EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED JUNE 13, 2025

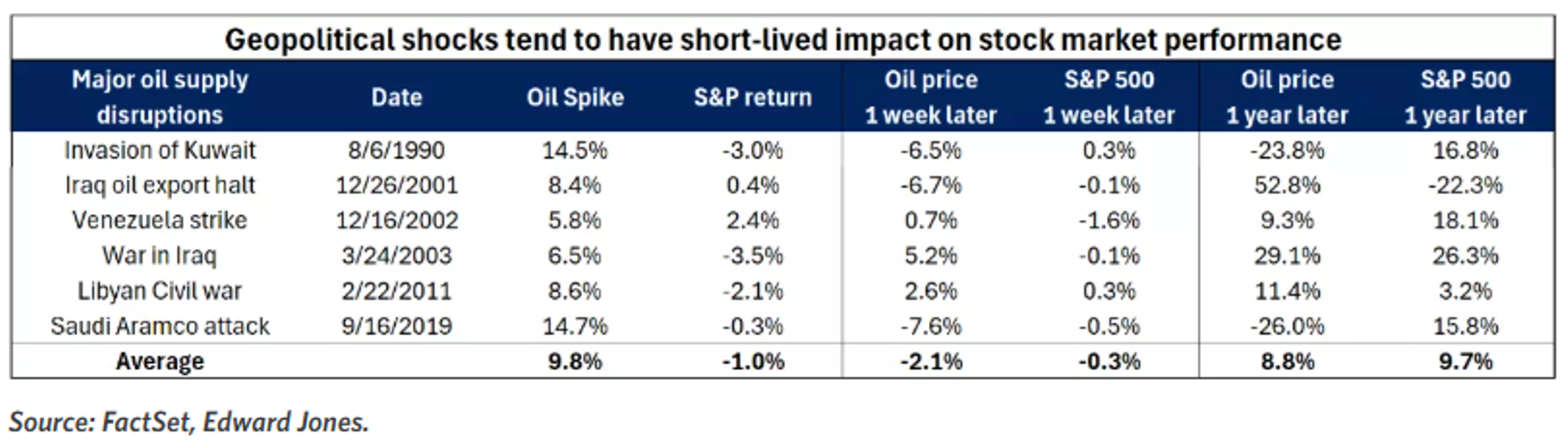

It has become somewhat of a trope that markets get “roiled” by geopolitical “tensions”. The historical record would show, however, that once the new information is incorporated into investors’ forecasts, shocks are short-lived and do not have long-lasting effects on the direction or character of equity markets. Our colleagues at Edward Jones published this table late last week in their weekly market recap (Weekly Stock Market Update | Edward Jones):

While in many of these war/political shocks to the energy supply leave the global oil price elevated, equity markets recover quite quickly, with 70% of the average decline recovered within a week. Oil is not as big an input into GDP and profits for developed countries as it once was, and it comprises a much smaller proportion of the market than it used to.

Late last week, we learned that Israel had begun full-scale attacks on Iranian nuclear energy and ballistic missile sites all around the country. On Friday the 13th, Brent futures spiked up more than 11%, and ended the day up over 6%. The action on US oil (WTI) contracts was similar, spiking overnight on the 12th to a 14.5% increase over the daily close, but settled for the day up just over 8%. Equity markets were mostly down on the week, but not by a great deal considering the magnitude of the news shock.

