EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED JULY 18, 2025

Axioma Risk Monitor: Robust earnings drive US market to new highs as volatility declines; US Financials rises amid strong bank results and crypto momentum; Countries around the globe show resilience amid trade uncertainty

Robust earnings drive US market to new highs as volatility declines

Strong earnings reports and positive economic data sent US indices to new highs last week, while investors appeared to shrug off the threat of a 30% tariff on the US’s largest trading partners—the European Union and Mexico. Better-than-expected retail sales and a drop in weekly jobless claims contributed to growing investor interest, even as they continued to parse slightly higher inflation data.

US consumer sentiment rose slightly in July, though it remained below the December peak, while consumers’ inflation expectations declined, according to the University of Michigan.

President Trump’s statement on Wednesday that he was not planning to fire Fed Chairman Jerome Powell also had a calming effect on the markets.

Tariff and other policy headlines are still influencing markets, but to a lesser extent, as headline fatigue seems to set in among investors due to the Trump administration’s frequent policy reversals. Although new records were reached, last week’s gains were modest, with the STOXX US Index posting a weekly increase of 0.75%.

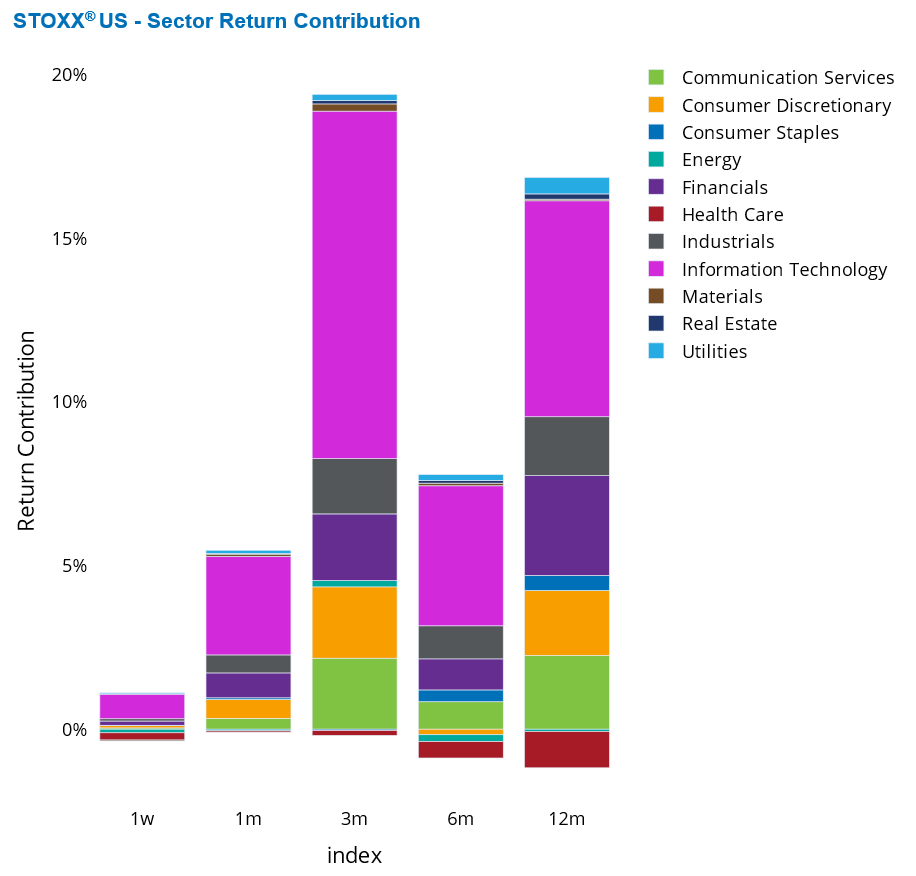

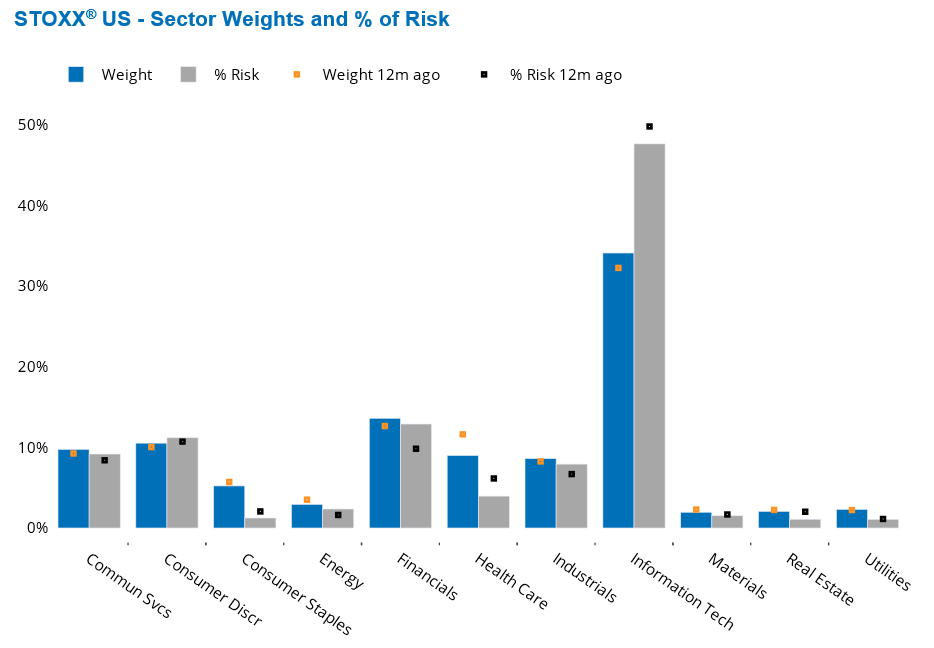

Information Technology was the main contributor (75 basis points) to the index’s weekly gain, due to its 34% weight in the benchmark and its strong performance last week. Declines in Health Care, Energy, and Materials offset gains in the rest of non-tech sectors within STOXX US.

