MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED JANUARY 16, 2026

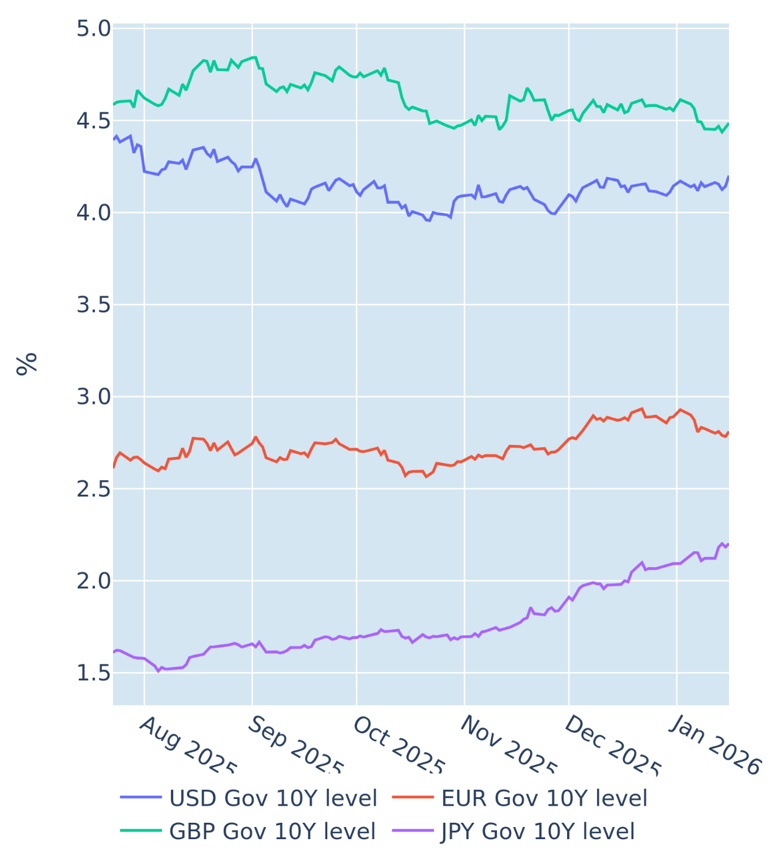

Easing UK inflation and fiscal pressures depress Gilt yields

British borrowing costs briefly touched a six-month low in the week ending January 16, 2026, as cooling inflation and shifting policy expectations sparked strong demand for UK government bonds. The 10-year benchmark rate fell to its lowest level since mid-2025 on Wednesday, following indications from the Debt Management Office that it plans to scale back issuance of long‑dated gilts in favor of shorter‑dated paper. Investors also grew more confident that inflation is easing faster than anticipated, strengthening expectations that the Bank of England may continue to cut interest rates as early as April.

Gilts yields still ended the week slightly higher, following stronger-than-expected GDP data. The Office for National Statistics reported on Thursday that the British economy grew 0.3% in November, comfortably beating analyst predictions of 0.1% and more than reversing October’s 0.1% decline. The general rise in global yields late in the week, led by US Treasury securities, added further external upward pressure, though UK government bonds still outperformed their American and Japanese rivals.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated January 16, 2026) for further details.

