MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED JUNE 21, 2024

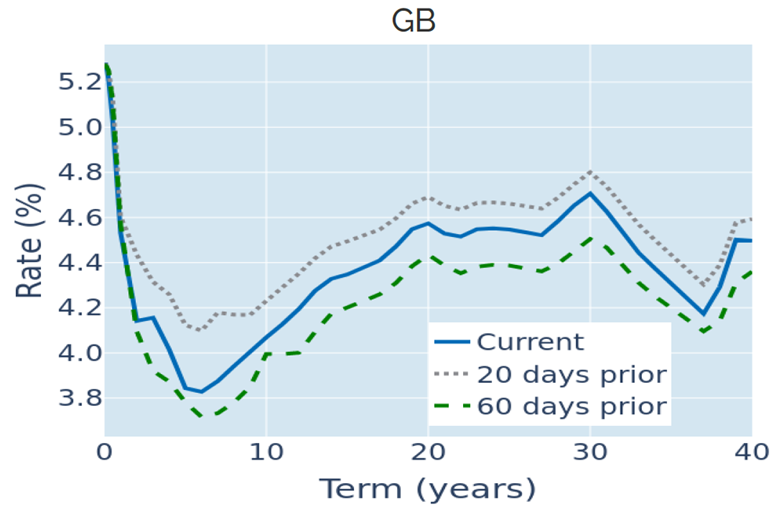

Gilt curve steepens as inflation hits BoE target

British short-term borrowing rates dropped to their lowest levels since early April in the week ending June 21, 2024, as UK headline inflation reverted to 2% for the first time in 34 months. Annual core-price growth also slowed for a twelfth consecutive time to 3.5%, but remained well above the Bank of England’s target, with the latest month-over-month change almost three times the monthly rate required for yearly inflation to revert to 2%. The Bank welcomed the news in its monthly meeting on Thursday, but still decided to hold its base rate at the current level of 5.25%, citing the persistent strength of services inflation—which came in at 5.7%—as a source of ongoing concern. In fact, headline CPI growth is expected to pick up again over the remainder of this year and to stay elevated in 2025, before falling back below target the year after. Long-term Gilt rates ended the week slightly higher, somewhat lessening the inversion of the yield curve.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated June 21, 2024) for further details.

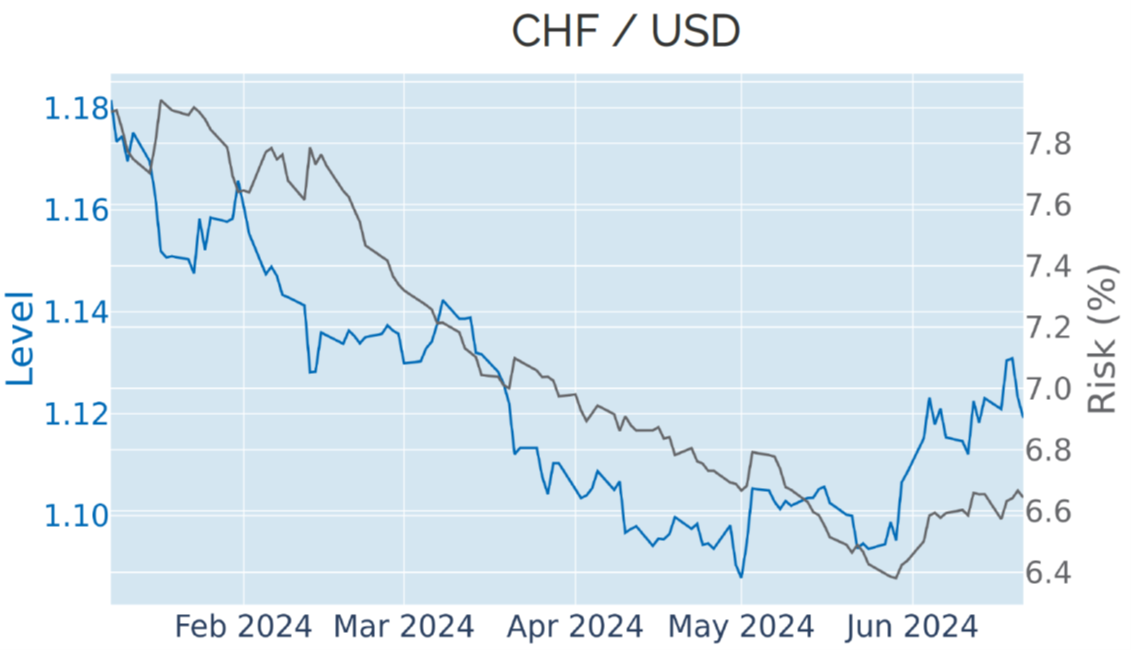

Second SNB rate cut weighs on Swiss franc

The Swiss franc depreciated against the US dollar and the euro in the week ending June 21, 2024, as the Swiss National Bank (SNB) cut rates for the second time this year. The SNB was the first major western central bank to ease monetary conditions in March and is now the only one which has lowered borrowing costs twice. The move comes on the back of the CHF’s significant strengthening in the preceding week, when investors sought a safe haven in the aftermath of the European parliamentary election and France calling a snap election. Weakening the franc was part of the reason for the rate cut, and the press release following the monetary policy decision noted the bank was “willing to be active in the foreign exchange market as necessary.” Swiss inflation of between 1% and 1.5% is much lower than in the Eurozone and the UK and should give the SNB more room to maneuver going forward.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated June 21, 2024) for further details.

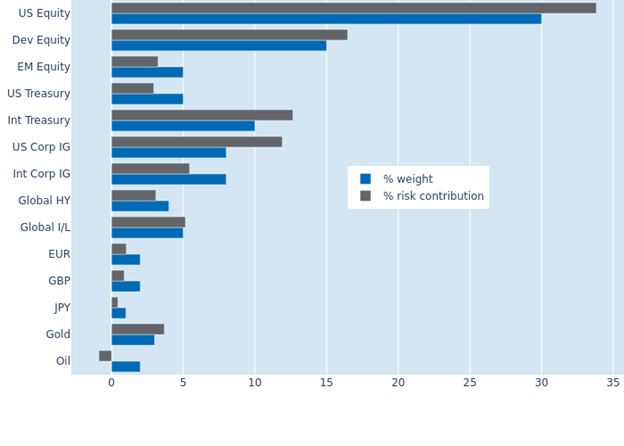

Weaker stock-bond correlation reduces portfolio risk

The predicted short-term risk of the Axioma global multi-asset class model portfolio plummeted 0.7% to 6.8% as of Friday, June 21, 2024, as interest-rate returns became less correlated with share prices and exchange rates against the US dollar. As a result, non-USD sovereign bonds saw their share of total portfolio risk shrink by 0.6% to 12.7%. But it was dollar-denominated investment grade corporates that experienced the biggest reduction in their percentage risk contribution from 13.2% to 11.8%, due to a weaker interaction of credit spreads with both risk-free rates and share prices. US equities also showed a lower standalone standard deviation, as a third consecutive week of gains propelled the American stock market to yet more record highs. This was in contrast to their counterparts in other developed markets where volatility increased, as European shares only recouped part of the losses from the aftermath of the European parliament election and the surprise announcement in France.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated June 21, 2024) for further details.