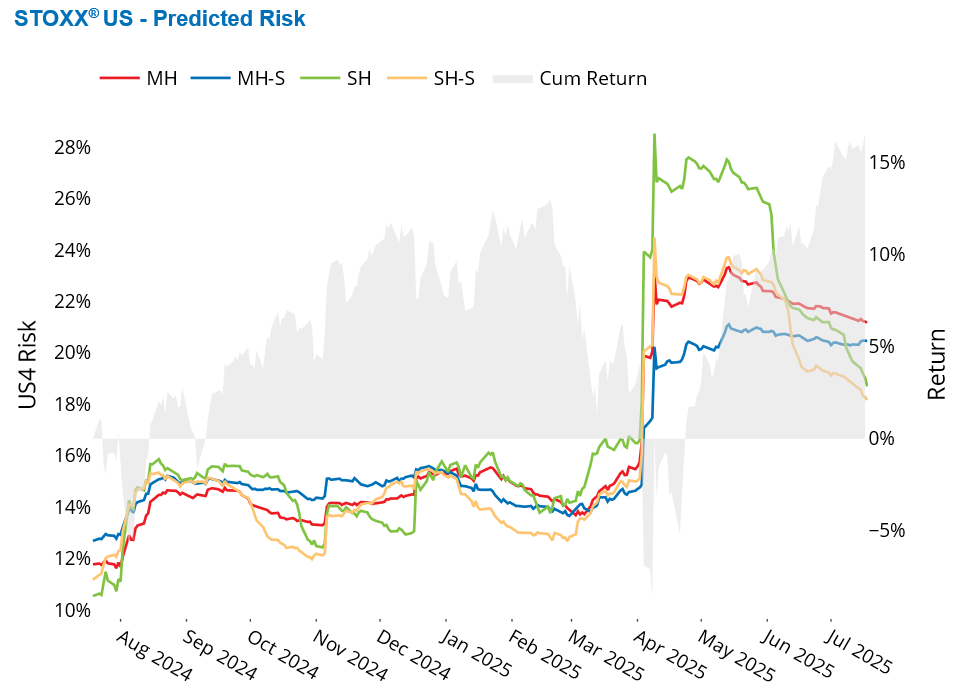

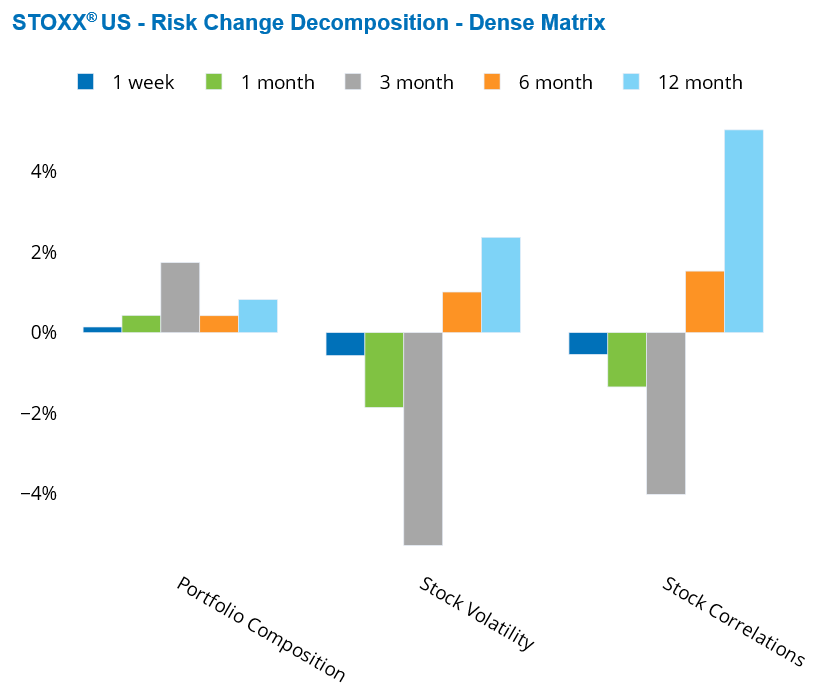

At the same time, forecasted risk for the US Index continued to decline, driven by a drop in both stock volatility and correlations, as measured by the Axioma US4 fundamental short-horizon risk model. Risk fell nearly 10 percentage points from the April 9 year-to-date peak of 28.5% though it remained above pre–Liberation Day levels and above the long-term median.

See graphs from the STOXX US Equity Risk Monitor as of July 18, 2025:

US Financials rises amid strong bank results and crypto momentum

Financials—the second-largest sector in the US—was also the second-biggest contributor to last week’s US market gains, following Information Technology. Most earnings reports from major banks exceeded expectations, lifting their share prices, with a few exceptions (e.g., Wells Fargo and Morgan Stanley). Interestingly, alongside Citigroup, JPMorgan, and Charles Schwab, Robinhood and Coinbase ranked among the top five contributors to the Financials sector’s weekly performance.

These five companies also accounted for nearly half of the Financials sector’s year-to-date gain of about 10%. The established banks reported strong returns for the year—Citigroup (35%), JPMorgan (24%), and Charles Schwab (30%)—but the cryptocurrency-related firms far outpaced them, with Coinbase (70%) becoming the 11th best performer and Robinhood (195%) the top performer in the STOXX US Index.

Crypto-related companies benefited from congressional progress on pro-crypto legislation—such as the GENIUS Act and the Digital Asset Market Clarity Act—which boosted investor confidence and revived cryptocurrency trading activity.

So far in 2025, Financials ranks as the fourth-best performing sector, behind Industrials (16%), Information Technology (12%), and Utilities (12%), while Consumer Discretionary and Health Care are the only US sectors to report year-to-date losses.

