MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED DECEMBER 5, 2025

Please note that this is the last multi-asset class update for 2025. We wish you a happy holiday season and will be back on our regular schedule in early January.

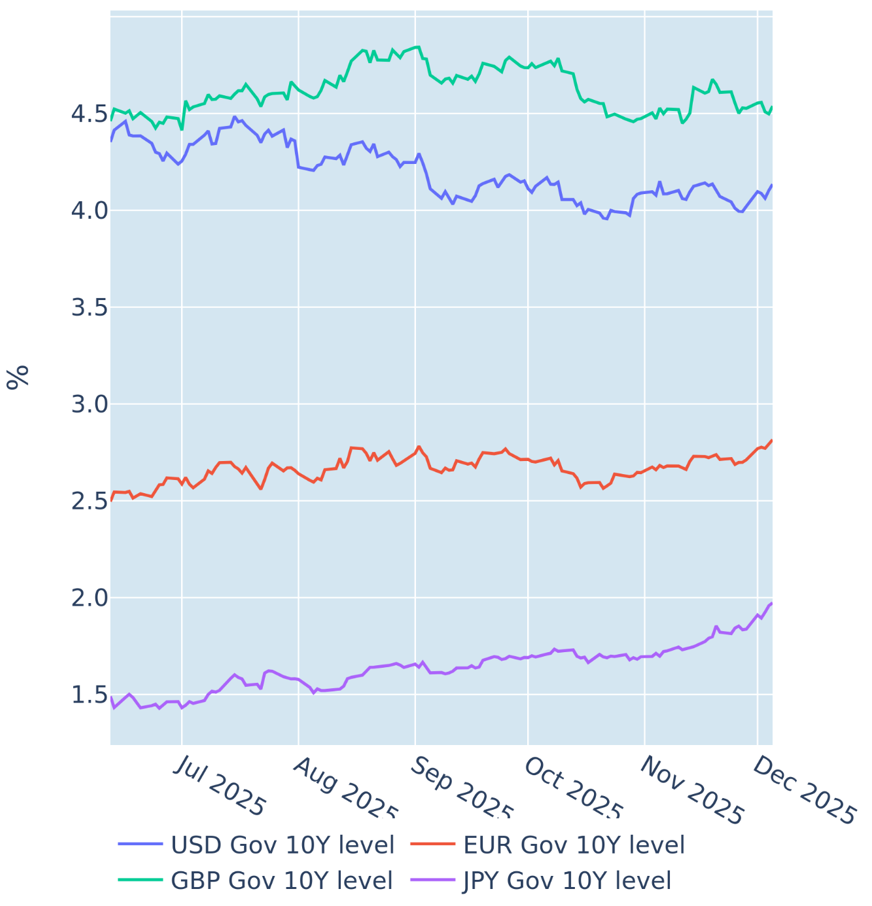

BoJ rate hike hint boosts global yields and yen

Japanese government bond yields climbed to an 18-year high in the week ending December 5. 2025, after Bank of Japan governor Kazuo Ueda hinted at a possible rate hike later this month. In a speech to business leaders on Monday, Ueda noted that real interest rates were “considerably below the real interest rate that is neutral to economic activity and prices,” which left room for raising nominal rates while still maintaining accommodative financial conditions.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated December 5, 2025) for further details.

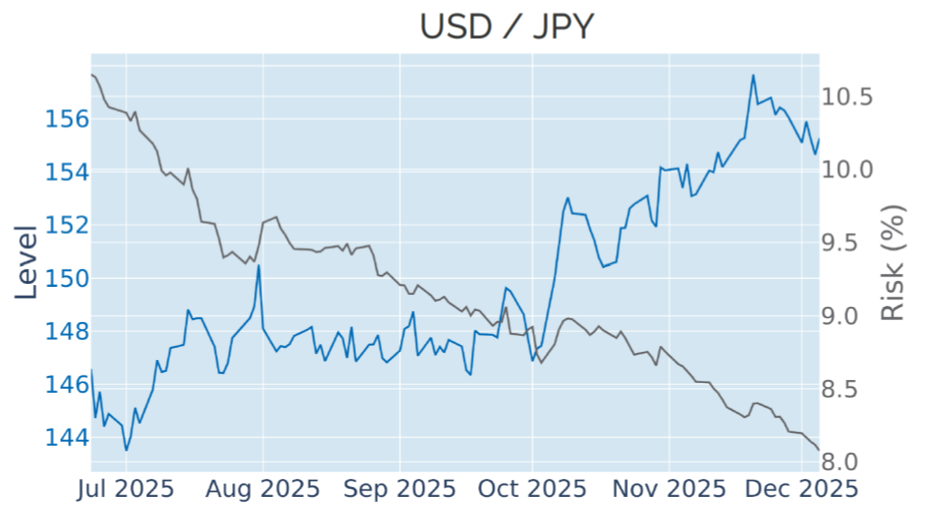

The yen strengthened on the back of the higher rates, which may have prompted some Japanese investors to repatriate their funds from foreign markets. Some of the ripples were felt in other parts of the world, with the German government benchmark ascending to levels last seen in March, while long Treasury yields recorded their biggest weekly increase since Liberation Day. Increased borrowing costs also made the carry trade more expensive, in which traders borrow cheaply in yen and invest the money in higher yielding assets elsewhere, thus reducing demand for the Japanese currency.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated December 5, 2025) for further details.

