EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED AUGUST 23, 2024

- UK risk is lower than a year ago, while Europe’s (including UK) is higher

- UK market concentration leads to some large sector-style exposures

- After a strong first half, Earnings Yield has taken a tumble in Europe

UK risk is lower than a year ago, while Europe’s (including UK) is higher

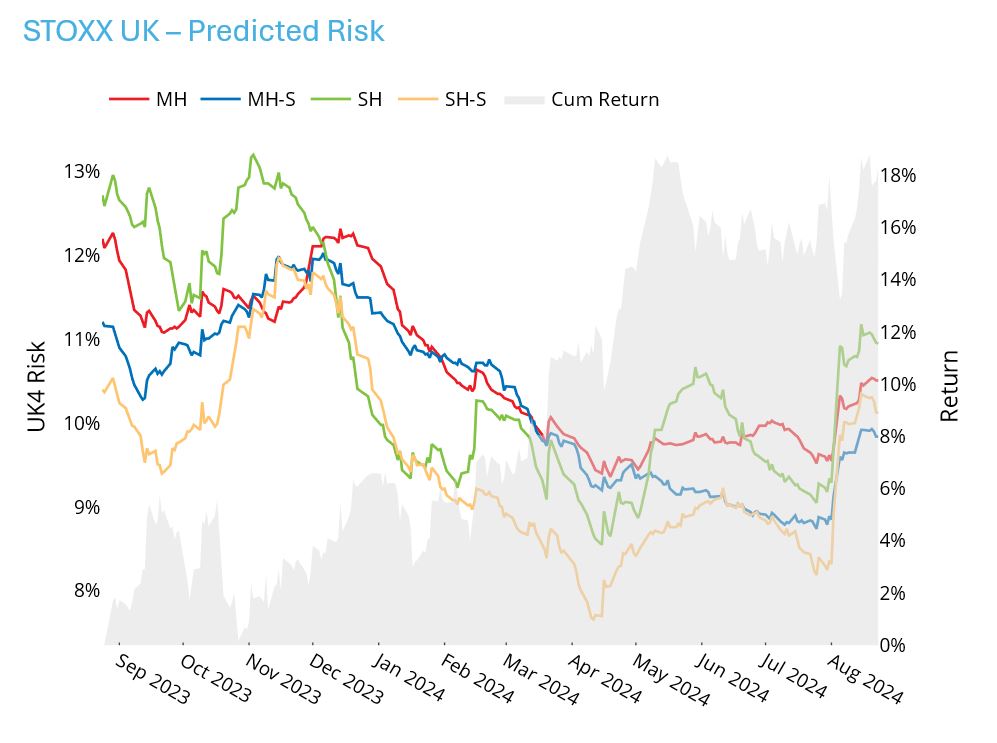

Whereas the short-horizon fundamental risk of most major benchmarks we track closely is substantially higher than it was a year ago (for example, US +33%, Japan +103%, Canada +26%), risk for the STOXX© UK Index is about 14% lower than it was this time last year. The decline in UK risk helped dampen the increase in risk for the STOXX© Europe 600, where the increase was just 11%.

