MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED FEBRUARY 6, 2026

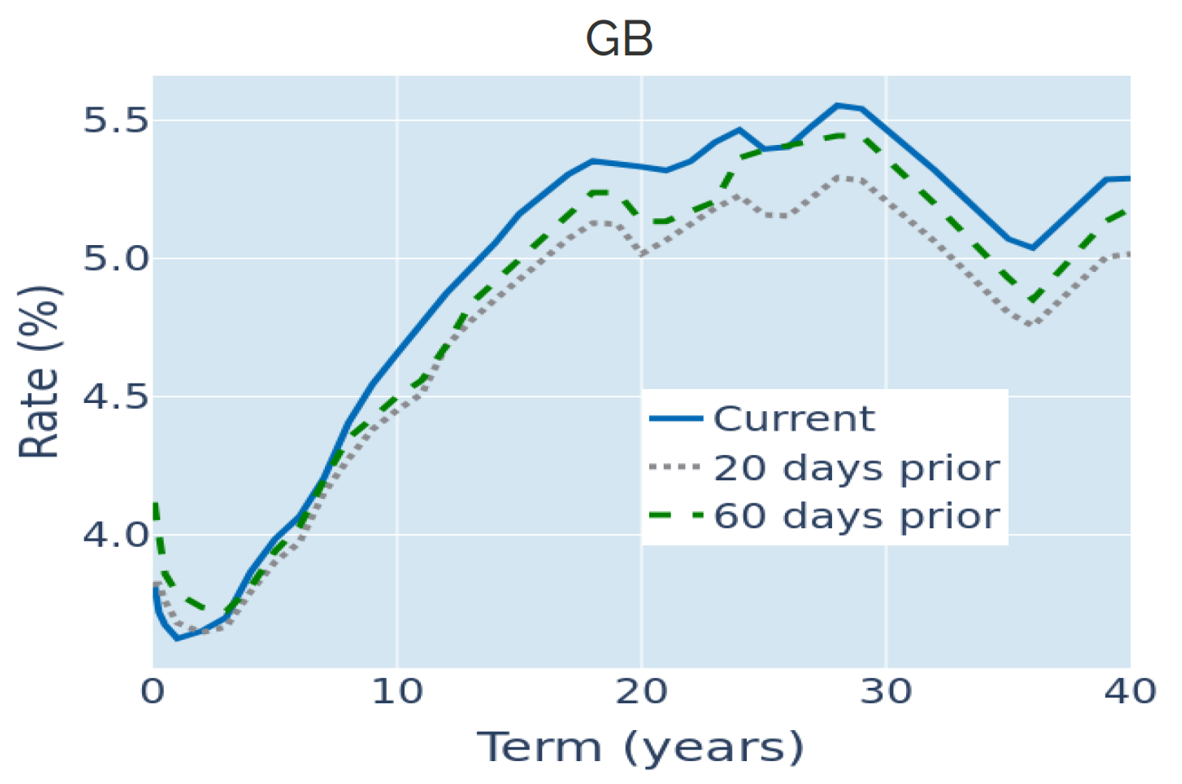

Gilt curve steepens after ‘dovish’ BoE decision

The term spread between long and short-dated British Gilts rose to its widest level since 2017 in the week ending February 6, 2026, following dovish signals from the Bank of England. In its meeting on Thursday, the Monetary Policy Committee (MPC) voted five to four to keep its monetary policy stance unchanged. The decision to hold the base rate at its current level of 3.75% had been widely anticipated, but the close margin of the decision took many market participants by surprise, who had expected no more policy changes until April. In its latest monetary policy report, the bank noted that “the risk of greater inflation persistence has continued to diminish” and that the “outlook for inflation over the next six months is notably lower than expected in November.” The current projection shows that CPI inflation could fall to the policy target of 2% as early as April, which is significantly lower than the previous forecast of 3.4%. As a result, short-term interest rate derivatives markets raised the probability of a rate cut at the next MPC meeting on March 19 from 20% to 50%. The monetary policy-sensitive 2-year Gilt yield fell by 7 basis points in response, whereas the 30-year benchmark increased by the same amount amid increasing speculation about Keir Starmer’s future as prime minister.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated February 6, 2026) for further details.

