EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED DECEMBER 6, 2024

Axioma Risk Monitor: US stocks continue to climb but risk spreads sound alarm bells; US trading volumes swell; South Korea’s market and currency sink to new lows

US stocks continue to climb but risk spreads sound alarm bells

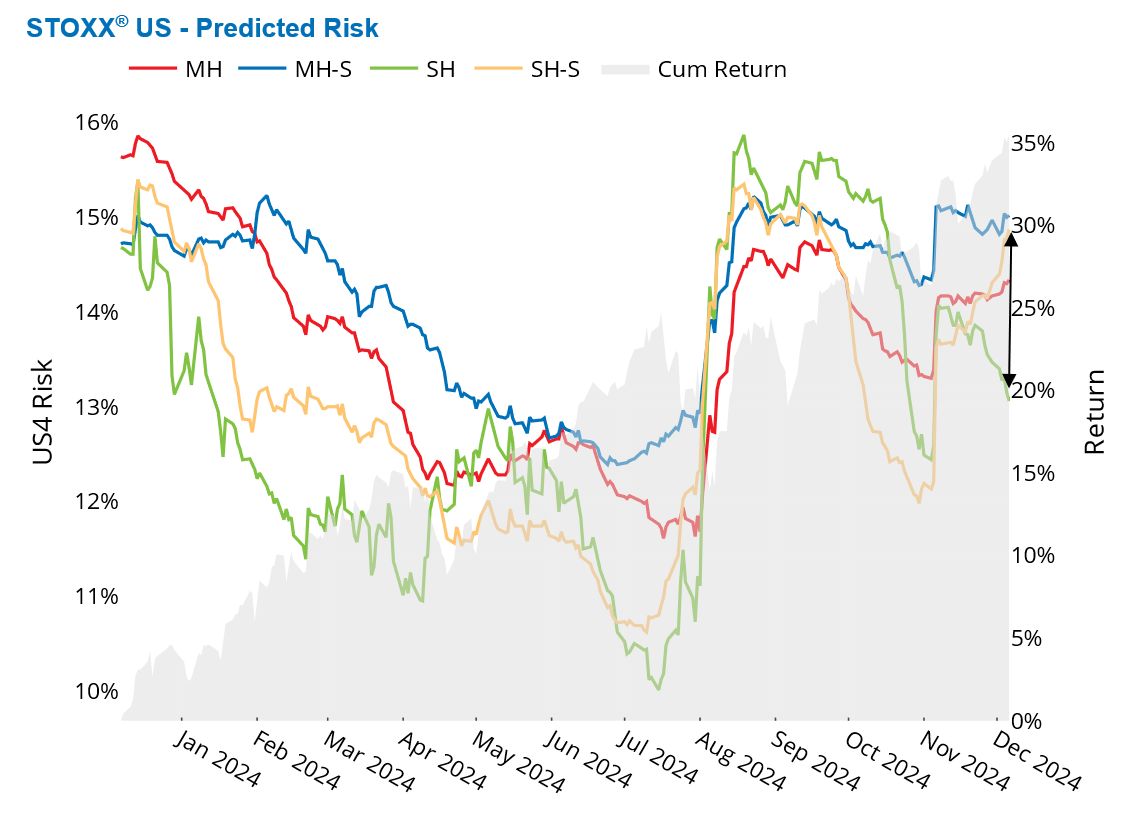

The US market continued its upward trend last week, but the growing disparity between statistical and fundamental risk forecasts raises concerns. The STOXX US index increased by 1% over the past five business days, buoyed by Friday's jobs report, which showed higher-than-expected job additions and a slight rise in the unemployment rate that matched estimates.

