EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED SEPTEMBER 19, 2025

Axioma Risk Monitor: Not all US sectors partake in the Fed rate-cut celebrations; Emerging Markets steal the spotlight as September rally propels them to the top; Info Tech drives returns and risk in Emerging and Developed Markets despite lagging performance

Not all US sectors partake in the Fed rate-cut celebrations

US equity indices reached fresh highs last week, buoyed by the Federal Reserve’s widely expected move to lower interest rates and its indication of additional cuts later this year. Small-cap stocks outperformed, as these companies tend to carry more leverage and are poised to benefit more from an invigorated US economy. The Russell 2000 advanced 2.19%, compared to a 1.26% gain for the Russell 1000 over the past five trading sessions. Despite this recent robust performance, the Russell 2000’s 11% year-to-date return still lags the large-cap benchmark by 300 basis points so far in 2025.

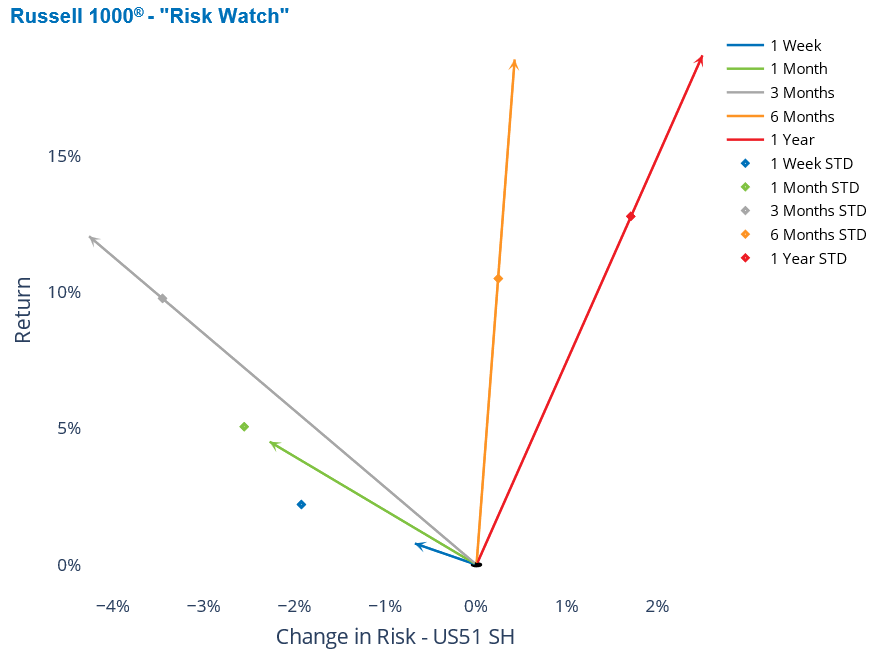

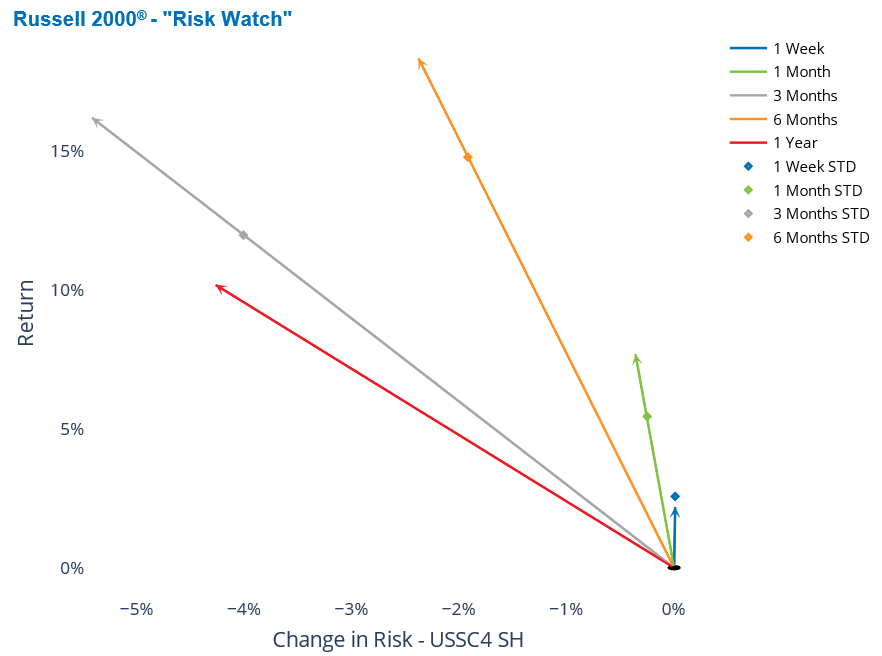

However, the one-week returns for both the Russell 1000 and Russell 2000 remained within one standard deviation of expectations at the week’s outset, as indicated by the Axioma US51 All Cap and US4 Small Cap fundamental short-horizon models, respectively. For the large-cap index, returns over three, six, and twelve months now significantly exceed expectations at the start of each respective period. In contrast, while the small-cap benchmark’s one-month return surpassed expectations, its twelve-month performance remains in line.

