MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED DECEMBER 6, 2024

Please note that this is the last multi-asset class update for 2024. We wish you a happy holiday season and will be back on our regular schedule in early January.

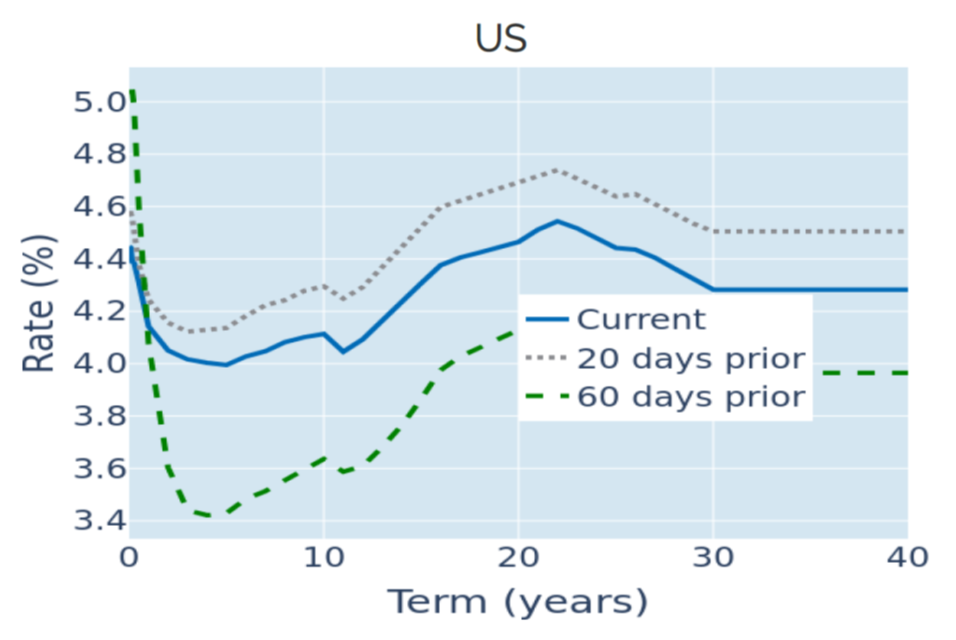

Traders bet on December rate cut despite strong jobs growth

US Treasury yields fell to their lowest levels in seven weeks in the week ending December 6, 2024, as traders raised the implied probability of a rate cut at this month’s FOMC meeting from a two in three chance to more than 85%. The move happened despite several Federal Reserve officials noting that inflation might take longer than anticipated to slow down, coupled with a bigger-than-expected jump in non-farm payrolls. The Bureau of Labor Statistics announced on Friday that the American economy added 227,000 jobs in November—beating analyst predictions of 200,000—while also revising up the October number from 12,000 to 36,000. Yet, fixed income investors appeared to focus more on the increase in the unemployment rate from 4.1% to 4.2%, which seemed to indicate that the labor market might be cooling off after all.

Meanwhile, US equity markets were also up, meaning that stock and bond prices have now been moving in lockstep for an eighth consecutive week. A positive correlation between the two asset classes has traditionally been an indicator that investors are concerned about inflation. If both markets rise, it implies that consumer price growth is expected to decelerate, which contradicts both recent empirical evidence and the observations from central bankers mentioned above. Based on the market reactions after the weak labor market reports in early August and September, expectations of faster rate cuts nowadays seem to express growing concerns about the state of the economy. So, if the bond market is worried about economic growth but equity investors are still buying, only one of the two can be right. And we all know that in the past, the yield curve has had a better track record of anticipating economic downturns than share prices.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated December 6, 2024) for further details.