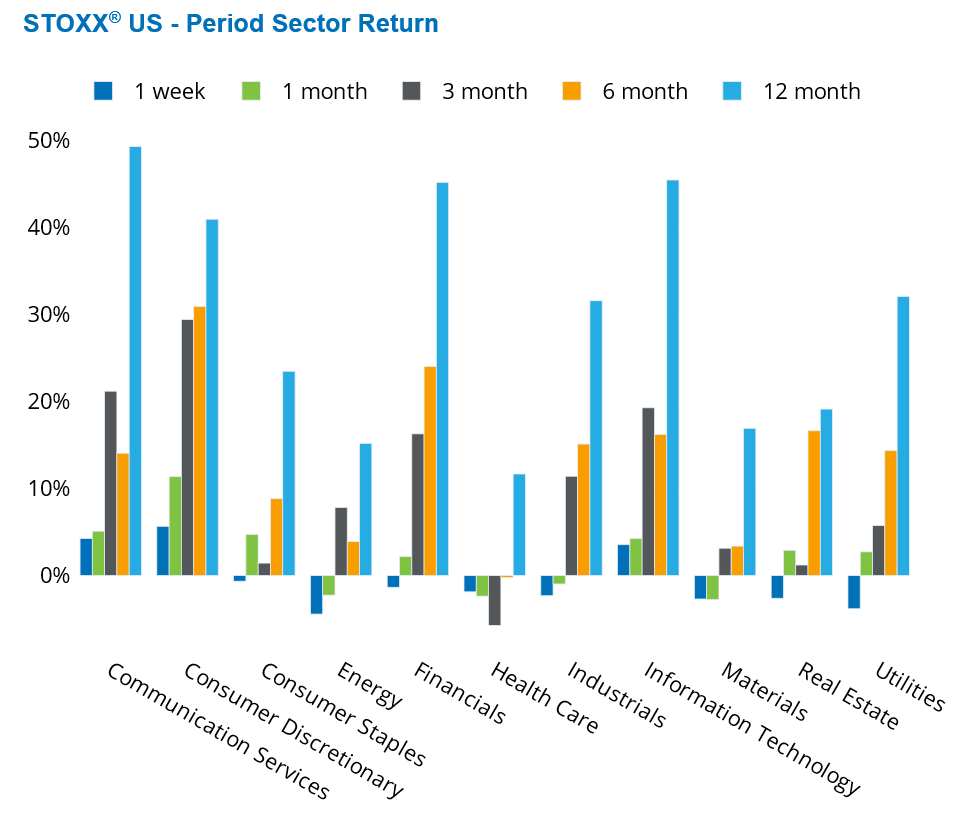

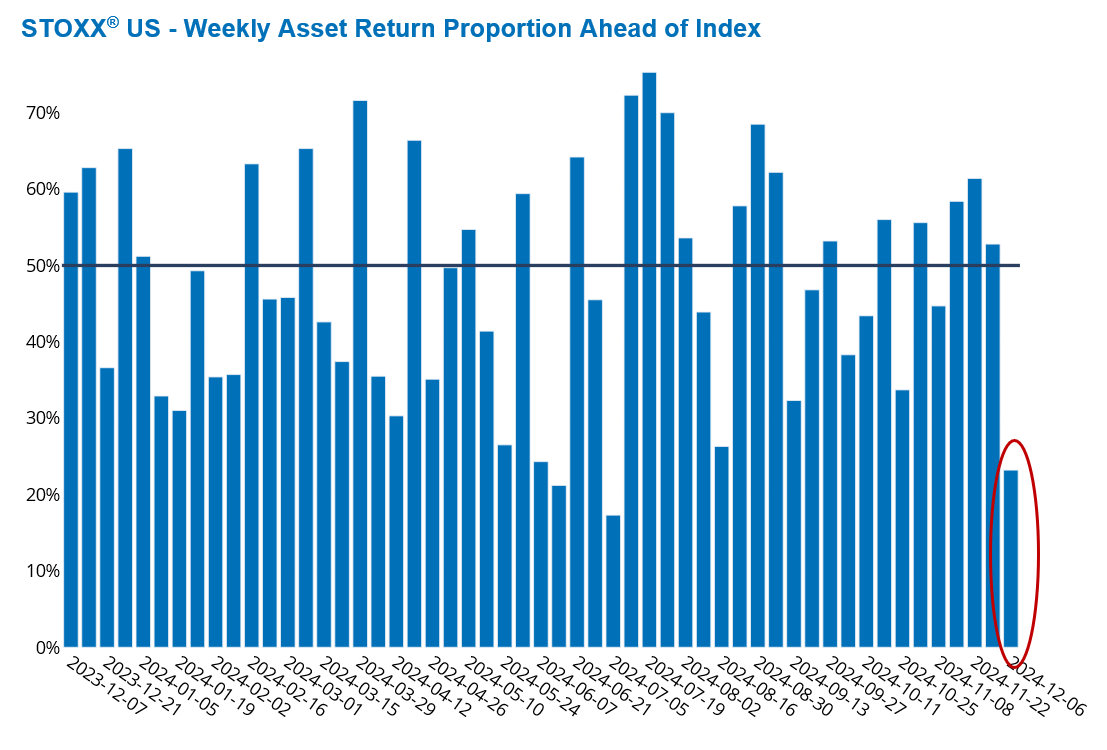

However, the market's rise was driven by only three sectors: Information Technology, Consumer Discretionary, and Communication Services. All other sectors in the STOXX US index declined last week. Notably, only 20% of the stocks in the US benchmark outperformed it, indicating that the market's gains were primarily due to large companies.

The statistical-fundamental risk gap became positive around the US Elections and has widened since, as the fundamental variant decreased while the statistical one increased, according to Axioma’s US4 short-horizon model. The positive spread suggests that statistical models are detecting additional risks beyond those identified by fundamental models.

This could signal potential shifts in the risk regime or the emergence of non-traditional risk factors in the market, especially as the Trump administration prepares to implement significant policy changes that could greatly impact the US economy.

See graphs from the STOXX US Equity Risk Monitor as of December 6, 2024:

