EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED SEPTEMBER 8, 2025

- Turmoil in French government leads to higher France country risk

- Value and Crowding turn in higher-than-expected returns

Turmoil in French government leads to higher France country risk

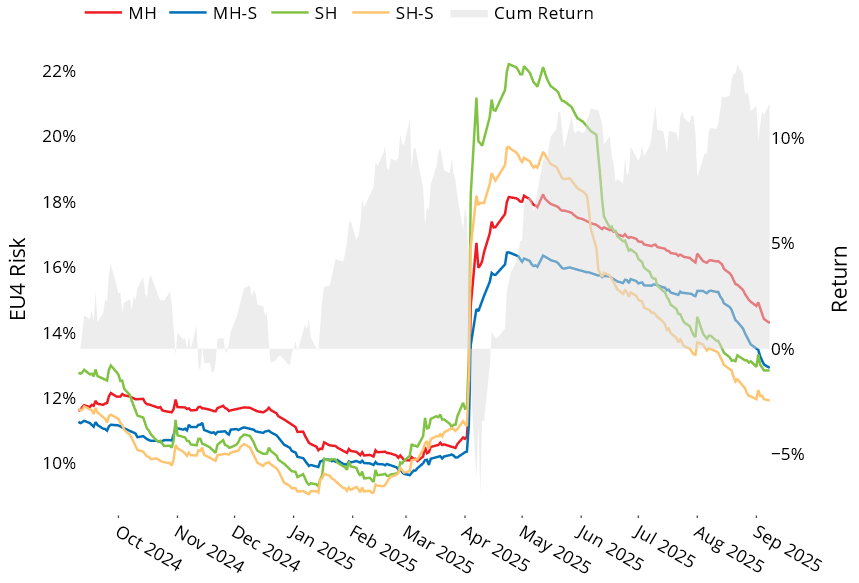

The recent turmoil in the French government, in which parliament voted to remove the Prime Minister was not reflected in an increase in overall risk for the STOXX Europe 600, as measured by Axioma’s European models.

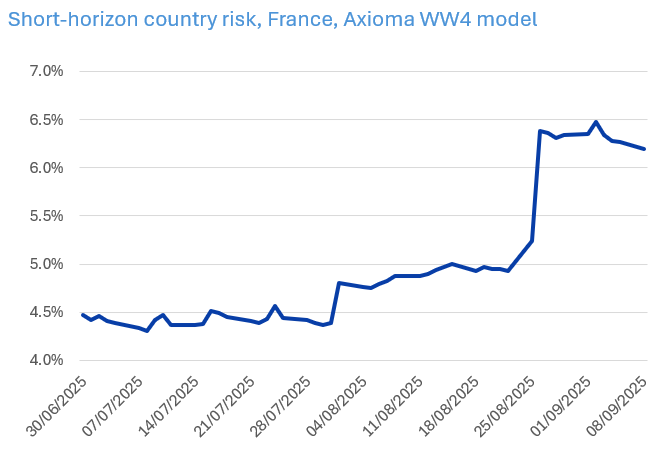

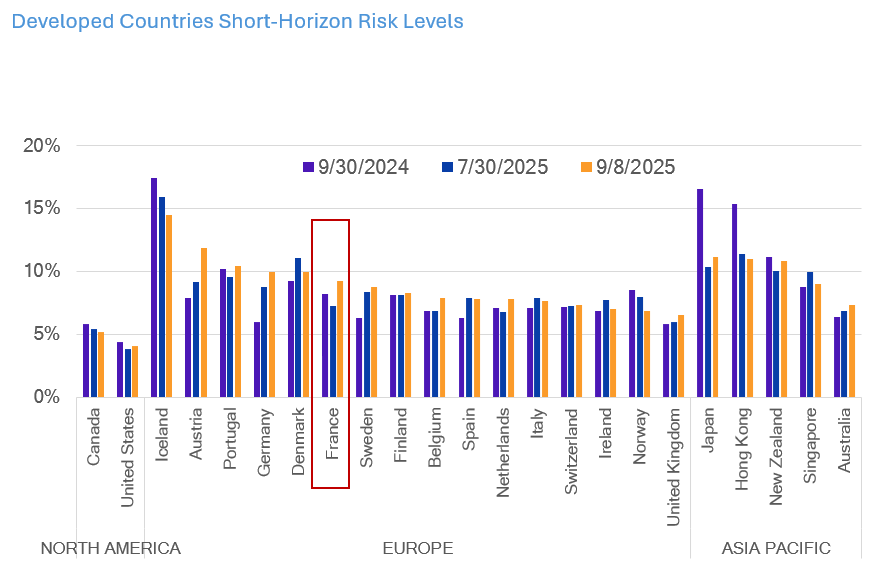

The France country factor in Axioma’s Worldwide (WW4) model, in contrast, seems to have anticipated the recent government collapse, with short-horizon risk rising more than 25% since the end of July. This was the biggest increase in country risk among developed market countries with the exception of Austria, and France is now the 9th-riskiest country among the 21 Developed market countries, up from 16th at the end of July. (Remember that country risk is over and above that of all the other model factors, and as such represents a kind of France-specific factor.

While pan-European index investors may not have seen an overall increase in portfolio or active risk, those with an active tilt toward or away from France may have seen a corresponding change in active risk and should be aware of the impact from the increase in France’s risk.

