MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED JUNE 13, 2025

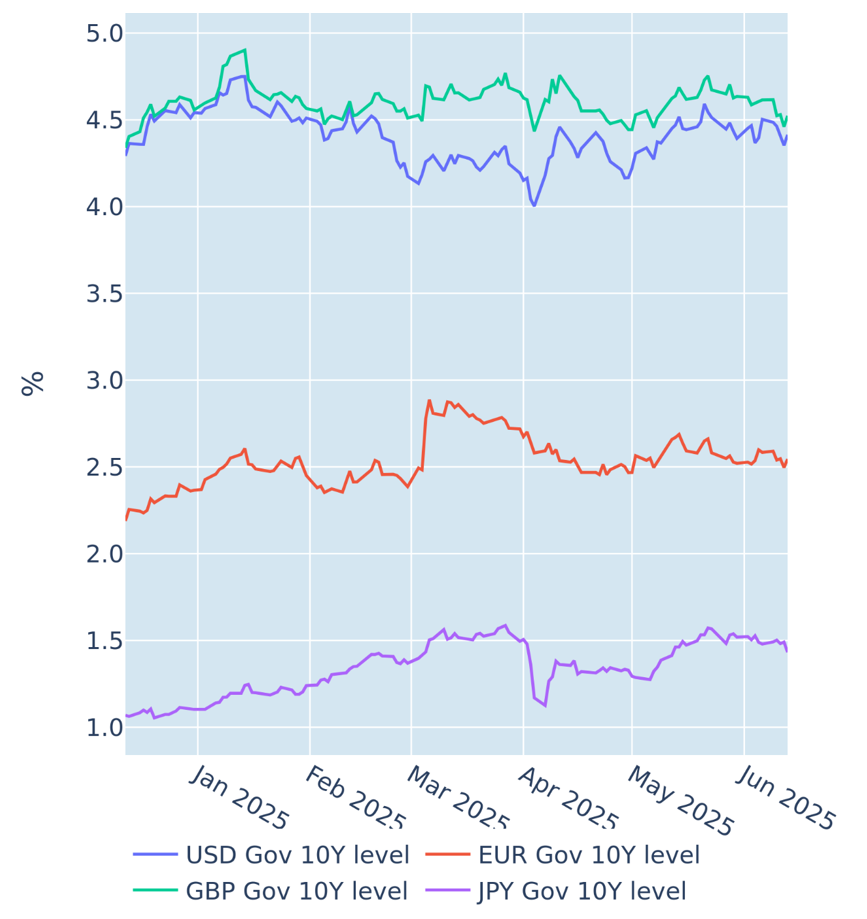

Treasury yields ease after weaker-than-expected inflation report

US borrowing rates dropped across the entire yield curve in the week ending June 13, 2025, after inflation came in slightly lower than anticipated. Headline consumer prices rose by 2.4% in the twelve months ending in May, up from 2.3% in the previous month, but slower than the 2.5% predicted by analysts. Core inflation remained stable at 2.8%, also undershooting the consensus forecast of 2.9%.

Borrowing rates decreased most for longer maturities, with the 10-year benchmark ending the week 10 basis points in the red. But short-term interest rates were only marginally lower, as the Federal Reserve is still projected to cut rates by no more than half a percentage point before the end of the year. No move is expected at this week’s FOMC meeting, as rate setters are likely to want more information on how the latest and any upcoming tariffs are going to affect both consumer prices and economic growth.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated June 13, 2025) for further details.

