MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED MAY 30, 2025

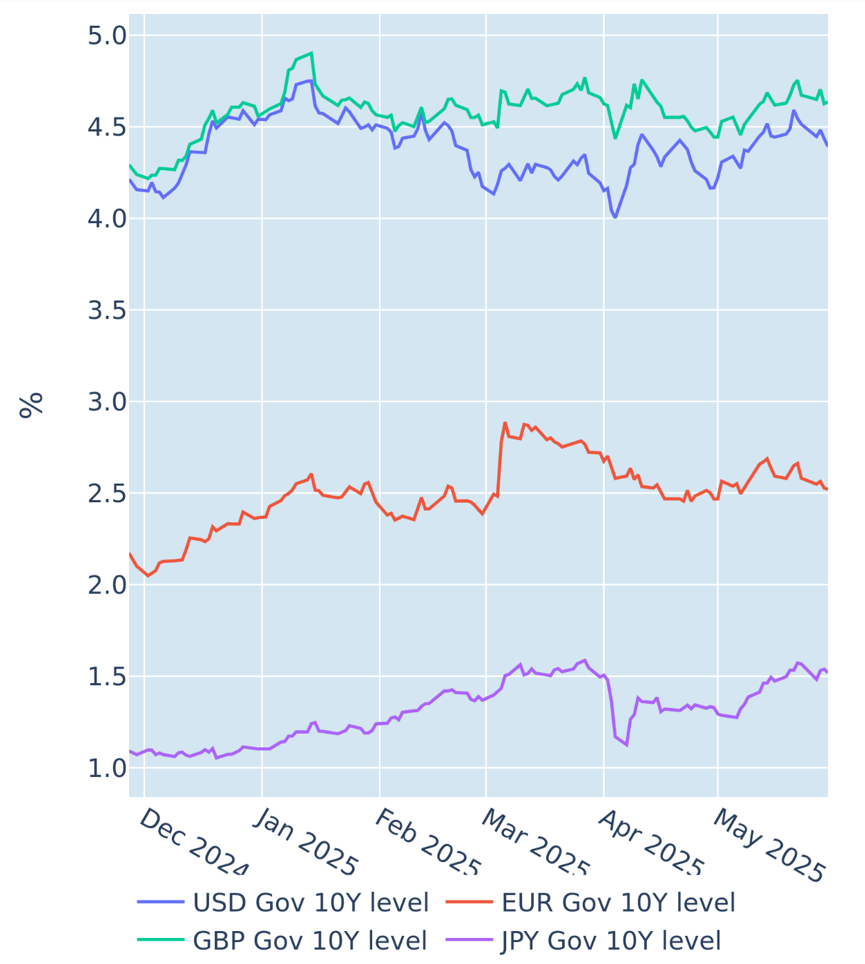

US markets recover after court brands tariffs illegal

US stocks, bonds, and the dollar recovered together in the week ending May 30, 2025, after a court ruling temporarily declared Donald Trump’s “liberation day” tariffs illegal. American share prices finished the week almost 2% higher, taking the total gain for May to 6.5%, which is the strongest monthly performance since November 2023, when slowing consumer prices raised hopes of more rate cuts from the Federal Reserve.

The latest personal consumption expenditure price index release on Friday also came in below market expectations, slowing from 2.3% per annum in March to 2.1% in April, beating analyst predictions of 2.2%. In response, short-term interest-rate traders raised the implied probability of Fed rate cuts of 50 basis points or more by the end of the year to over 75%, compared with 67% on the previous Friday. This was also reflected in a decline in Treasury yields of 10-12 basis points across all maturities greater than two years.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated May 30, 2025) for further details.

