EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED MAY 2, 2025

- Correlations Sky-High Almost Everywhere

- Momentum is Defense?

- US Risk Ticks Down

Correlations Sky-High Almost Everywhere

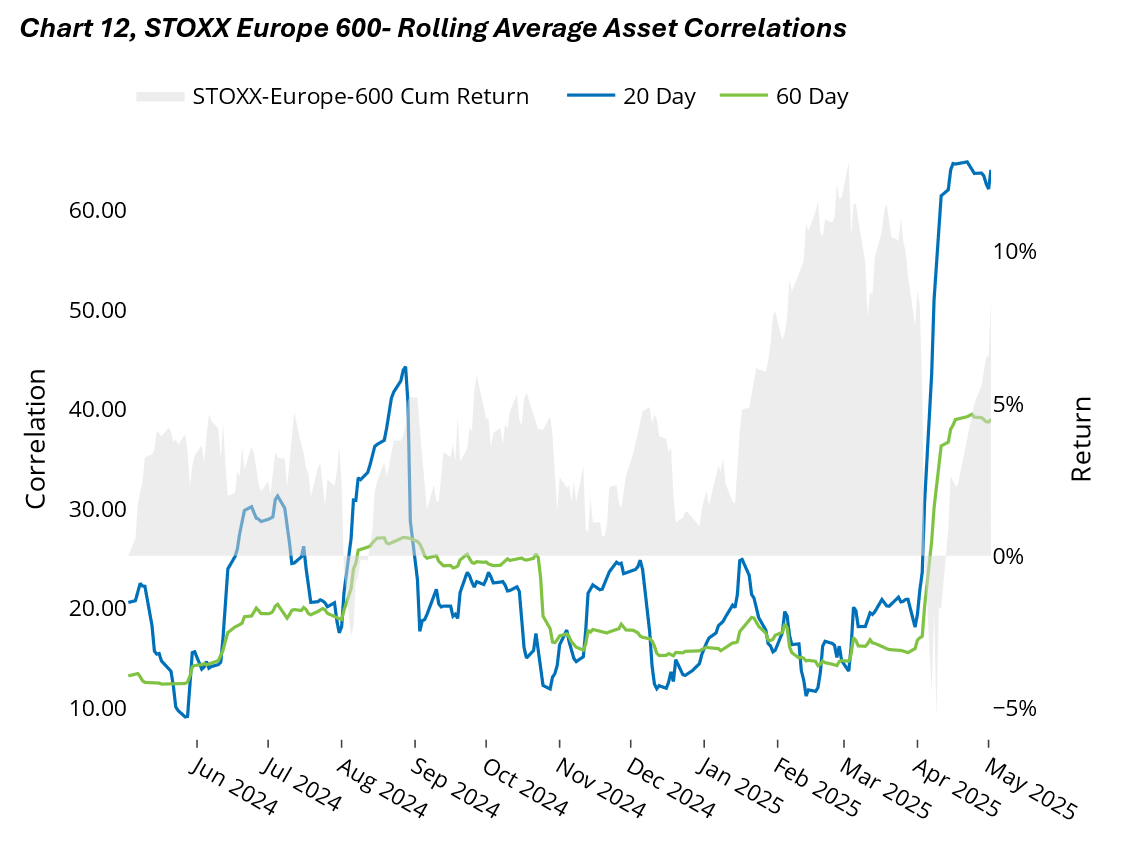

Last week we pointed out rising correlations in the US market approaching levels not observed since the spring of 2020. This phenomenon is more or less occurring globally, but the measure in the STOXX Europe 600 index stands out:

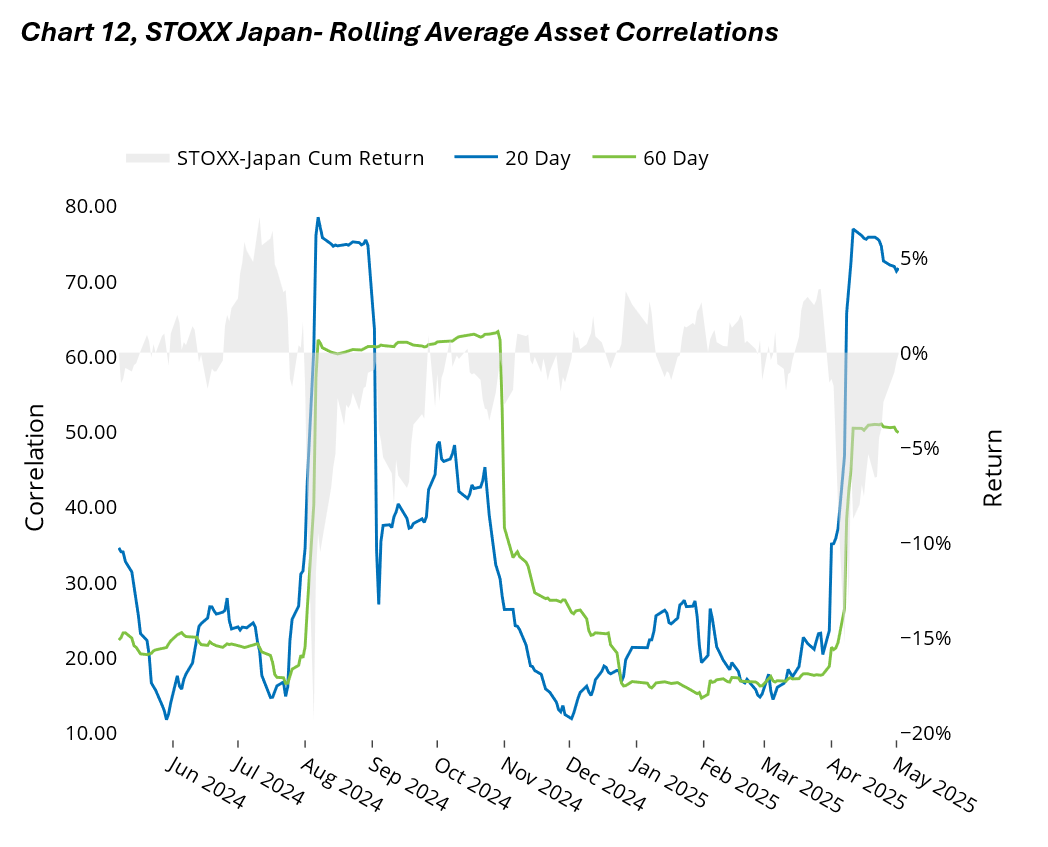

In Japan, they are even higher:

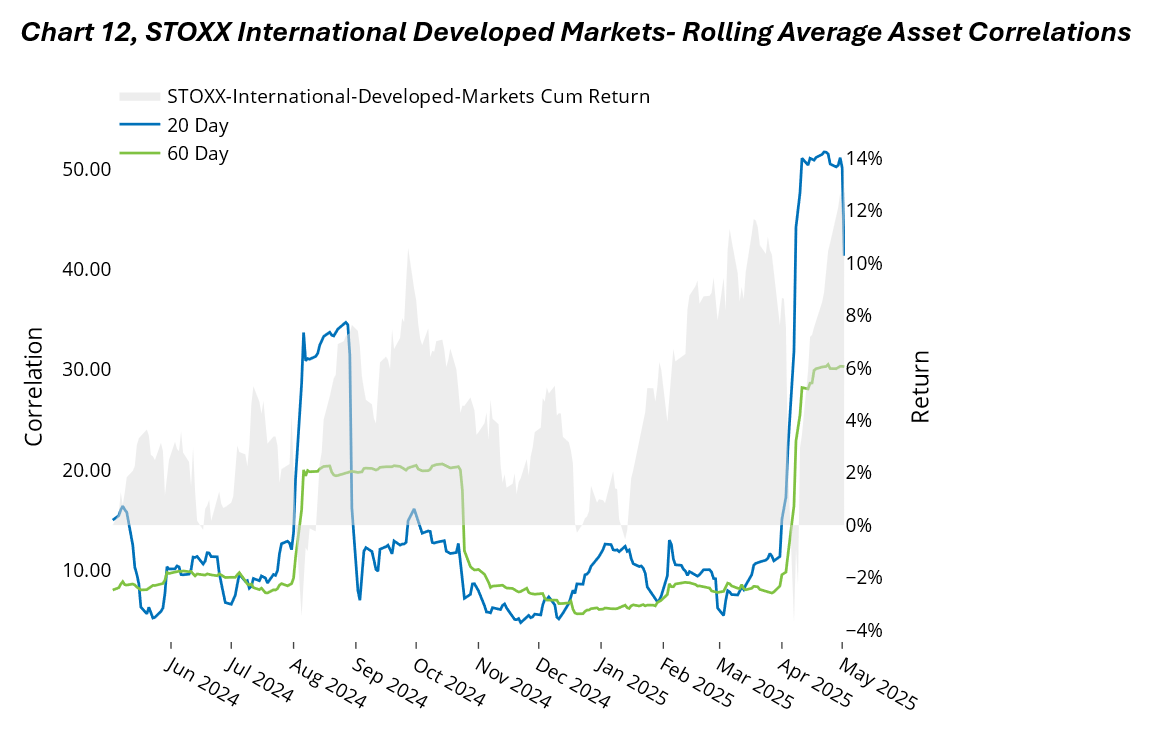

However, when measured across all Developed markets (ex-US), they look considerably lower, implying that correlations across markets (Europe, Japan, Australia, Canada) etc. are not as strong as they are within markets:

These correlation measurements are average pair-wise correlations of all the constituents in the named indices and are not a product of the Axioma risk models.

Momentum as Defense?

