EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED JULY 11, 2025

- A barrage of tariffs does not move the market after all…

- …but Pharmaceutical and Biotechnology factor risk remains high

The Market Does Not Buy Trump’s Tariffs but Does Buy the Dip

The week of July 7th began with President Donald Trump reigniting the trade war discourse by announcing tariffs on a variety of countries in Asia, as well as an additional 10% tariff on trading partners “aligned” with BRICS (i.e. Brazil, Russia, India, China, and South Africa). The deadline was then extended to August 1st. Later in the week, the tariff threats continued unabated with a 50% tariff on copper imports and a 200% tariff on pharmaceuticals.

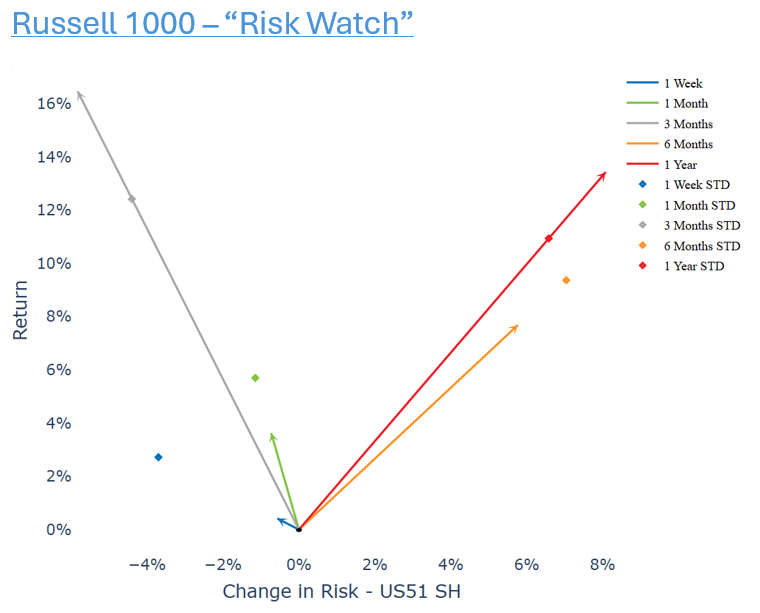

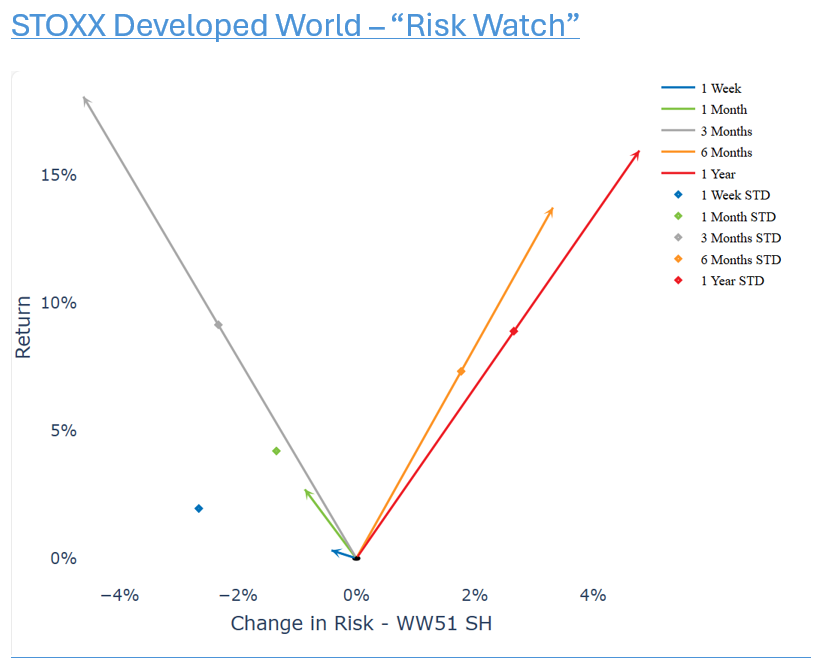

Despite initially falling on the 7th, the Russell 1000 recovered by week’s end, returning 42bps week over week. Even with the additional uncertainty around trade, risk as measured by our US5.1 model has decreased 57bps over the same time period. In fact, this measure of risk has decreased over both the 1 month and 3 month time periods. We see similar return and risk numbers as measured by the WW5.1 model in the STOXX Developed World index.

See chart from the Russell 1000 – US51 Equity Risk Monitor as of July 11, 2025

See chart from the STOXX Developed Word – WW51 Equity Risk Monitor as of July 11, 2025

Is Pharmaceutical Factor Risk a Tough Pill to Swallow?

