MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED NOVEMBER 29, 2024

Trade war threats push Treasury yields to six-week low

Long-term US borrowing rates fell to their lowest levels since mid-October in the week ending November 29, 2024, amid rising concerns of a renewed economic conflict between the United States and its closest trading partners. The 10-year benchmark Treasury yield plummeted 23 basis points following Donald Trump’s threat on Truth Social that he will impose a 25% tariff on all products entering the country from Mexico and Canada on his first day in office on January 20. The reaction of the bond market was comparable in size to the periods in 2018 and 2019 when Trump announced additional trade barriers during his first stint in the White House.

The stock market also followed the familiar script with automobile manufacturers bearing the brunt of the selloff, due to their heavy reliance on cross-border flows of components and finished vehicles. Energy companies also suffered, as the United States import around 60% of their oil needs from Canada, while the latter sells over 80% of its oil output to its southerly neighbour. However, the American stock market as a whole still ended the week in the black, meaning that share and bond prices kept moving in the same direction for a seventh consecutive week.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated November 29, 2024) for further details.

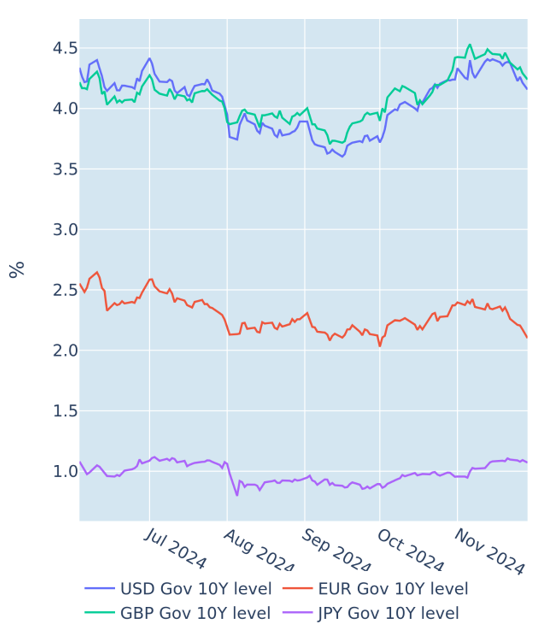

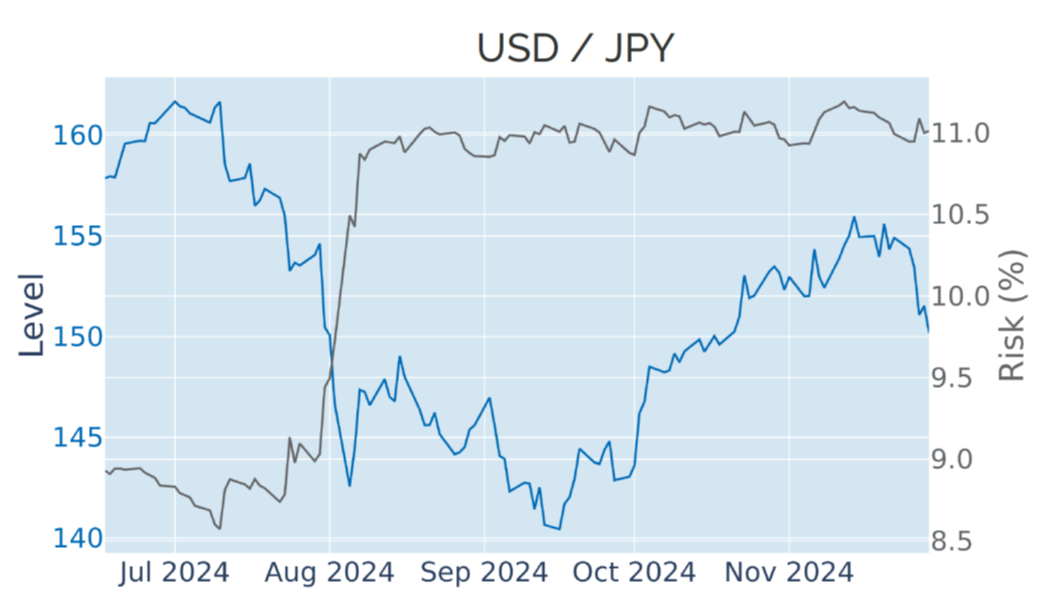

Yen soars against dollar as rate differential narrows

