EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED OCTOBER 25, 2024

Axioma Risk Monitor: Global Energy continues to underperform; High-beta, large stocks with momentum favored in Developed Markets; Top-line risk declines but what is brewing under the hood?

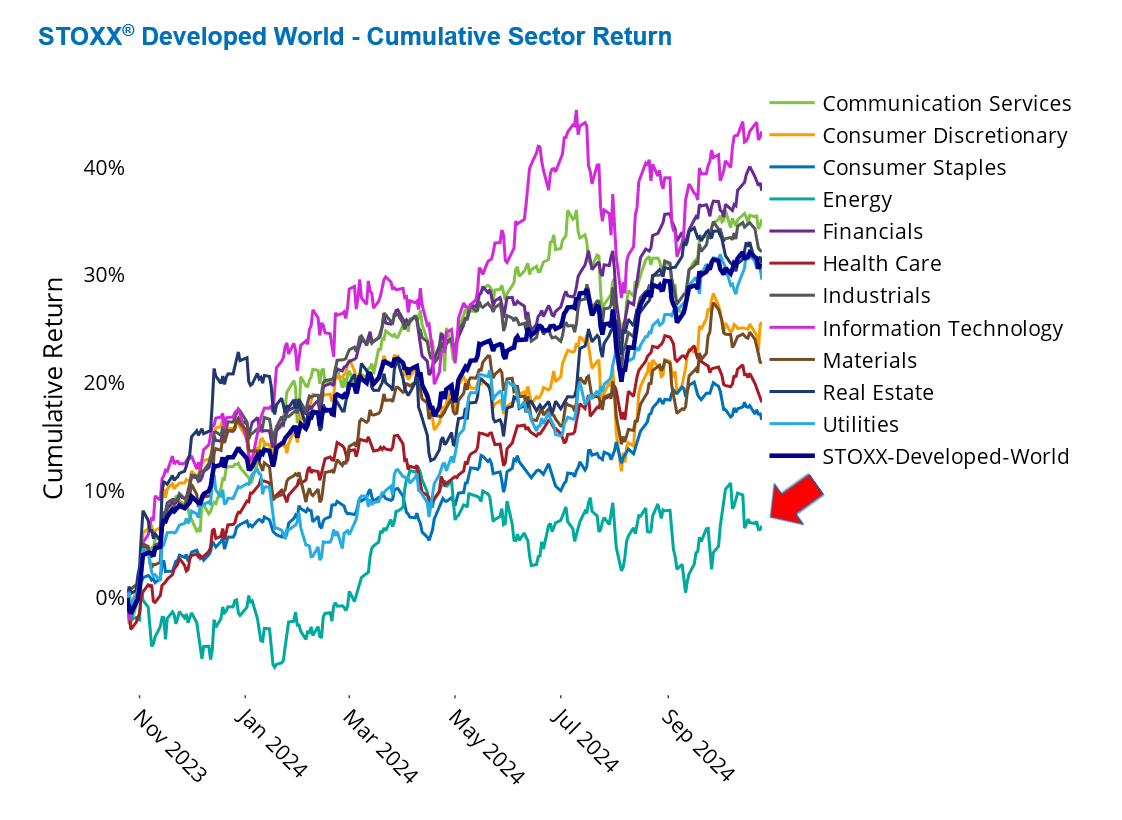

Global Energy continues to underperform

The global Energy sector continued to underperform dragged down by declining oil prices. Despite price pressures from OPEC’s production cuts and geopolitical risks stemming from the ongoing Russia-Ukraine war and escalating Middle East conflicts, oil prices fell due to weak demand as the global economy, particularly China’s, slowed down. Energy recorded the lowest 12-month return (7%) among all GICS sectors in the STOXX Developed Market index, trailing the benchmark by nearly 30% and the best performing sector—Information Technology by 45%.