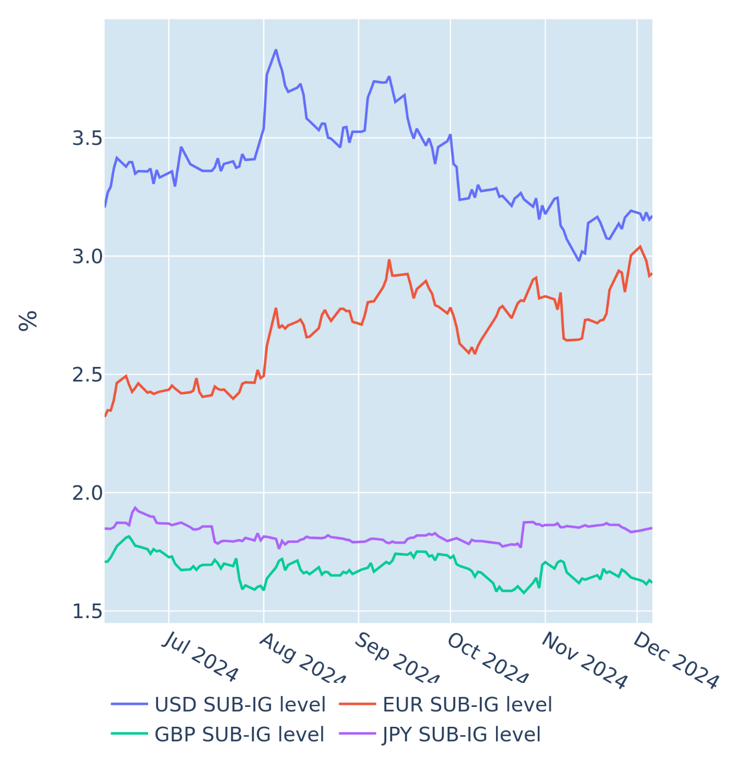

US credit spreads decouple from share prices

Risk premia on low-rated corporate debt remained stable in the week ending December 6, 2024, even though the US stock market closed at yet another record high. High yield credit spreads and share prices are usually strongly negatively correlated, and the fact that they no longer mirror each other could be another symptom of the growing discrepancy between fixed income and equity markets. But it also needs to be said that USD high yield premia are near historical lows, which means that there could be less room for further tightening.

Developments were very different on the other side of the Atlantic, where credit spreads on European corporate bonds touched their widest levels since the start of the year. This divergence against their American counterparts reflects dispersing growth expectations for the respective economies.

Please refer to Figure 5 of the current Multi-Asset Class Risk Monitor (dated December 6, 2024) for further details.

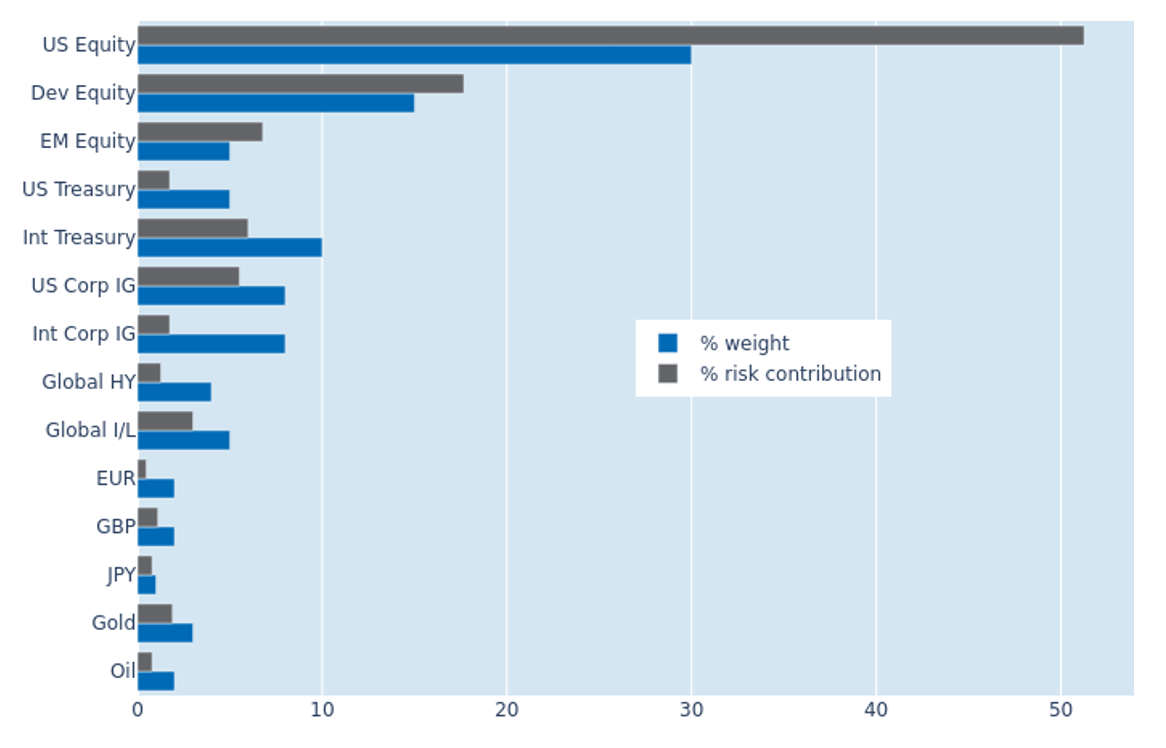

Ongoing equity rally further reduces portfolio risk

The predicted short-term risk of the Axioma global multi-asset class model portfolio descended further to 6.3% as of Friday, December 6, 2024, from 6.9% the week before. The decrease was largely due to lower share price volatility and was mostly reflected in the US equity bucket, which saw its share of total portfolio risk shrink from 56.1% to 51.3%. The same could not be said for their counterparts in other regions, though. The percentage risk contributions of both developed and emerging market shares rose by 2.2% and 1.2%, respectively, due to a stronger co-movement of equity and FX returns. The ongoing positive correlation of stock and bond prices also resulted in added volatility from government and investment grade corporate securities.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated December 6, 2024) for further details.

You may also like