MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED MAY 2, 2025

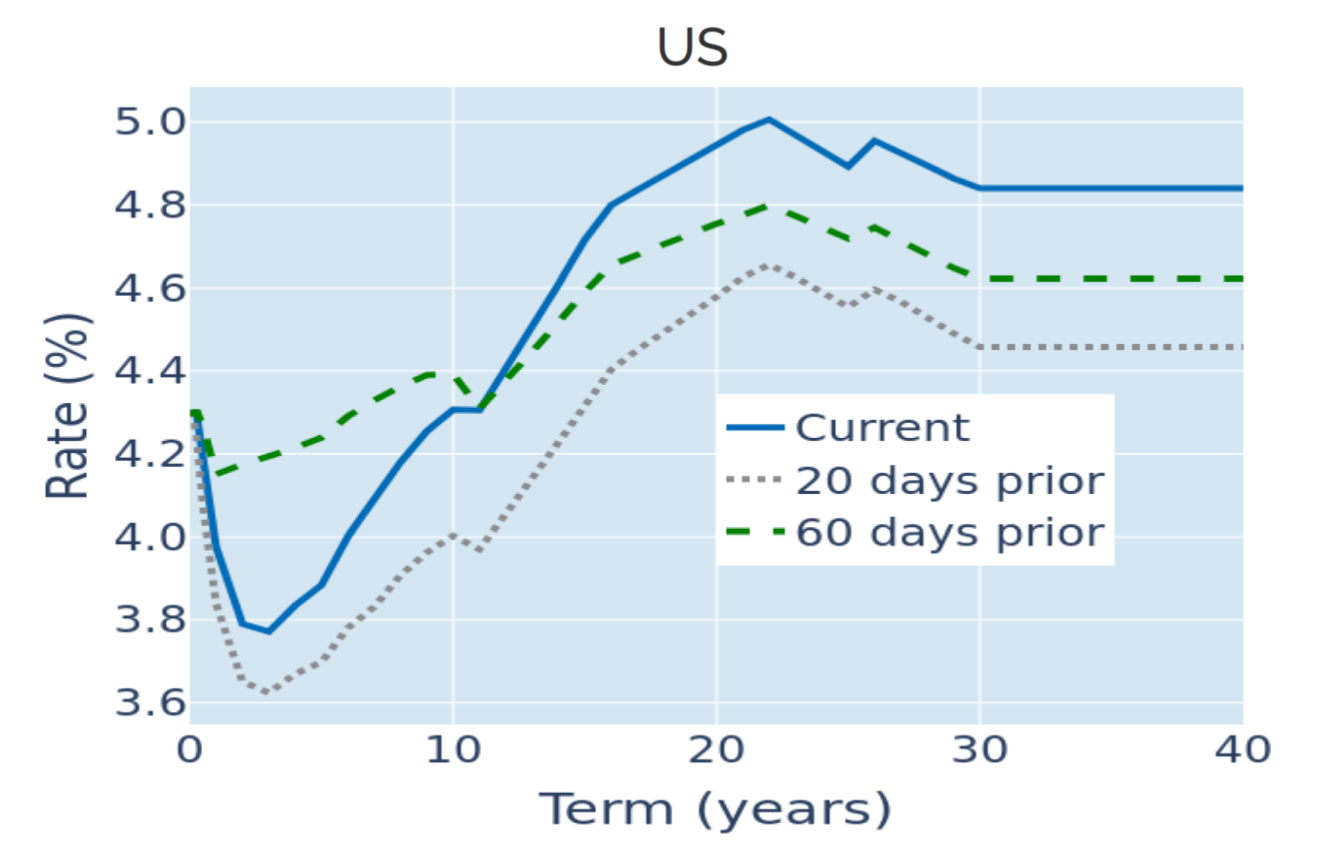

Treasury yields rebound as traders favor labor market over GDP

US Treasury yields rebounded alongside recovering share prices in the week ending May 2, 2025, as market participants revised their expectations on the Federal Reserve’s next move in light of the latest economic data. The surprise drop in GDP reported on Thursday did little to deter investors who focused instead on the stronger-than-anticipated labor market report released on Friday.

The American economy contracted by an annualized 0.3% in the first quarter, down from 2.4% in the last three months of 2024 and undershooting analyst predictions of a 0.3% expansion. Many market commentators blamed the decline in domestic economic activity on consumers and companies buying and stockpiling foreign goods to front run the incoming tariffs. But the net effect on GDP of that should theoretically be zero, as increases in inventories are exactly offset by an opposing decrease in net exports. Instead, these purchases may just have masked underlying weaknesses in consumer spending and business investment.

