MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED JULY 11, 2025

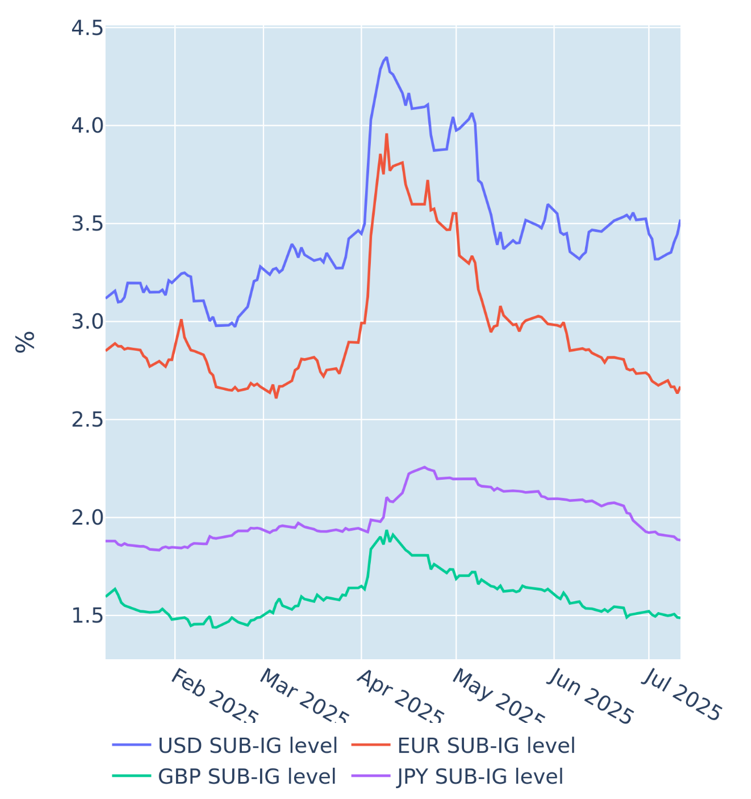

Euro stock recovery depresses credit spreads to pre-tariff lows

Risk premia on euro-denominated high yield bonds tightened to four-month lows in the week ending July 11, 2025, as European stock markets outperformed their American and Asian counterparts and ended the week firmly in the black. Euro sub-investment grade credit spreads are now only a few basis points above their most recent lows from when the first trade barriers were introduced at the end of February. This could mean that further downside might be limited if share prices were to recover further.

USD yield premia, on the other hand, remained elevated around the levels recorded after the first tariff round, though still way below the post-Liberation Day peaks.

Please refer to Figure 5 of the current Multi-Asset Class Risk Monitor (dated July 11, 2025) for further details.

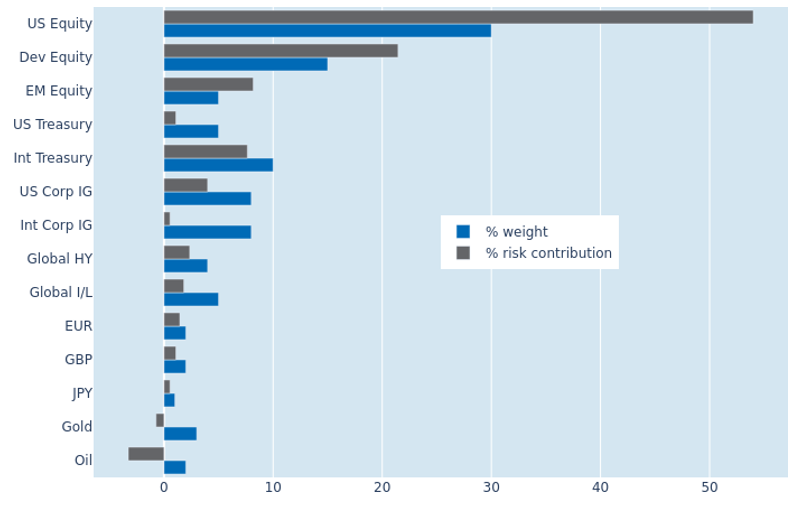

Ongoing fall in equity volatility depresses portfolio risk to 8-month low

The predicted short-term risk of the Axioma global multi-asset class model portfolio descended further to 5.5% on Friday, July 11, 2025, its lowest level since before the US presidential election in November last year. The continued easing was mostly due to the ongoing decline in share price volatility, though equities remained the predominant source of risk, accounting for around 84% of total portfolio volatility. The bulk of this came from American stocks with a percentage risk contribution of 54% compared with a monetary weight of 30%. The ratio was much lower for their counterparts from other parts of the world, which benefitted from a low correlation of FX and equity returns. Oil and gold even actively reduced overall volatility due to their current inverse relationship with stock markets.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated July 11, 2025) for further details.

You may also like