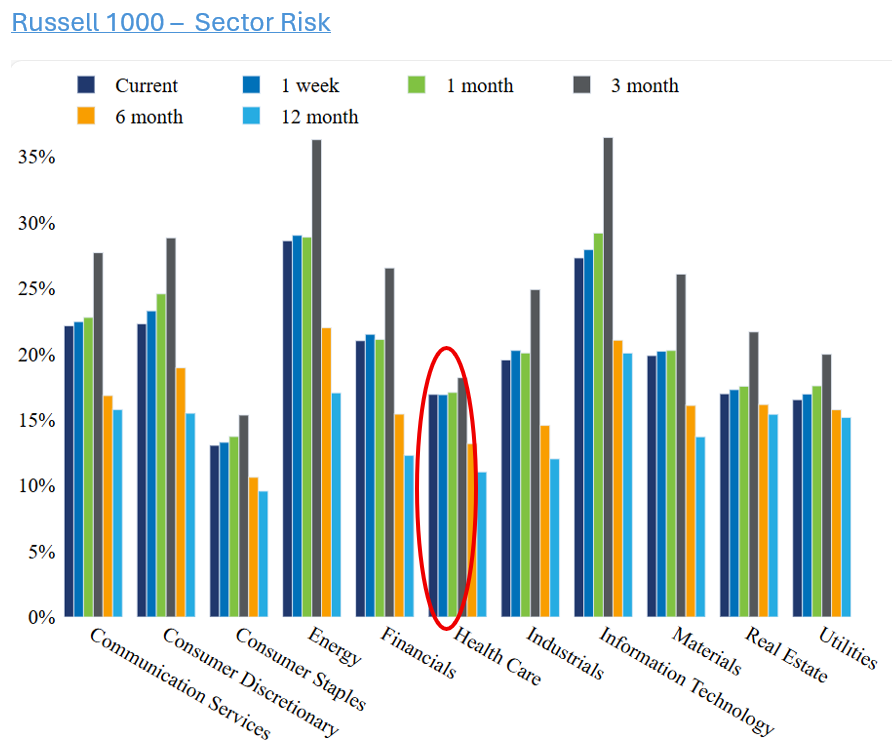

In contrast to the copper tariff, which affects a wide swath of geographies and industries, the tariff on pharmaceuticals is rather targeted. Nonetheless, the risk of the Russell 1000 Health Care sector as measured by the US5.1 model is nearly flat over the last month:

See chart from the Russell 1000 – US51 Equity Risk Monitor as of July 11, 2025

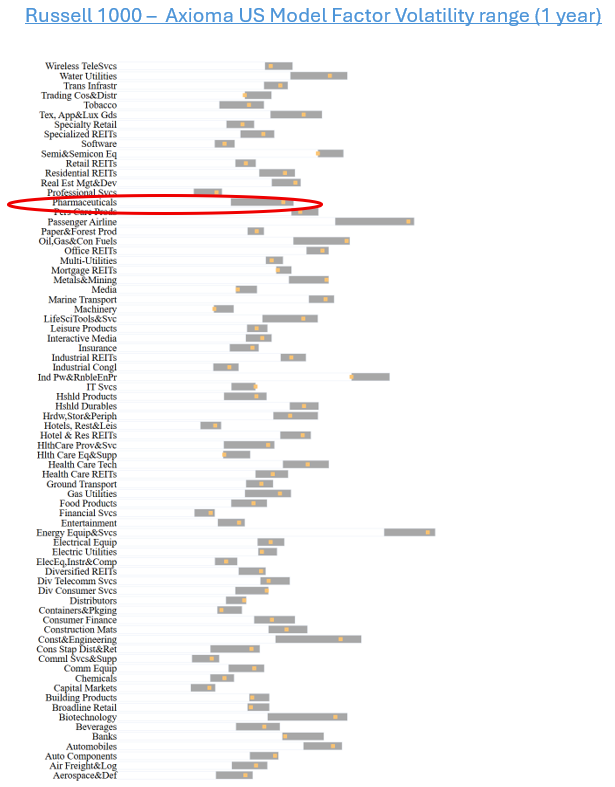

While we tend to look at risk on a sector basis, our risk models contain industry level risk factors, and the Equity Risk Monitor tracks the volatility of these factors. Looking here instead, we can see that the industries that belong to the Health Care sector are behaving rather differently than the sector itself. When ranked by current factor volatility, the three industries most directly related to the tariffs, Pharmaceuticals, Biotechnology, and Life Sciences Tools & Services, are in the top 33% of industries as a whole. Furthermore, Pharmaceuticals is within 86bps of its trailing one-year maximum volatility.

See chart from the Russell 1000 – US51 Equity Risk Monitor as of July 11, 2025

In contrast, two of the remaining Industry factors that belong to the Health Care Sector, Health Care Equipment & Supplies and Health Care Providers & Services, are in the bottom half of Industry factors by current forecast volatility. Interestingly, the Health Care Technology factor has a relatively high current volatility reading when compared to the other Industry factors, but it is not near its trailing one-year maximum volatility.

You may also like