Traders still tuned down their rate cut expectations over the coming months, following Friday's non-farm payroll report, which showed that 177,000 new jobs were created in April, compared with a consensus forecast of 130,000. It needs to be noted, though, that this was on the back of a downward revision of the March number from 228,000 to 185,000. Nevertheless, the monetary policy-sensitive 2-year yield climbed by 9 basis points, as short-term interest-rate futures markets flipped the implied probability of a rate cut in June from two thirds to a one-in-three chance. At the same time, the projected average effective federal funds rate for December climbed from 3.46% to 3.61%, implying 75 basis points worth of easing over the remainder of the year.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated May 2, 2025) for further details.

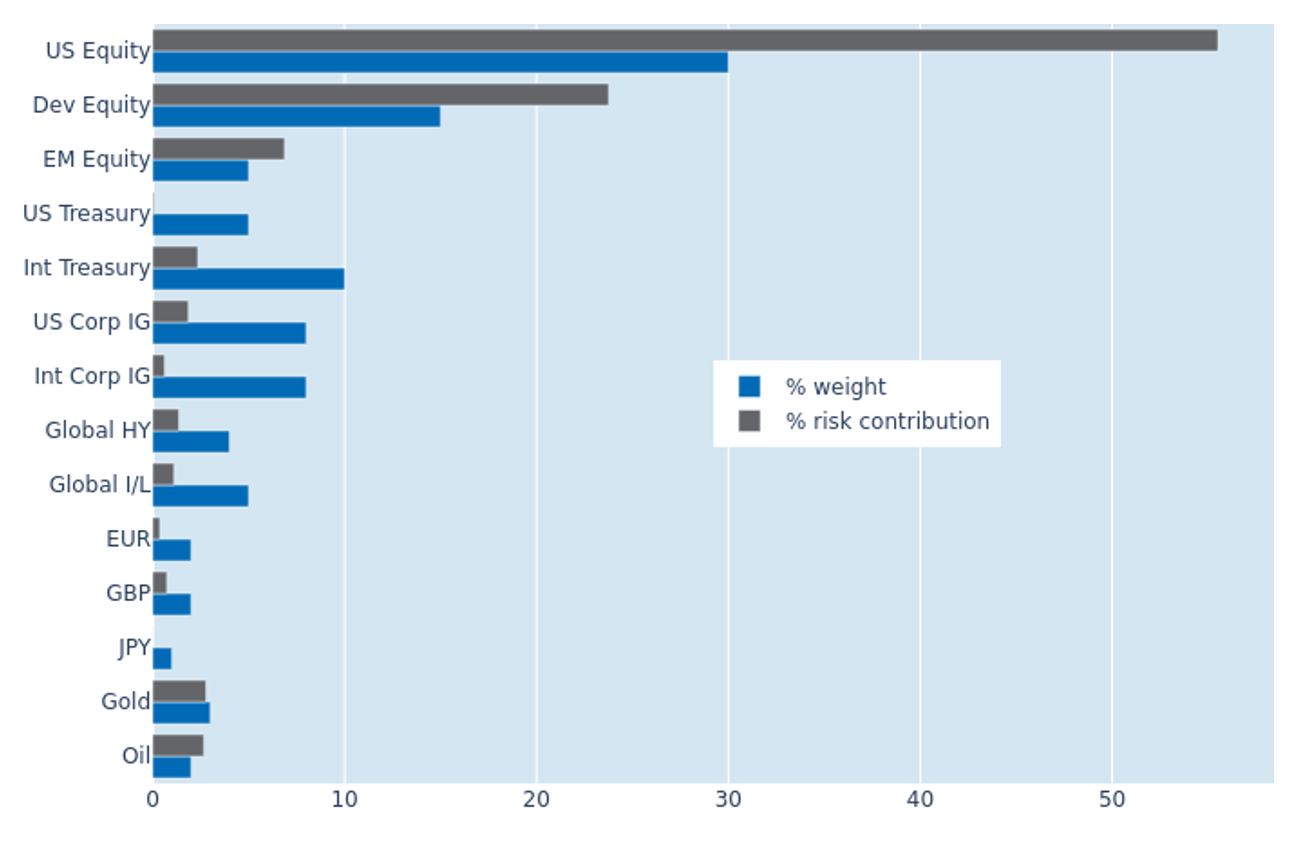

Portfolio risk continues to ease as US equities recoup losses

The predicted short-term risk of the Axioma global multi-asset class model portfolio continued to ease from 18.4% to 16.2% as of Friday, May 2, 2025, as American stocks recouped the losses incurred since Donald Trump’s “liberation day” tariff announcements a month ago. Cross-asset correlations remained mostly stable, which meant that the contraction in risk was predominantly due to the reduction in share price volatility. US equities were still the main source of overall risk, accounting for 55% of total predicted volatility. Treasury bonds and the Japanese yen, on the other hand, neither added to nor subtracted from total risk, due to the decoupling of FX, interest rate, and equity returns.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated May 2, 2025) for further details.

You may also like