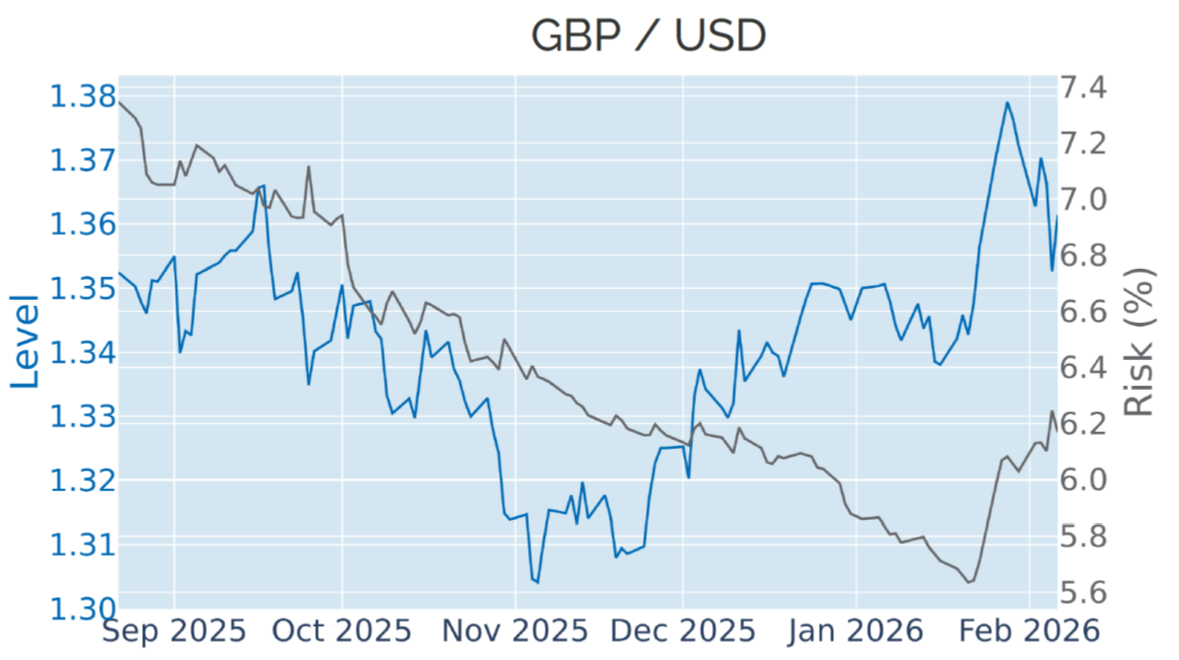

Political uncertainty weighs on the pound

Last week’s political uncertainty and higher long-term borrowing costs also weighed on the pound, which recorded its biggest weekly selloff since late October, when concerns ahead of November’s autumn budget depressed the British currency to a 6-month low against the US dollar and its weakest level against the euro since May 2023. The move raised the predicted volatility for the GBP/USD currency pair to 6.2%, which constitutes the highest level in two months. It needs to be noted, though, that the latest increase in FX rate volatility is part of a broader trend, which started with the “sell-America” trades in the wake of Donald Trump’s tariff threats against European countries as part of his push to acquire Greenland in mid-January and the subsequent rebound after the nomination of Kevin Warsh as the next Fed chair.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated February 30, 2026) for further details.

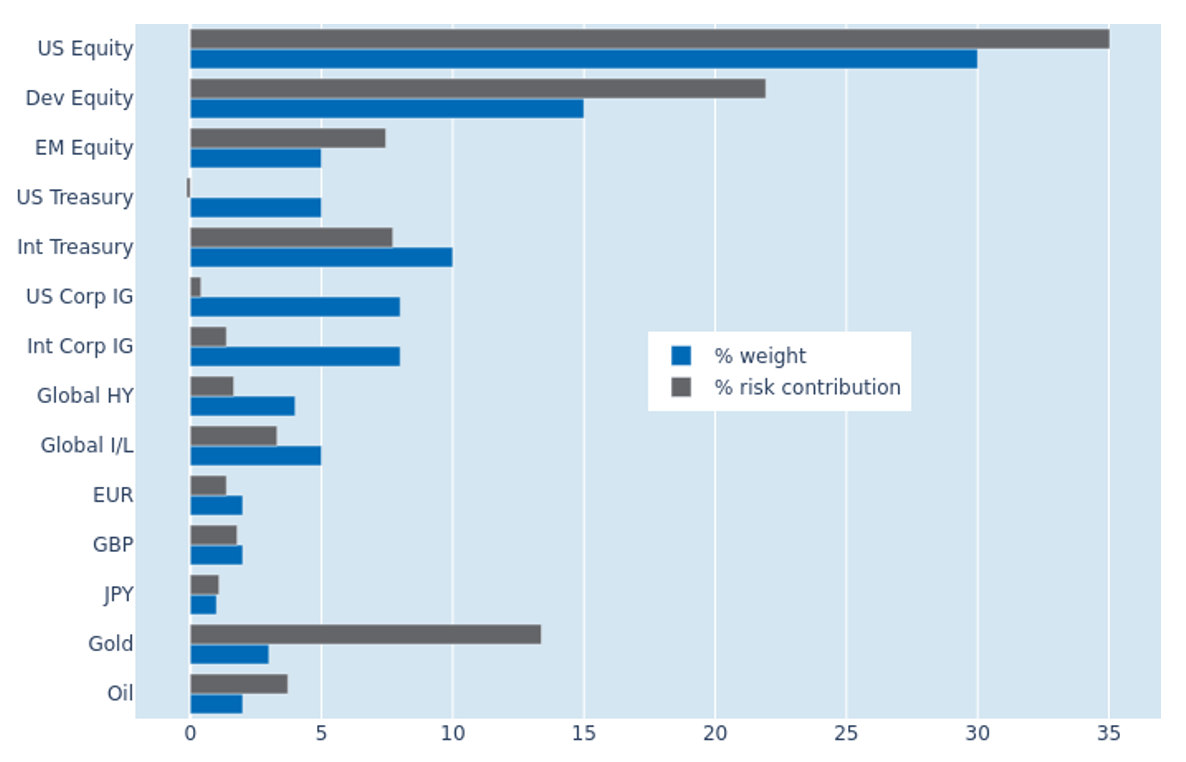

Increased gold volatility further boosts portfolio risk

Increased volatility in gold prices and a stronger co-movement with share prices further raised the predicted short-term risk of the Axioma global multi-asset class model portfolio from 7.1% to 7.3% as of Friday, February 6, 2026. The precious metal saw its share of total portfolio volatility expand again from 10.4% to 13.4%, which is nearly 4.5 times its monetary weight of 3%. Most of the increase was caused by stronger fluctuations in gold prices, which now account for more than a quarter of its total risk contribution. Another 45% came from its strong positive correlation with non-USD securities, mostly due to its inverse relationship with the value of the greenback. Last week’s selloff and rebound in tech stocks also inflated the percentage risk contribution of US equities by two points to 35%, though part of the risk increase was offset by opposing movements in the bond market.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated February 6, 2026) for further details.

You may also like