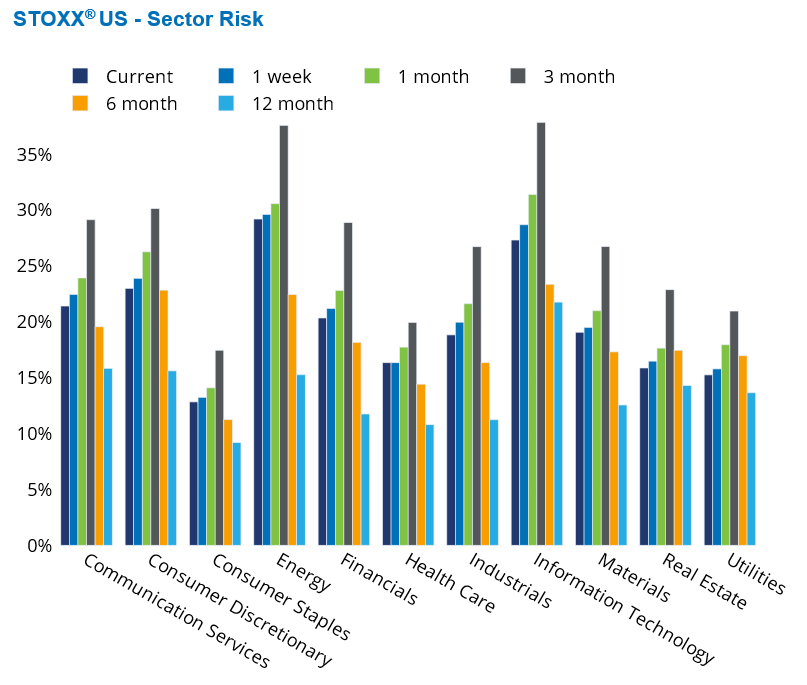

Financials experienced a decline in risk, in line with all other US sectors, and now sits mid-range among its peers. Although Financials’ contribution to STOXX US Index risk has increased over the past 12 months, it remains below its weight in the benchmark.

See graphs from the STOXX US Equity Risk Monitor as of July 18, 2025:

Countries around the globe show resilience amid trade uncertainty

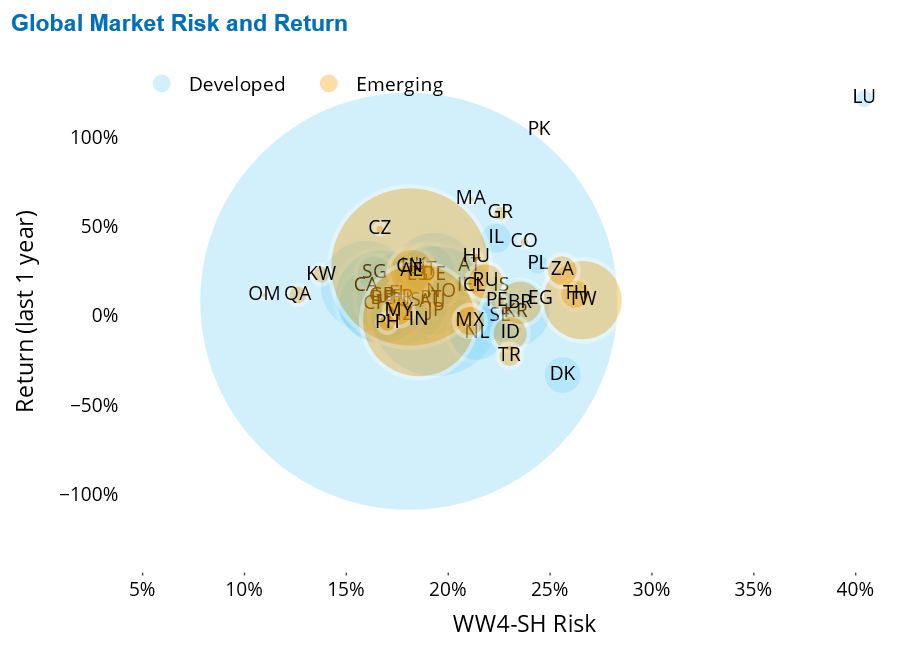

While tariff and trade uncertainty persists, most countries are showing positive one-year returns in US dollar terms, aided by the depreciation of the greenback. Most developed markets are in positive territory over the one-year period, with European countries such as Greece, the Czech Republic, Hungary, and Poland among the top performers. Denmark stands out with the largest loss (over 30%), followed by Turkey and Indonesia.

Individual country risk ranges between 10% and 30%, similar to levels seen a year ago. However, the risk profiles of emerging markets have converged with those of developed markets, whereas twelve months ago, they were significantly higher, according to the Axioma Worldwide fundamental short-horizon model.