See chart from the STOXX Europe 600 Equity Risk Monitor of September 8, 2025

The following charts are not in the equity risk monitors, but are available on request:

Value and Crowding turn in higher-than-expected returns

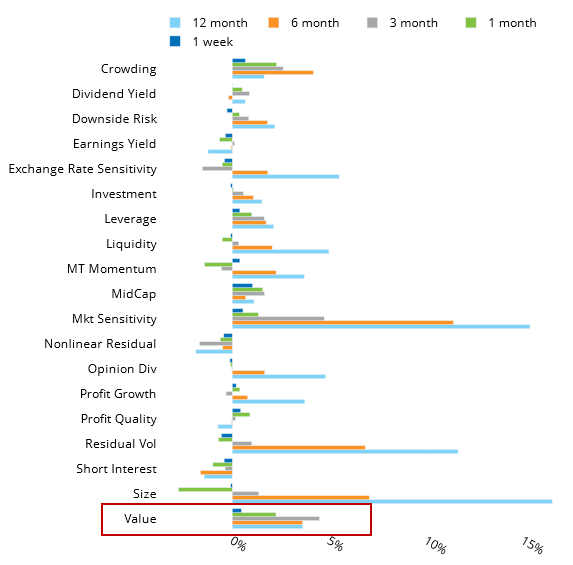

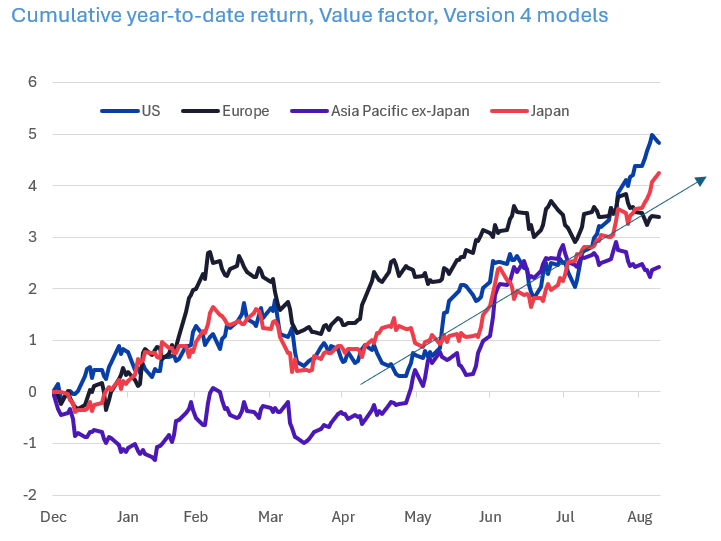

Value (defined as book/price) has had an unusually strong run over the past one, three and six months, especially in the US, where the respective returns of 2.25%, 4.49%, and 3.62% were each more than two standard deviations above the risk forecasts at the beginning of each period (according to the US5 model). In fact the three month return was more than three standard deviations, suggesting the magnitude of return was highly unexpected (and for many investors, quite welcome).

Indeed, Value has turned in good performance in other regions as well, if not quite as much above expectations as in the US, especially in the period post “Liberation Day”.

See charts from the Russell 1000 (US5, Right) Risk monitors of September 8, 2025

The following chart does not appear in the risk monitors, but is available on request:

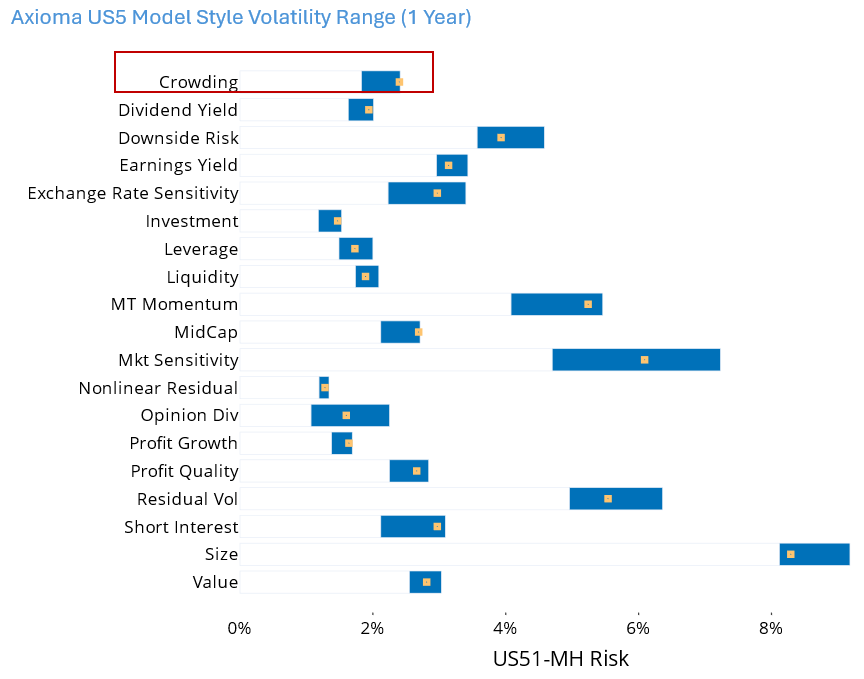

The US5 Crowding factor has also turned in returns that were two-to-three standard deviations above beginning-of-period expectations. Unlike Value, however, where predicted volatility is currently at its long-term average, Crowding’s risk is at the high end of its 12-month range (albeit still low relative to many other model factors).

See chart from the Russell 1000 Equity Risk Monitor as of September 8, 2025

You may also like