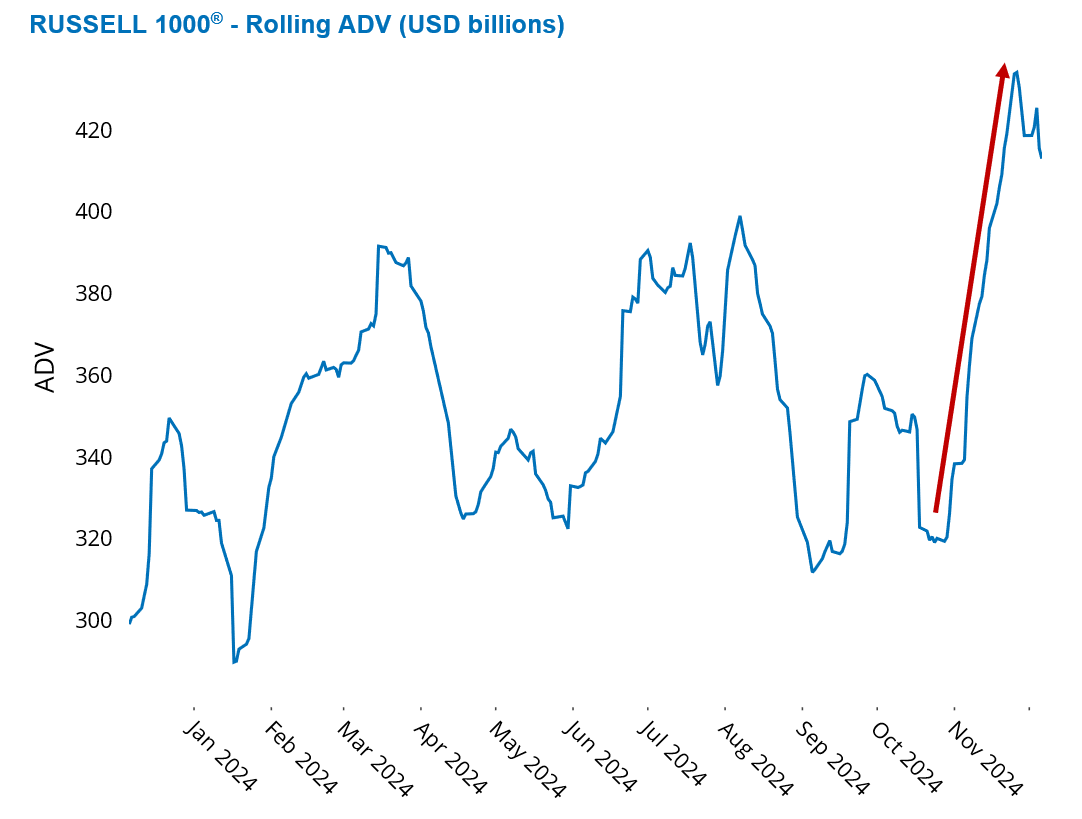

US trading volumes swell

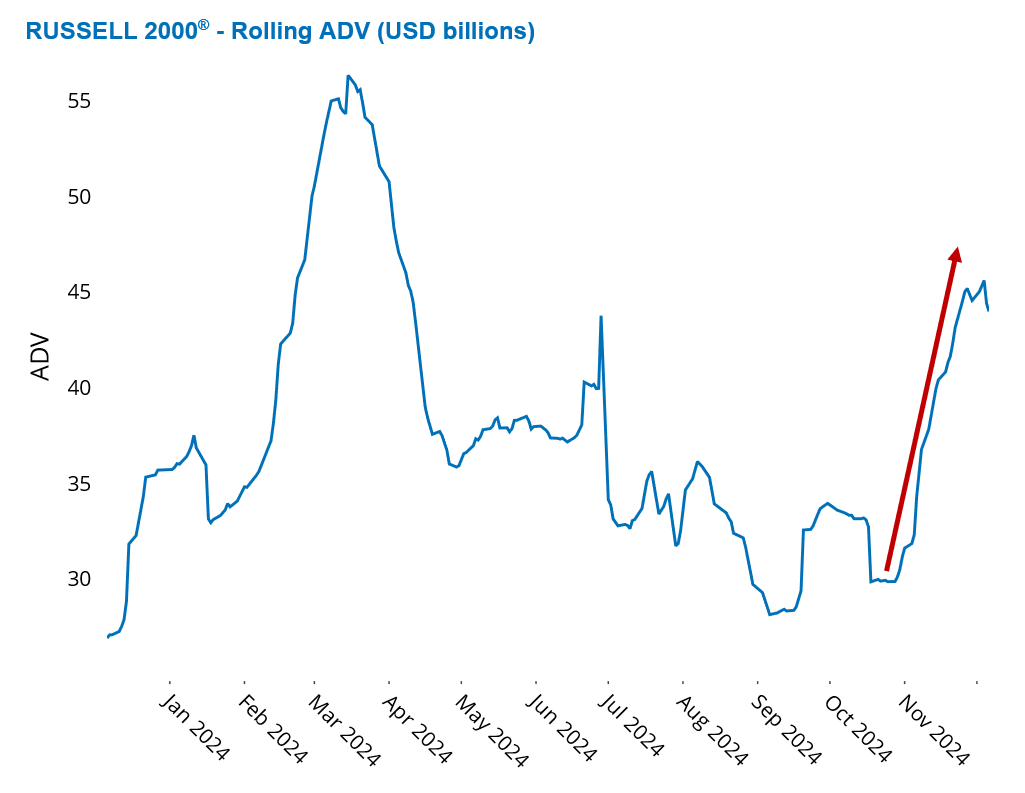

Since the US Elections, trading activity in both large- and small-cap US stocks has surged. The combination of reduced political uncertainty, expectations of favorable domestic economic policies, a significant shift in investor sentiment, and sector rotation have all led to a sharp increase in trading volumes for US stocks.

With the election uncertainty removed, many felt more confident in making investment decisions. The anticipated pro-business agenda (e.g., potential tax cuts and deregulation) of the new administration is expected to favor domestic companies. There was also a notable shift in investor sentiment towards small-cap stocks, with investors reallocating their portfolios to capitalize on expected growth. Investors have also been rotating out of Energy, Health Care, and Materials and into Consumer Discretionary and Information Technology.

