MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED MAY 16, 2025

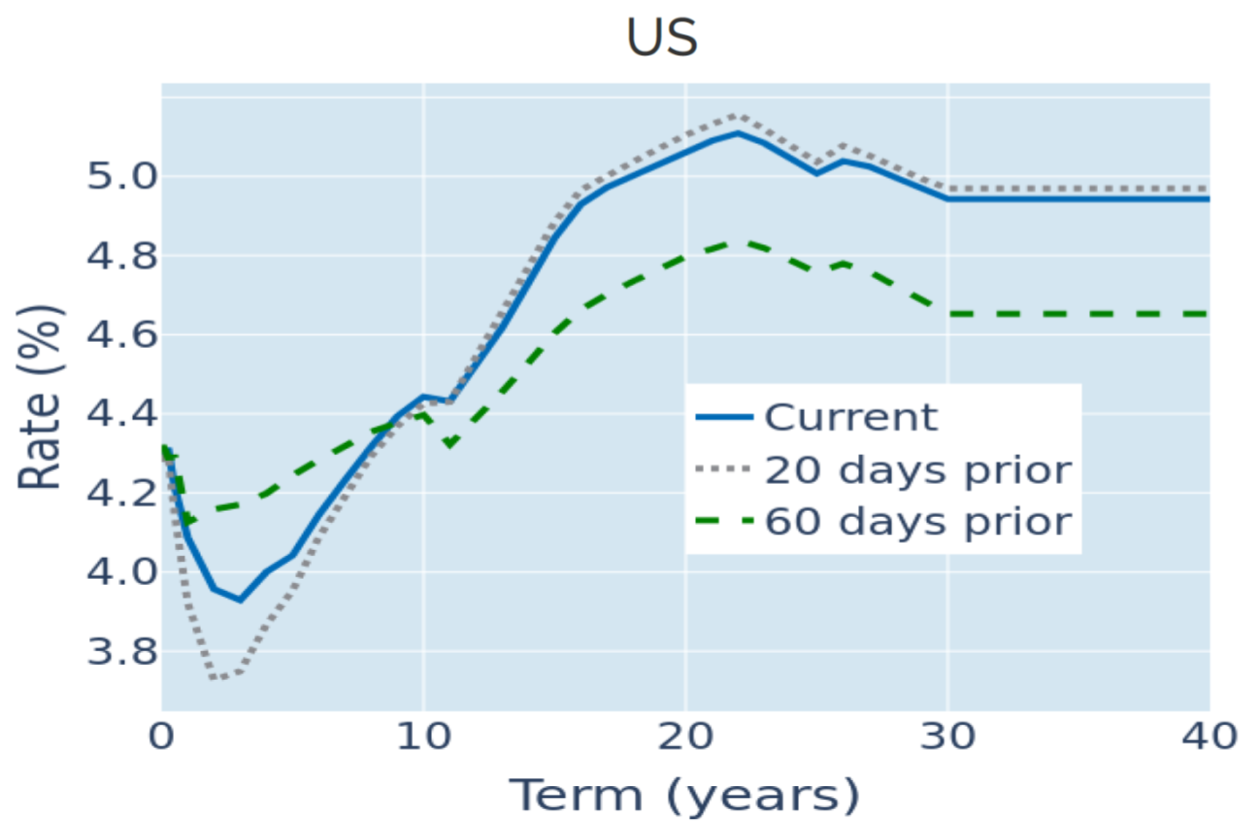

US Treasury yields keep rising despite surprise inflation drop

US Treasury yields recorded a third consecutive weekly increase in the week ending May 16, 2025, despite a surprise drop in headline inflation. Economists had predicted that American consumer price growth would remain stable at 2.4%, but instead slowed down to 2.3% in April. The deceleration was mostly due to falling energy costs, as oil prices dropped by more than 17% in the wake of last month’s tariff announcements.

But the 10-year breakeven inflation rate was still 8 basis points higher after the data came out on Wednesday, pushing the same-maturity nominal yield to a 12-week high. The monetary policy-sensitive 2-year rate also climbed by 0.1% to its highest level in eight weeks, after short-term interest-rate markets raised their year-end projection for the effective federal funds rate by 15 basis points to 3.87%. This means that there is now a less than one in three chance that the Federal Reserve will ease monetary conditions by more than half a percentage point over the remainder of this year.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated May 16, 2025) for further details.