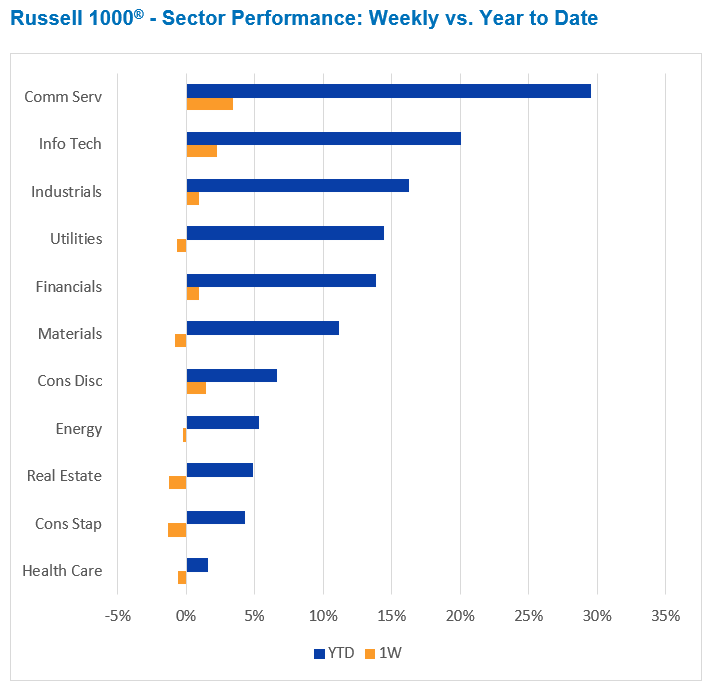

Not every US sector participated in last week’s rally. Consumer Staples and Real Estate were the biggest losers in both the Russell 1000 and Russell 2000 indices. In fact, six of the eleven GICS sectors in the Russell 1000 ended the week lower. The largest underperformers among large caps so far in 2025—Health Care, Consumer Staples, Real Estate, and Energy—all posted losses last week. Materials and Utilities also declined. The weekly advance in the Russell 1000 was driven solely by Information Technology, Communication Services, Consumer Discretionary, Financials, and Industrials.

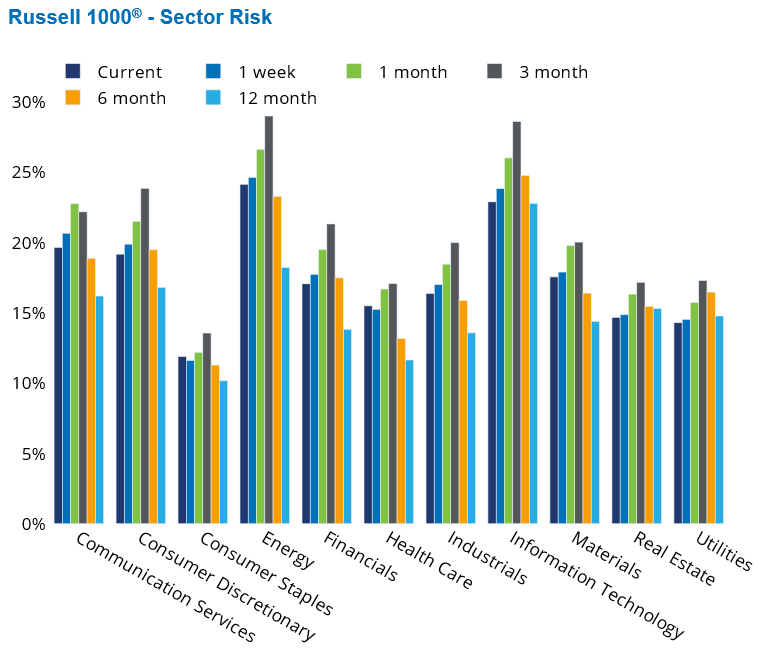

Meanwhile, the Russell 1000 continued to see a reduction in its forecasted risk, as measured by the Axioma US51 model. Of the Russell 1000 sectors, only Consumer Staples and Health Care experienced a modest uptick in risk.

