MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED NOVEMBER 7, 2025

Contradictory US job reports rock Treasury yields

US Treasury yields went on a rollercoaster ride in the week ending November 7, 2025, rocked by seemingly contradictory jobs data. With no non-farm payroll report from the Bureau of Labor Statistics for a second month in a row due to the ongoing government shutdown, investor focus was once again on data compiled by private institutions.

Payroll processor ADP released its monthly national employment report on Wednesday, showing that private businesses in the United States added 42,000 new positions in October, rebounding from an upwardly revised 29,000 reduction in September and beating analyst predictions of a 25,000 gain. The 10-year Treasury yield climbed by 7 basis points in response to its highest level in four weeks.

However, the move was immediately reversed on the next day, when the monthly job cuts report compiled by Challenger, Gray & Christmas showed that American firms shrank their workforces by 153,000 positions last month, bringing the total year-to-date reduction to nearly 1.1 million.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated November 7, 2025) for further details.

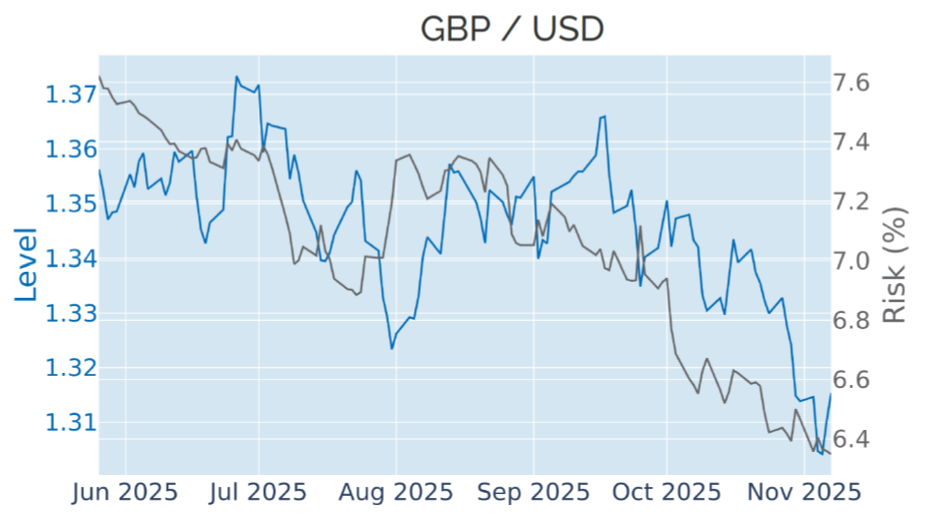

Pound remains flat after knife-edge BoE decision

The pound sterling ended last week flat, following the Bank of England’s decision to keep monetary policy steady on Thursday. The Monetary Policy Committee (MPC) voted to keep its base rate at 4%, with five of its nine members—including BoE governor Andrew Bailey—voting in favor of no change, while the remaining four wanted to cut by 25 basis points.

This second consecutive knife-edge decision reflects the Bank’s conundrum of trying to balance the risk of persistent above-target inflation against the risk of weakening economic demand. But Bailey also hinted that he expects to be able to cuts rates again further if inflation stays on track, potentially as early as next month. CPI growth is expected to have peaked at 3.8% in September—0.2 percentage points below the Bank’s previous prediction from August—and is projected to slow to 3.2% by March next year, before reverting to its 2% target in 2027.

Last week’s decision to hold rates steady marks the first time since August last year that the Bank of England has not eased monetary conditions in a month in which it updated its quarterly staff projections. Over the past three decades, since the publication of first quarterly inflation report in 1993, the MPC has shown a clear preference for acting with the benefit of up-to-date economic predictions, with around half of the past monetary policy changes having been announced in February, May, August, or November.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated November 7, 2025) for further details.

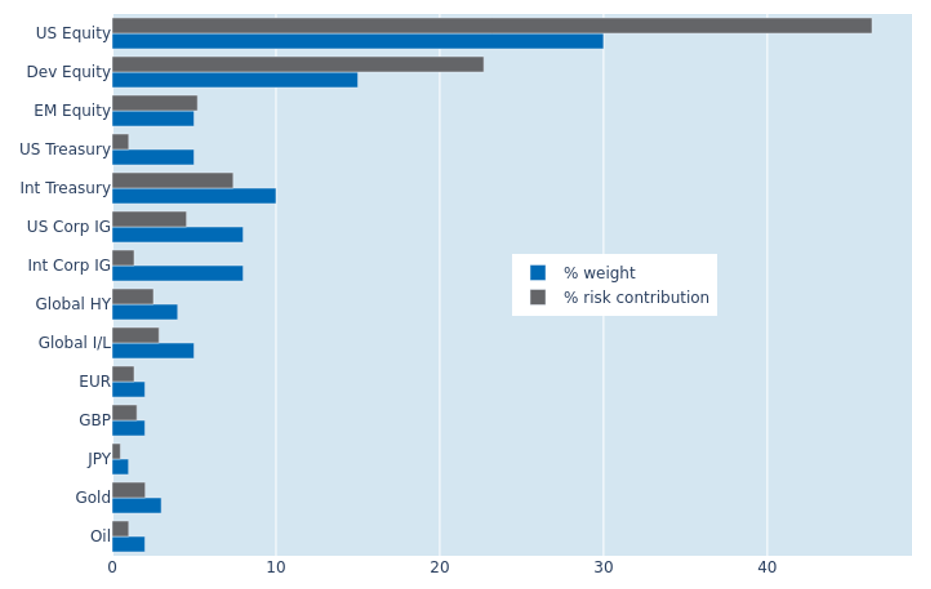

Lower equity volatility reduces portfolio risk

The predicted short-term risk of the Axioma global multi-asset class model portfolio eased by 0.4% to 5.7% as of Friday, November 7, 2025, mostly driven by a decline in standalone equity volatility. Almost all of the risk reduction benefit accrued to US equities, which saw their share of total portfolio volatility shrink from 52% to 47.9%. US Treasury bonds provided the best diversification benefits relative to their market-value weight, as their returns remained completely uncoupled from share prices.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated November 7, 2025) for further details.

You may also like