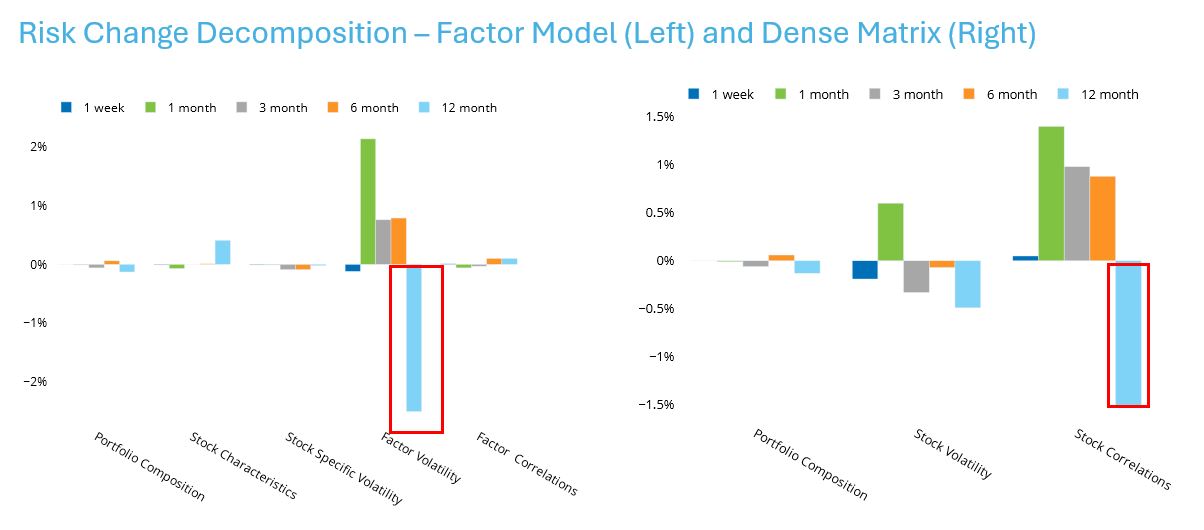

The decomposition of the change in risk from the point of view of the factor model over the past year shows that lower factor volatility explains the decrease. Interestingly, from the point of view of the dense matrix, the major reason for the decline was that asset-asset correlations are lower. This seems to be a phenomenon somewhat unique to the UK, as realized correlations are higher in other markets. See our highlights from July 5, 2024 for a detailed discussion of the decomposition of the change in risk.

Another reason for lower risk versus other markets may be the UK’s low weight in Information Technology, which has been one driver of the increase in many other markets, most notably the US. In the UK, as elsewhere, Tech’s risk is higher than it was a year ago, but many other UK sectors have seen their risk decrease.

See graphs from the STOXX UK Equity Risk Monitor as of August 23, 2024:

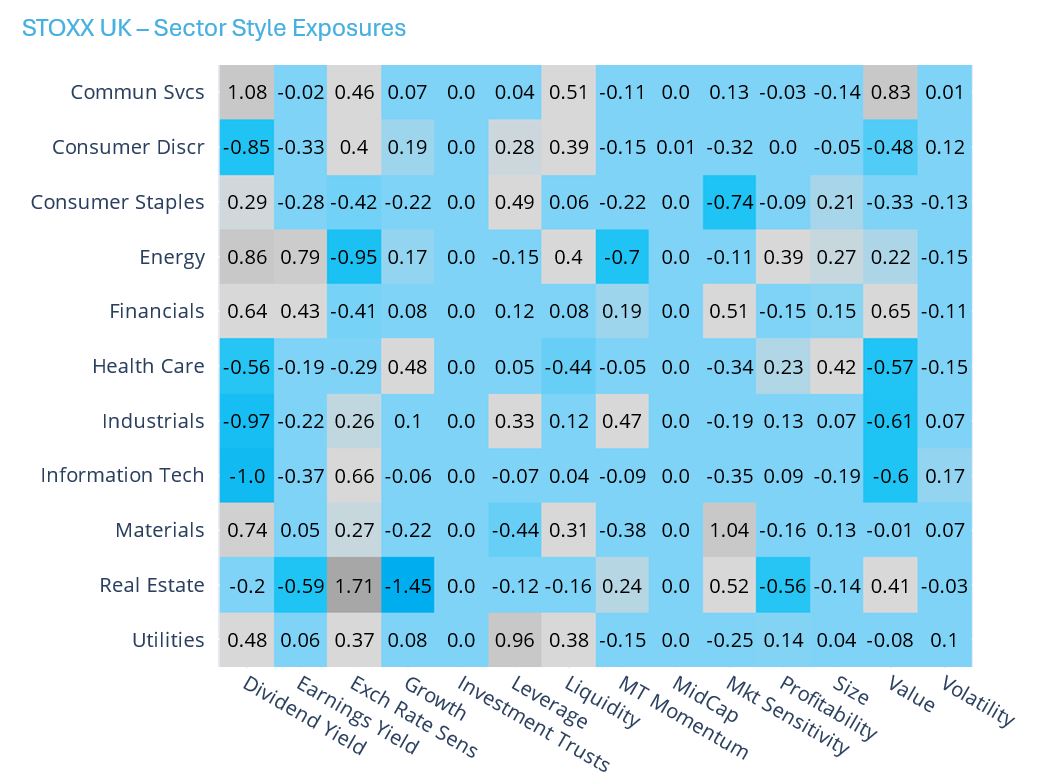

UK market concentration leads to some large sector-style exposures

We often discuss the high level of concentration of the US market, especially as it relates to the high weight of Information Technology (see, for example, the highlights from June 14, 2024). The UK market has less sector concentration, but the five biggest companies in the STOXX UK Index comprise 33% of the weight, as compared with 25% of the weight in the STOXX© US Index. (The five names are distributed across four sectors, thereby reducing the sector concentration.) The effective number of names in the UK is just 27 currently, versus a still-low 56 for the US.