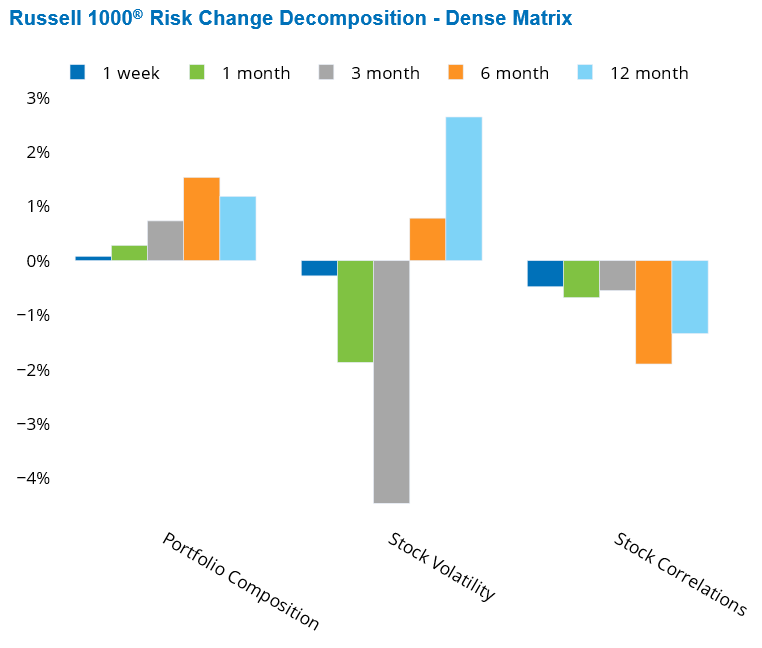

A breakdown of the change in risk, using a dense matrix approach, revealed that the Russell 1000’s risk decline was driven by decreases in both stock volatility and stock correlations. The drop in correlations had a more pronounced effect on the benchmark’s risk reduction, as investors tried to assess how lower rates might differently impact various stocks.

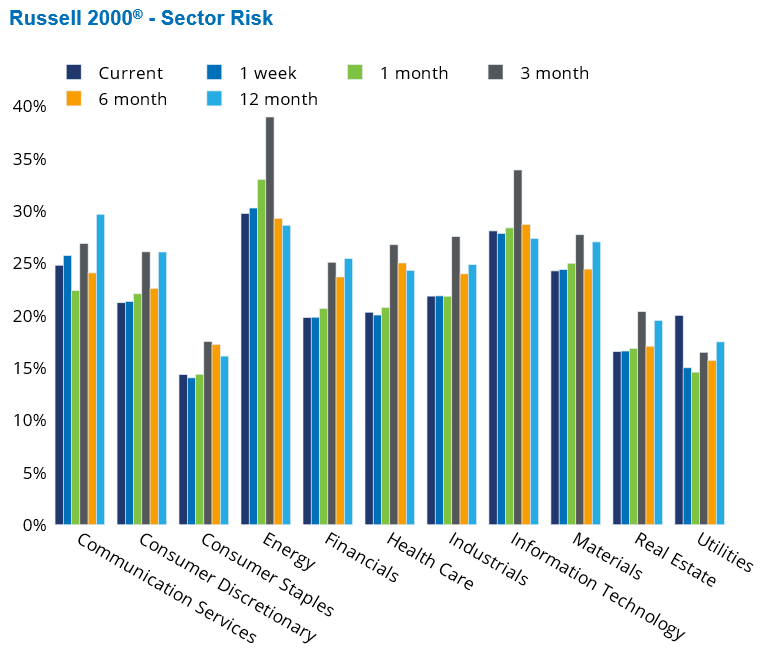

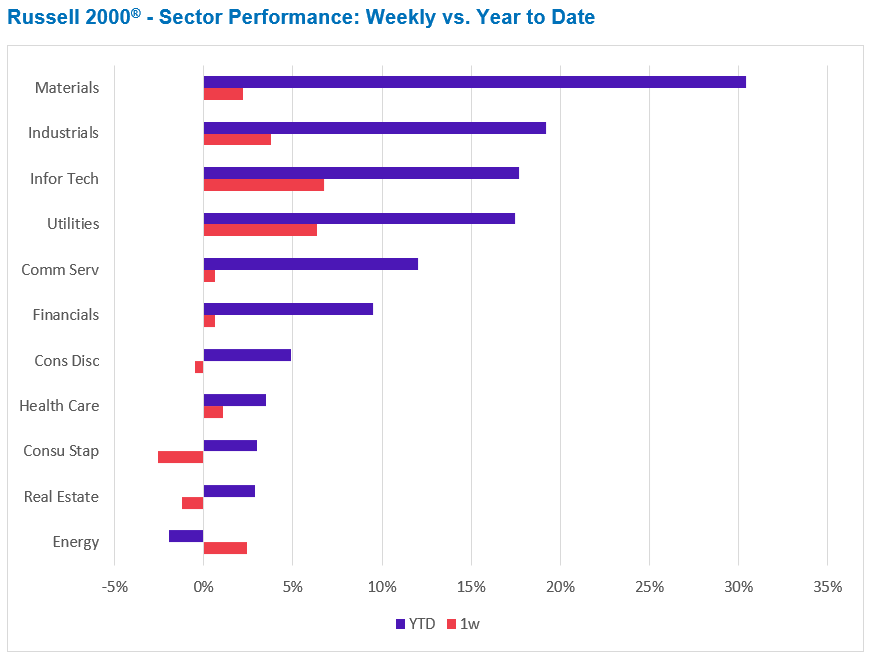

Within the small-cap universe, only Consumer Staples, Consumer Discretionary, and Real Estate posted weekly declines, while Information Technology, Utilities, and Industrials propelled the Russell 2000 higher.

Predicted risk for the Russell 2000, according to the Axioma US4 Small Cap model, remained unchanged.

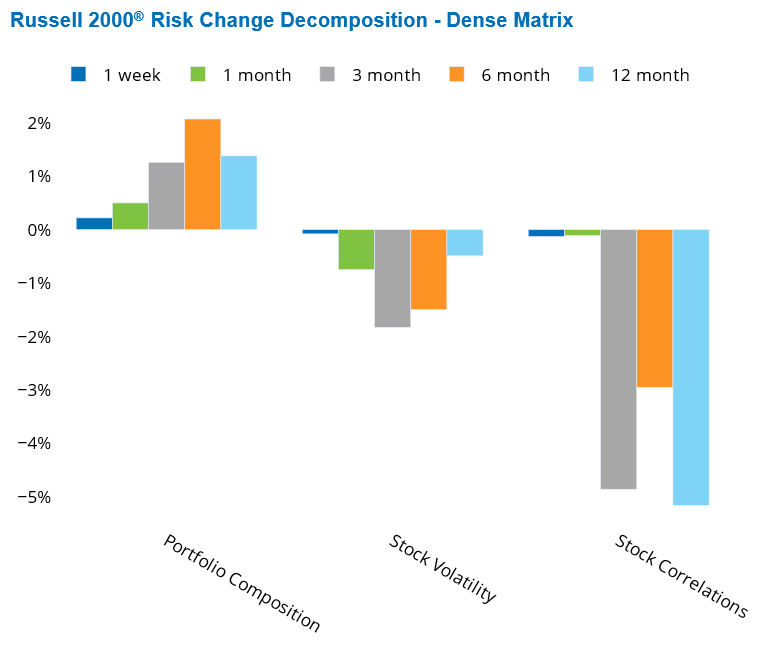

Utilities saw a notable increase in risk, with Consumer Staples, Health Care, and Information Technology also experiencing slight upticks. Nevertheless, at the benchmark level, a marginal decrease in both stock volatility and stock correlations within the Russell 2000 offset the risk increase stemming from changes in index composition last week.

See graphs from the Russell 1000 Equity Risk Monitor as of September 19, 2025:

See graphs from the Russell 2000 Equity Risk Monitor as of September 19, 2025:

The following charts are not included in the Equity Risk Monitors but are available on request:

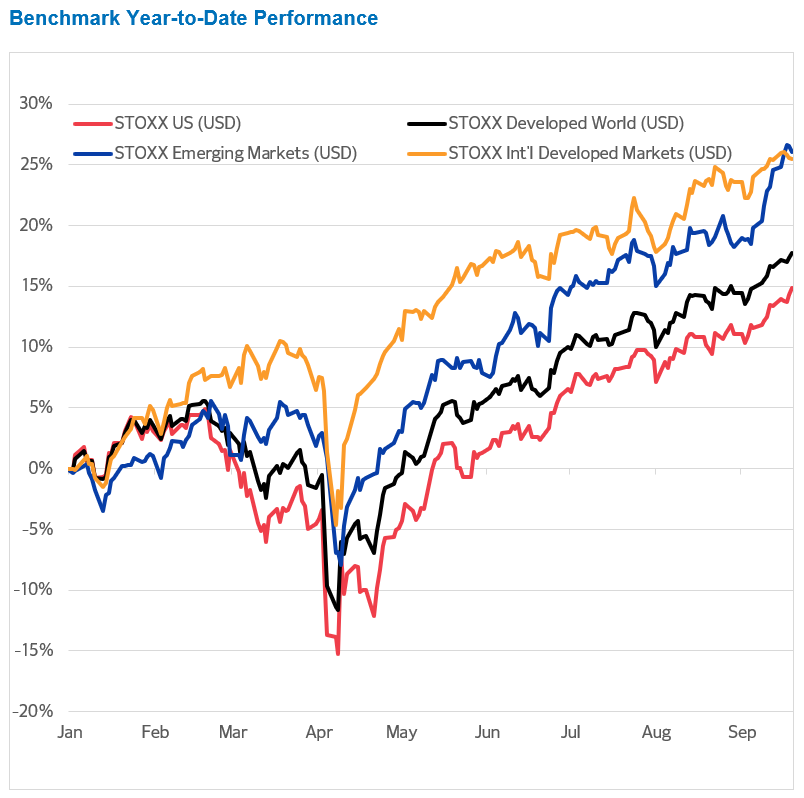

Emerging Markets steal the spotlight as September rally propels them to the top

While the US market grabbed headlines, Emerging Markets quietly outperformed all major regions tracked by the Equity Risk Monitors. The STOXX Emerging Markets index has climbed nearly 7% in September alone, lifting its year-to-date return to 26%. STOXX Emerging Markets is now outperforming STOXX US by 11 percentage points, STOXX Developed World by eight percentage points, and STOXX International Developed Markets (which has been in the lead for most of 2025) by 0.5 percentage point.

