EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED OCTOBER 3, 2025

In this week’s highlights we review some of the major findings in our third-quarter Insight analysis. For more detail, please join our October 7 webinar (you can register here), or view the recording (which will be here after Wednesday morning). You can also contact your sales representative, or us at InvestmentDecisionResearch-MEBR-E@simcorp.com, for the slides.

Markets were extremely calm during the third quarter, despite geopolitical and economic headwinds:

- The defining characteristic of the third quarter was how markets remained calm and volatility remained low even as uncertainty about the economy, inflation, geopolitical tensions and other events like government shutdowns grew

- During the quarter we saw both unemployment and inflation rise

- The frenzy around “Liberation Day” subsided, and investors seemed to assume the largest tariff threats would be dialed back (and many were)

- Still, inflation remained elevated, with the latest report on the PCE in line with expectations but well above the Fed’s 2% target

- Employment numbers were more disappointing, but by quarter end, GDP growth from earlier in the year was revised upward, and the GDPNow Q3 forecast put out by the Atlanta Fed remains strong at 3.8% - bringing into question the need to cut interest rates

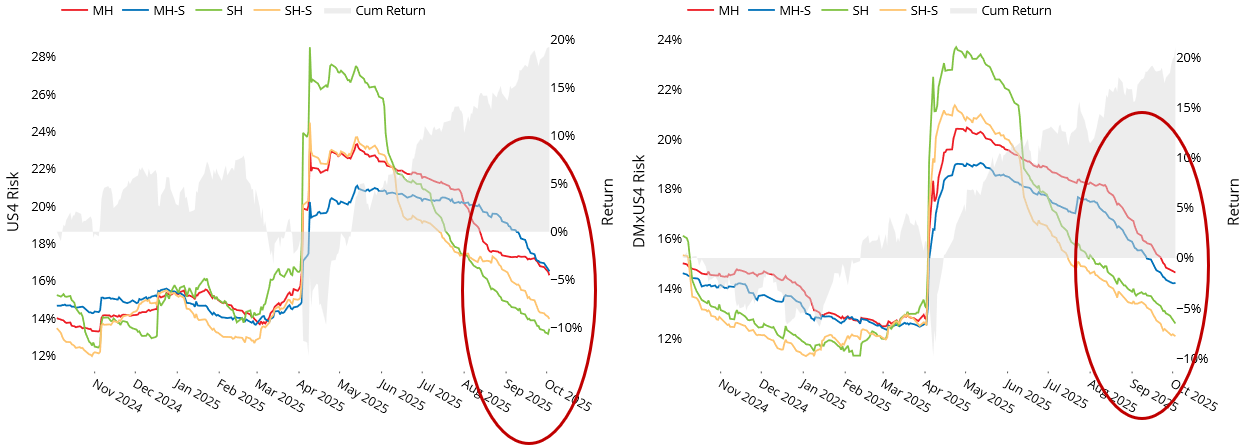

The US market moved up or down by more than 1% in only four days of the 64 in Q3, or a little more than 6% of the days. For comparison, over the long term, the market moves by that magnitude about 25% of the days. Axioma risk models showed sharp decreases in predicted volatility across the globe

- Stocks seemed to be driven by one expectation only: the Fed would lower rates, even if inflation is not yet subdued

- Although the focus seemed to be on the Fed, risk outside the US fell as the Developed Markets ex-US Index ratcheted up as well

See charts from Equity Risk Monitors of October 3, 2025

Predicted Risk

STOXX US (Left), STOXX International Developed Markets (Right)