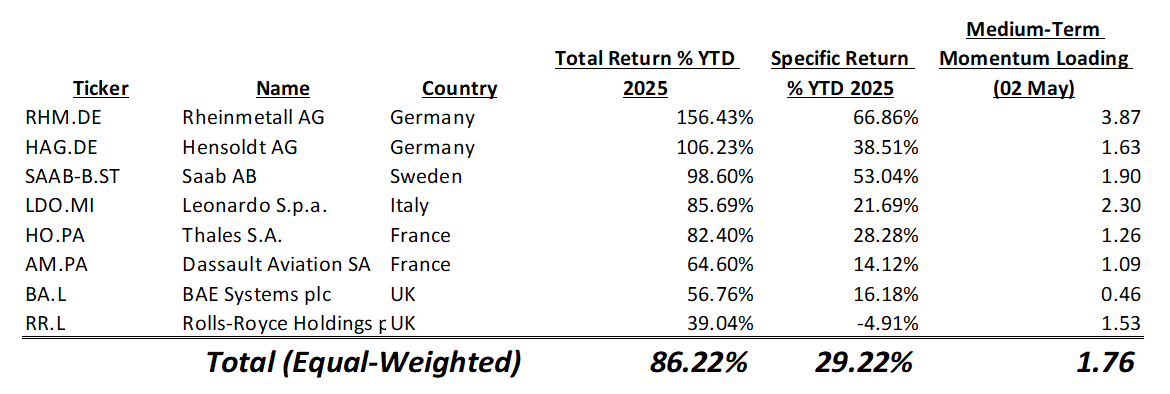

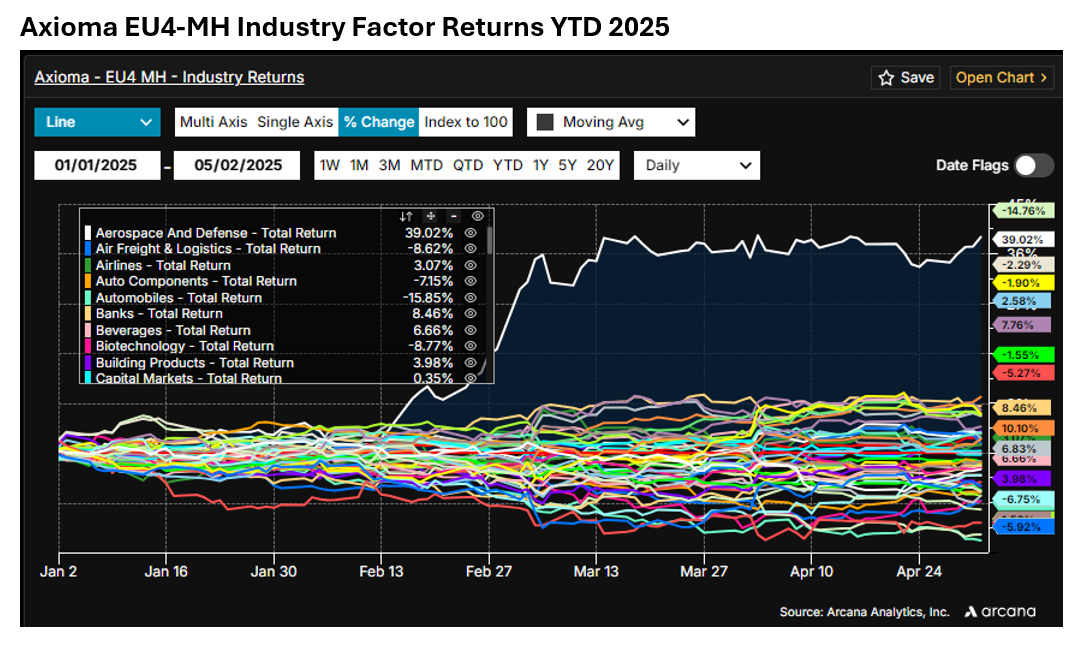

Move over “Magnificent 7,” there’s a new super-group in town. While they don’t dominate the European indices like the US tech stocks do, the major European defense stocks have been standouts YTD:

Source: Axioma, Arcana

Led by Rheinmetall, these industrial powerhouses have captured investor attention as countries pledge meaningful increases in their defense budgets for the first time in decades, as the US provided security umbrella is retracted by the Trump administration. The EU4 Aerospace and Defense Industry factor is, by far, the most significant industry factor in Europe, if not the entire world YTD:

Source: Axioma, Arcana

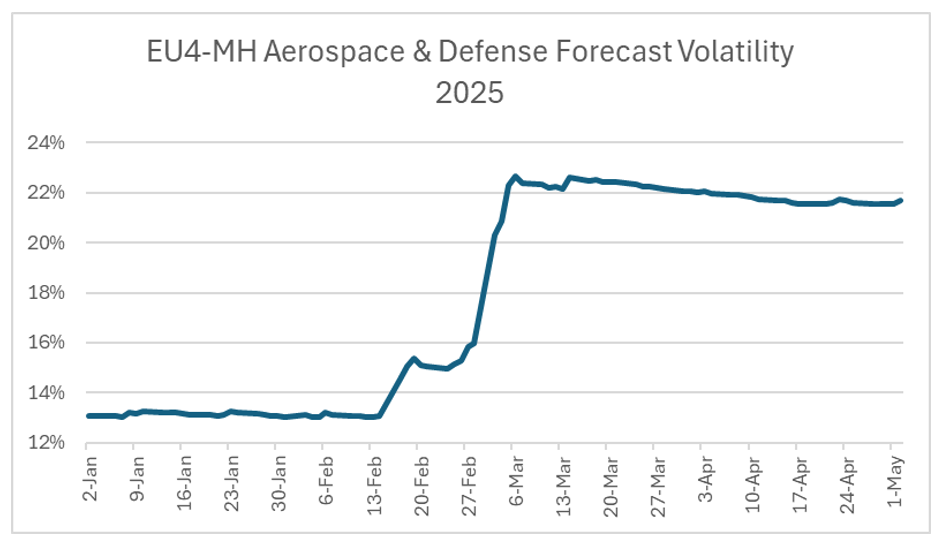

The forecast volatility of the Aerospace & Defense factor has risen by 65% YTD- second only to the risk of the Ukraine Country factor in the Axioma EU4 fundamental medium-horizon model:

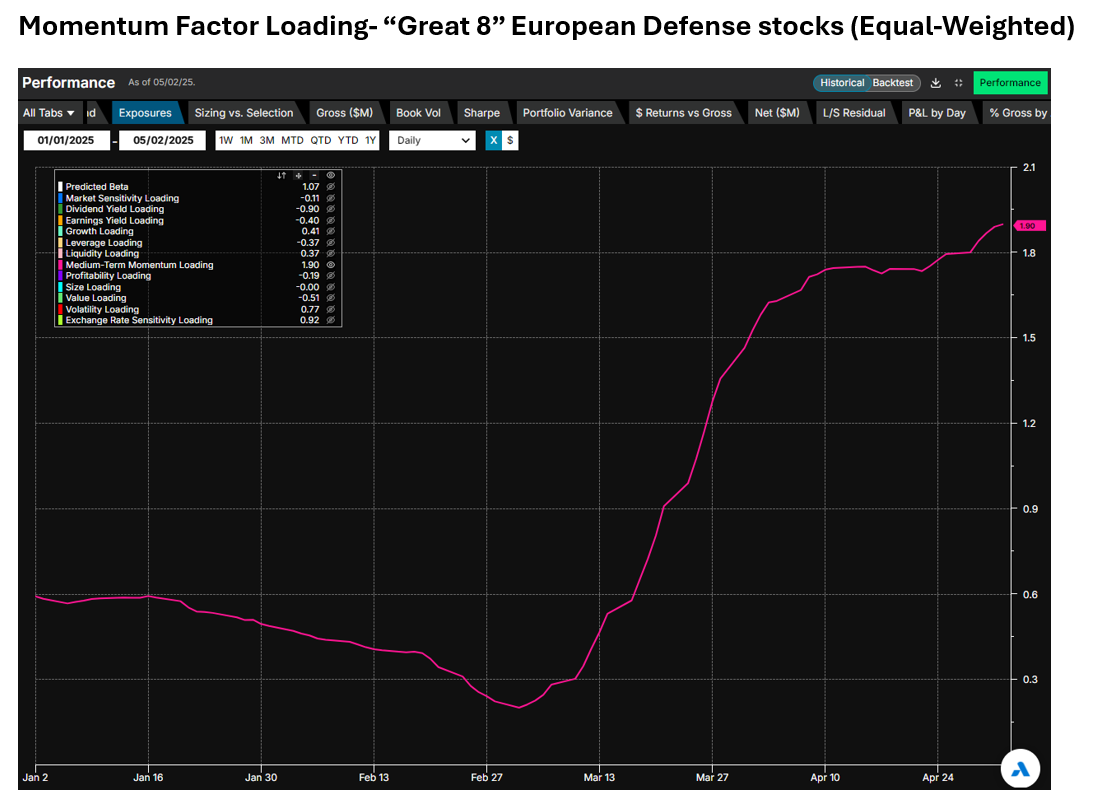

In addition, this group of stocks has continued to gain Momentum Exposure YTD, particularly after the Munich Security Conference and the subsequent announcement by Germany of the removal of deficit restrictions for defense spending:

Source: Axioma, Arcana

Even after this historic rally, the Aerospace & Defense sector makes up less than 5% of the STOXX Europe 600 index, compared to 11% for Banks and 10% for Pharmaceuticals.