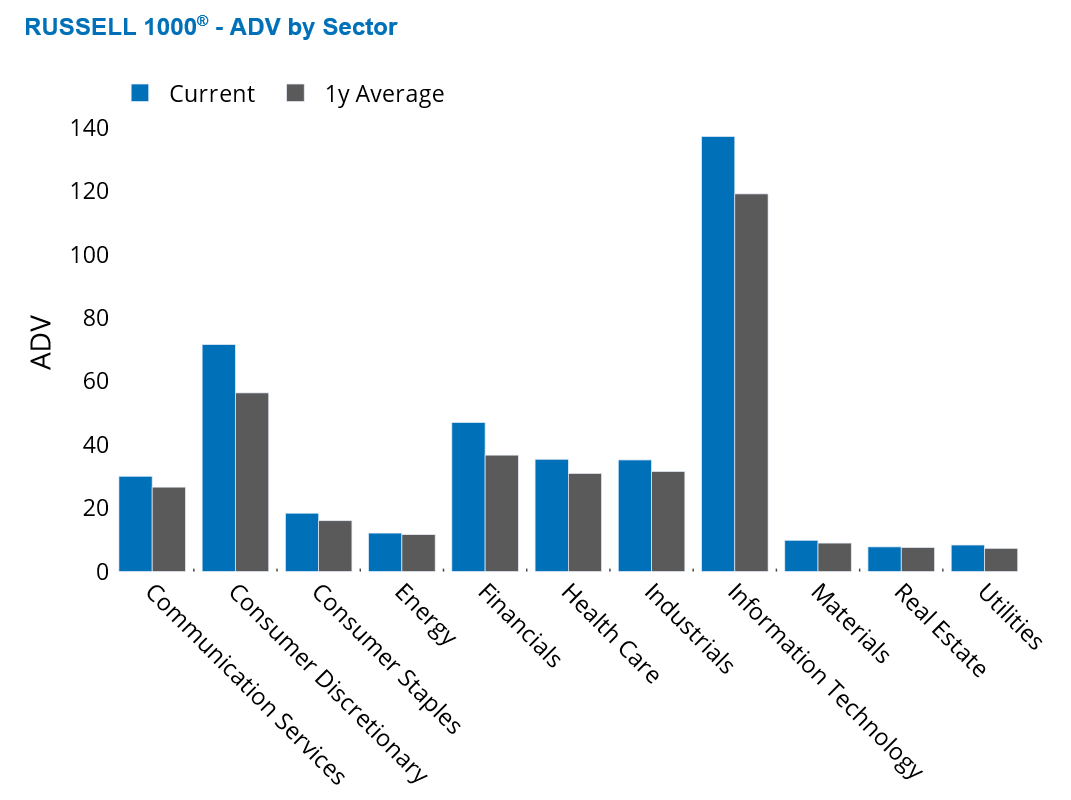

The average daily trading volume in the Russell 1000 now exceeds $400 billion, marking more than a 20% increase compared to pre-election levels. This recent peak in volumes is the highest in at least 12 months. The surge was driven by intense trading activity in Information Technology, Financials, and Consumer Discretionary, which have seen much larger trading volumes compared to their respective one-year averages.

