Retail rebels flip the script: The Short Interest reversal in July

A surge fueled by sentiment, not fundamentals

Author

Diana R. Baechle, Ph.D., Senior Principal, Investment Decision Research

In July, a select group of meme stocks surged dramatically, driven not by company fundamentals but by a powerful short-squeeze dynamic. These stocks – characterized by high short interest – were effectively captured by the Short Interest style factor in the Axioma US5.1 suite of models, which identified this sentiment-driven movement as a major contributor to their returns.

This insight offers portfolio managers a critical tool for assessing short-term risk and return, especially during periods when holdings morph into meme stocks and experience volatility disconnected from broader market trends or company performance.

Understanding the short-squeeze mechanism

We’ve seen this playbook before – most notably in 2021 with GameStop and AMC – where retail investors targeted heavily shorted stocks, triggering a buying frenzy that forced short sellers to cover positions, driving prices even higher.

The mechanism is straightforward: short sellers borrow shares and sell them, hoping to buy them back at a lower price. If the price rises instead, they must repurchase shares to limit losses, creating a feedback loop of rising demand and soaring prices.

Ironically, companies with weak fundamentals are more likely to see their stock prices rise in these scenarios, because they tend to attract short sellers, who then draw in meme-stock traders hoping to trigger a short squeeze.

The Meme Portfolio: Anatomy of a rally

To analyze this phenomenon, we constructed an equal-weighted portfolio of six meme stocks that took center stage in July: Beyond Meat (BYND), Kohl’s (KSS), Krispy Kreme (DNUT), Rigetti Computing (RGTI), Rocket Companies (RKT) and QuantumScape (QS).

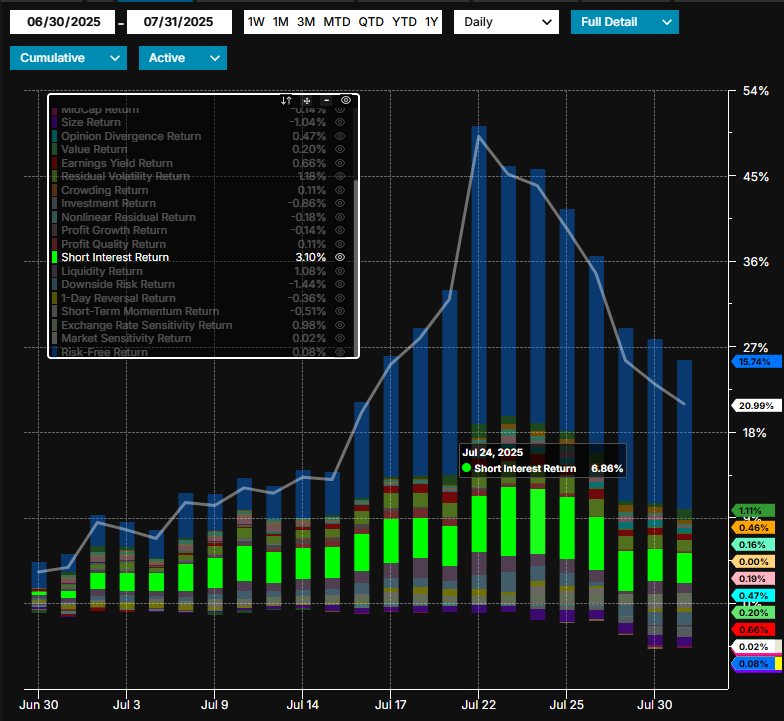

While most of the portfolio’s July performance was attributed to residual return (as expected for such a small undiversified portfolio), one style factor, Short Interest, stood out as a dominant driver (Figure 1).