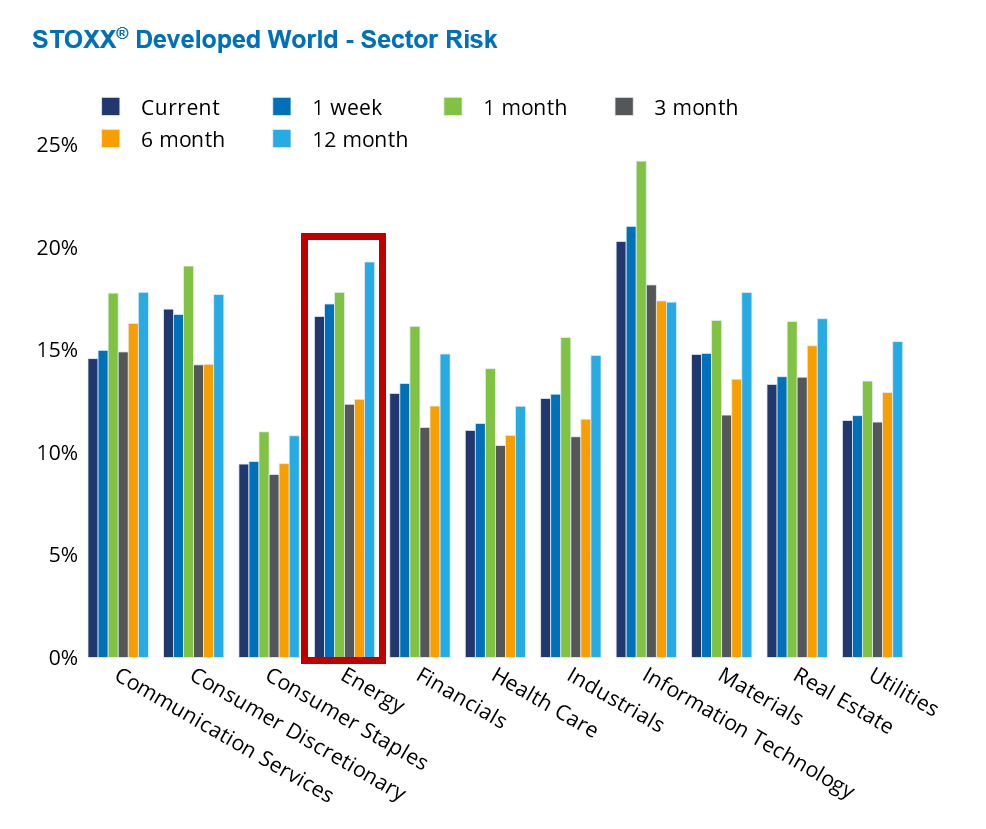

Whereas Energy started the year as the riskiest sector, its volatility has decreased along with most other sectors in the benchmark, ranking third as of last week, according to Axioma’s Worldwide fundamental short-horizon risk model. Information Technology was the only sector in the index to experience a risk increase over the past 12 months, becoming the riskiest sector.

