MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED NOVEMBER 21, 2025

Treasury yields plummet over growing rate cut hopes

US Treasury yields plummeted to a 3-week low in the week ending November 21, 2025, amid growing hopes for a Fed rate cut at its final meeting of the year on December 10.

The Bureau of Labor Statistics finally published its non-farm payroll report for September on Thursday, showing that the American private sector added 119,000 jobs that month. The number soundly beat analyst predictions of 50,000 new positions, though almost half of the difference was offset by a downward revision of 33,000 jobs for the preceding two months. At the same time, the unemployment rate climbed from 4.3% to 4.4%, which marks its highest level since October 2021.

The latest FOMC minutes from the October 28-29 meeting, which were published on Wednesday, revealed “strongly differing views” among participants about the upcoming rate decision, but also noted that the committee could “ease its policy stance in response to downside risks to employment.” The notion that a rate cut could be on the cards was further underpinned by New York Fed president John Williams who noted in a speech on Friday that he saw “room for a further adjustment in the near term” to the bank’s policy target.

In response, traders in federal funds futures more than doubled the implied probability of a rate cut next month from 30% on Wednesday to over 70% on Friday, with the projected average rate for December 2026 dropping below 3% for the first time since October 28. Yield decreases were most pronounced in the “belly” of the curve between the 2-year and 7-year points, where borrowing rated fell by more than 10 basis points.

Please refer to Figures 3 & 4 of the current Multi-Asset Class Risk Monitor (dated November 21, 2025) for further details.

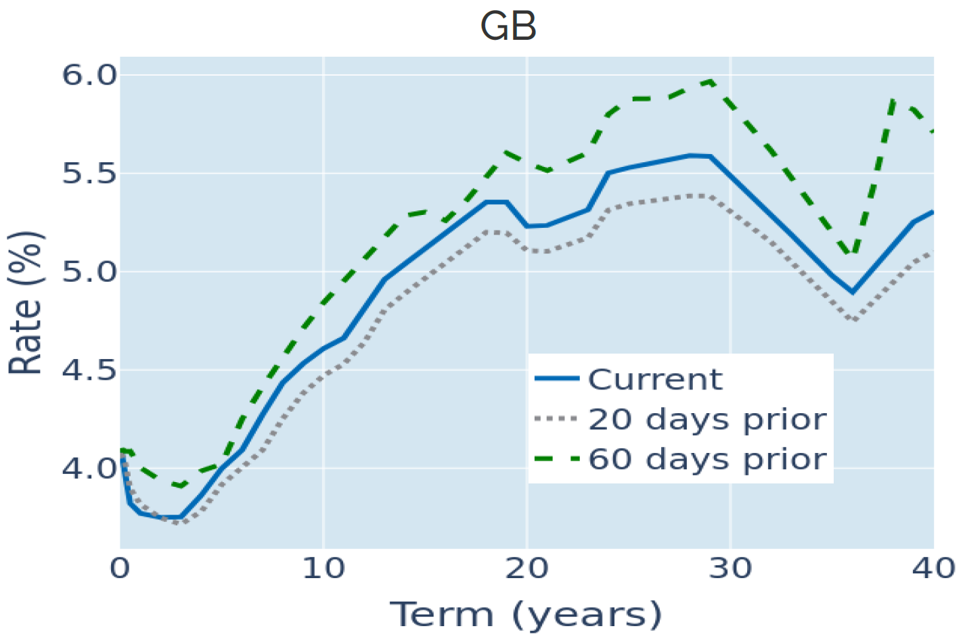

Gilt curve steepens as inflation slows down

British government borrowing costs declined in tandem with their American counterparts in the week ending November 21, 2025, as easing inflation seemed to pave the way for a December Bank of England rate cut.

UK consumer price growth decelerated from 3.8% in September to 3.6% in October in line with market expectations, due to energy costs rising less than in the same month last year. But core inflation also fell from 3.5% to 3.4%, with price growth in the important services sector dropping from 4.7% to 4.5%. Economists had predicted a smaller decrease to 4.6%.

Markets now consider a 25-basis point reduction in the Bank’s base rate at the upcoming MPC meeting on December 18 a near certainty, and the monetary policy-sensitive 2-year Gilt yield dropped by 0.07% in response. But rate declines were much less pronounced at maturities over 10 years, which fell by only 2-4 basis points, as markets remained wary ahead of this week’s budget announcement.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated November 21, 2025) for further details.

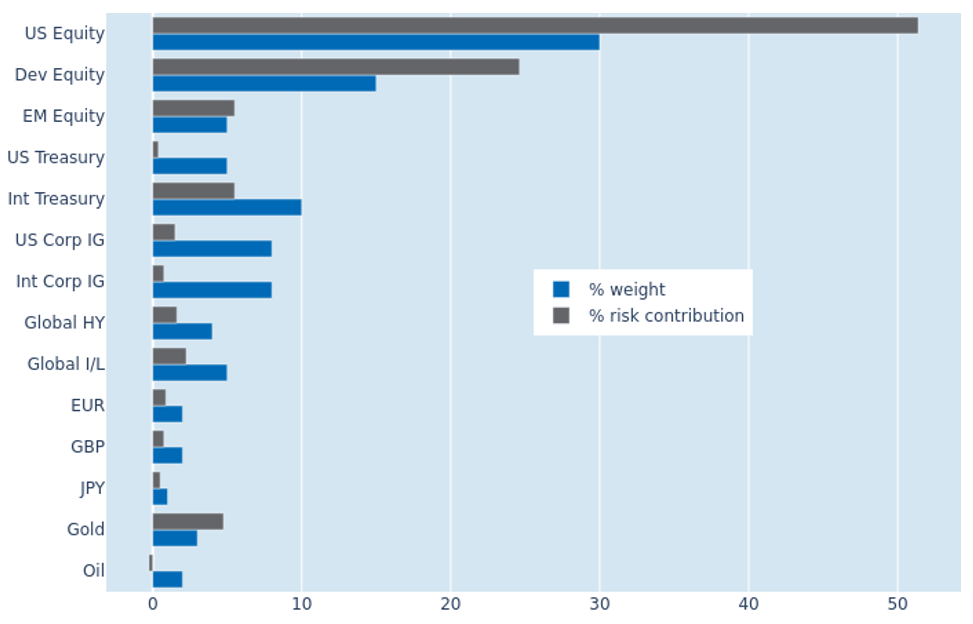

Surging equity volatility boosts portfolio risk

Surging stock market volatility boosted the predicted short-term risk of the Axioma global multi-asset class model portfolio by nearly two percentage points to a 5-month high of 8% as of Friday, November 21, 2025. US equities took the brunt of the increase, with their share of total portfolio volatility expanding by 4.6% to 51.4%. On the flipside, all fixed income holdings experienced a decline in their percentage risk contributions, as interest rates remained decoupled from share prices. US investment grade corporates saw their contribution more than half from 3.2% to 1.5%, but non-US government bonds still added to overall volatility, due to the increased co-movement of stock prices and exchange rates against the US dollar.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated November 21, 2025) for further details.

You may also like