One impact of this concentration can be seen in higher sector exposures to various style factors as compared with other countries. Take Financials, the highest-weighted sector, for example. It has a high exposure to value-based style factors Dividend Yield, Earnings Yield and Value, each exceeding 0.5 (exposures are stated as standard deviations versus the index). Other sector-factor exposures that look unusually large are Consumer Staples’s low Market Sensitivity score, Energy’s low Exchange Rate Sensitivity score, Real Estate’s high Exchange Rate Sensitivity score, and others.

This concentration may make it more difficult for style-based managers to build sector neutral portfolios, at least as compared with how they are able to do it in other countries.

See graph from the STOXX UK Equity Risk Monitor as of August 23, 2024:

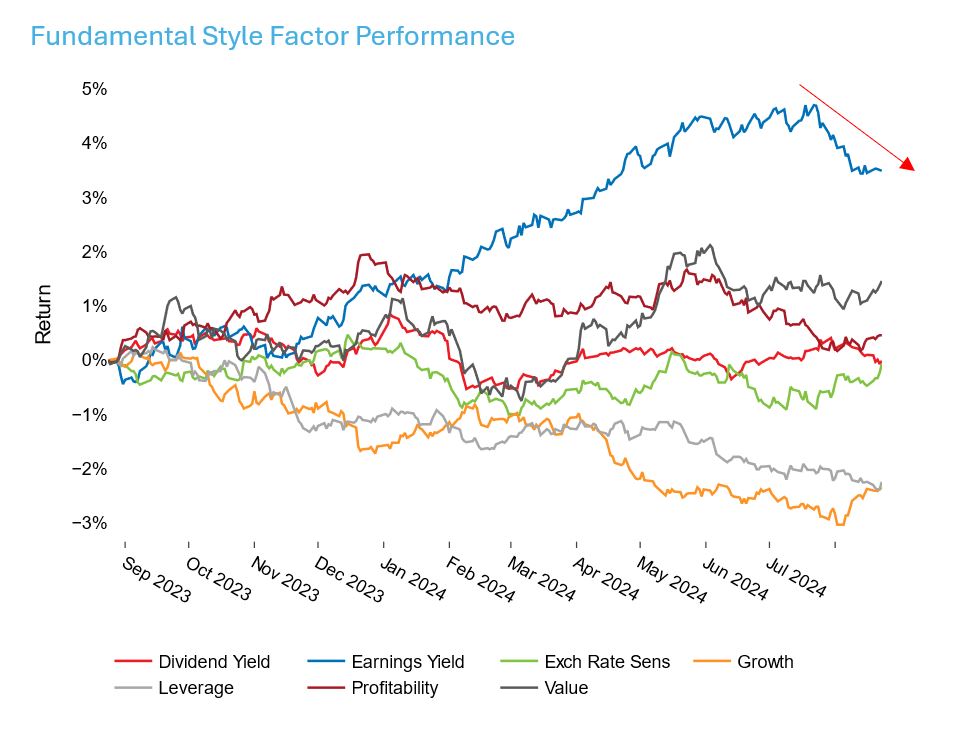

After a strong first half, Earnings Yield has taken a tumble in Europe

The Earnings Yield factor in Axioma’s European medium-horizon fundamental model had a very strong first half, far outpacing any of the other style factors. Returns were also high relative to history, with the first quarter return in the 86th percentile and the second quarter in the 92nd percentile compared with quarterly returns back to 1996. However, the factor peaked in mid-July, and has generally seen a downward trend since then. Over the past month, the return was almost three standard deviations below expectations, based on the volatility forecast at the beginning of the month. To be sure, Earnings Yield has not fared well in most markets recently, but the return in Europe stands out because Earnings Yield had been so far ahead of the other style factors year to date.

See graph from the STOXX Europe 600 Equity Risk Monitor as of August 23, 2024: