MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED MAY 23, 2025

US capital exodus resumes over downgrade, deficit, and tariffs

The capital exodus from the United States picked up speed once more in the week ending May 23, 2025, with US stocks, bonds, and the dollar all selling off in unison, as investors digested a triple whammy of a sovereign rating downgrade, a controversial tax bill, and another batch of trade barriers.

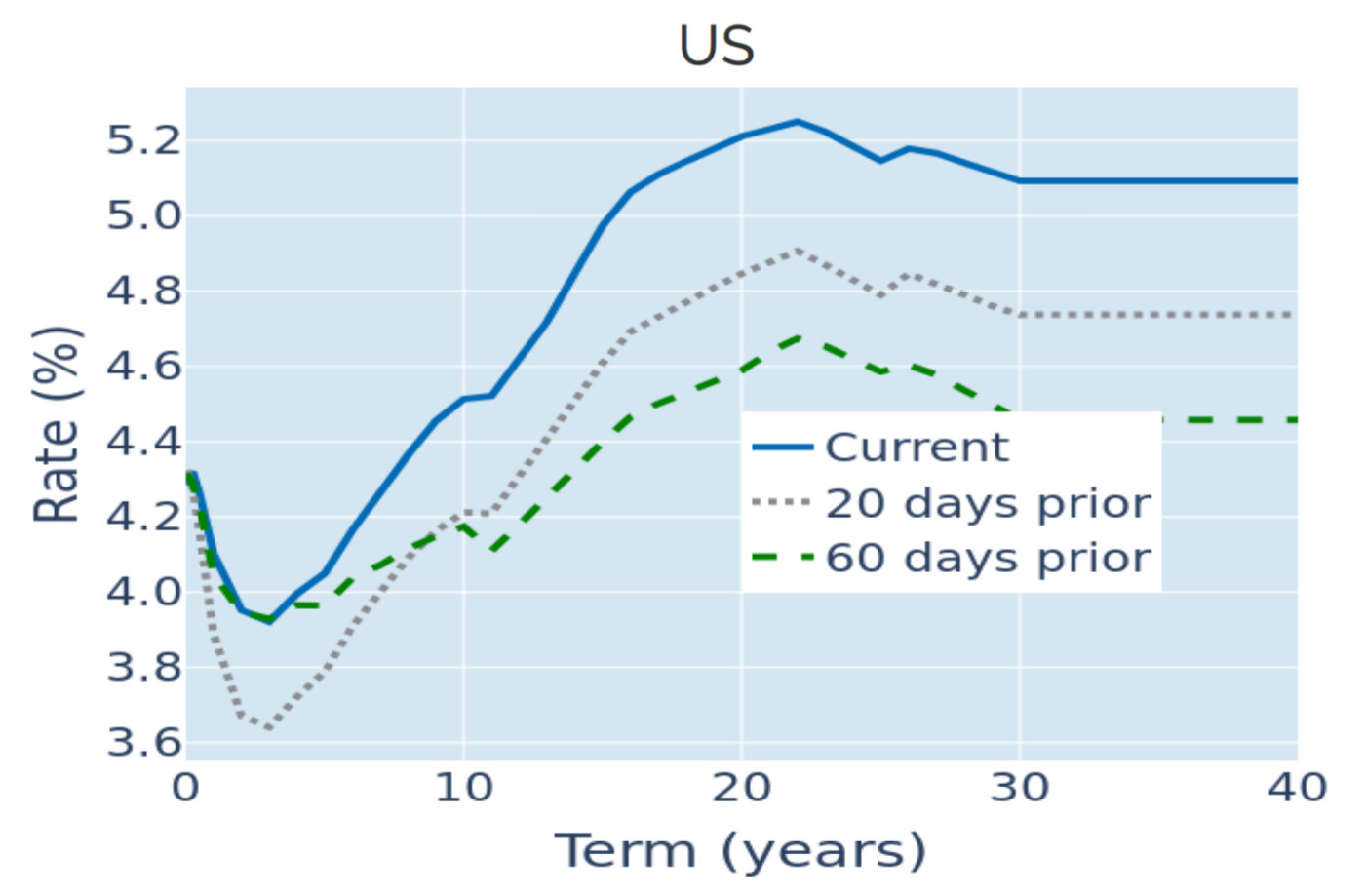

Ultra-long Treasury yields soared to their highest levels since October 2023, following a soft auction of 20-year bonds on Wednesday, which came with a 5% coupon—the highest interest rate for that maturity segment since it was reintroduced in 2020. The surge in borrowing costs aroused concerns of much bigger increases ahead, but so far the 10-year benchmark rate has remained well below its peaks from right before Donald Trump’s inauguration in mid-January. The main reason, in our view, was that despite the potential short-term inflationary effects of the latest tariffs, long-term breakeven rates remained anchored around 2.3%, limiting further upside for nominal yields.

Historically—with the exception of the post-GFC, QE years—the 10-year nominal rate has always traded around two times inflation expectations. As yields started to rise again in 2022, the relationship was restored to its ‘natural’ equilibrium and has held ever since. The fact that the 10-year yield peaked just under 4.6% on Wednesday further corroborates this. If we assume that the historical relation between breakeven and nominal rates holds, it would require a significant upward shift in long-term inflation projections to justify the steep increases in Treasury yields predicted by some punters.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated May 23, 2025) for further details.

Mining and defense gains boost UK stock market and pound

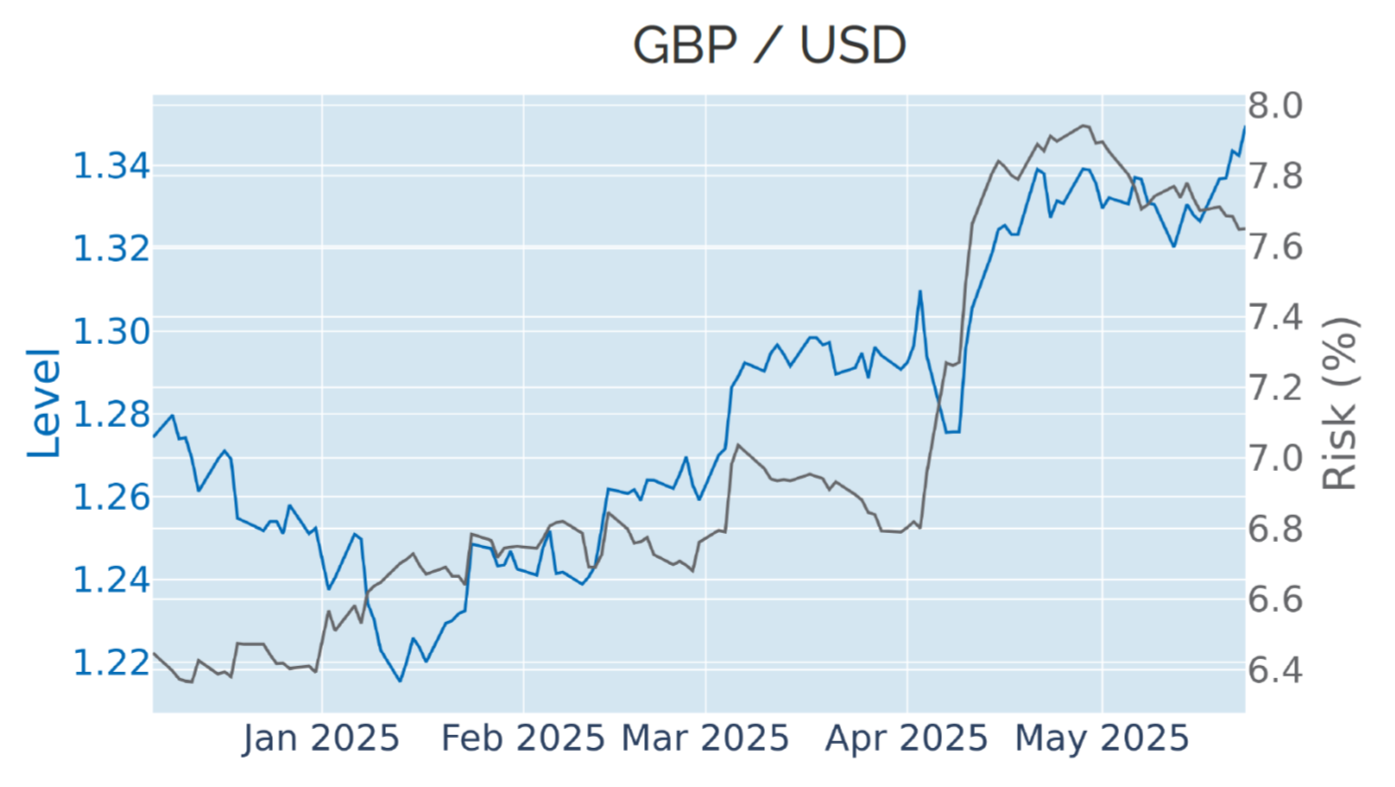

The British pound climbed to its strongest level against the US dollar since February 2022 last week, as the UK stock market bucked the global trend of falling share prices, boosted by strong gains for mining and defense firms. That being said, the pound’s appreciation was part of broader weakening of the greenback against its major trading partners. The Dollar Index was once again down more than 10% from its most recent high in mid-January, with less than a percentage point further to go to the post-Liberation Day low from the end of April.

Last week’s rise in bond yields and monetary policy expectations did little to curb the greenback’s fall, as the strong positive interaction between US interest and exchange rates over the past three years appears to have decoupled in the current environment. The projected federal funds rate for the month of December climbed further to 3.9%, which is only 43 basis points below current levels. The Federal Reserve is now expected to hold rates steady for at least the next two meetings in June and July, with only a one in four chance that it will ease monetary conditions by more than half a percentage point before the year is out.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated May 23, 2025) for further details.