Emerging Markets’ recent outperformance stems from several converging factors. Economic growth projections for Emerging Markets are much stronger, with the International Monetary Fund (IMF) April 2025 forecasts showing Emerging Markets to grow 3.7% in 2025 versus just 1.4% for Developed Markets. Emerging market stocks also benefited from renewed optimism in China and surging demand for Asian technology, especially due to AI-linked investments in Taiwan and South Korea.

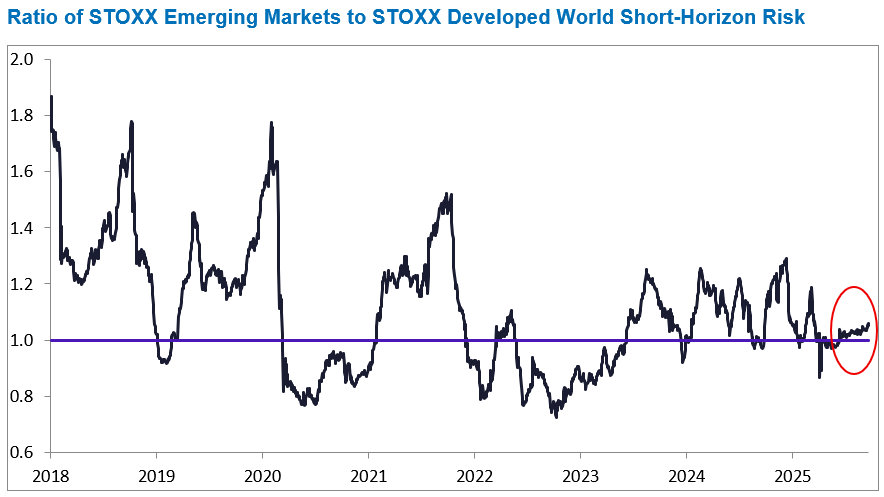

Despite Emerging Markets’ strong outperformance over Developed peers in 2025, their forecasted risk is still similar to that of Developed Markets, as measured by Axioma Emerging and Developed Markets fundamental short-horizon models. Emerging Markets started the year with risk levels matching those of Developed Markets, became significantly riskier in March, then shifted to a less risky profile in April, and have hovered near parity since May.

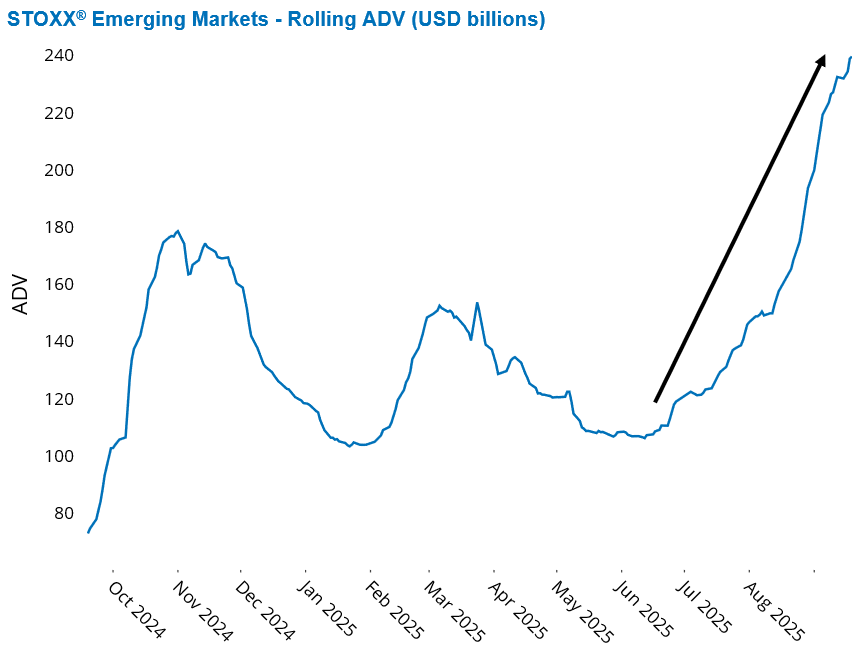

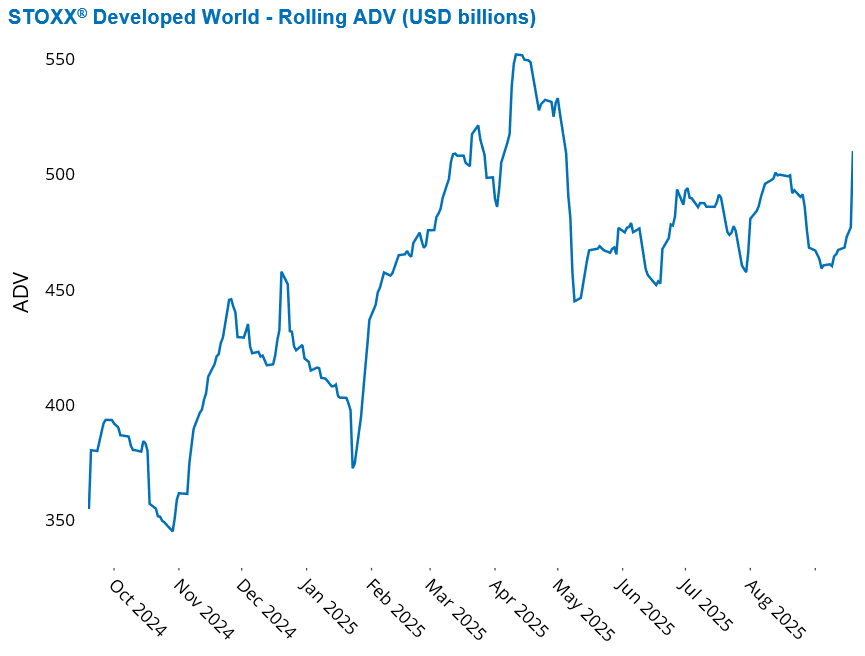

Investor enthusiasm for Emerging Markets equities was also reflected in the skyrocketing of the STOXX Emerging Markets’ average daily trading volume (ADV), which doubled since June. In contrast trading activity in STOXX Developed World has been oscillating in recent months.

