MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED OCTOBER 24, 2025

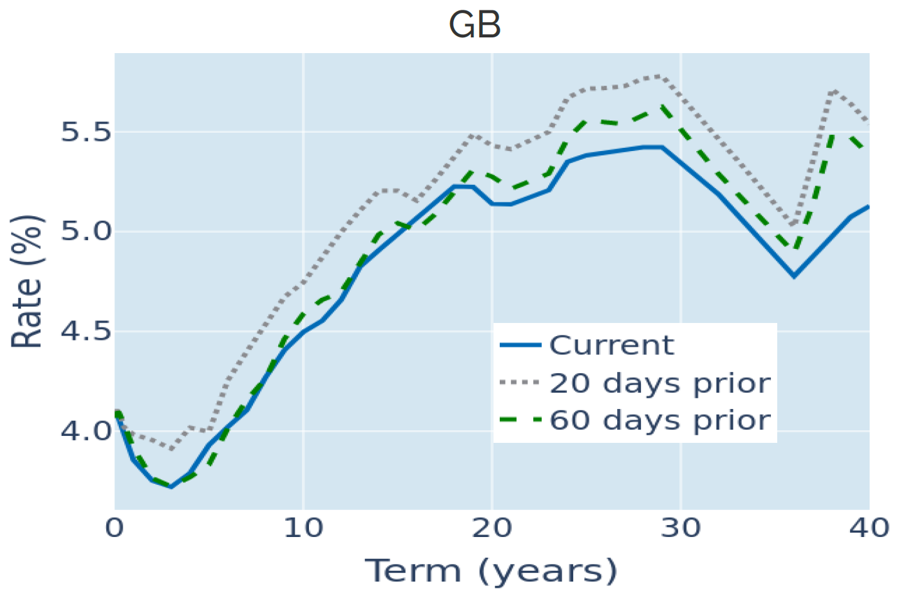

Gilt yields tumble over softer inflation…

British Gilt yields declined for a fourth consecutive week to their lowest level in nearly four month in the week ending October 24, 2025, as UK inflation came in softer than anticipated. The Office for National Statistics reported on Monday that annual headline consumer price growth remained stable at 3.8% in September, undershooting the consensus forecast of 4%. Core inflation even eased from 3.6% to 3.5%, while analysts had predicted an increase to 3.7%.

Short-term interest rate traders responded by raising the implied probability of another rate cut from the Bank of England (BoE) in November to around 40%, with seven out of ten expecting further easing before the year is out. This in turn led to lower yields across the entire Gilt curve, with changes ranging from 8 basis points at the 2-year point to -0.14% for longer maturities.

In terms of the exact timing for next rate move, the Monetary Policy Committee has been more likely to change policy in the middle month of a quarter, which is when BoE staff publish their updated projections on inflation and economic growth. Since the publication of the first inflation report in 1993—now known as the monetary policy report—around half of the monetary policy changes have occurred in February, May, August, or November.

Please refer to Figures 3 & 4 of the current Multi-Asset Class Risk Monitor (dated October 24, 2025) for further details.