Figure 1: Factor Decomposition of Meme Portfolio Returns in July

Source: Arcana, Axioma US Equity Factor Risk Model Trading Horizon (US5.1.-TH)

Meme Portfolio performance and volatility over time

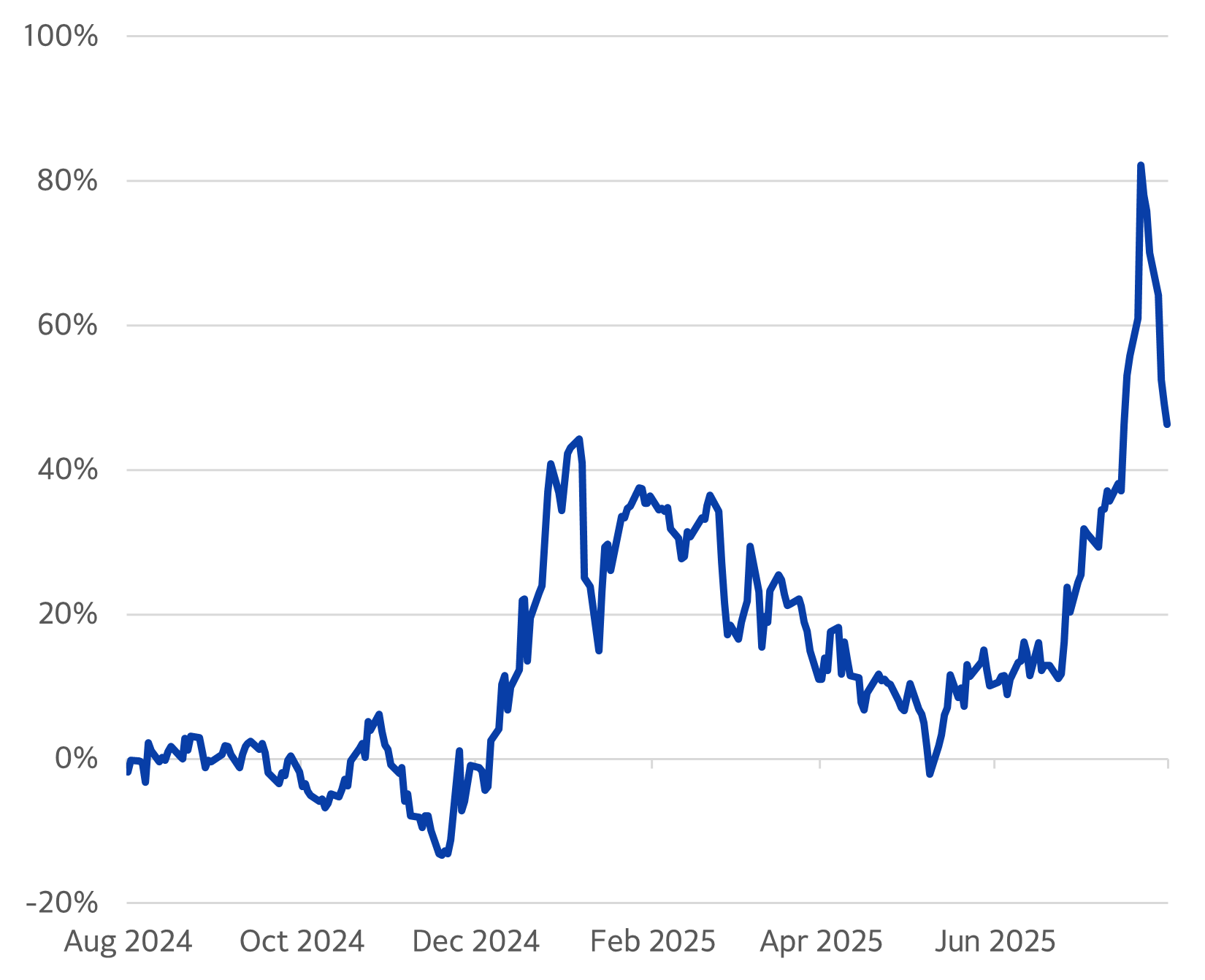

Although these companies made headlines for their rapid rise and fall in July, their momentum actually began after the US election. By early January, they had surged more than 40% ahead of the STOXX US Small Cap index, peaking briefly before declining to match the benchmark by early May (Figure 2). They then began climbing again, and by July 22, the Meme Portfolio had delivered an 80% active return since July 31, 2024. Despite a sharp drop over the following two weeks, it still outperformed the index by 46% over the full one-year period ending July 31, 2025.

