MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED OCTOBER 31, 2025

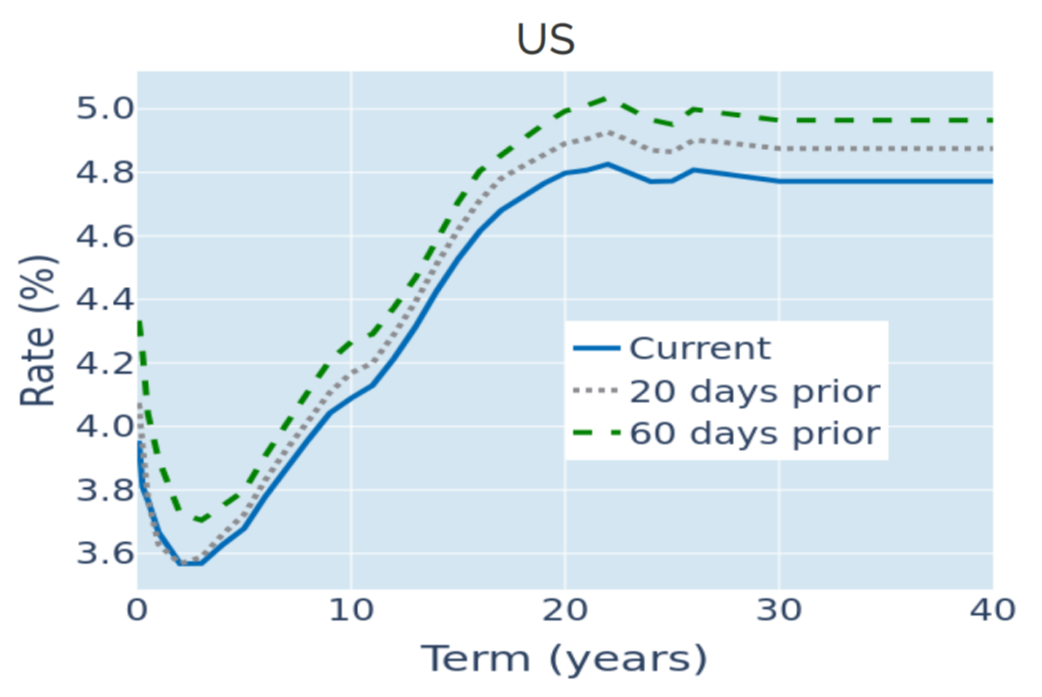

Treasury yields soar over monetary policy uncertainty

US Treasury yields recorded their biggest weekly increase in nearly five months in the week ending October 31, 2025, amid growing doubts about the monetary policy path for the remainder of the year. The Federal Reserve lowered its target corridor by 25 basis points in line with market expectations, but also warned that further easing next month was far from being a “foregone conclusion.” In the press conference following the decision, Jerome Powell cited “differing views” among FOMC members on how to deal with the “challenging situation” of inflationary pressures from tariffs and slowing job growth as the main reason for the policy uncertainty.

Short-term interest rate traders reacted by downgrading the implied probability of a December rate cut from a near certainty to a two in three chance. The subsequent yield increases were most pronounced at the monetary policy-sensitive 2-year point, which ended the week 0.12% higher. Long rates also climbed between 8 and 10 basis points, as Powell’s announcement that the central bank will conclude its quantitative tightening program from next month did little to stem the immediate rise in borrowing costs.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated October 31, 2025) for further details.