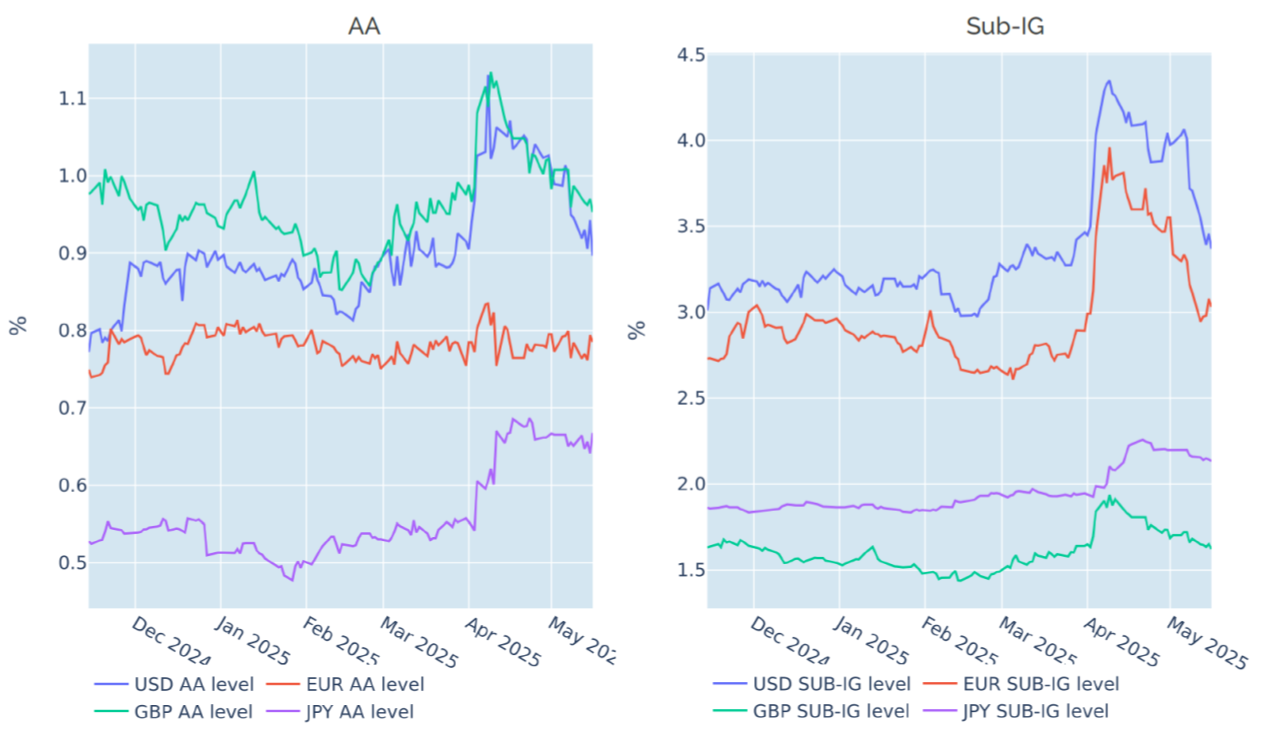

Credit spreads narrow as stocks continue to recover

Credit spreads fell sharply in the week ending May 16, 2025, as stock markets recouped the losses incurred since President Trump’s inauguration in mid-January, boosted by Tuesday’s news that China and the United States agreed to slash reciprocal tariffs by 115% on either side for 90 days. Risk premia on USD-denominated corporate bonds reverted to pre-Liberation Day levels, but there is still some way to go to their most recent lows from late February, which also coincided with the last record high in the American stock market.

Please refer to Figure 5 of the current Multi-Asset Class Risk Monitor (dated May 16, 2025) for further details.