Figure 2: One-Year Cumulative Active Return of Meme Portfolio

Source: STOXX, Axioma Portfolio Analytics

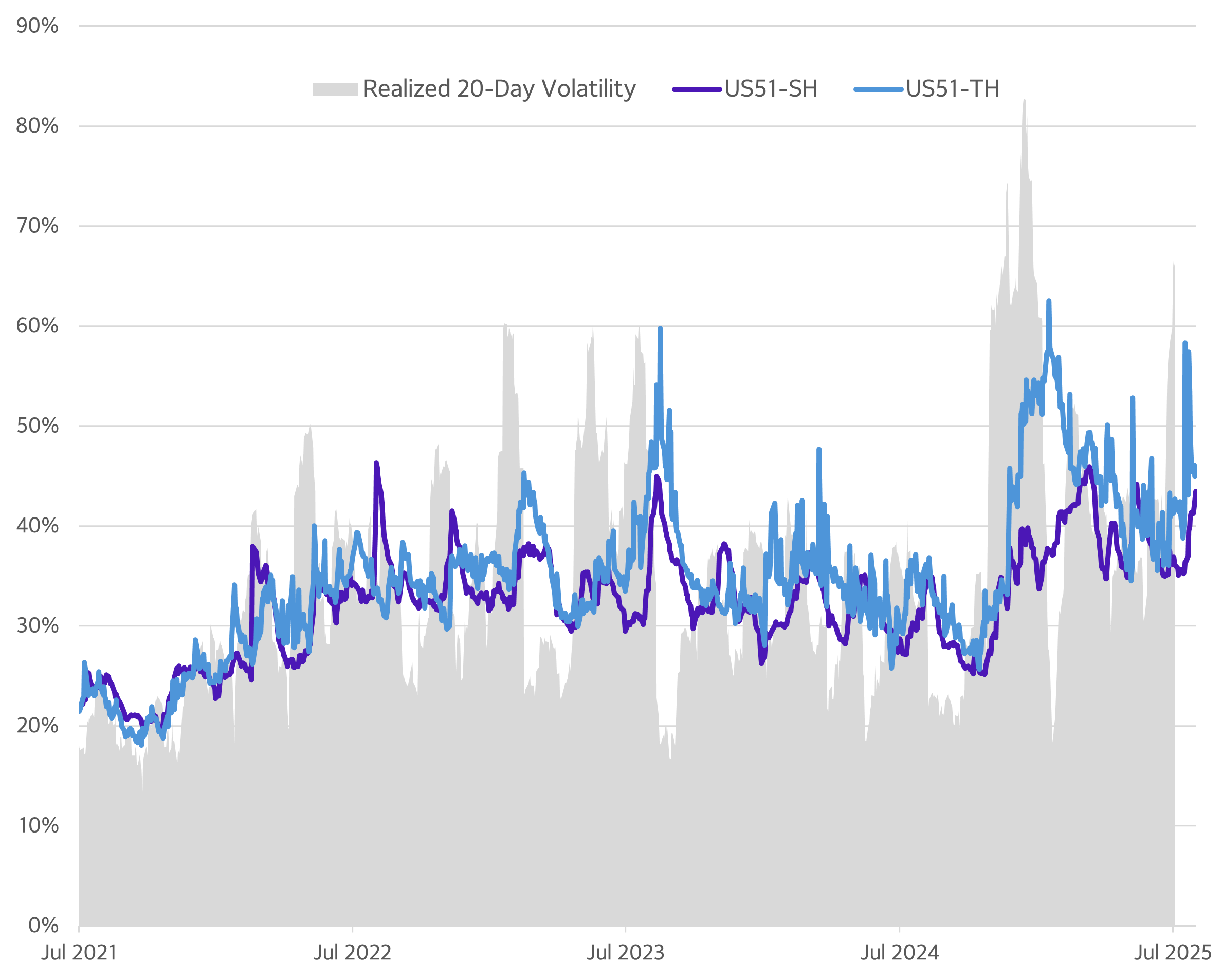

These dramatic swings were reflected in the portfolio’s elevated volatility (Figure 3). In December of last year, the Meme Portfolio’s 20-day annualized realized volatility of active returns exceeded 80%. In 2025, realized active volatility peaked at around 60%.