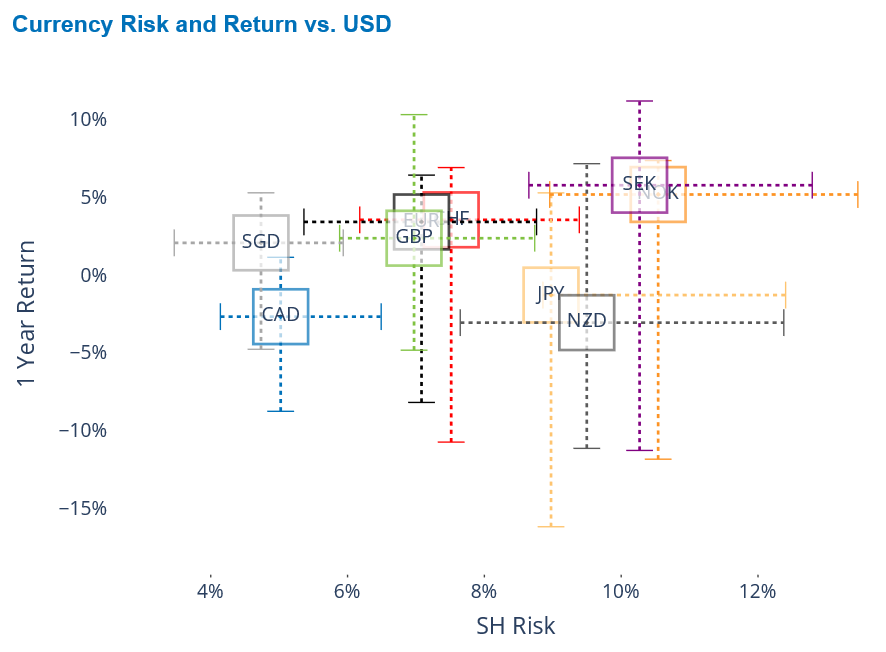

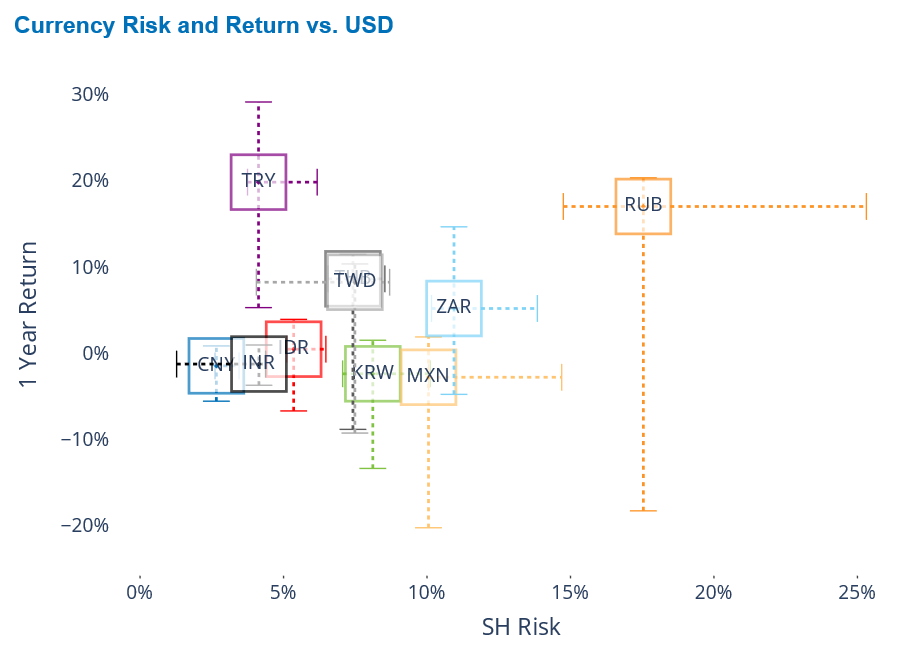

The US dollar climbed to a near three-week high but remains down about 9% year-to-date. Among major developed currencies, only the Canadian dollar, New Zealand dollar, and Japanese yen have posted twelve-month losses against the US dollar. In contrast, most emerging market currencies remain below the break-even line. The Turkish lira has recorded the largest one-year gain, while the Mexican peso has seen the steepest decline.

