MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED NOVEMBER 14, 2025

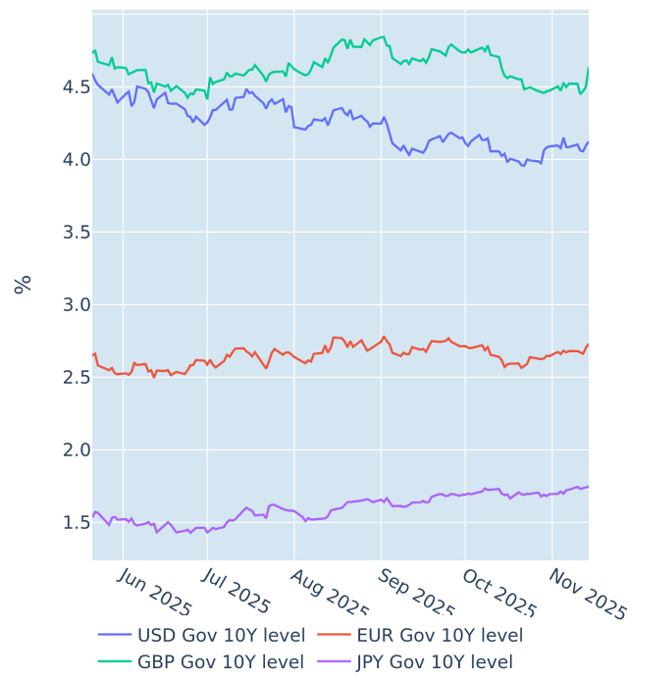

Gilt yields soar after government tax U-turn…

British borrowing costs skyrocketed in the week ending November 14, 2025, following a surprise decision by chancellor Rachel Reeves to scrap a potential hike in income tax in her upcoming budget. Government insiders signaled that the decision was facilitated by an improved economic growth projection from the Office of Budget Responsibility. But bond investors had a different take, suspecting that the chancellor and prime minister had given in to political pressure from backbenchers who would have considered the tax rise as a break of Labour’s election pledge not to increase the financial burden of “working people.”

Instead of reassuring creditors that the government had found a better way of plugging its widening fiscal gap, the decision supported the market perception of a weak leadership that is unable to take tough fiscal decisions for fear of alienating its party grassroots. As a result, the 10-year benchmark Gilt yield surged 13 basis points to a 5-week high on Friday. The move also constituted the biggest daily increase since the beginning of July when speculations erupted around Reeves’ position as chancellor.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated November 14, 2025) for further details.

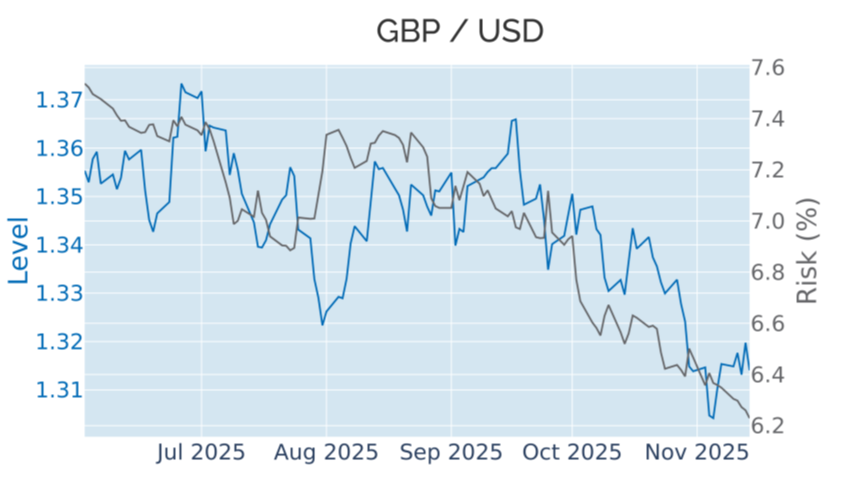

…but the pound remains unaffected

Despite the latest bond market turmoil, the pound ended the week largely flat, though there was some volatility on the way. When the Office for National Statistics reported on Thursday that the British economy unexpectedly shrank by 0.1% in September—analysts had predicted zero growth—the pound initially strengthened by half a percent against the dollar. But the gains were quickly erased after the tax U-turn the next day, despite the significant rise in interest rates.

The interaction between Gilt yields and the GBP/USD exchange rate has been predominantly negative over the past three years, seemingly contradicting the notion that higher rates should make a currency more attractive to foreign investors (and vice versa). The main reason for this counterintuitive behavior was that the relationship was dominated by the dollar leg, which was very highly correlated with US monetary policy expectations. Though the recent budget concerns amplified this even more, as they propelled financing costs for the British government to the highest level among the G7 countries, while the erosion of trust in the United Kingdom as a whole weighed on the pound.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated November 14, 2025) for further details.

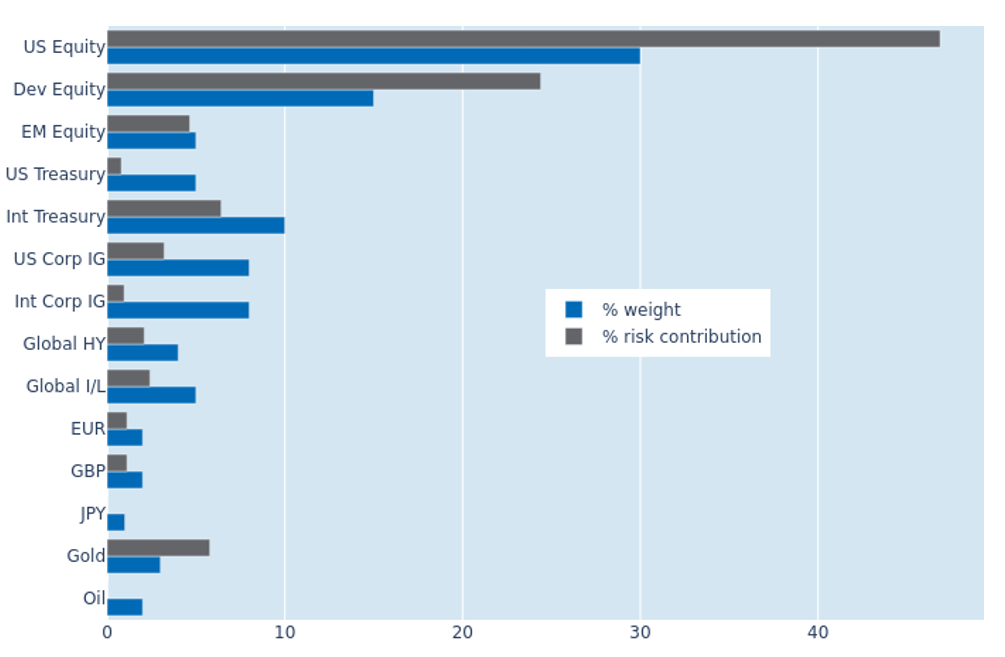

Portfolio risk rebounds driven by stronger equity volatility

The predicted short-term risk of the Axioma global multi-asset class model portfolio rebounded to 6.2% as of Friday, November 14, 2025, up from 5.7% the week before. The increase was almost entirely due to stronger stock market volatility, especially for non-US developed equities, which saw their share of overall risk expand from 22.2% to 24.5%. But at the same time, cross-regional correlations decreased, which meant that the percentage risk contributions from US shares fell by one percentage point to 46.8%, despite an uptick in their standalone volatility.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated November 14, 2025) for further details.

You may also like