Both the Trading Model and the Fundamental Short-Horizon Model versions of the US5.1 Model effectively captured this heightened risk, with the Trading Model offering greater precision due to its shorter calibration window.

Figure 3: Meme Portfolio Forecasted versus Realized Active Risk

Source: STOXX, Axioma US Equity Factor Risk Models: Short Horizon (US5.1-SH) and Trading Horizon (US5.1-TH)

Sentiment factors: Short Interest and Crowding

This analysis focuses on two newly introduced sentiment-themed factors in the US5.1 models – Short Interest and Crowding – as they offer valuable insights into hedge fund-related risks and opportunities.

Crowding measures the concentration of shares held long by hedge funds. It’s often seen as a proxy for “Long Interest,” suggesting potential outperformance due to perceived informational advantages.

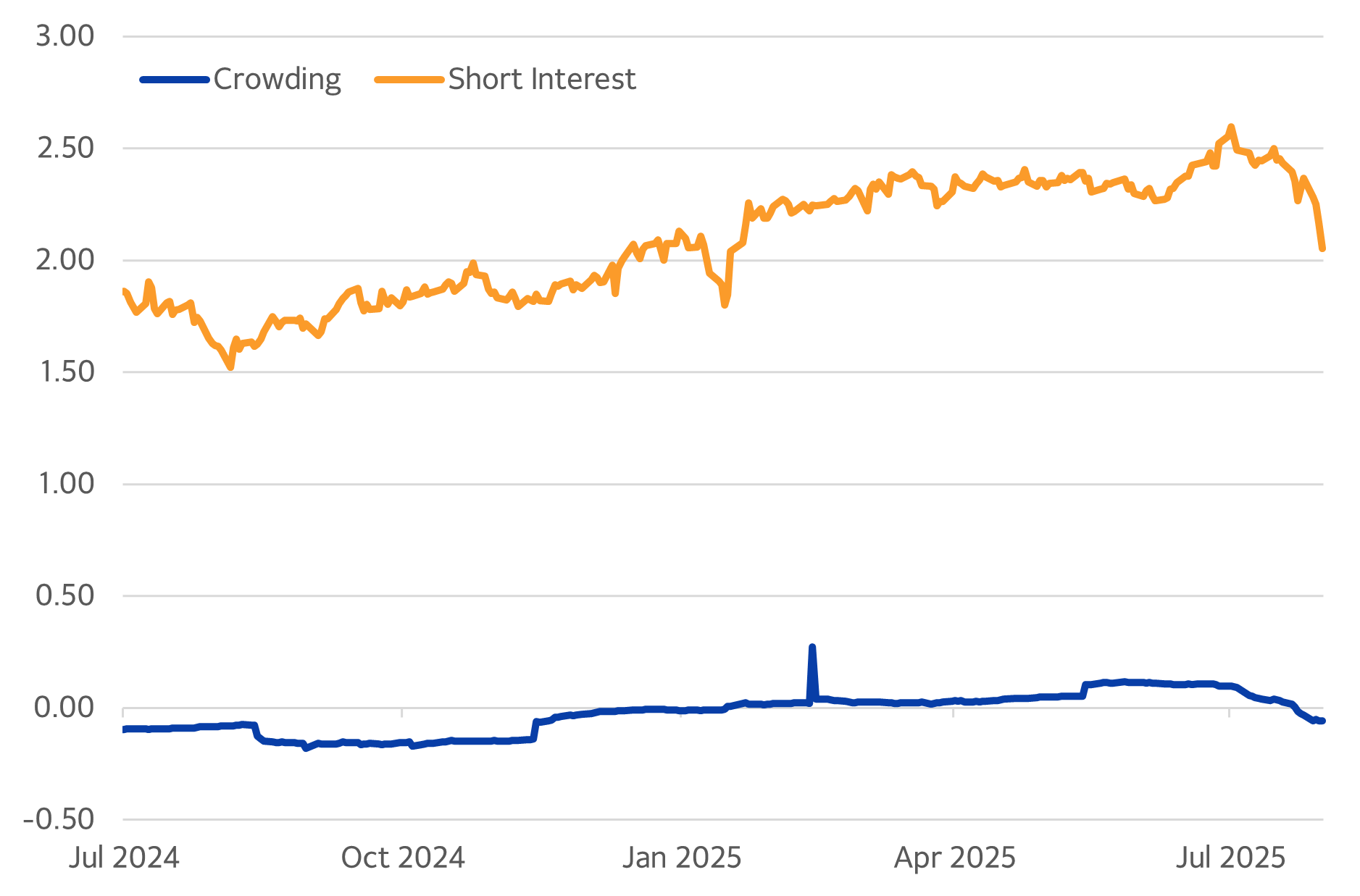

The Meme Portfolio's exposure to Crowding was comparable to that of the broader small-cap market, indicating it had minimal influence on the portfolio's outperformance (Figure 4).

Although these meme stocks appeared crowded – particularly in July – the near-zero active factor exposure confirms that hedge funds were not the source of this crowding and supports the view that their popularity stemmed from retail investors involved in the short squeeze, further amplified by others seeking to capitalize on the momentum.

Figure 4: Meme Portfolio’s Active Exposure to Crowding and Short Interest

Source: STOXX, Axioma US Equity Factor Risk Model Trading Horizon (US5.1.-TH)

Short Interest measures the proportion of a stock that has been sold short, reflecting bearish sentiment. This often leads to further shorting and typically signals underperformance for heavily shorted stocks.

The Meme Portfolio has shown a steadily increasing positive exposure to Short Interest over the past 12 months, peaking in July (Figure 4). This sharp upward trend over the past year, coupled with previous share price increases, may have signaled early warning signs that these stocks were on the path to becoming meme stocks as early as the fourth quarter of last year.