Source: ISS STOXX, Axioma Risk Models

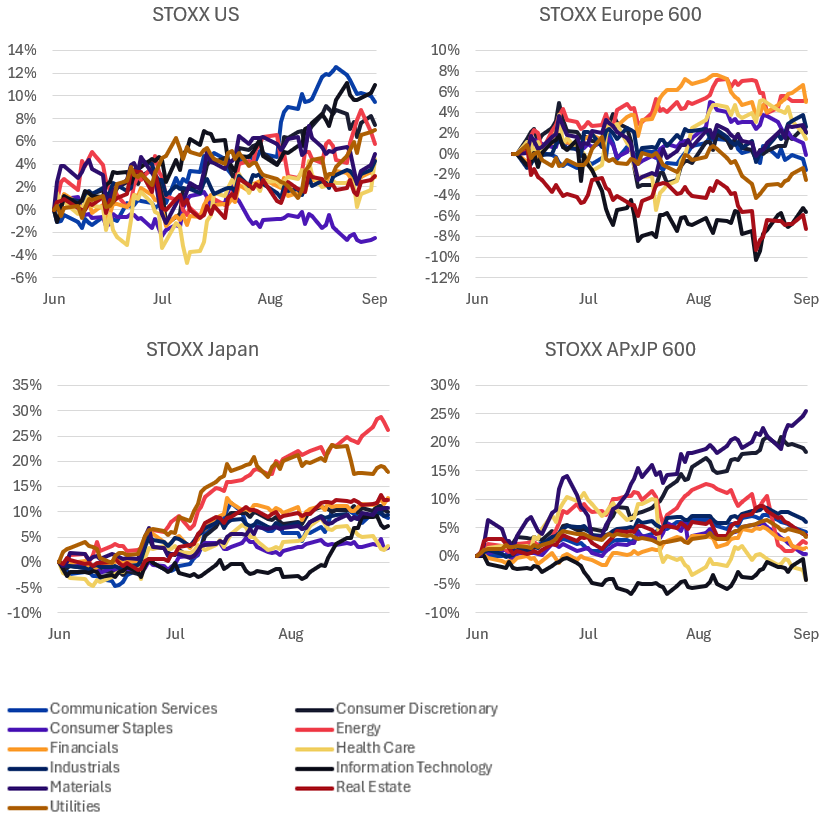

The strength in global markets and the corresponding decrease in volatility masked some volatility under the surface that seemed to cancel each other out, but nonetheless were likely to impact active managers:

- Widely varying sector returns

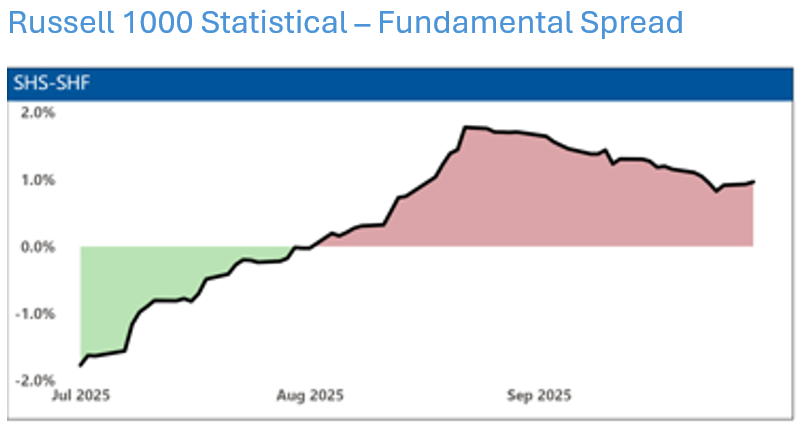

- Statistical risk in US higher than fundamental, suggesting some unidentified risk may be bubbling under the surface