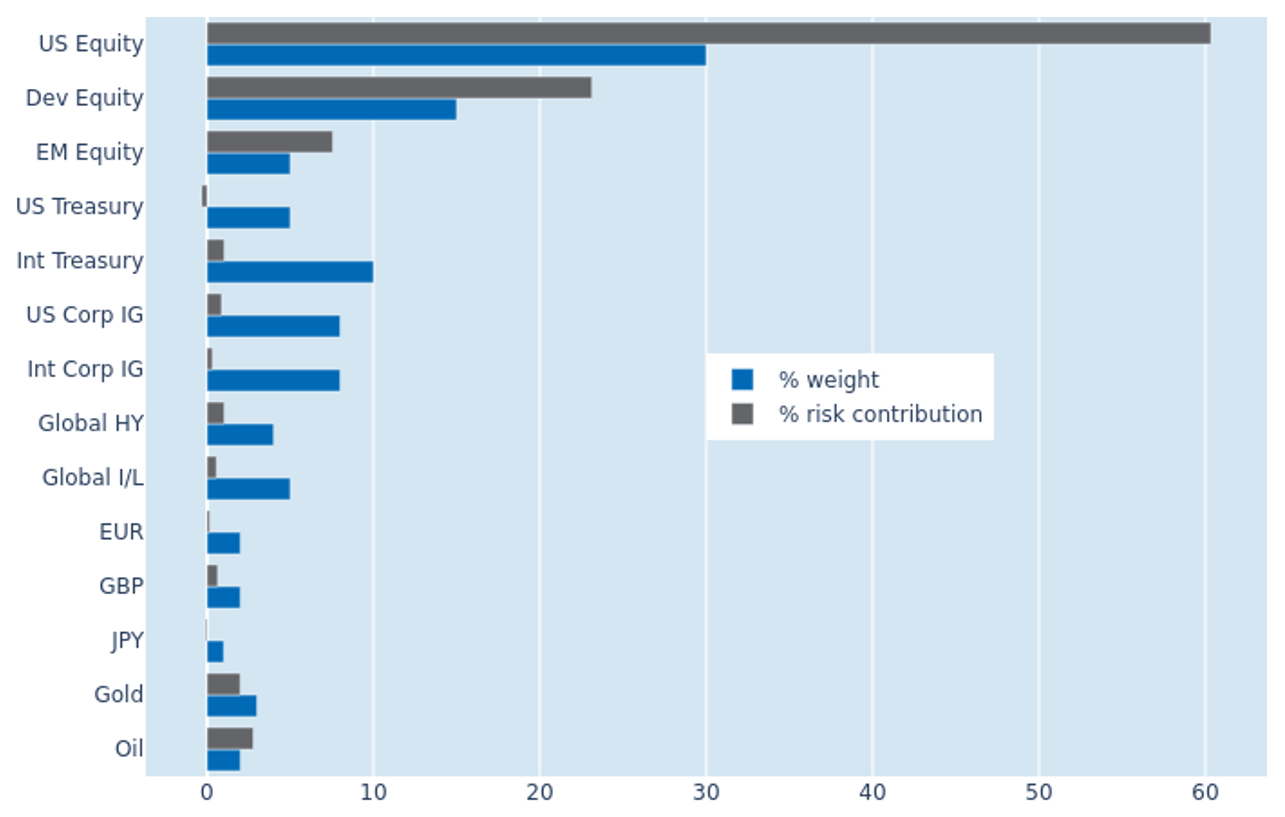

Portfolio risk falls further as FX and bond losses offset equity gains

The predicted short-term risk of the Axioma global multi-asset class model portfolio continued to fall by another 1.5 percentage points to 12.6% as of Friday, May 16, 2025, as stock market gains were offset by opposing movements in exchange rates and government bond returns. The effect was most notable for non-USD sovereigns, which saw their share of overall portfolio volatility more than half from 2.2% to 1%. Non-US developed equities also benefited from the inverse relationship between FX rates and share prices, which made their returns appear less volatile when converted into US dollars. US Treasury securities once more reduced total risk, although only marginally, as the negative correlation with share prices remained relatively weak.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated May 16, 2025) for further details.

You may also like

.png%3Fh%3D1080%26iar%3D0%26w%3D1920&w=3840&q=75)