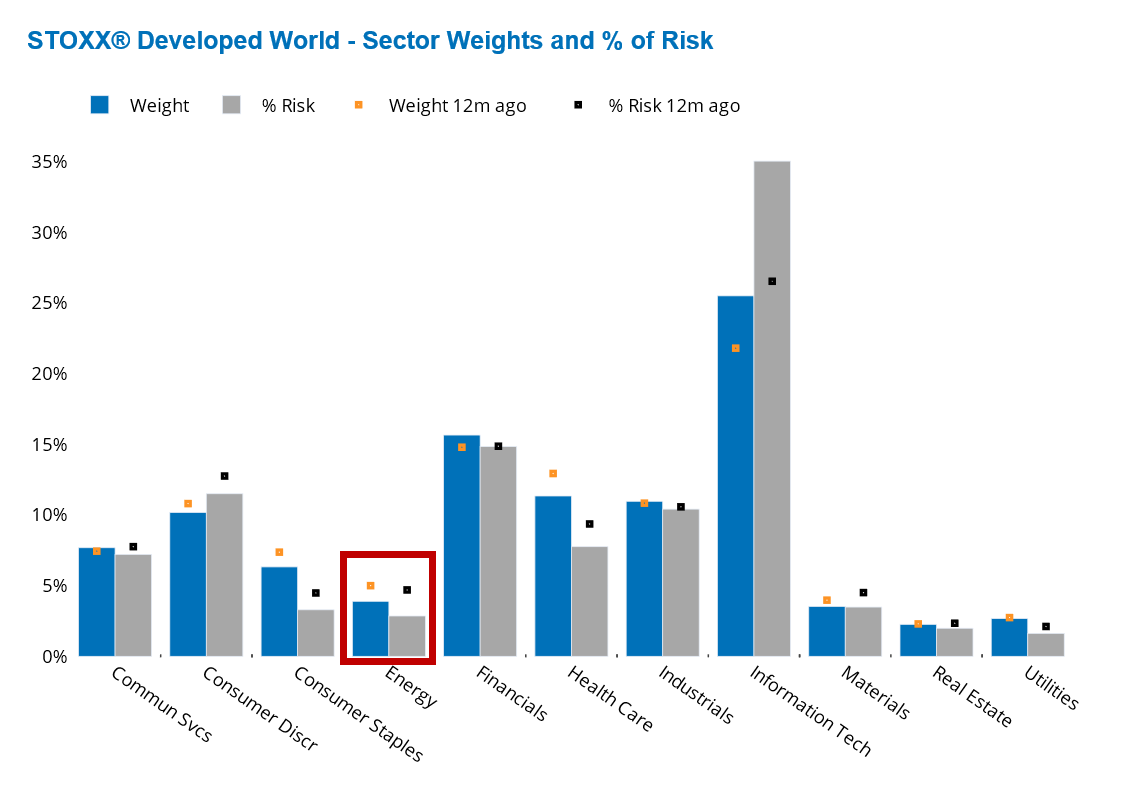

Yet, due to its small weight (of about 4%), Energy contributes minimally to the STOXX Developed Market index’s risk and return. Energy’s current weight and contribution to benchmark risk are lower than they were 12 months ago.

See graphs from the STOXX Developed World Equity Risk Monitor as of October 25, 2024:

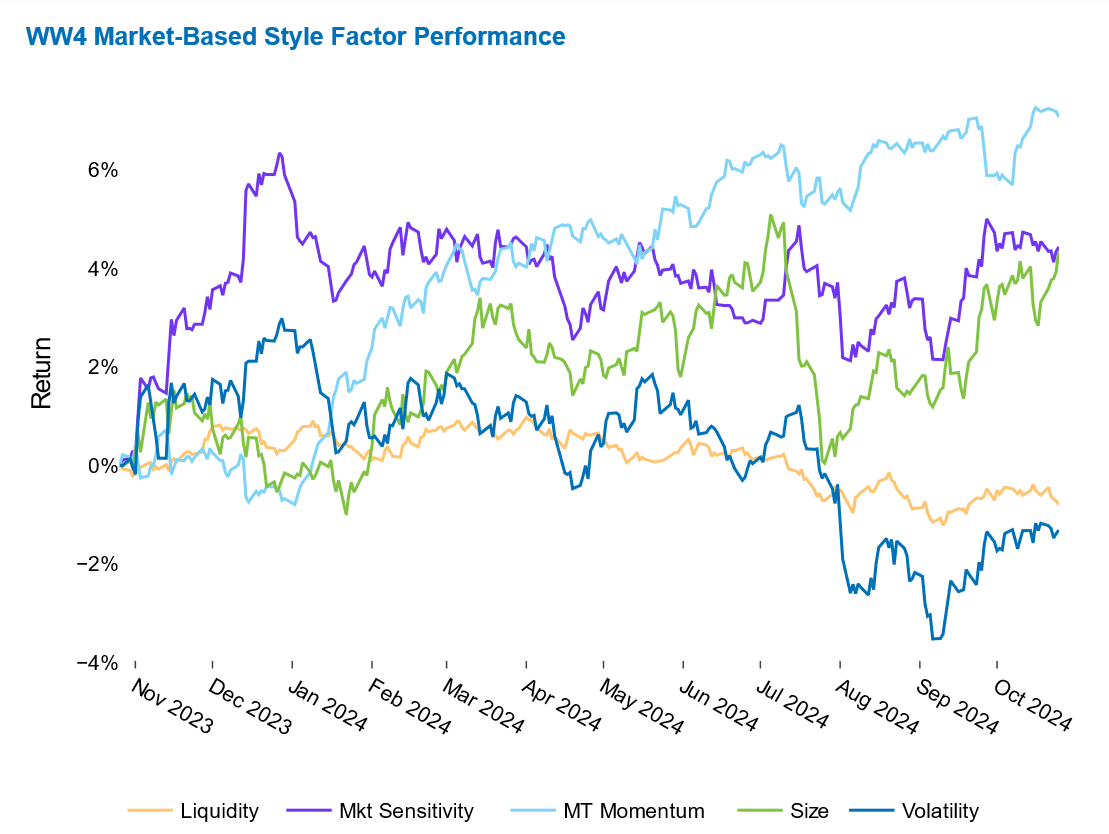

High-beta, large stocks with momentum favored in Developed Markets

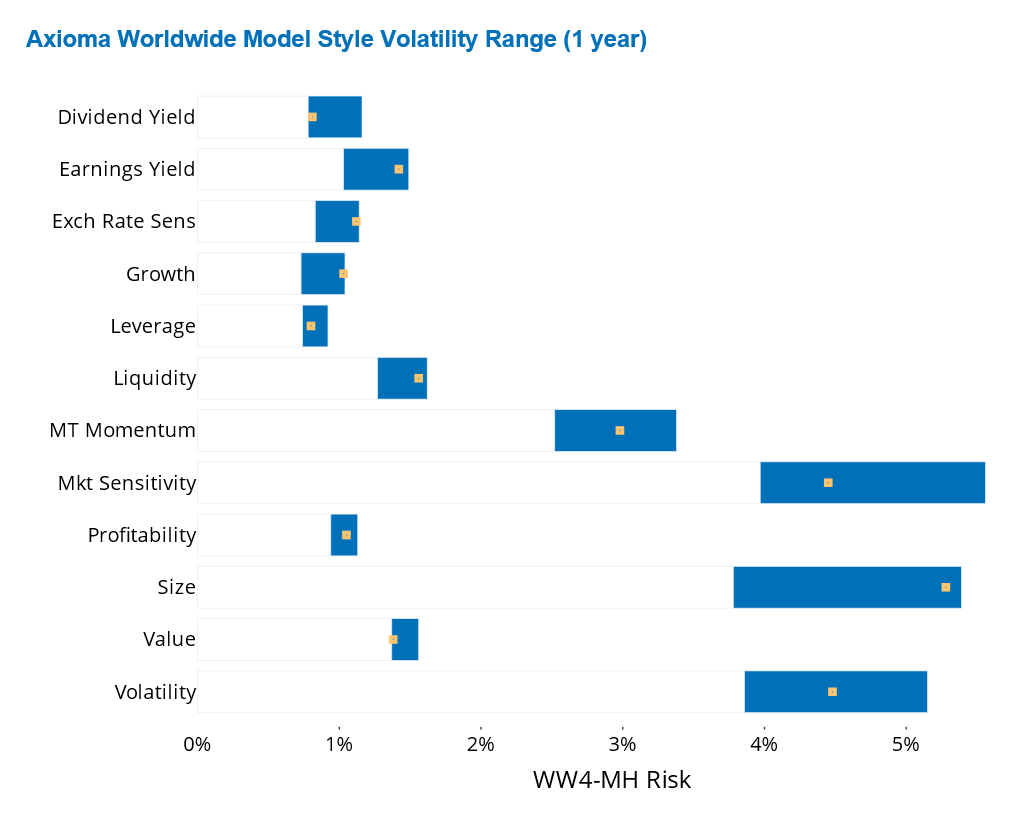

Over the past year, investors favored high-beta, large stocks with momentum in Developed Markets, as evidenced by the significant positive returns of Market Sensitivity, Size, and Medium-Term Momentum, respectively, in Axioma’s Worldwide fundamental medium-horizon model. Although these three style factors achieved similar 12-month gains, they each took unique paths to get there.

Momentum has been on a steep upward trajectory since January, posting the highest 12-month return (7%) among all style factors in the model. Market Sensitivity climbed significantly at the start of the one-year period and has remained relatively flat since February. Size marched up steadily until July, when it dropped sharply, only to retrace its steps in most recent months and reach a 12-month return of about 4% last week, on par with that of Market Sensitivity. Of the three style factors, only Momentum’s 12-month return exceeded the expectation at the beginning of the period.