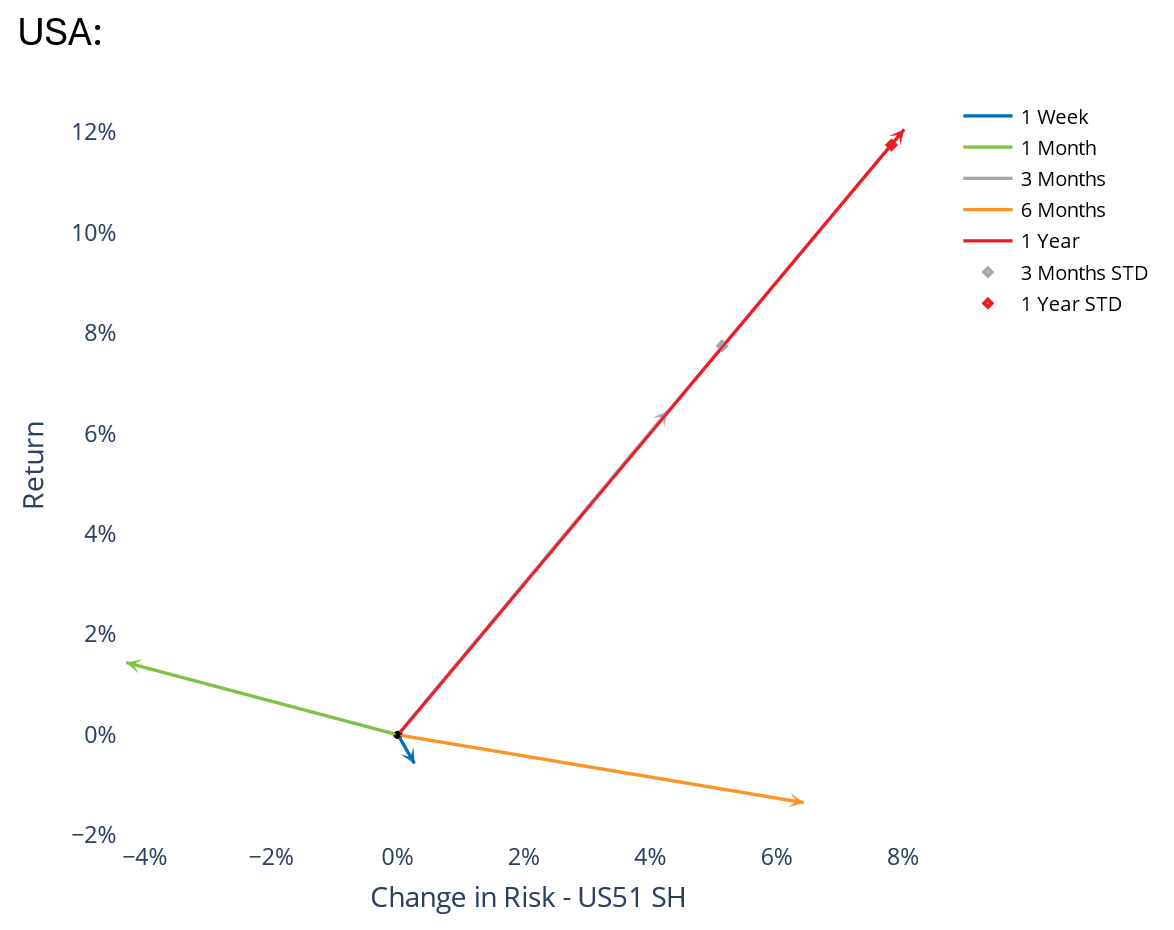

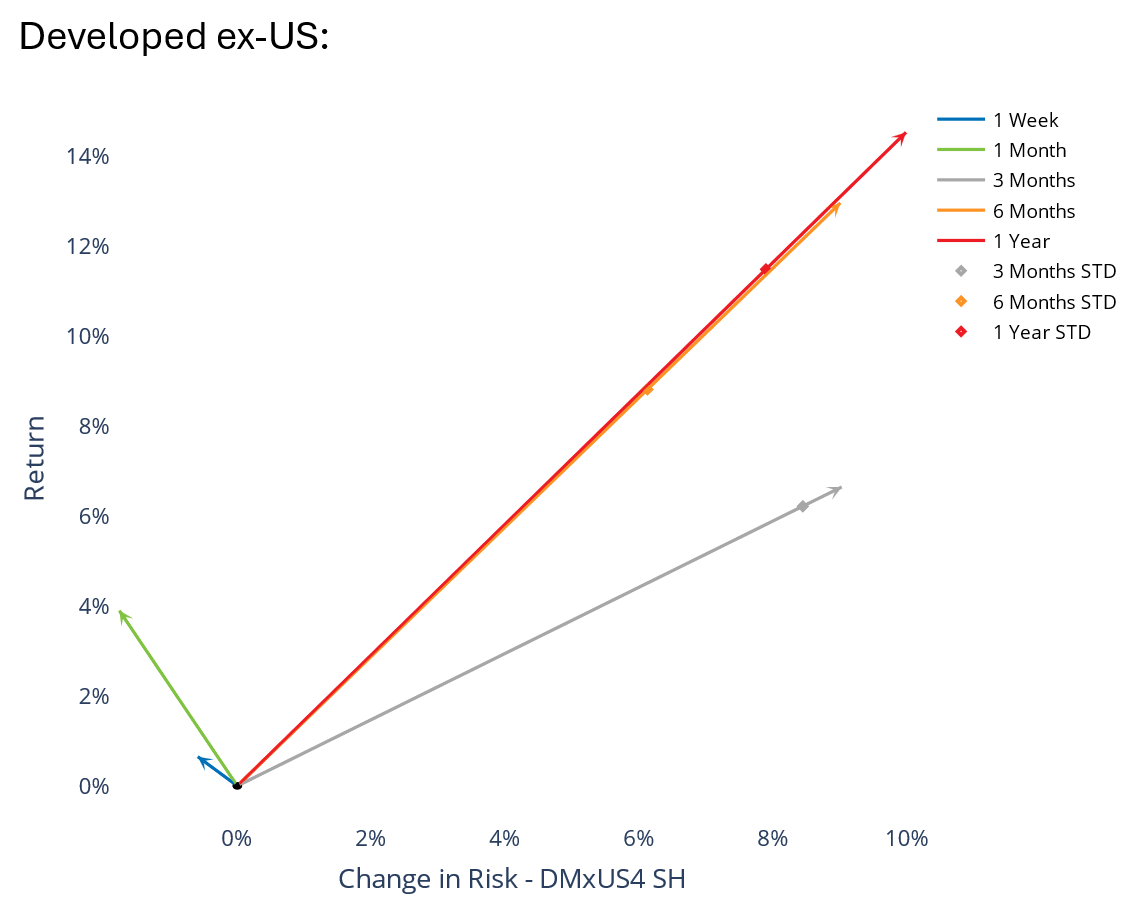