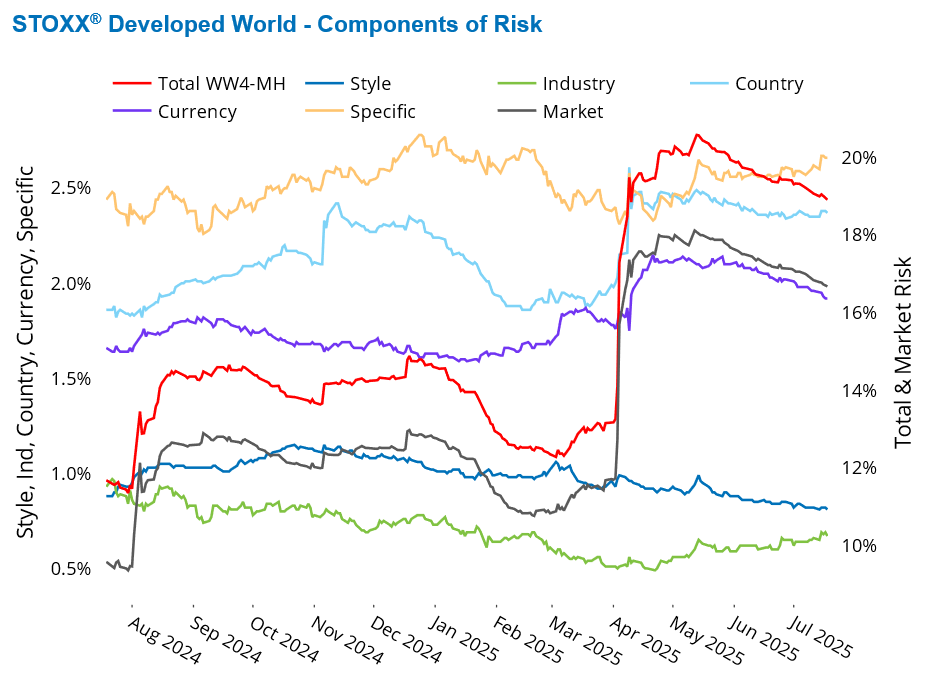

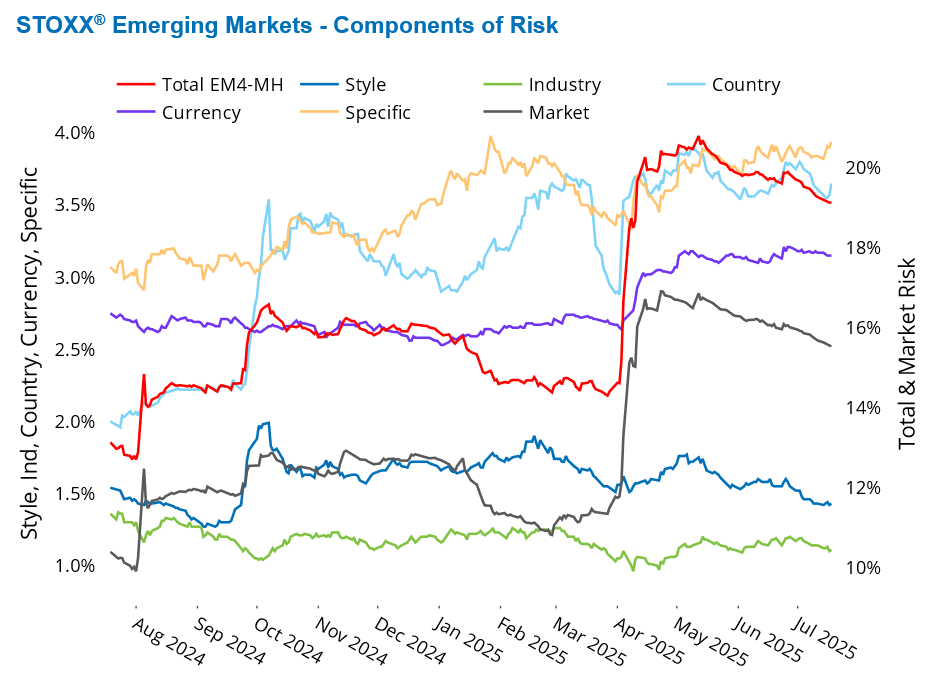

Aggregate country risk in the STOXX Developed World Index rose in April and has remained relatively stable since. Country risk in the STOXX Emerging Markets Index has fluctuated more and now also sits above its level at the start of the year, as measured by the Axioma fundamental medium-horizon Developed and Emerging Markets risk models, respectively. Aggregate developed market currency risk also rose in April for both indices and has only slightly declined for Developed Markets since then.

See graphs from the STOXX Developed World Equity Risk Monitor as of July 18, 2025:

See graphs from the STOXX Emerging Markets Equity Risk Monitor as of July 18, 2025:

You may also like