The Japanese yen rose to a six-week high against the US dollar in the week ending November 29, 2024, as traders upped their expectations that the Bank of Japan (BoJ) will raise interest rates at its next meeting on December 19, following a stronger-than-expected rise in core inflation. Last week’s 3% gain means that the JPY is now the only G10 currency that has strengthened relative to the greenback since the presidential election on November 5, while all its major rivals are down between 1% and 3%. With the BoJ a long way behind its major counterparts in the policy cycle—only just starting to tighten monetary conditions while the others are already easing—the yen has been and remains extremely sensitive to the relative levels of interest rates, both actual and expected.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated November 29, 2024) for further details.

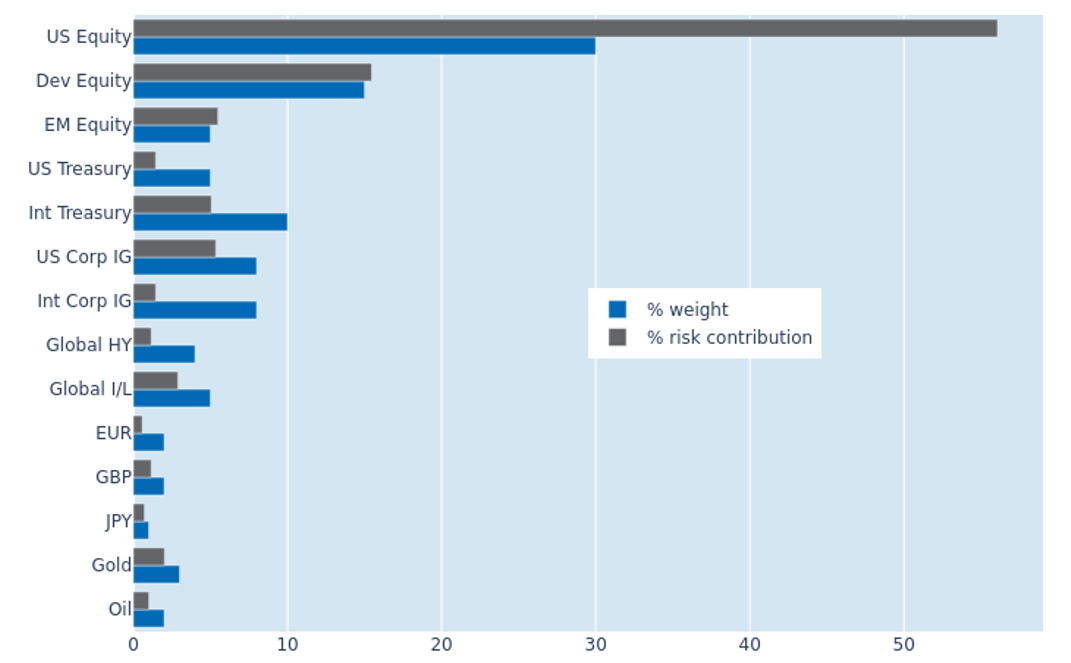

Inverse FX-equity interaction reduces portfolio risk

The predicted short-term risk of the Axioma global multi-asset class model portfolio fell another 0.2% to 6.9% as of Friday, November 29, 2024, as a more negative correlation between FX and equity returns more than offset the adverse effects stronger standalone volatilities of the underlying risk factors. The benefit was most notable for emerging market stocks, which saw their share of total portfolio shrink from 6.9% to 5.6%. Gold also decoupled from exchange rates against the US dollar, making it seem less correlated with non-USD-denominated securities and shrinking its percentage risk contribution by 1.6 points to 2.1%. Oil also saw its share of overall volatility half from 2% to 1%. This contrasted with most high-quality government and corporate bonds, which further increased total portfolio risk, due to the stronger co-movement of equity and interest rate returns.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated November 29, 2024) for further details.

You may also like