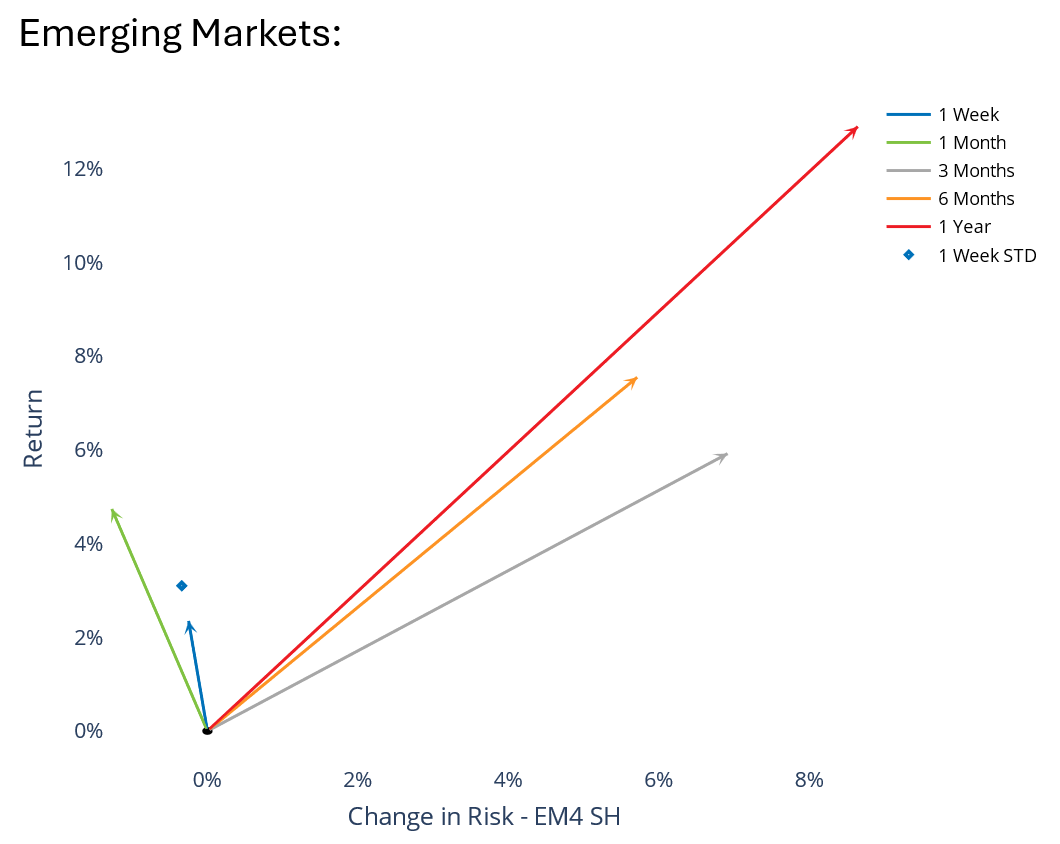

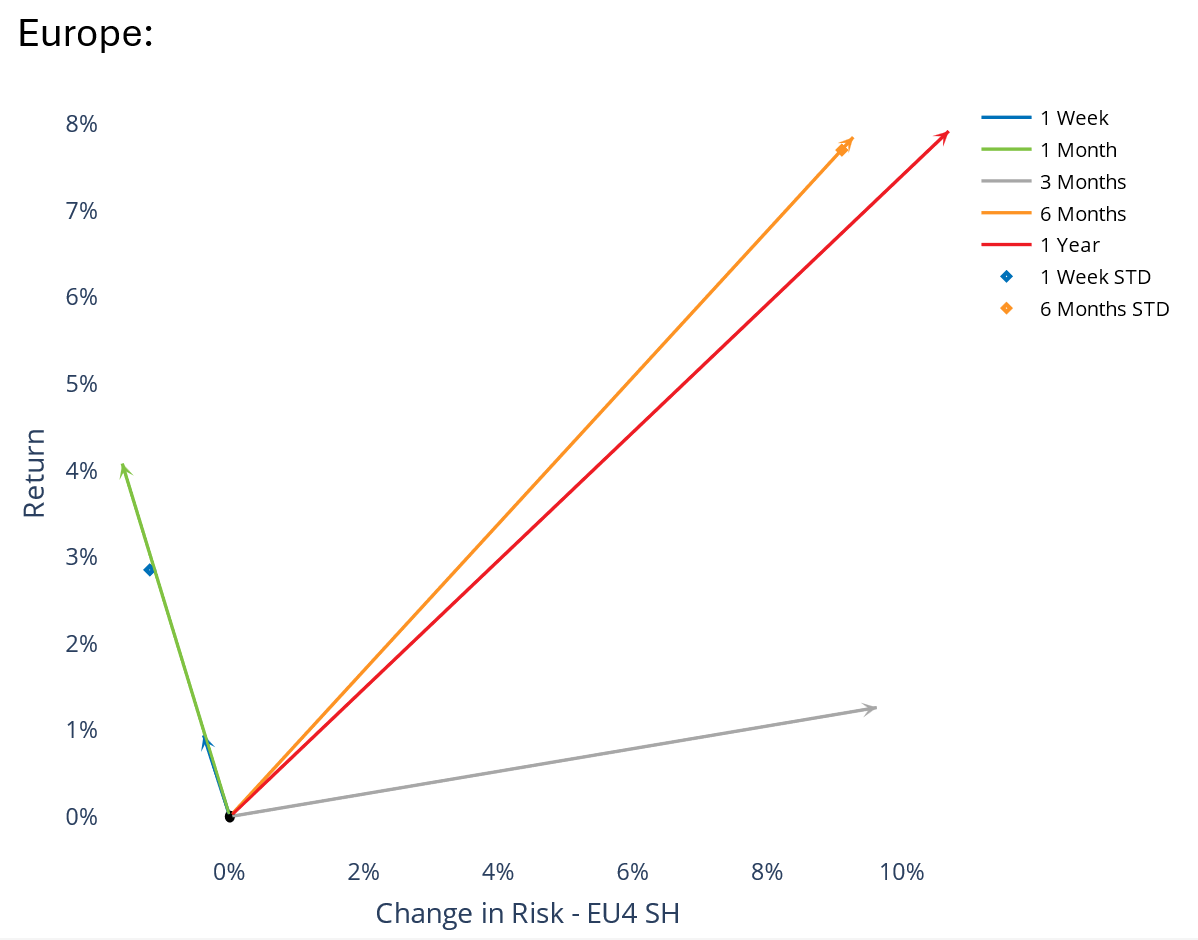

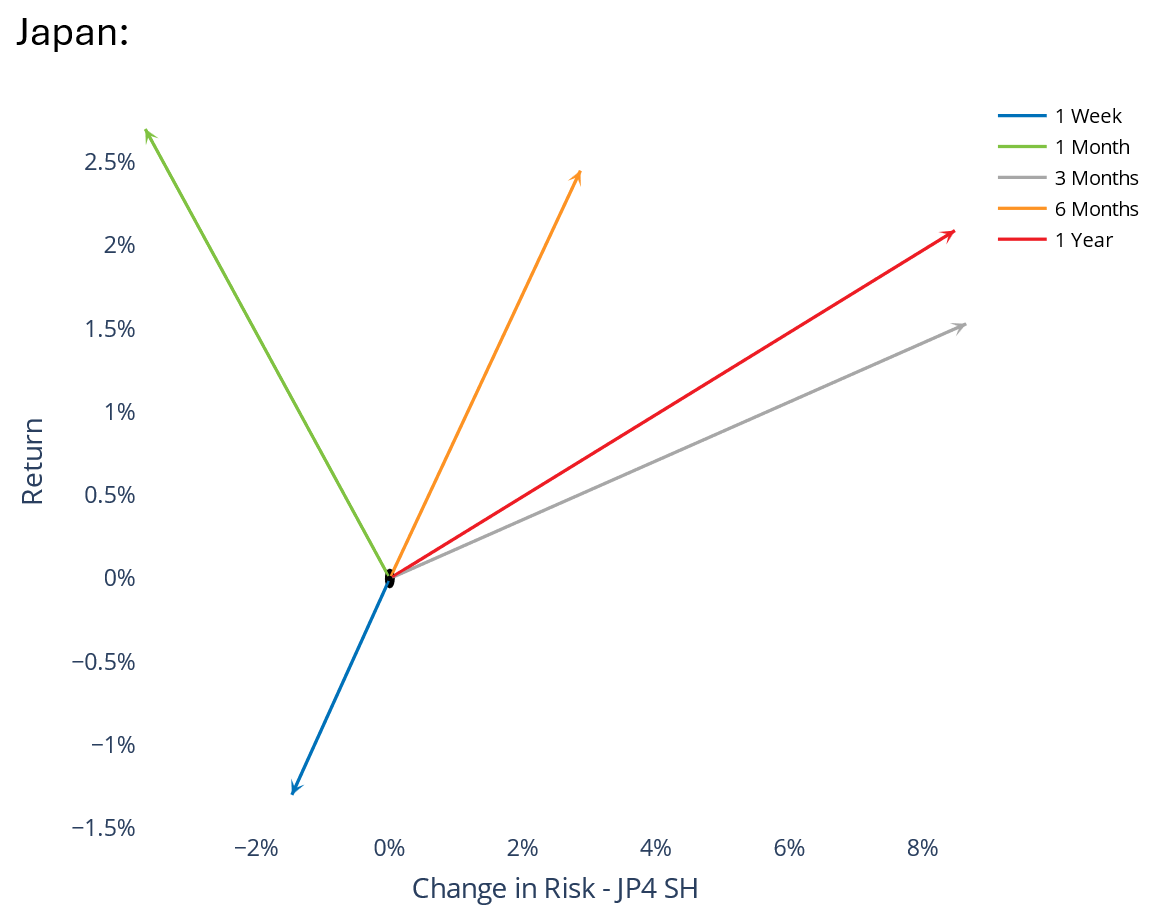

