MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED NOVEMBER 28, 2025

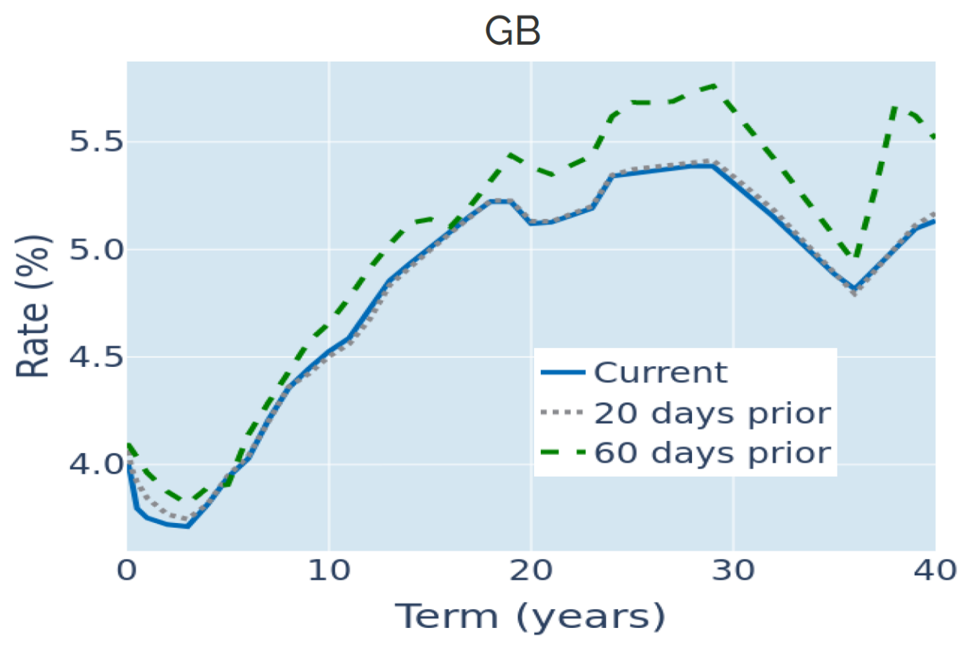

Gilt yields tumble over tax increases

British long-term borrowing costs recorded their biggest weekly drop in four months in the week ending November 28, 2025, after chancellor Rachel Reeves managed to alleviate investor concerns about the sustainability of her government spending plans.

In her highly anticipated budget statement on Wednesday, Reeves announced £26bn worth of tax increases, expanding her fiscal headroom over the next five years to £21.7bn. Almost half of the additional tax revenues will come from extending the current freeze of income tax thresholds by an extra three years to 2030-31. Most of the other announced measures, such as the high-value property surcharge and the cap on pension salary sacrifice, will also only come into effect toward the end of the current parliament in 2028 and 2029, respectively.

Yield decreases were most pronounced at the long end of the curve, with the 30-year benchmark ending the week 19 basis points lower. This was in contrast to the monetary policy-sensitive 2-year rate, which was largely unchanged, as the Bank of England is still expected to follow the previously projected path of another 2-3 rate cuts, the first of which is anticipated at the next MPC meeting later this month.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated November 28, 2025) for further details.

Pound recoups some of its pre-budget losses

The pound sterling climbed to a 4-week high against the US dollar in its biggest weekly gain since early August, recovering some of the losses it accumulated in the runup to last week’s budget announcement. From the time when the first doubts emerged about Rachel Reeves’ position as chancellor in early July to the most recent low on November 19, the pound shed 4.7% against its American rival, more than double the 2% the euro recorded over the same period.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated November 28, 2025) for further details.

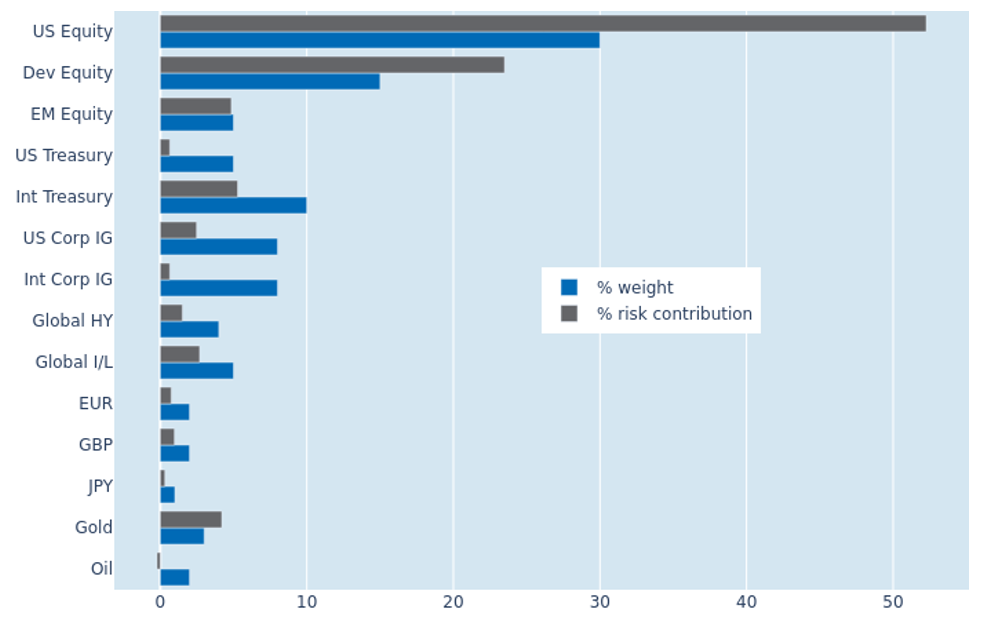

Portfolio risk continues to rise amid increasing equity volatility

The predicted short-term risk of the Axioma global multi-asset class model portfolio rose by another 1.3% to 9.3% as of November 28, 2025, amid a further increase in stock market volatility. US equities once again recorded the biggest expansion in their share of overall portfolio risk from 51.4% to 52.2%, which makes them the largest contributor not only on an absolute basis, but also relative to their market-value weight of 30%. Gold also added more to overall volatility than its monetary share, due its current co-movement with stock prices and its inverse relationship with the value of the dollar, which makes it appear positively correlated with assets in most other currencies.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated November 28, 2025) for further details.

You may also like