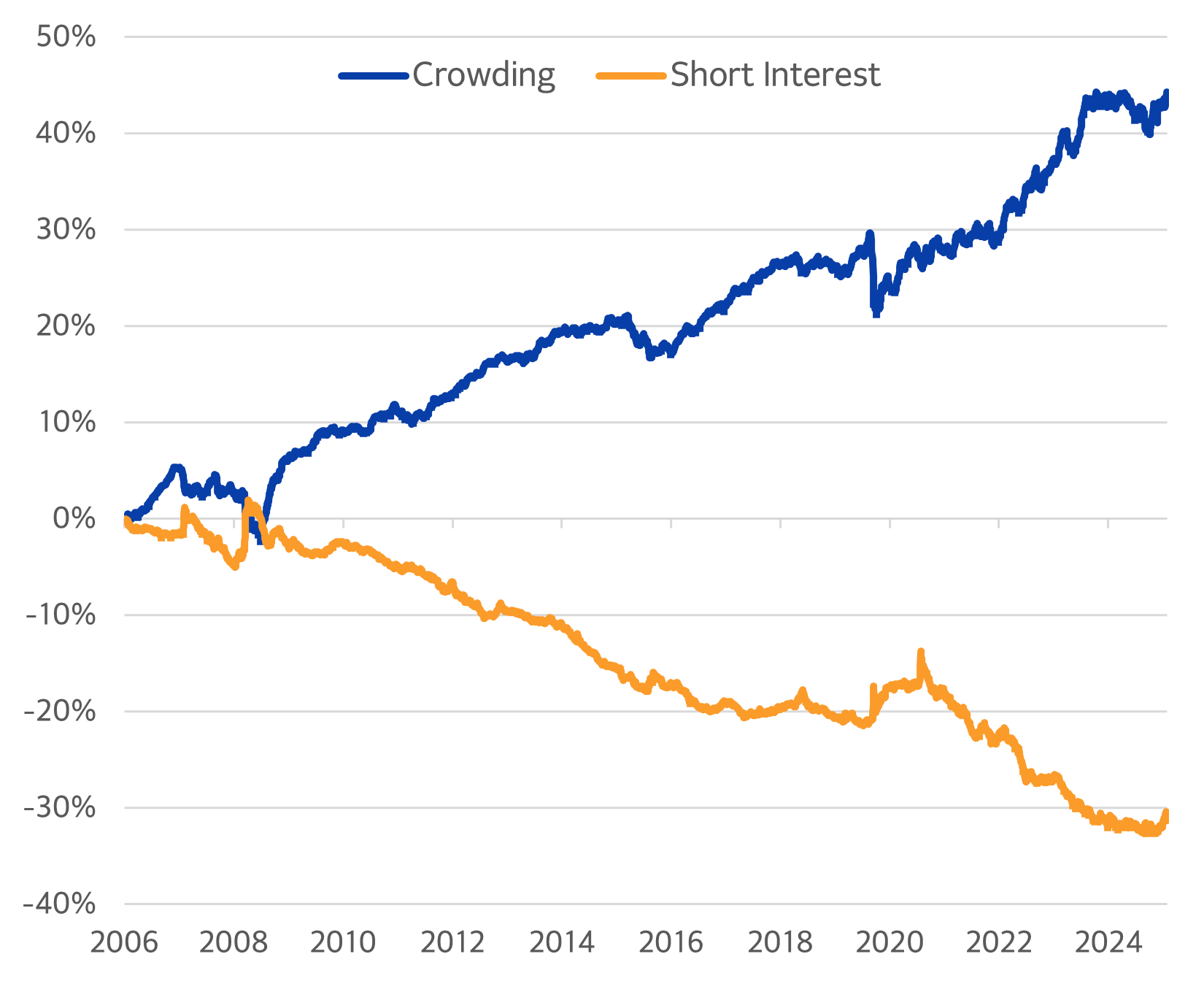

Historically, unlike Crowding, which tends to exhibit a positive risk premium, positive exposure to Short Interest has been detrimental due to its negative risk premium – except during crisis points or meme-stock rallies, when sharp reversals occur (Figure 5).

Figure 5: Crowding and Short Interest Cumulative Daily Return (July 2006-July 2025)

Source: Axioma US Equity Factor Risk Model Trading Horizon (US5.1.-TH)

