MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED JULY 18, 2025

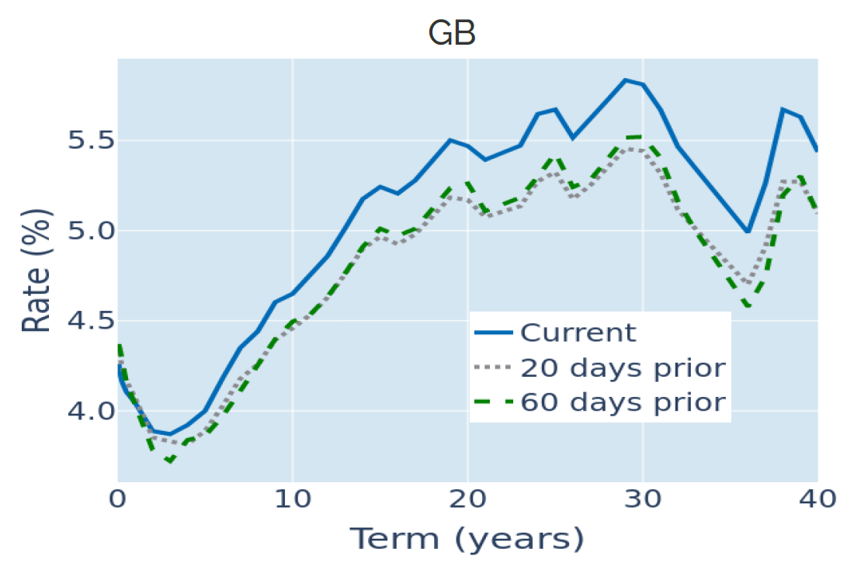

Gilt curve steepens after surprise inflation surge

The term premium of long over short Gilt yields widened to its steepest level in ten weeks in the week ending July 18, 2025, following a surprise surge in UK inflation. The Office for National Statistics (ONS) reported on Wednesday that British consumer prices rose by 3.6% in the twelve months to June, the fastest pace since January 2024. Economists had predicted that the annual growth rate would remain stable at the previous month’s level of 3.4%.

The Bank of England is still projected to cut its base rate by 25 basis points at its upcoming meeting on August 7, after the ONS’s labour market report on Thursday showed an unanticipated increase in the unemployment rate from 4.6% in the three months to April to 4.7% in May. This weaker-than-expected reading underpinned the previous week’s news that the British economy shrunk for a second consecutive months in May, defying the consensus forecast of a mild expansion.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated July 18, 2025) for further details.

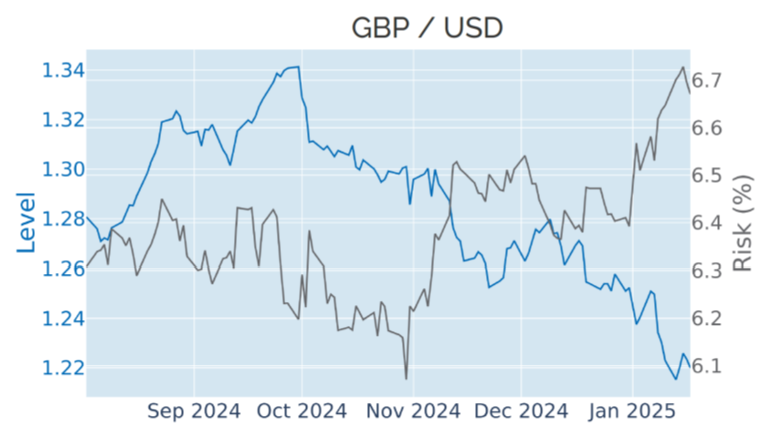

Dollar continues to strengthen with fewer Fed rate cuts expected

The dollar strengthened for a second consecutive week against a basket of major trading partners, recouping part of its steep losses since Donald Trump took office in January, and setting up the greenback for its first monthly gain of the year. Last Tuesday’s release from the Bureau of Labor Statistics showed a resurgence in headline consumer price growth from 2.4% in May to 2.7% in June, while core inflation accelerated from 2.8% to 2.9%. Both were seen as a sign that the tariffs introduced earlier in the year were starting to feed through to end customers.

The strong inflation reading reinforced the notion that the Federal Reserve may only ease monetary conditions once or twice more over the remainder of the year. This was in contrast to the two to three rate cuts that were expected at the start of the month, before the non-farm payroll report showed that the American economy added 147,000 jobs in June instead of the 110,000 predicted by analysts.

The strengthening dollar meant that the British pound continued to depreciate despite last week’s increase in Gilt yields, taking its month-to-date decline to -2%. The only other G10 currency that showed a bigger loss of -3.4%this month was the Japanese yen.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated July 18, 2025) for further details.

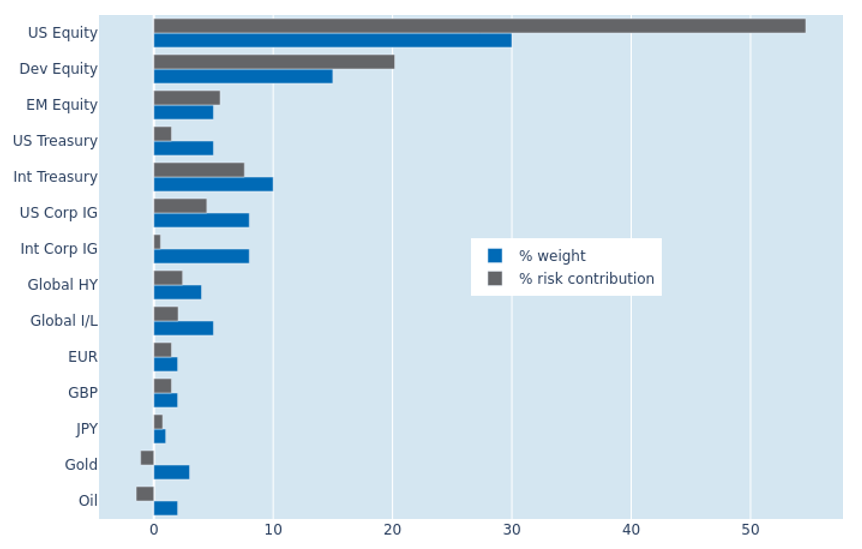

Less negative stock-bond correlation offsets lower equity volatility

The predicted short-term risk of the Axioma global multi-asset class model portfolio fell marginally from 5.5% to 5.4% as of Friday, July 18, 2025, as the benefits of a further decline in share price volatility were largely offset by a less negative interaction of stock and bond prices. US equities and Treasury bonds both saw their shares of total portfolio risk increase as result. This was in contrast to the combined percentage risk contribution from developed and emerging-market non-US equities, which shrank by a total of 3.7 points. Gold and oil remained negatively correlated with most other asset classes, both continuing to actively reduce overall volatility.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated July 18, 2025) for further details.

You may also like