While Size’s 12-month return is not “outsized” relative to its volatility, it is contrary to historical norms (which indicate a negative long-term return for Size). Size is also the riskiest among all style factors, followed by Volatility, Market Sensitivity, and Momentum. Additionally, Size is currently positioned at the high end of its one-year volatility range.

See graphs from the STOXX Developed World Equity Risk Monitor as of October 25, 2024:

Top-line risk declines but what is brewing “under the hood”?

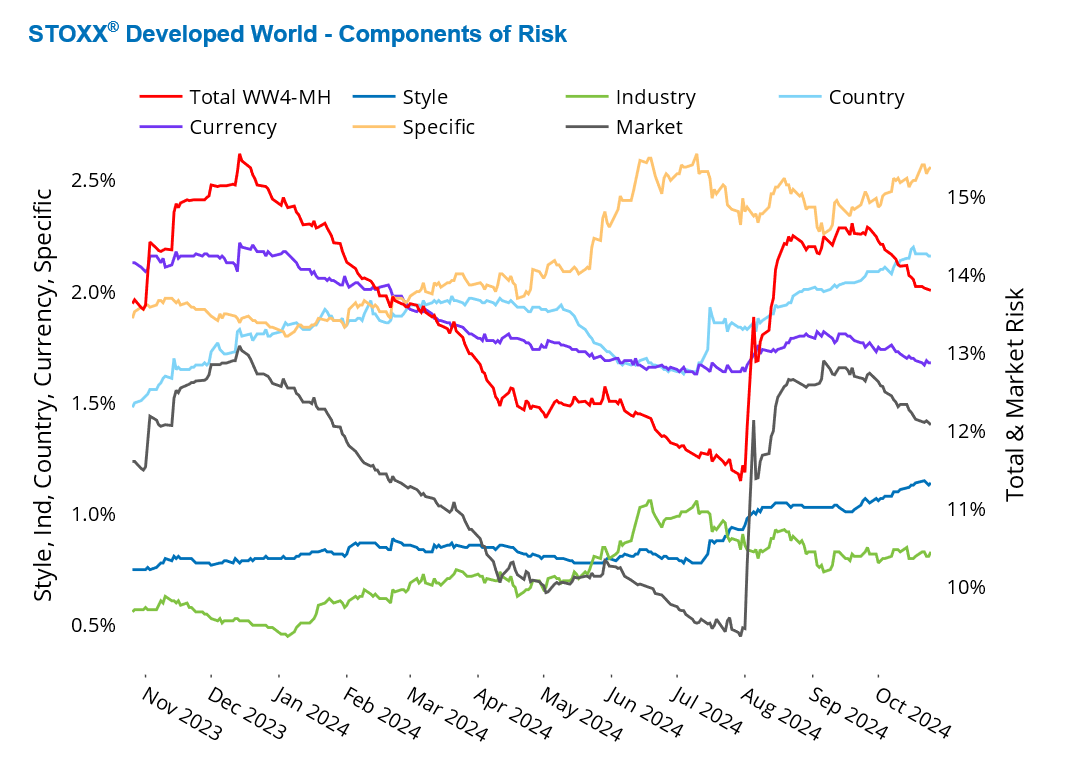

While global risk is now lower than in the beginning of the year, a lot has happened “under the hood.” The Total predicted risk of the STOXX Developed Markets index risk fluctuated significantly over the past year, as measured by Axioma’s Worldwide medium-horizon fundamental model. After a sharp decline in the first seven months, Total predicted risk surged in August, peaked in September, and then decreased somewhat over the past month.

Ultimately, these fluctuations resulted in a 100 basis point year-to-date drop in the Total risk of the STOXX Developed Markets index which has risen 19% so far this year.

Examining the major components of risk, Market risk—the primary driver of benchmark risk—mirrored the path of Total risk. However, Country, Industry, Style, and Specific risks have all trended upward during the same period. Only Currency risk has somewhat steadily declined throughout the year.

See graph from the STOXX Developed World Equity Risk Monitor as of October 25, 2024:

You may also like