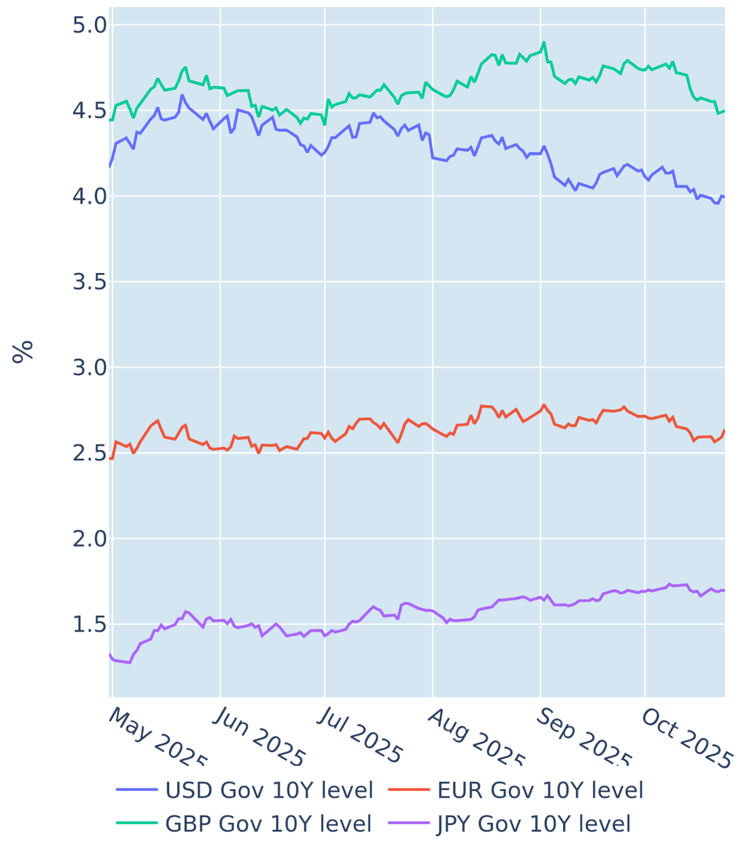

…but Treasury rates remain stable

US Treasury yields remained stable in the week ending October 24, 2025, despite inflation numbers coming in slightly below consensus. American headline consumer prices rose by 3% in the twelve months ending September, up from 2.9% in August, but slower than the 3.1% predicted by analysts. More importantly, core price growth decelerated from 3.1% to 3%, while market participants had expected the annual rate to remain stable. Yet, monetary policy expectations were little changed, with the projected federal funds rate for the end of 2026 even rising by 5 basis points to 2.93%.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated October 24, 2025) for further details.

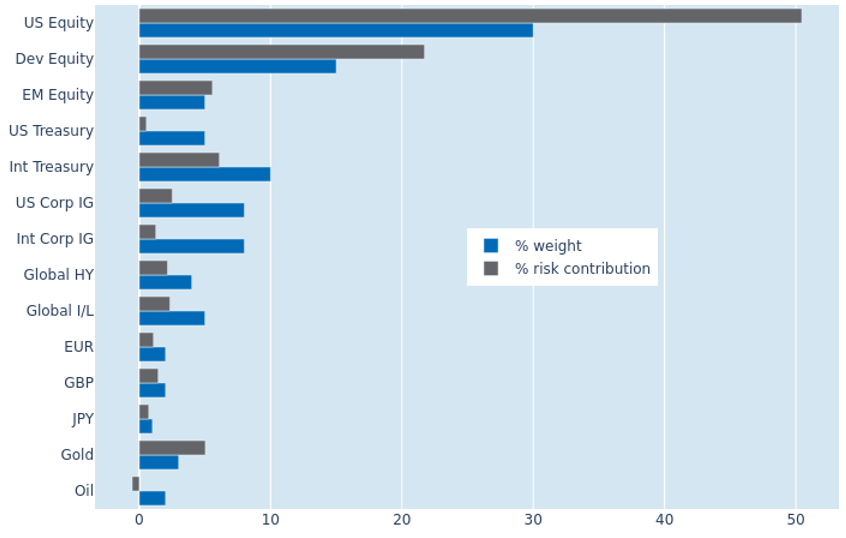

Portfolio risk eases as currency losses offset equity gains

The predicted short-term risk of the Axioma global multi-asset class model portfolio eased from 6.2% to 5.6% as of Friday, October 24, 2025, as stock market gains were offset by exchange rate losses against the US dollar. Non-US developed equities were the biggest beneficiary, with their share of total portfolio volatility shrinking by 2.3% to 21.7%. This currency effect also reduced the percentage risk contribution of non-USD sovereign bonds from 7.6% to 6.1%.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated October 24, 2025) for further details.

You may also like