 2% target. But it was lower fuel prices that were predominantly responsible for the stable headline CPI figure, while core inflation rose from 2.9% to 3.1%, surpassing the consensus forecast of 3%.

Traders still focused on the benign headline number, temporarily raising the implied probability of a September rate cut from 85% to 95% right after the release, with even a one in twenty chance of a bigger half-point move. The monetary policy-sensitive 2-year Treasury yield ended the week marginally lower as a result. This was in contrast to longer borrowing rates, which climbed by 6-7 basis points, as they maintained their renewed positive interaction with share prices.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated August 15, 2025) for further details.

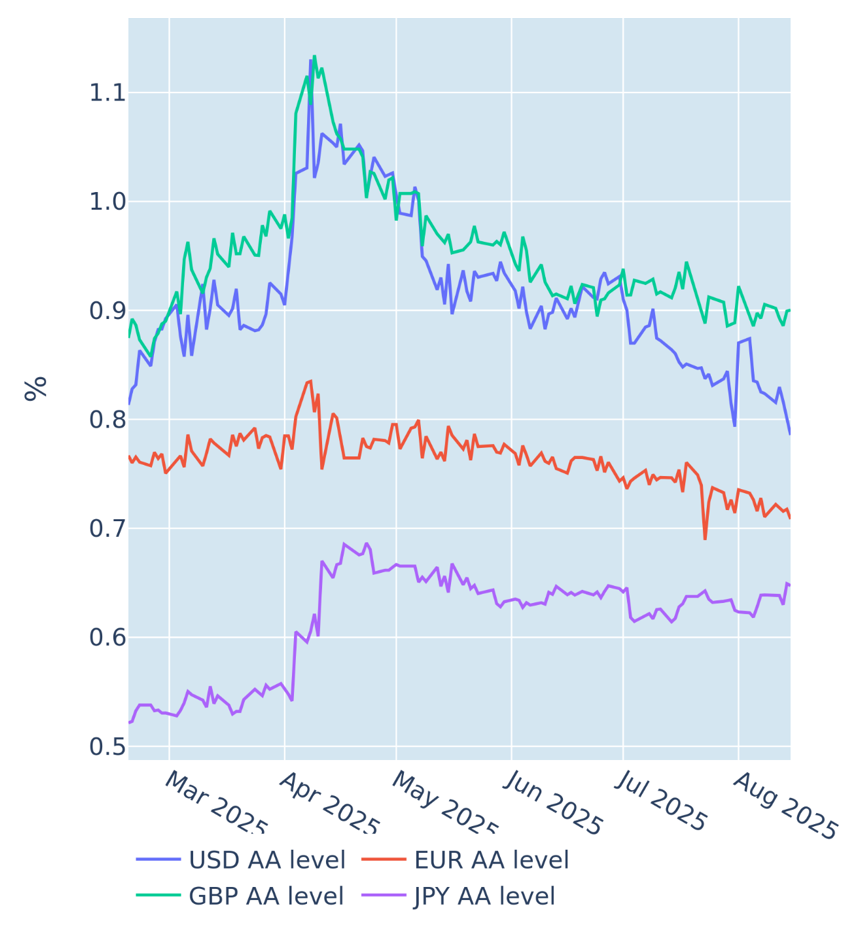

US stock market record depresses credit spreads to 9-month low

Credit spreads on EUR and USD investment grade corporate bonds fell to their tightest levels since the presidential election in November, as the American stock market claimed yet another all-time high on the back of last week’s inflation numbers. European high yield securities preformed even better, with their yield premia over risk-free rates descending to a one-year low, as the EURO STOXX 50® index gained 2% over the week. But compared to their counterpart across the pond, European equity benchmarks still stopped short of their most recent peaks from early March.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated August 15, 2025) for further details.

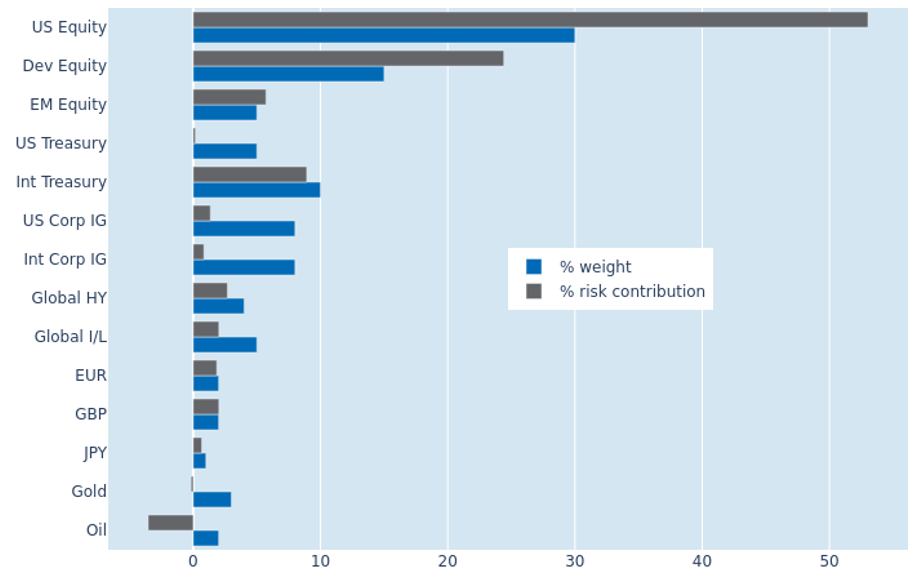

Portfolio risk rebounds amid ongoing stock market recovery

The predicted short-term risk of the Axioma global multi-asset class model portfolio rebounded by 0.2% to 5.9 as of Friday, August 15, 2025, as global stock markets extended their recent gains into a second week. US equities took the brunt of the increase, with their percentage risk contribution soaring from 45.4% to 53%. Non-USD sovereign bonds, on the other hand, saw their share of total portfolio volatility shrink by nearly two percentage points to 8.9%. Gold now also actively reduces overall risk alongside oil, as its interaction with share prices became even more negative.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated August 15, 2025) for further details.

You may also like