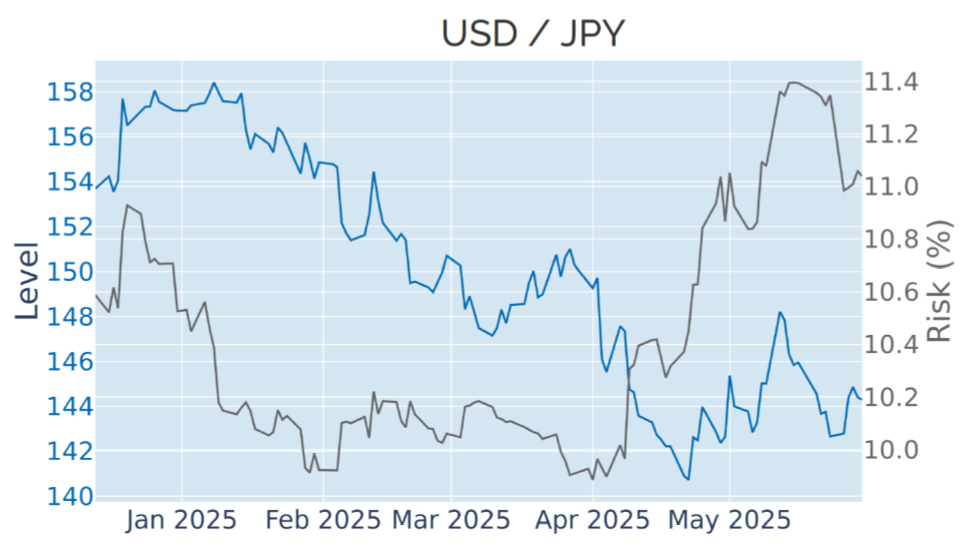

Dollar strengthens despite lower rates

The dollar strengthened against a basket of major trading partners in the week ending May 30, 2025, moving in the opposite direction of interest rates for a second consecutive week. Between June 2022, when the Federal Reserve started to aggressively tighten monetary conditions, and the start of this year, the Dollar Index and Treasury yields moved mostly together, with weekly return correlations between 0.2 and 0.8. But the relationship collapsed with the introduction of the first tariffs in late February, with both variables completely decoupled since.

The greenback’s latest gains were most pronounced against the Japanese yen, which makes the latter the only major currency that finished the month of May in the red against its American rival.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated May 30, 2025) for further details.

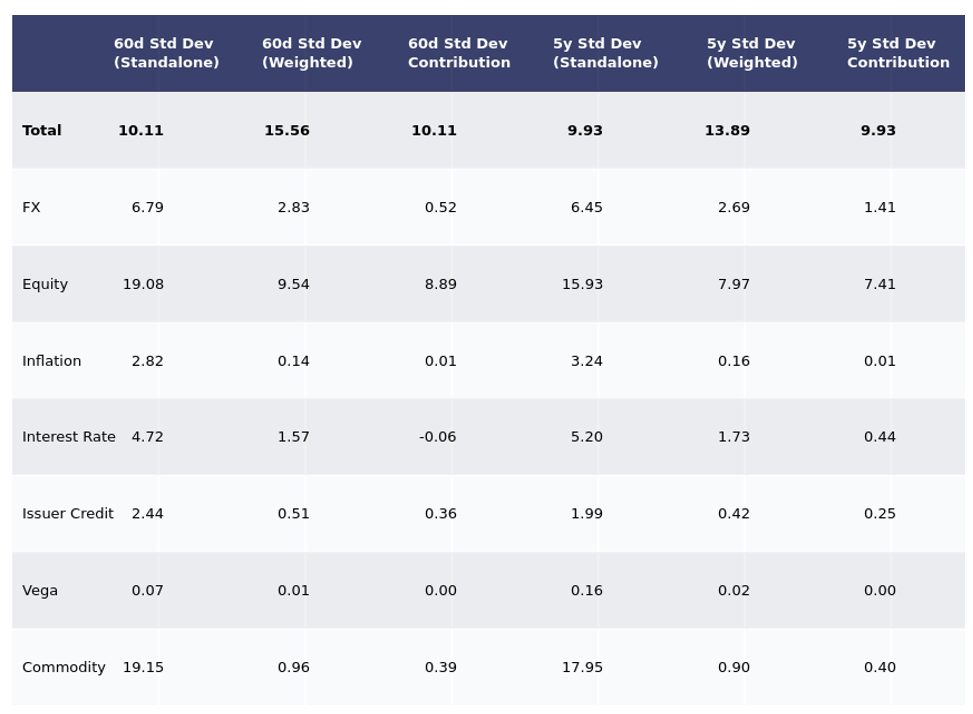

Equity volatility continues to fall but still dominates portfolio risk

An ongoing decline in equity volatility reduced the predicted short-term risk of the Axioma global multi-asset class model portfolio by another 1.2 percentage points to 10.1% as of Friday, May 30, 2025. That being said, fluctuations in share prices are still the dominant source of portfolio risk, accounting for 88% of overall volatility. The remaining 12% were almost equally attributable to variations in FX rates, credit spreads, and commodity prices. Changes in interest rates, on the other hand, neither added to nor subtracted from total portfolio risk, as sovereign yields remained range bound and decoupled from most other risk factors. This was also reflected in the zero risk contribution from US Treasury bonds. The yen’s recent weakening even meant that it marginally reduced overall volatility.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated May 30, 2025) for further details.

You may also like

.png%3Fh%3D1080%26iar%3D0%26w%3D1920&w=3840&q=75)