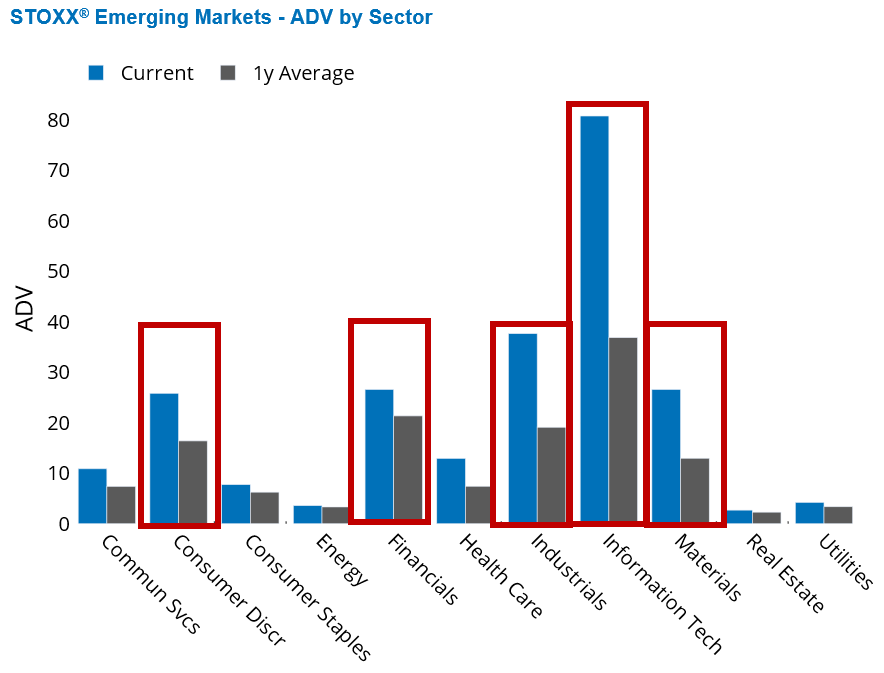

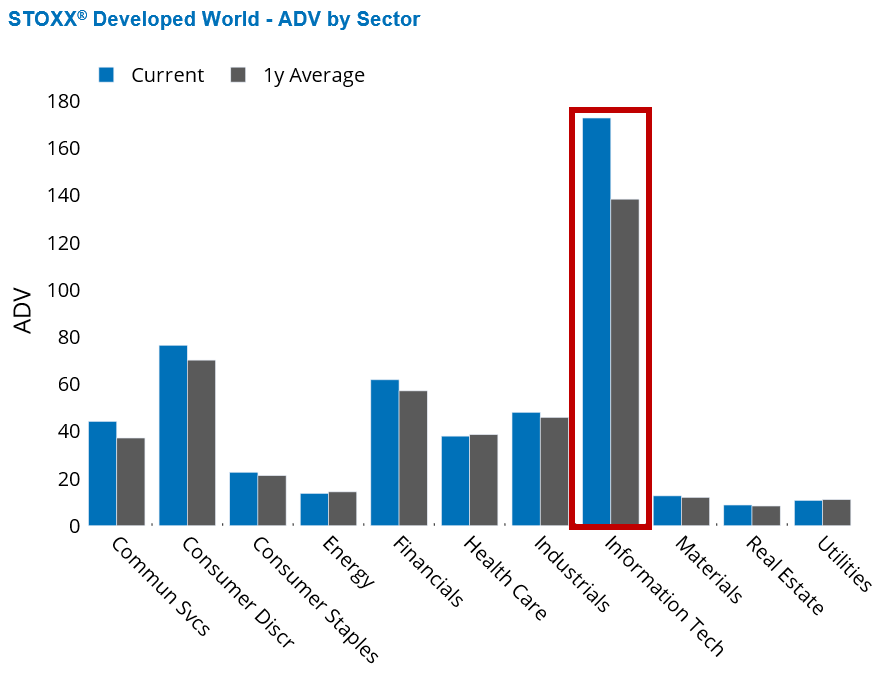

More than a third of Emerging Market trading activity was concentrated in tech stocks. Information Technology’s ADV was more than twice its one-year average last week. Most other Emerging Market sectors also saw increased trading volumes compared to their annual averages, with Industrials, Materials, Consumer Discretionary, and Financials showing the largest gains after Info Tech. While Info Tech also saw a rise in trading volume within Developed Markets, most other sectors either remained near their respective averages or fell below them.

The following charts are not included in the Equity Risk Monitors but are available on request:

See graphs from the STOXX Emerging Markets Equity Risk Monitor as of September 19, 2025:

See graphs from the STOXX Developed World Equity Risk Monitor as of September 19, 2025:

Info Tech drives returns and risk in Emerging and Developed Markets despite lagging performance