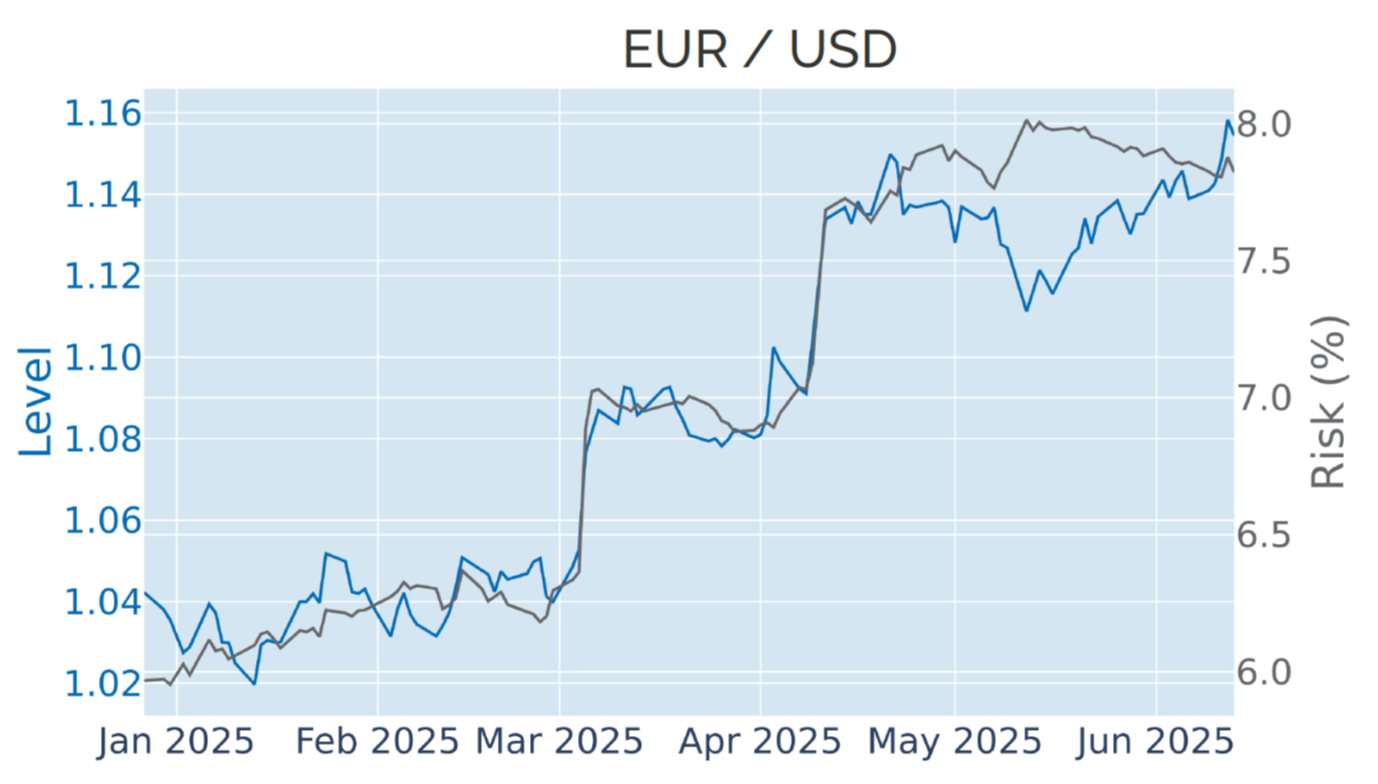

Renewed tariff threats depress dollar to three-year low

The dollar fell to its lowest level in more than three years against a basket of major trading partners in the week ending June 13, 2025, after President Donald Trump announced that he would send letters to other nations outlining unilateral tariff rates before the 90-day suspension of so-called “reciprocal” levies expires in early July. The move depressed the greenback below its post-“Liberation Day” low from late April and expanded its losses since Trump’s inauguration in mid-January to almost 11%. Continental European currencies were the preferred destinations of the capital exodus, with gains ranging from 13% for the euro and the Swiss franc to 16% and 19% for the Norwegian krone and Swedish krona, respectively.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated June 13, 2025) for further details.