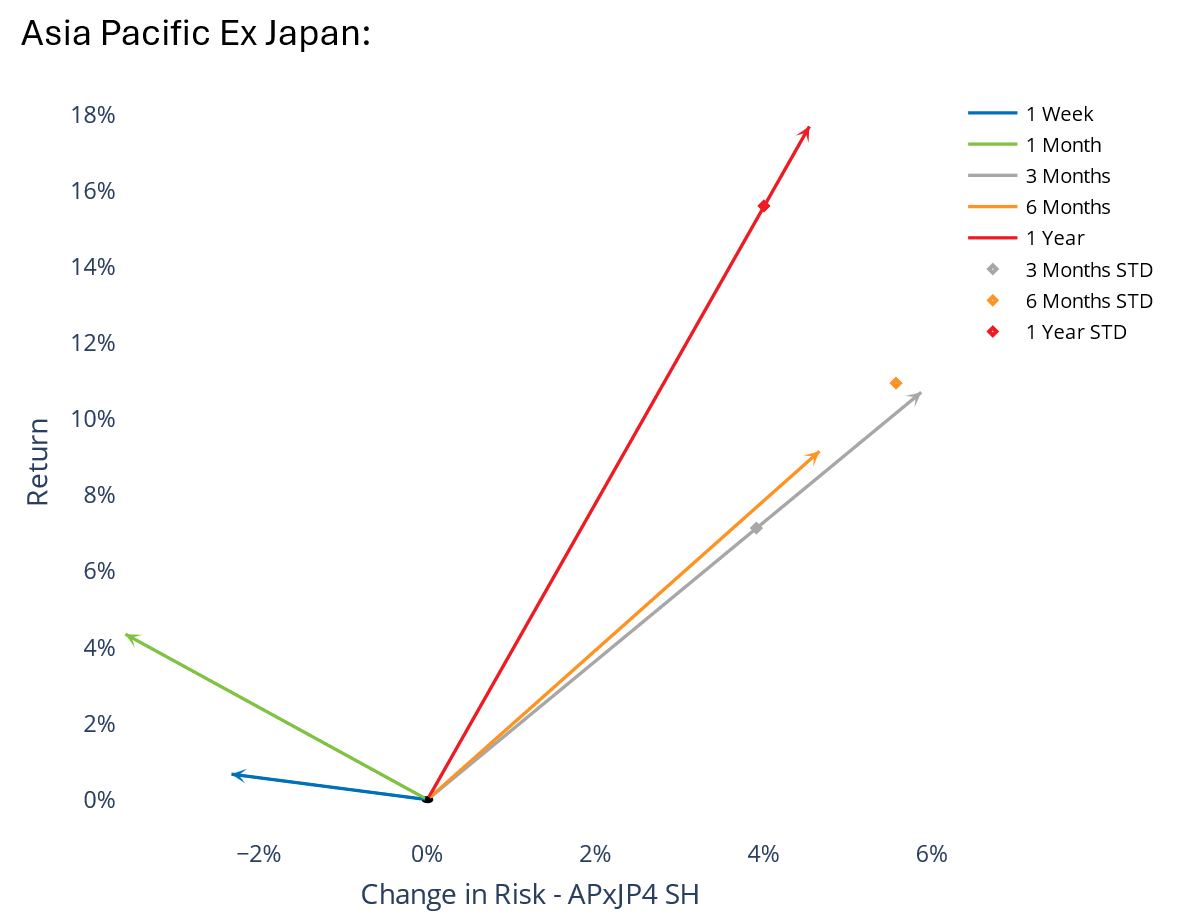

The US and Japan ended the week down, but Europe and Emerging markets eked out gains. Predicted Risk in nearly all of the markets we track continued to decline from the April-May peaks:

See Equity Risk Monitors (various regions, June 13, 2025)