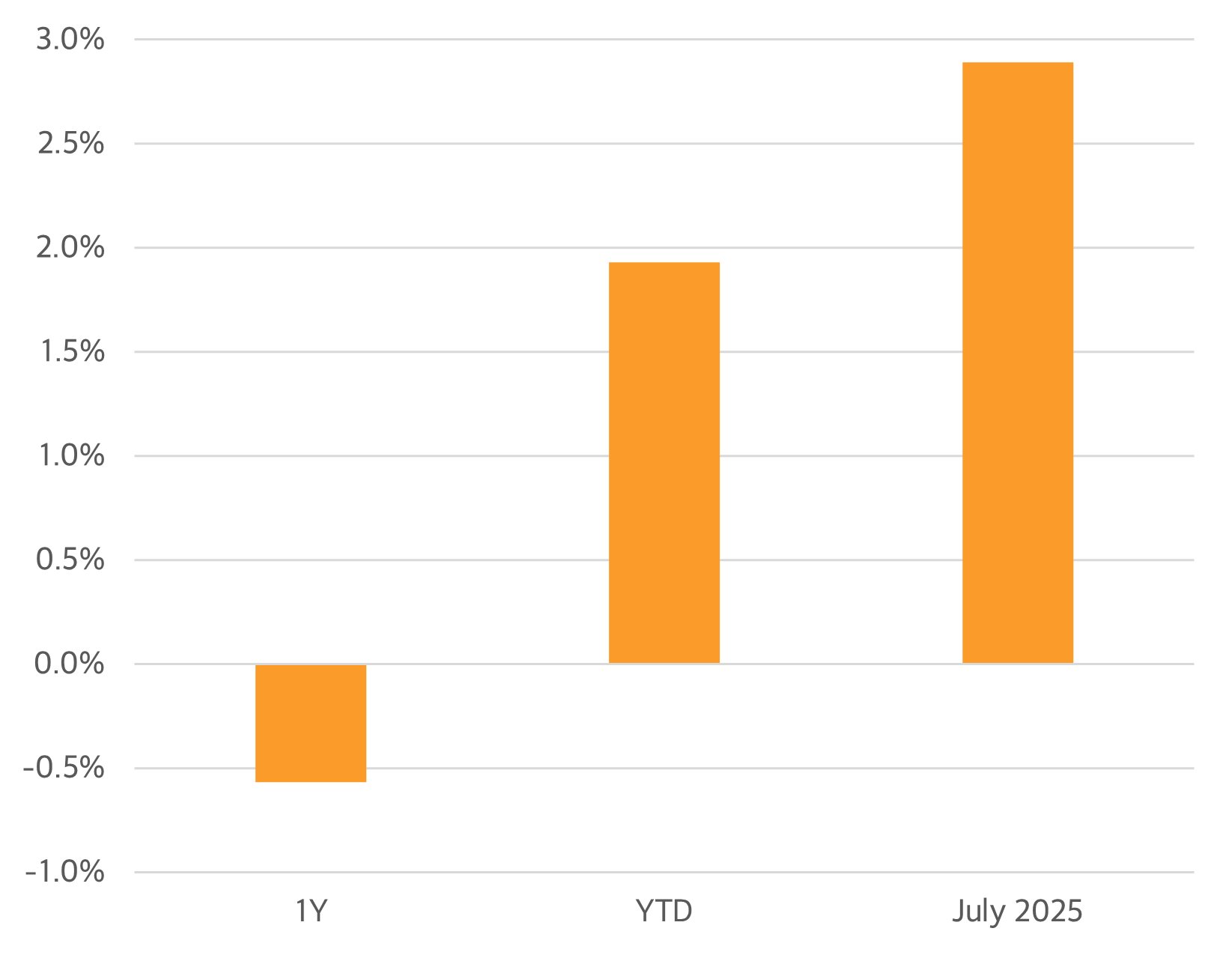

Short Interest reversal: A primary force behind July’s Meme Portfolio gains

As expected, Short Interest posted a negative return over the 12-month period, resulting in a modest drag on the Meme Portfolio’s one-year performance.

However, when the factor return turned sharply positive in July, the portfolio’s significant positive active exposure to Short Interest amplified the factor’s contribution to that month’s gain (Figure 6).

Because of this strong, anomalous positive return for the Short Interest factor in July, even portfolios with modest Short Interest underweights were significantly negatively impacted – highlighting the importance of closely monitoring this exposure.

Figure 6: Short-Interest Contribution to Meme Portfolio Active Return

Source: STOXX, Axioma US Equity Factor Risk Model Trading Horizon (US5.1.-TH)