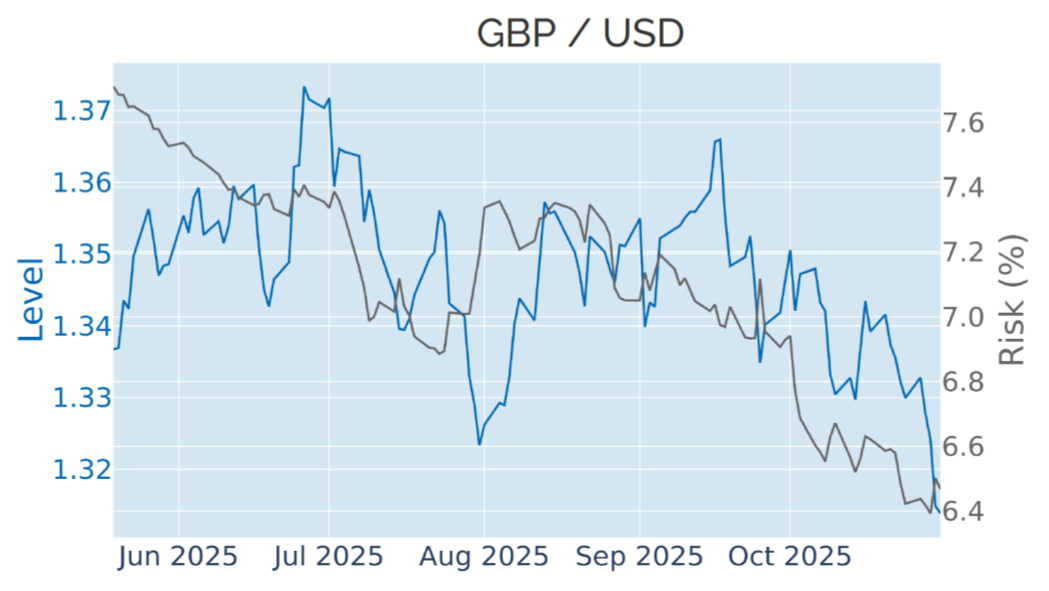

UK budget concerns weigh on the pound

Last week’s rise in interest rates boosted the US dollar to a 3-month high against a basket of major trading partners. The appreciation happened mostly against European currencies and the yen, most of which lost between 0.7% and 1%. The British pound experienced the biggest drop of 1.2% to a 6-month low versus the greenback and its weakest level relative to the euro since May 2023. The strong sterling depreciation reflects the heightened uncertainty around the upcoming autumn budget later this month, as chancellor Rachel Reeves battles an ever-increasing fiscal hole, while prime minister Keir Starmer no longer ruled out increases to income tax or VAT to cover the deficit.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated October 31, 2025) for further details.

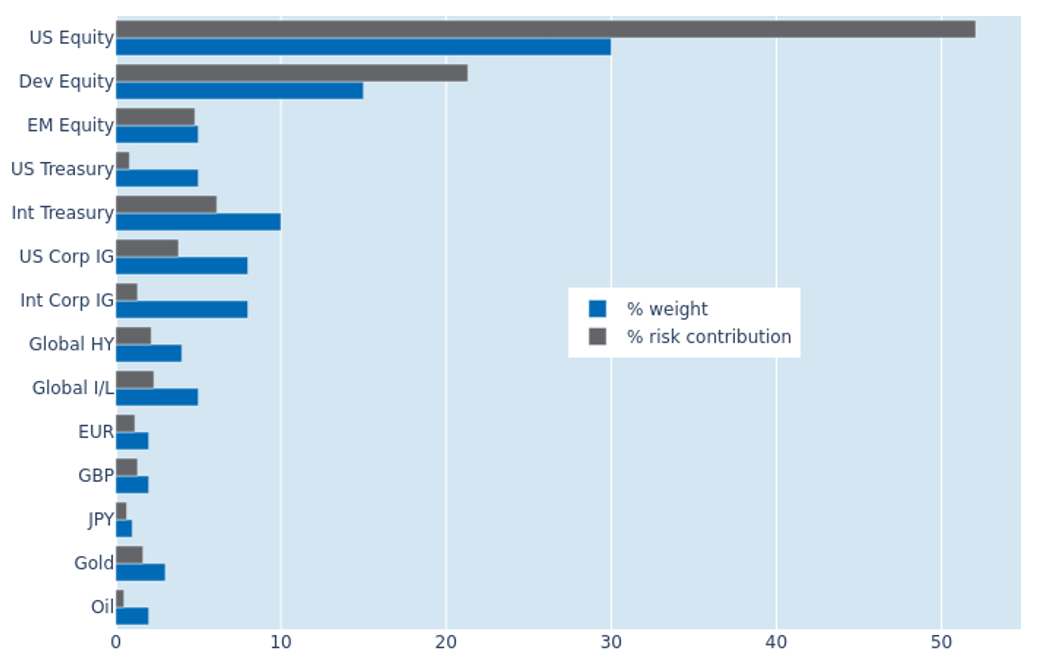

Portfolio risk resurges due to higher equity volatility

The predicted short-term risk of the Axioma global multi-asset class model portfolio resurged to 6.1% as of Friday, October 31, 2025, up from 5.6% the week before. The increase was mostly due to higher stock market volatility, with US equities exhibiting the biggest increase of 1.6 points in their percentage risk contribution to 52%. At the other end of the spectrum, Gold reduced its share of total portfolio volatility by more than two thirds from 5% to 1.6%, as its interaction with emerging market stocks and its fellow commodity oil turned negative. The latter, on the other hand, lost its risk-reducing properties, flipping its contribution from -0.5% to +0.5%.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated October 31, 2025) for further details.

You may also like