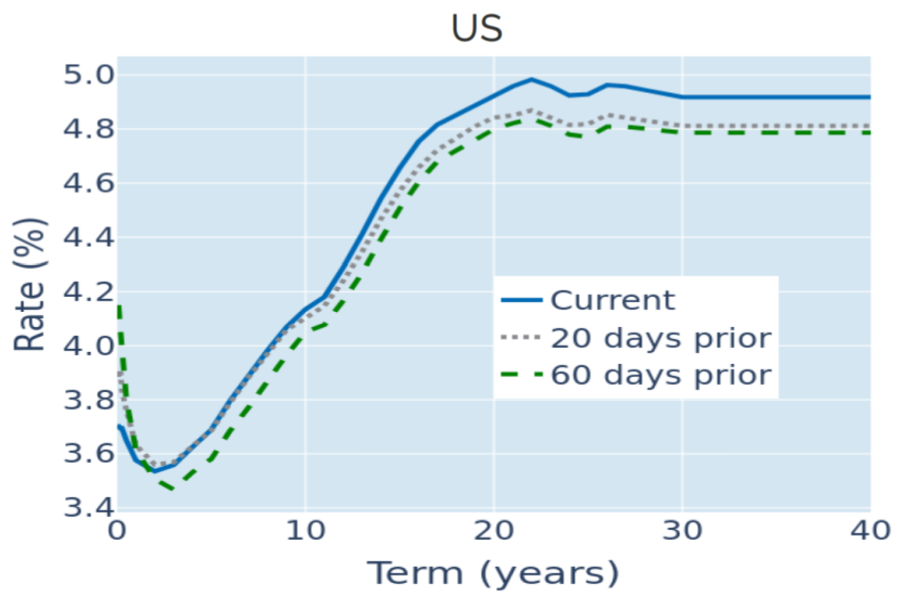

Treasury curve steepens amid further signs of job weakness

The US Treasury curve steepened in the week ending December 5, 2025, as the global rise in yields pushed long-term borrowing costs up by 12-13 basis points, marking the biggest weekly increase since the capital flight in the wake of the so-called Liberation Day tariff announcements in April. At the same time, the 1-month T-Bill rate plummeted 25 basis in anticipation of further monetary easing at the upcoming FOMC meeting on December 10.

The case for a third rate cut from the Fed this year was further underpinned by the latest labor market figures. The next official employment report for November from the Bureau of Labor Statistics is still delayed until December 16, which is after the rate decision, but private sector numbers point toward further weakness. Payroll provider ADP reported on Wednesday that private businesses cut 32,000 positions last month, which marks the biggest monthly decline since March 2023 and undershot the consensus prediction of a 10,000 job increase. A slight upward revision of 5,000 of the October release to 47,000 did little to soften the blow.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated December 5, 2025) for further details.

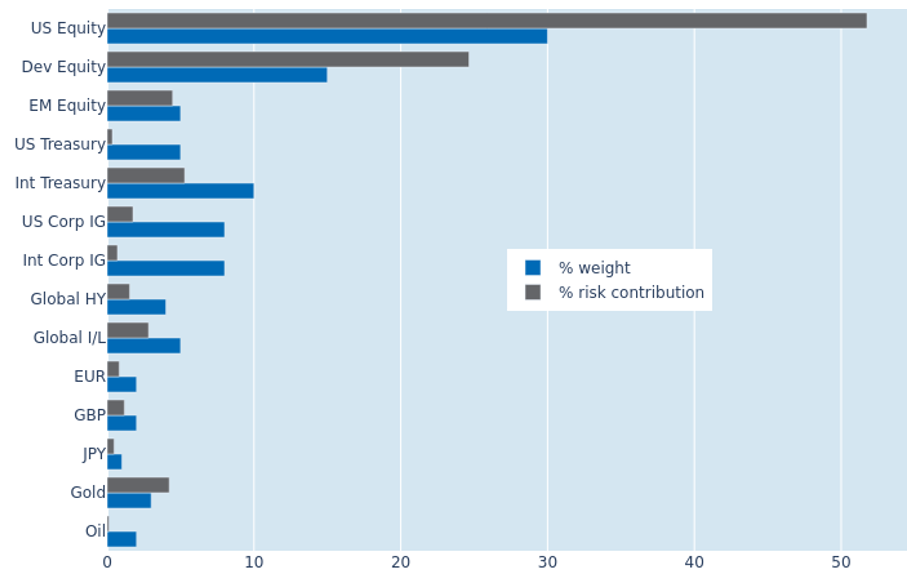

Portfolio risk eases due to lower equity volatility

The predicted short-term risk of the Axioma global multi-asset class model portfolio eased back to 8.5% as of Friday, December 5, 2025, down from 9.3% a week earlier. The decrease was mostly due to lower stock market volatility, combined with a less intense co-movement of share and bond prices. US investment grade corporates were the biggest beneficiaries, with their share of total portfolio volatility shrinking from 2.4% to 1.7%. US equities and Treasury securities also recorded declines in their percentage risk contributions of 0.5% and 0.3%, respectively.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated December 5, 2025) for further details.

You may also like