Equity volatility and portfolio risk keep falling despite selloff

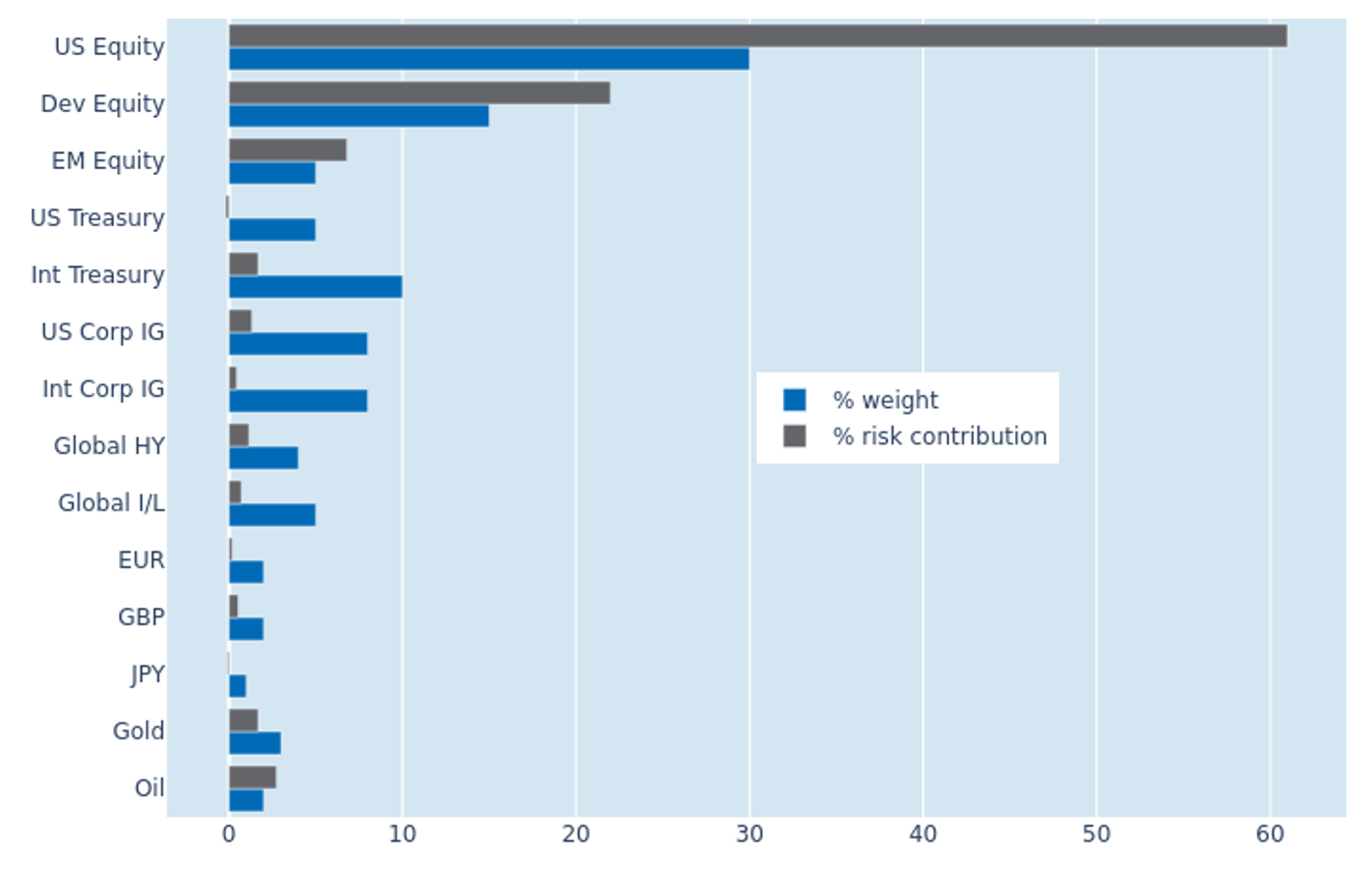

The predicted short-term risk of the Axioma global multi-asset class model portfolio fell another 1.3 percentage points to 11.3% as of Friday, May 23, 2025, with equity volatility easing for a sixth consecutive week despite the renewed selloff in US shares. However, it was non-US developed equities which recorded the biggest drop of 1.1% in their percentage risk contribution to 22%, as local stock market losses were dampened by currency gains against the US dollar. Non-USD government bonds derived the same benefit, but their share of total portfolio volatility still increased from 1% to 1.6%, due to the stronger co-movement with share prices.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated May 23, 2025) for further details.

You may also like

.png%3Fh%3D1080%26iar%3D0%26w%3D1920&w=3840&q=75)