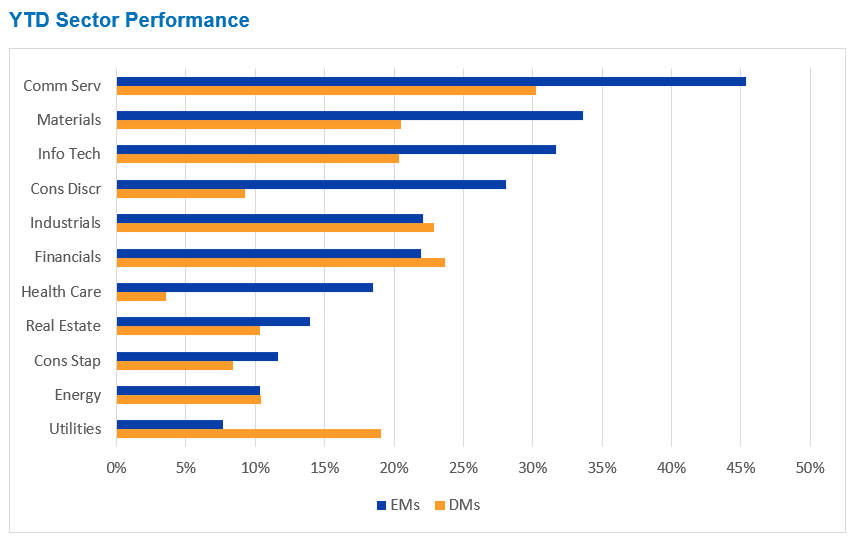

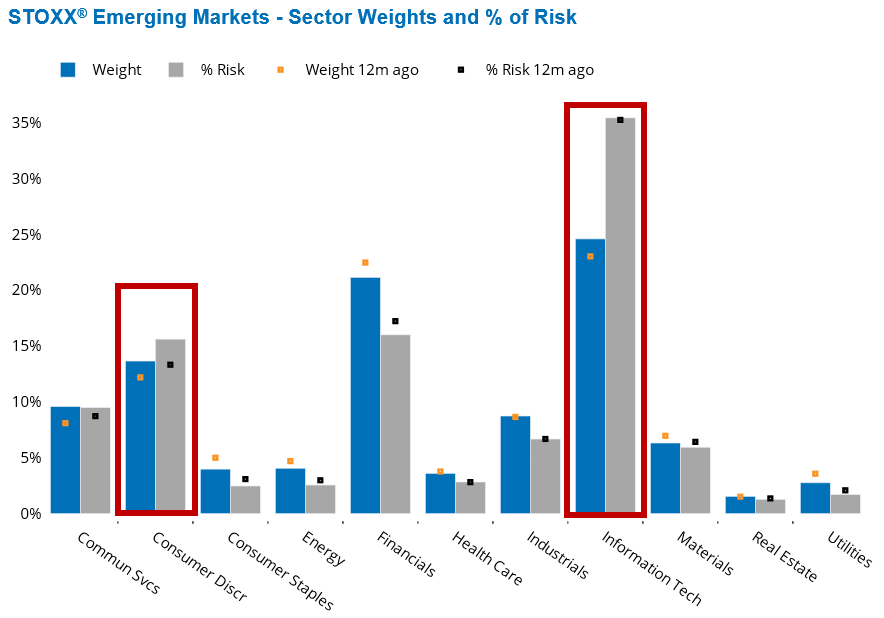

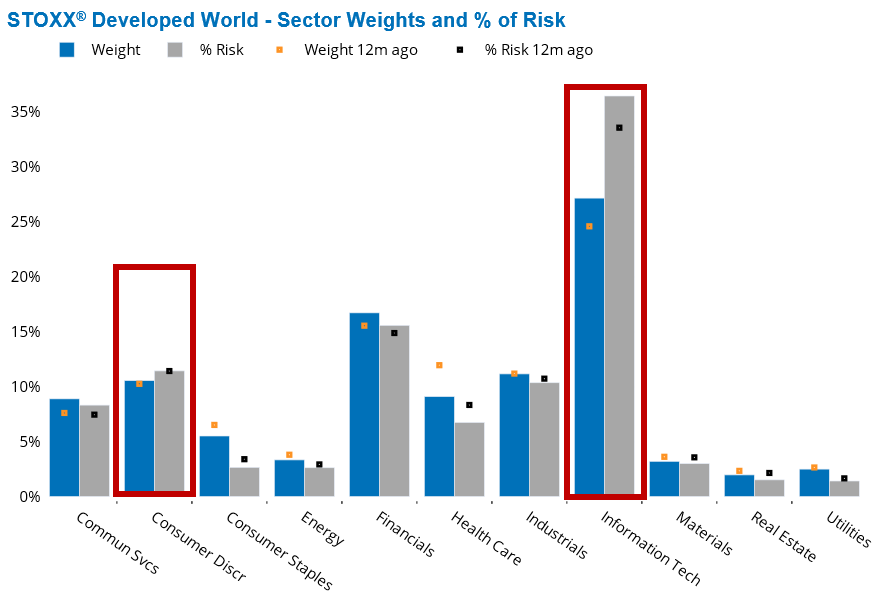

All Emerging and Developed sectors are in positive territory this year, with Communication Services emerging as the clear leader in both regions. The sector has posted a 45% gain in Emerging Markets and 30% in Developed Markets. Information Technology—Developed Markets’ largest sector and the second-largest in Emerging Markets, as well as the one with the highest trading volumes in both markets—trailed Communication Services by double digits: 12 percentage points in Emerging Markets and 10 in Developed Markets.

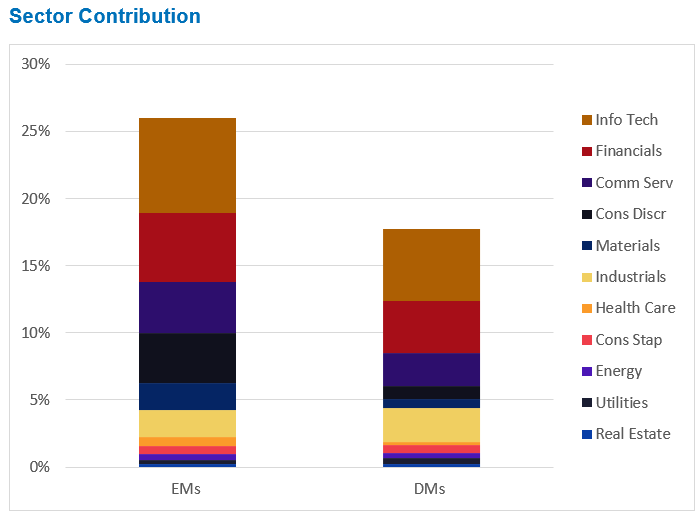

Still, due to its significant weight in both STOXX Emerging Markets and STOXX Developed World indices, Info Tech accounted for roughly one-third of the year-to-date gains in each. Together, Info Tech, Financials, Communication Services, and Consumer Discretionary were responsible for about 70% of the year-to-date return of Emerging Markets (26%) and Developed Markets (18%). It’s worth noting that Communication Services has less than half the index weight of Info Tech in both STOXX Emerging Markets and STOXX Developed World.

Defensive sectors—such as Health Care, Consumer Staples, Energy, and Utilities—have been the weakest performers, particularly in Emerging Markets. However, their relatively small weights in both regions have limited their overall impact.

Info Tech also stands out as the largest contributor to risk in the STOXX Emerging Markets index, accounting for 35%—more than 10 percentage points above its index weight. In the STOXX Developed World index, Info Tech’s risk contribution is even higher, though the gap between its risk share and weight is slightly narrower than in Emerging Markets.

Consumer Discretionary is the only other sector, aside from Info Tech, whose contribution to benchmark risk exceeds its index weight in both markets. All other Emerging and Developed sectors contribute risk in line with or below their respective weights.

The following charts are not included in the Equity Risk Monitors but are available on request:

See graph from the STOXX Emerging Markets Equity Risk Monitor as of September 19, 2025:

See graph from the STOXX Developed World Equity Risk Monitor as of September 19, 2025:

You may also like