MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED JANUARY 9, 2026

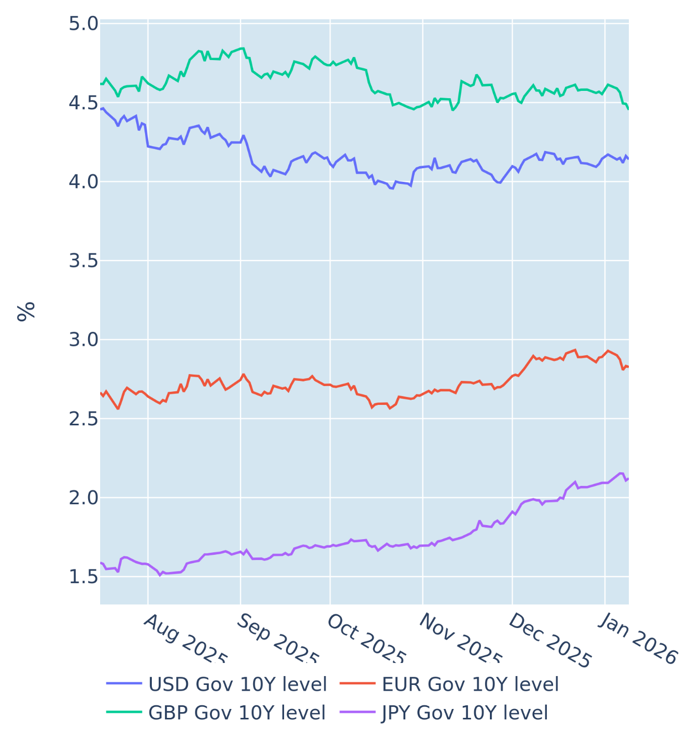

Euro sovereigns outperform Treasury bonds amid easing inflation

Decelerating consumer prices depressed European borrowing costs to a five-week low in the week ending January 9, 2026. The latest flash estimate from Eurostat on Wednesday showed that the Eurozone headline CPI grew by 2% in line with the European Central Bank’s target in the 12 months ending in December 2025, down from 2.1% the month before. Core inflation also slowed from 2.4% to 2.3%, surprising analysts who had predicted no change in the annual rate. In response, German Bund yields fell across all maturities greater than one year, with the biggest drop of 10 basis points recorded at the 10-year point.

The decline in financing costs was even more pronounced in the United Kingdom, where long Gilt yields recorded their biggest weekly plunge in nearly nine months to their lowest levels since mid-November. The monetary policy-sensitive 2-year rate also fell to a three-year low, as traders raised the probability of two further Bank of England rate cuts this year from 60% to 80%.

This was in contrast to the United States, where the futures-implied federal funds rate for the end of this year climbed from 3.07% to 3.15% in the wake of Friday’s non-farm payroll report. The US economy added 50,000 new positions in December—well below the consensus forecast of 60,000 and also weaker than the November number, which was revised downward from 64,000 to 56,000. By itself, this weak jobs growth might have warranted more easing from the Federal Reserve, but market participants focused instead on the bigger-than-expected drop in the unemployment rate from a revised 4.5% in November to 4.4% last month.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated January 9, 2026) for further details.

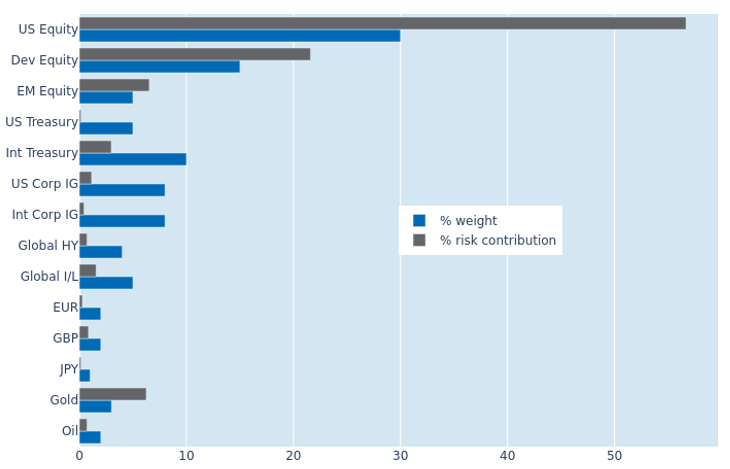

Stronger equity volatility boosts portfolio risk

The predicted short-term risk of the Axioma global multi-asset class model portfolio resurged to 7% as of Friday, January 9, 2026, up from 6.7% the week before. The rise was predominantly driven by stronger stock market volatility, though much of it was offset by a weaker co-movement of share prices and exchange rates against the US dollar. Global equities took the brunt of the risk increase, with the their combined share of portfolio volatility expanding from 79.1% to 84.9%. The lower correlation with FX rates mostly benefitted non-US government bonds, which saw their percentage risk contribution shrink from 4.8% to 2.9%.Oil also further decoupled from all other asset classes, making only a marginal impact of 0.7% on overall risk portfolio risk—less than half its monetary weight of 2%.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated January 9, 2026) for further details.

You may also like