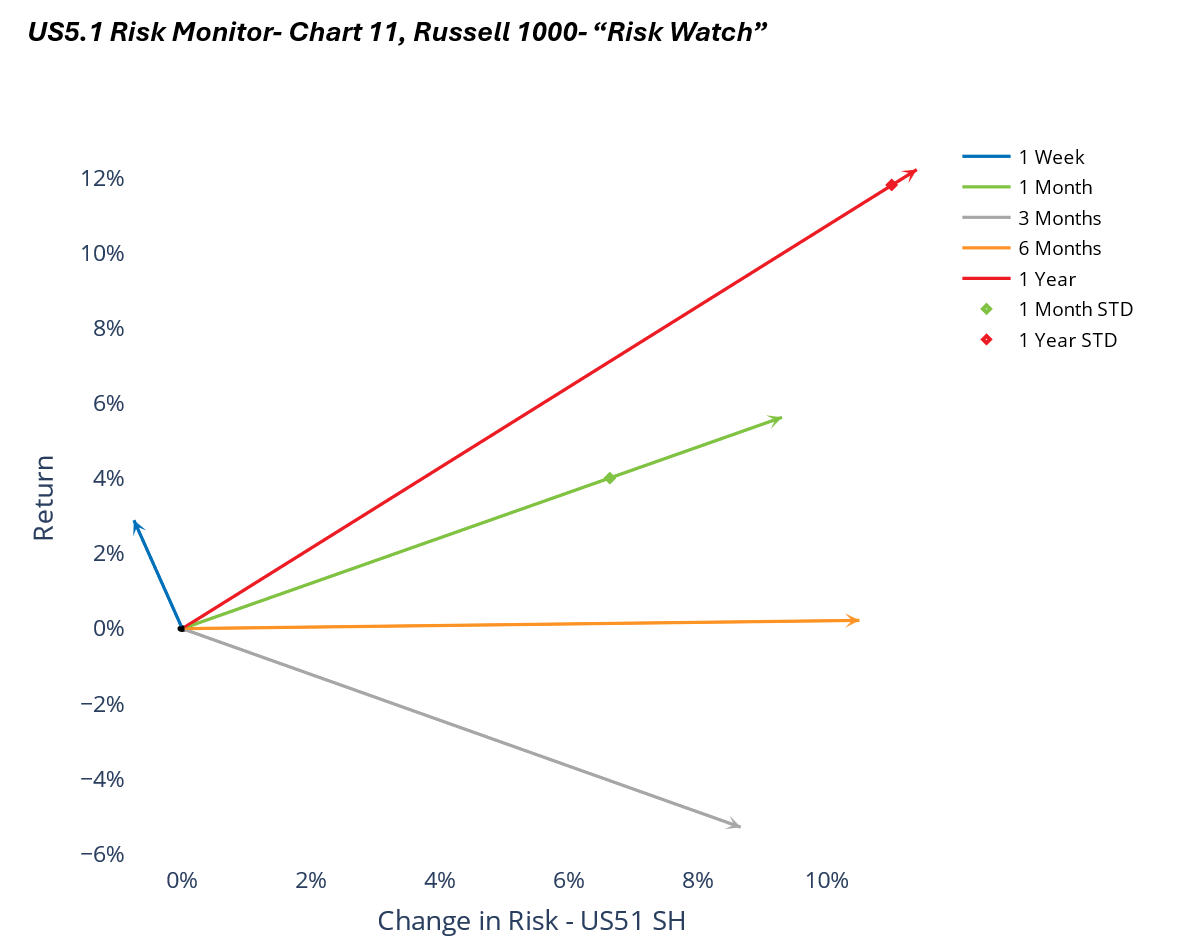

US Risk Ticks Down

Finally, in the US, the market rallied nearly 3% and predicted risk came down by 75 basis points relative to the end of the prior week:

You may also like