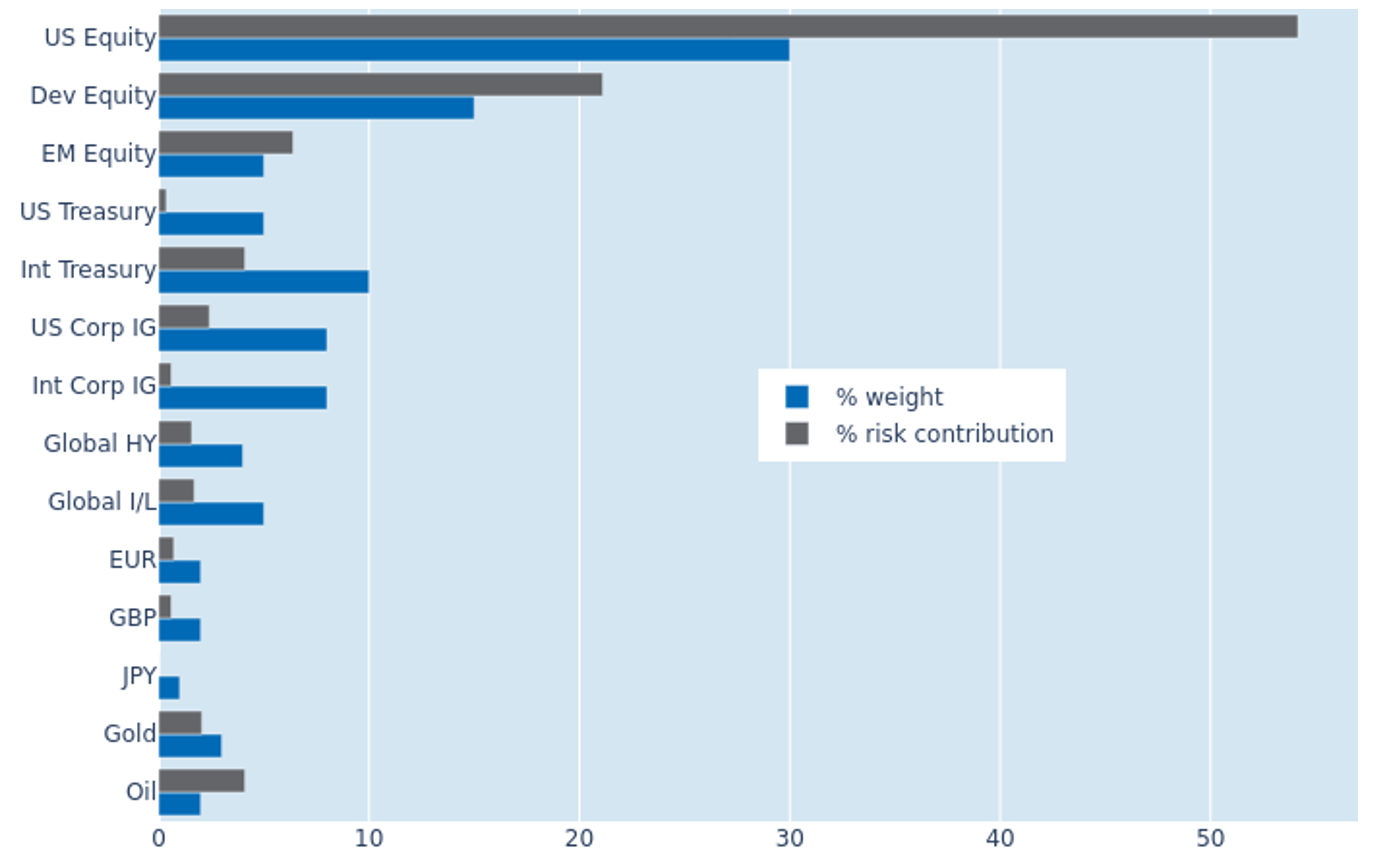

Declining stock-market volatility continues to reduce portfolio risk

The predicted short-term risk of the Axioma global multi-asset class model portfolio kept easing to 8.3% on Friday, June 13, 2025, as stock-market volatility continued to decline. US equities saw their share of total portfolio risk shrink to 54.2% as result, but still retained the largest risk contribution relative to their monetary weight of 30%. At the other end of the spectrum were US Treasury and investment grade corporate bonds, which neither added to nor subtracted from overall volatility, with risk-free interest rates staying decoupled from share prices. The Japanese yen also showed a zero risk contribution, as its inverse relationship with the American stock market offset its positive correlation with non-USD-denominated fixed income securities.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated June 13, 2025) for further details.

You may also like

.png%3Fh%3D1080%26iar%3D0%26w%3D1920&w=3840&q=75)