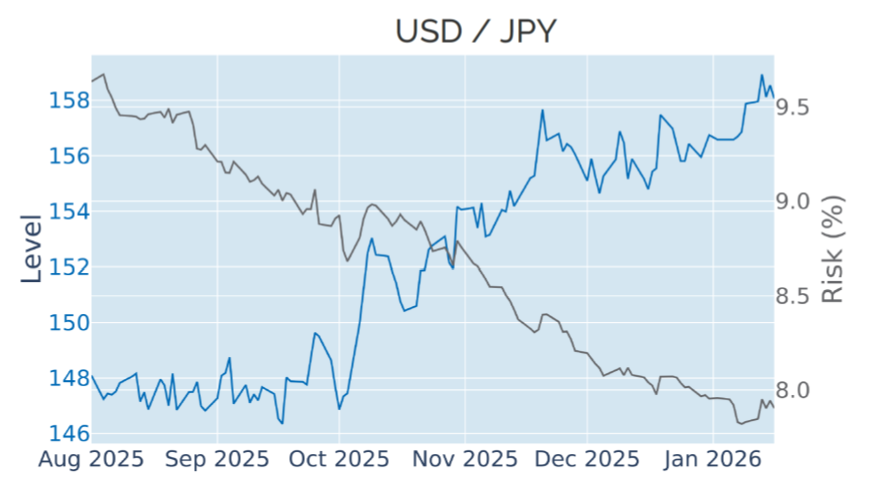

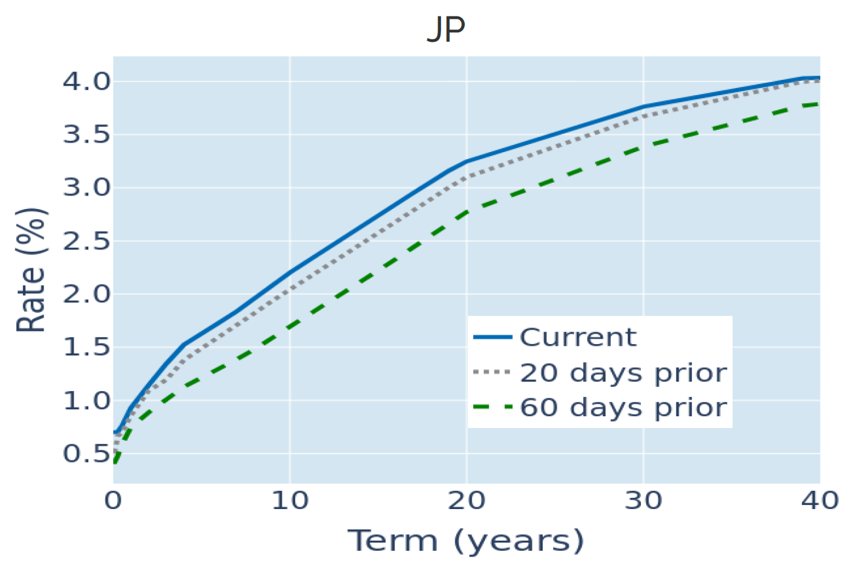

Takaichi trade weighs on yen and boosts JGB yields

The Japanese yen tumbled to an 18-month low while share prices and long-term borrowing rates surged to record highs in the week ending January 16, 2026, as the anticipation of the prime minister’s snap election announcement reignited so-called “Takaichi trades.”

Concerns over increased government spending and tax cuts boosted 20-year JGB yields to their highest levels on record, while the 10-year benchmark climbed to a 27-year high. But there was much less movement at the short end of the curve, as the Bank of Japan was expected to hold its policy rate unchanged in the near term, reflecting caution over domestic growth and a desire to assess the effects of its most recent tightening steps.

Please refer to Figures 3 & 6 of the current Multi-Asset Class Risk Monitor (dated January 16, 2026) for further details.

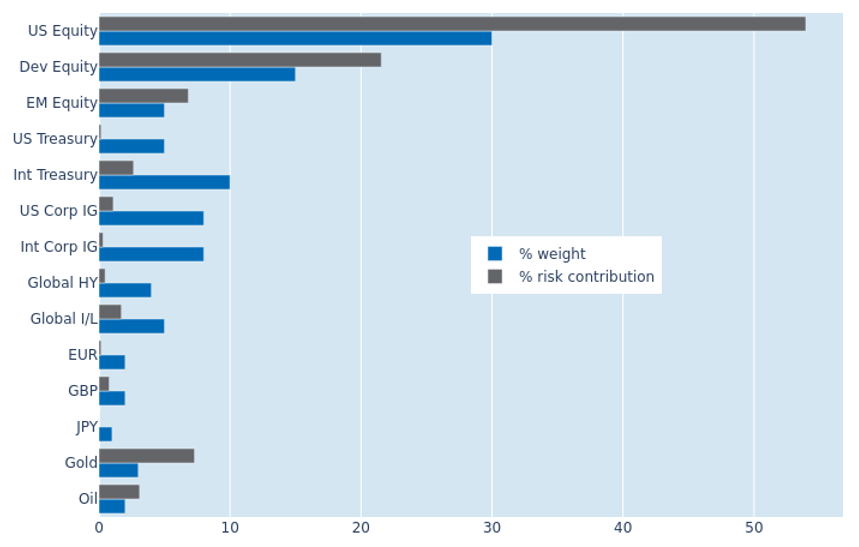

Portfolio risk eases over lower equity volatility

The predicted short-term risk of the Axioma global multi-asset class model portfolio eased back to 6.5% as of Friday, January 16, 2026, from 7% a week earlier. Most of the decline was due to lower stock market volatility, with US equities recording the biggest contraction in their percentage risk contribution from 56.6% to 54%. That being said, American stocks still contributed more to overall risk relative to their market value weight of 30% than their counterparts from other parts of the world, which benefitted from a decoupling of share prices and exchange rates against the US dollar. Gold was by far the biggest source of risk when assessed against its monetary weight of 3%, accounting for 7.2% of total portfolio volatility.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated January 16, 2026) for further details.

You may also like