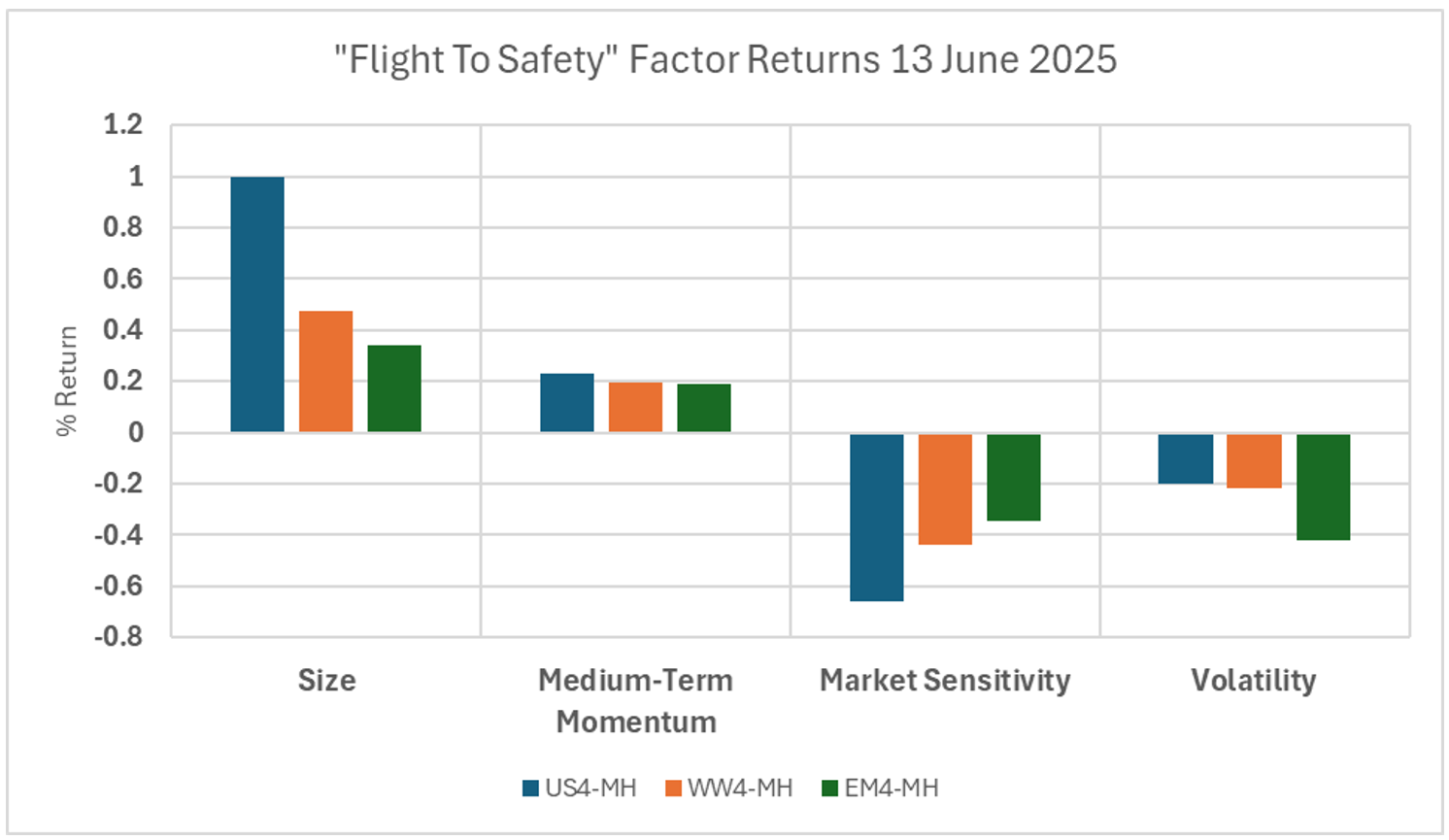

Flight to Safety Factor Returns

On the 13th itself, the familiar pattern re-emerged indicating a “flight to safety” within the style factors: Size up, Momentum up, Market Sensitivity and Volatility down:

The following chart is not available in the Equity Risk Monitors but is available upon request:

We reverted to US4-MH here to compare “apples to apples” across regional models as the new US5.1 model breaks Volatility up further into “Downside Risk” and “Residual Volatility”.

If the market perceives this new phase of the Middle East conflict as inherently more dangerous, we would expect this flight to safety to continue over the coming days; if however the outcome becomes more clear, we might see a sharp reversal, particularly around the “risk” styles, Market Sensitivity and Volatility.

You may also like

.png%3Fh%3D1080%26iar%3D0%26w%3D1920&w=3840&q=75)