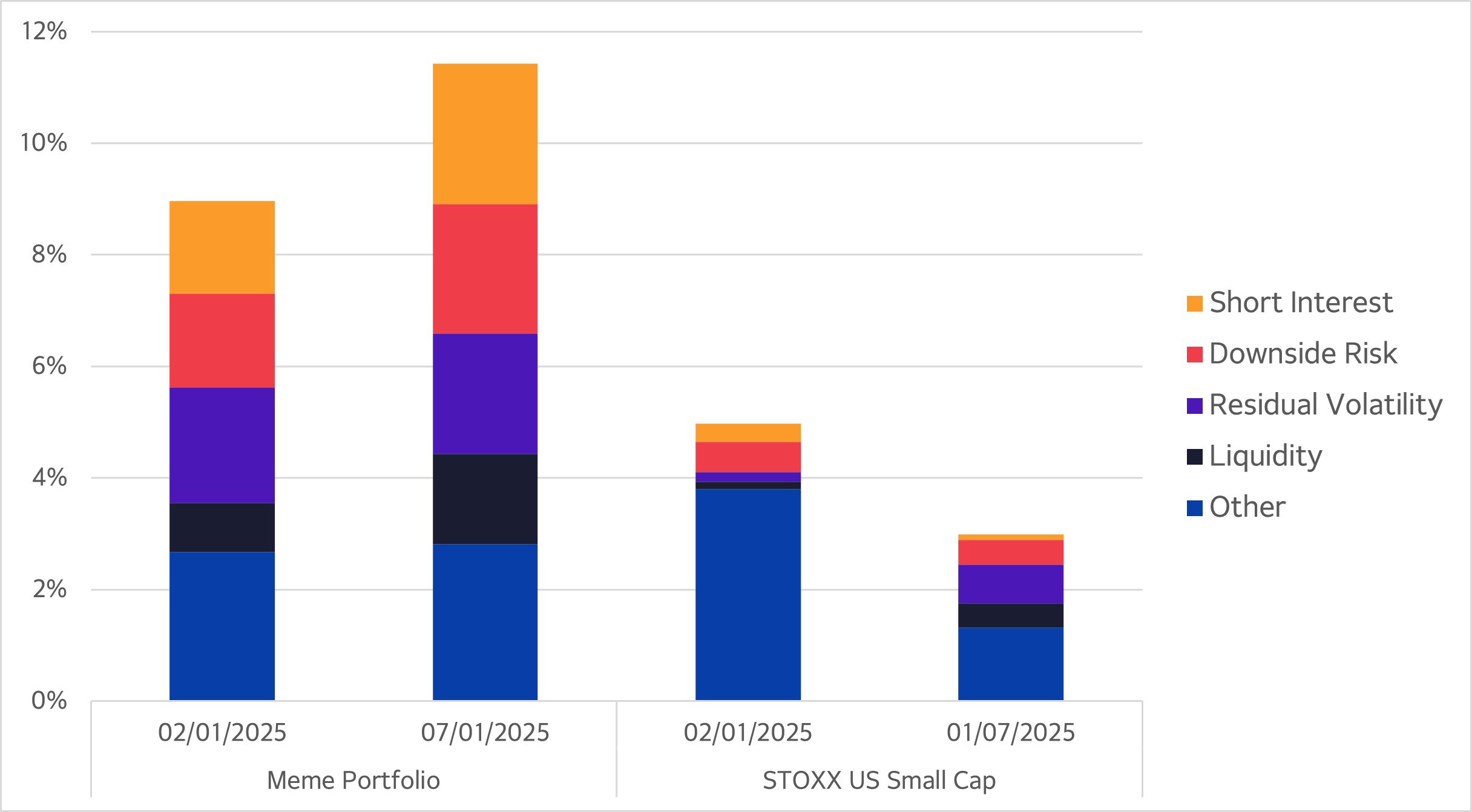

Other key risk contributors

Style Risk in the Meme Portfolio has increased significantly over the past seven months, driven primarily by Short Interest. Liquidity, Downside Risk, and Residual Volatility also contributed meaningfully, with these four factors together accounting for 75% of the portfolio’s Style Risk by early July.

As of July 1, 2025, Style Risk contributed 11 percentage points to the Meme Portfolio’s Total Risk of 47%, with nearly nine percentage points attributed to these four style factors (Figure 7).

While the contribution of Style Risk to the Total Risk of the broad STOXX US Small Cap Index has declined since the beginning of the year, Short Interest, Liquidity, Downside Risk, and Residual Volatility have grown increasingly influential within the STOXX US Small Cap Index. Their combined contribution to Total Risk rose modestly – from 117 to 167 basis points – but the four style factors’ share of overall Style Risk increased significantly, climbing from roughly one-quarter in January to nearly one-half by July.

When stocks in your portfolio begin to exhibit meme-like behavior, it's important to monitor not just Short Interest, but also your exposures to Liquidity, Downside Risk, and Residual Volatility, as these factors tend to move in tandem – amplifying overall portfolio risk and potentially driving unexpected performance swings.

Figure 7: Style Risk Contribution to the Total Risk of Meme Portfolio and Benchmark

Source: STOXX, Axioma US Equity Factor Risk Model Trading Horizon (US5.1.-TH)

Navigating meme market turbulence

Meme stocks once again took center stage in July, delivering explosive gains followed by swift reversals. For some portfolios, the impact was lucrative; for others, it came as a costly surprise. The takeaway is clear: Short Interest exposure can be a double-edged sword.

In typical markets, Short Interest carries a negative risk premium, prompting many strategies to maintain negative exposure. But during short-squeeze episodes, these positions can suffer sharp drawdowns while positive exposure, which is generally to be avoided, can lead to outsized gains. The July reversal in Short Interest was so pronounced that even portfolios with slight negative exposure were severely affected.

In today’s meme-driven environment – where retail coordination, social media, and trading algorithms can trigger sudden reversals – these dynamics can shift overnight. By closely monitoring Short Interest exposure, portfolio managers can better anticipate and manage the risks and opportunities posed by meme phenomena.

References/footnotes

Many thanks to my colleagues Melissa Brown and Leon Serfaty for their valuable insights and contributions to this study.

Related Content