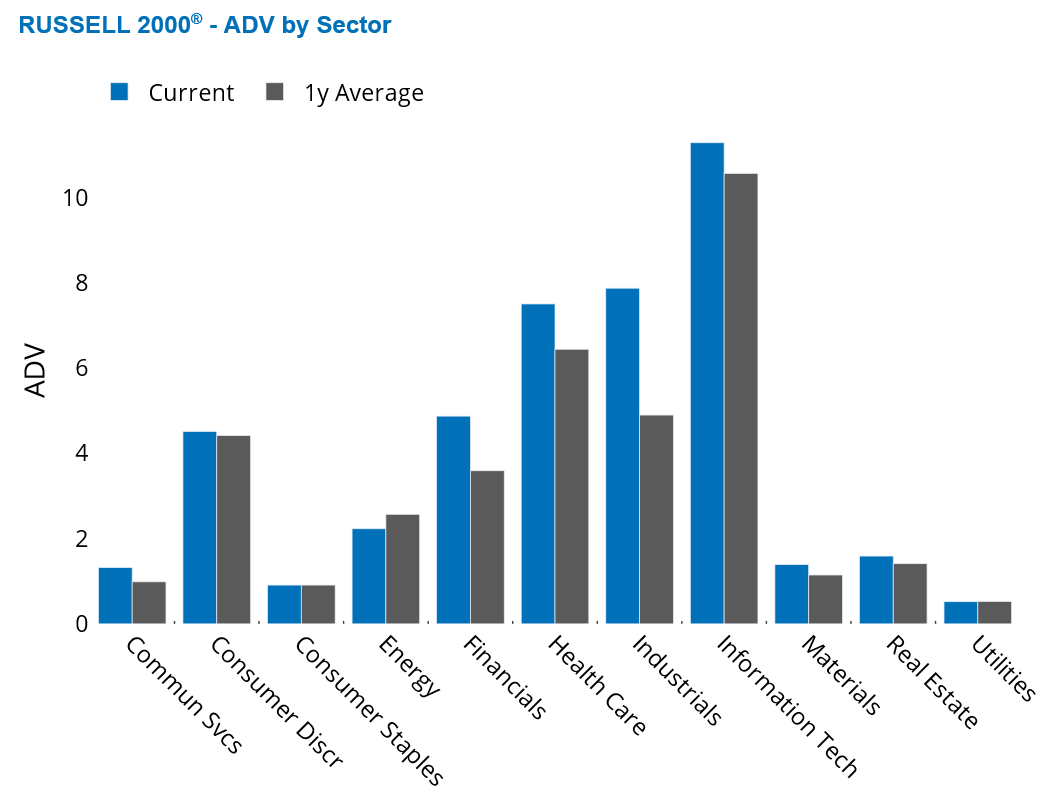

Trading activity in the Russell 2000 has increased by 40% since Election Day, with Information Technology, Industrials, and Health Care being the largest contributors. However, the current trading volume for the Russell 2000 is lower than it was earlier this year in March.

See graphs from the Russell 1000 Equity Risk Monitor as of December 6, 2024:

See graphs from the Russell 2000 Equity Risk Monitor as of December 6, 2024:

South Korea’s market and currency sink to new lows

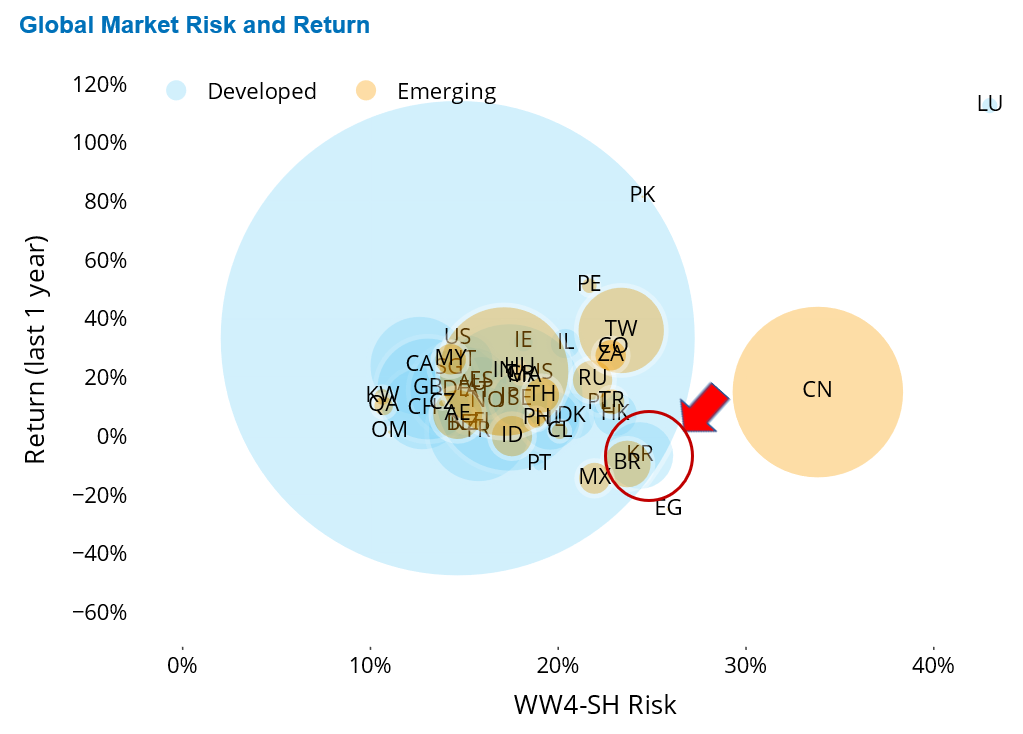

Recent political turmoil in South Korea has caused significant declines in both the Korean stock market and the value of the won, reflecting heightened investor anxiety over political stability and economic prospects. The South Korean market fell for three consecutive days following the martial law announcement on Dec. 3rd, resulting in a total weekly loss of 3%. Although the imposition of martial law was brief, the head of South Korea’s ruling party suggested last Friday that martial law could be declared again.

South Korea’s one-year negative return of 6.5% (denominated in US dollars) is the second worst after Portugal’s (10%) among major developed markets. Among emerging markets, only Brazil, Mexico, and Egypt have lower 12-month returns. With 24% volatility, South Korea is also the riskiest major developed country, with its risk now surpassing that of Mexico and Brazil, as measured by Axioma’s Worldwide fundamental short-horizon model.

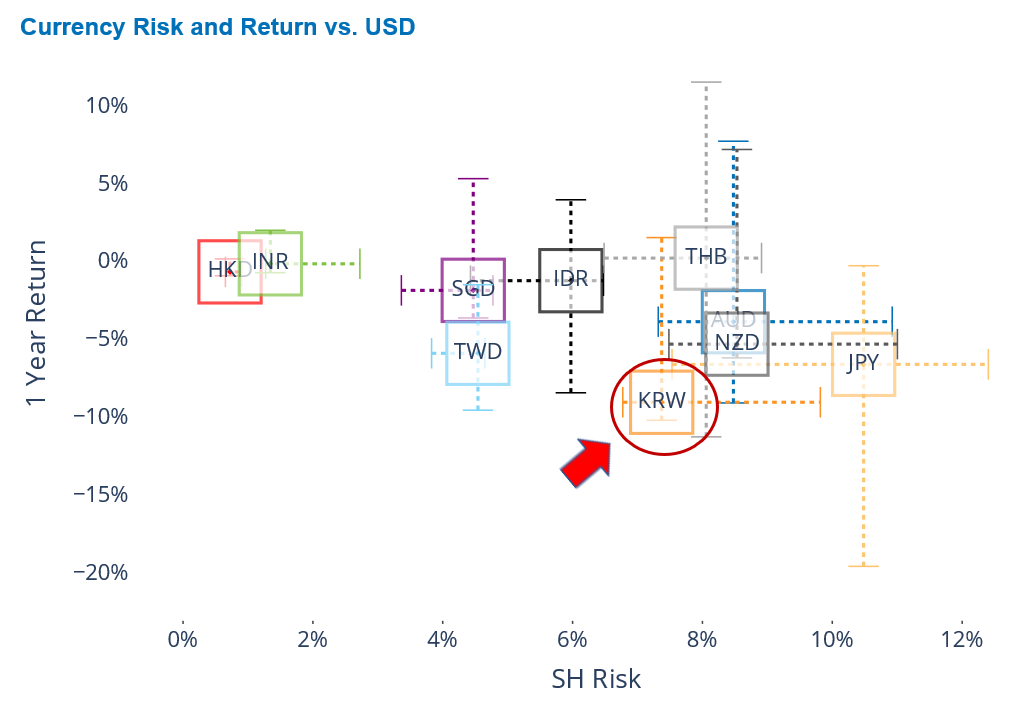

The Korean won weakened sharply against the US dollar, sinking to a two-year low. As of last Friday, the won recorded a 12-month loss of 9%, making it the worst performer among major Asian currencies. The Korean currency’s recent loss pushed it to the low end of its one-year return range. The won’s risk remained relatively low, staying close to the low end of its one-year volatility range, and relative to other Asian currencies, it was somewhere in the middle of the pack.

See graphs from the STOXX Asia Pacific 600 ex-Japan Equity Risk Monitor as of December 6, 2024:

You may also like