- Low asset-asset correlations

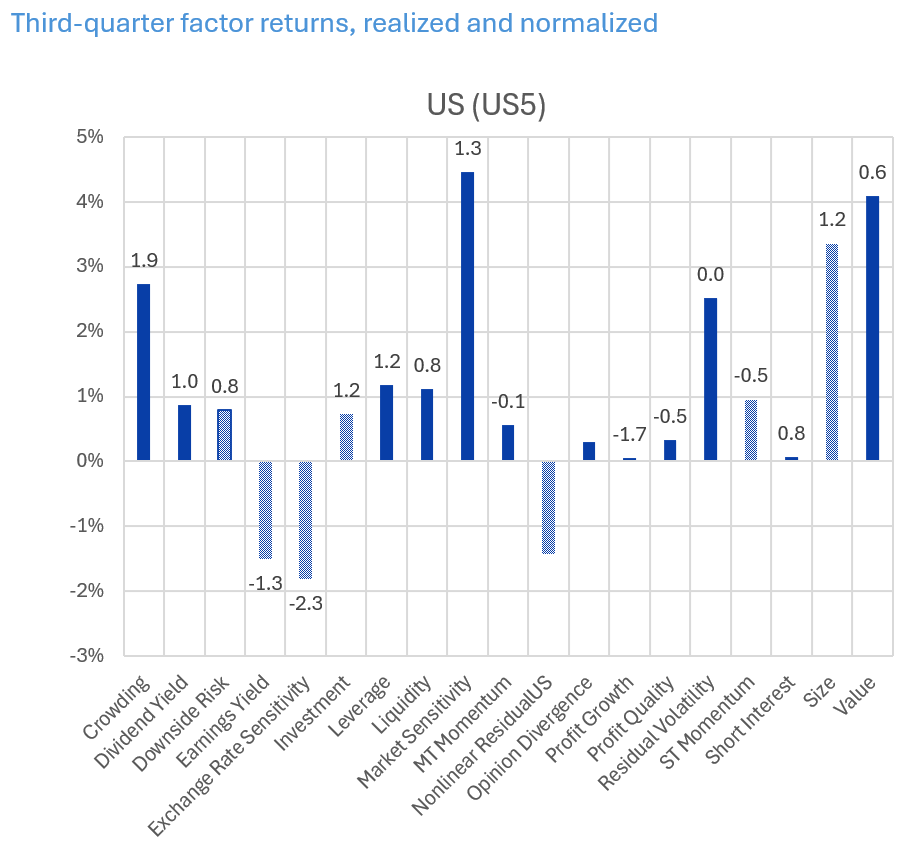

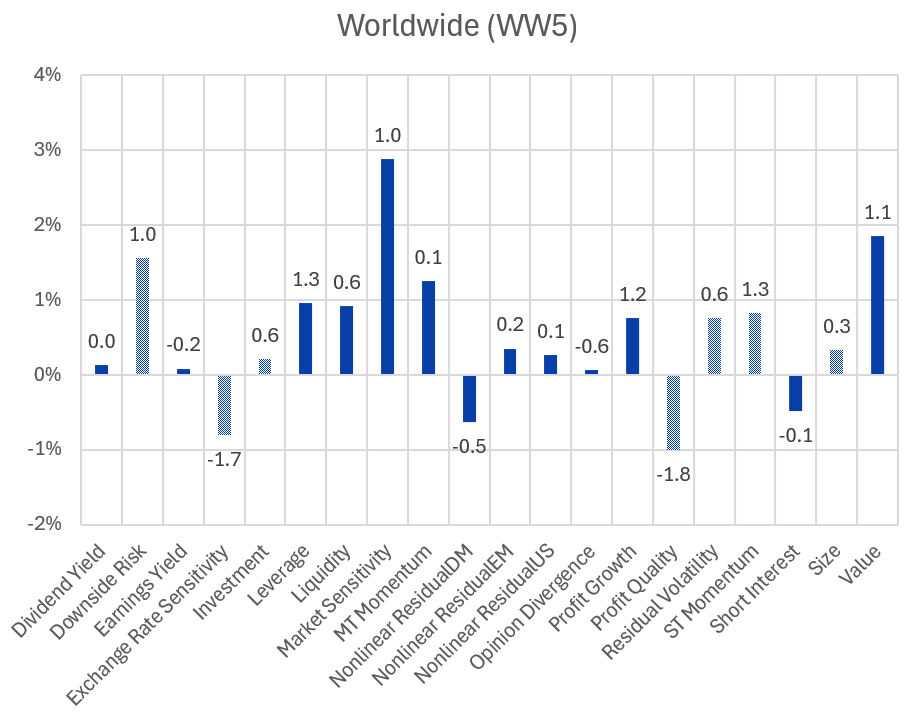

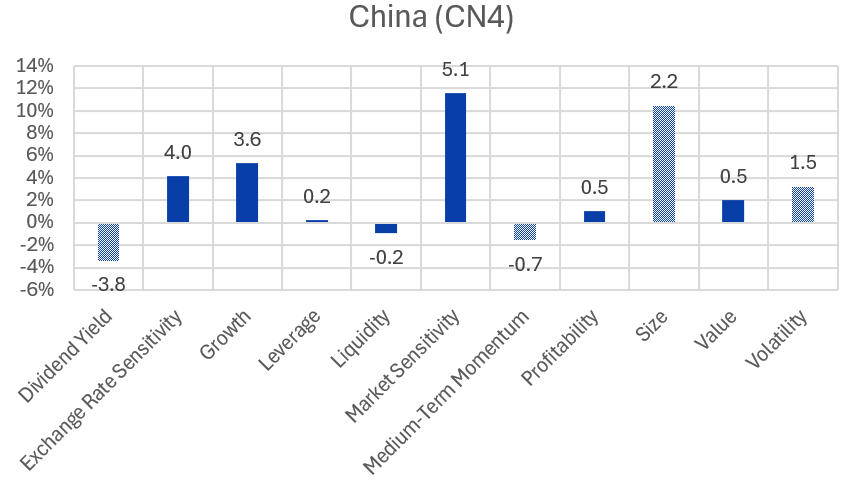

- Many factors had returns in the opposite direction to what is expected based on the long-term average. Often, when factors reverse course, especially when the return is high in magnitude, it signals a change of heart on the part of investors and can signal a turning point in the market direction

- Factor returns in Q3 were generally not larger than expected in magnitude, except in China, where many factors had returns that were three or four standard deviations away from their long-term average, and the historically best or worst quarter in the history of the model

The following charts are not included in the Equity Risk Monitors, but are available on request.

Q3 sector returns by market

Source: ISS STOXX

Source: FTSE Russell, Axioma Risk Models

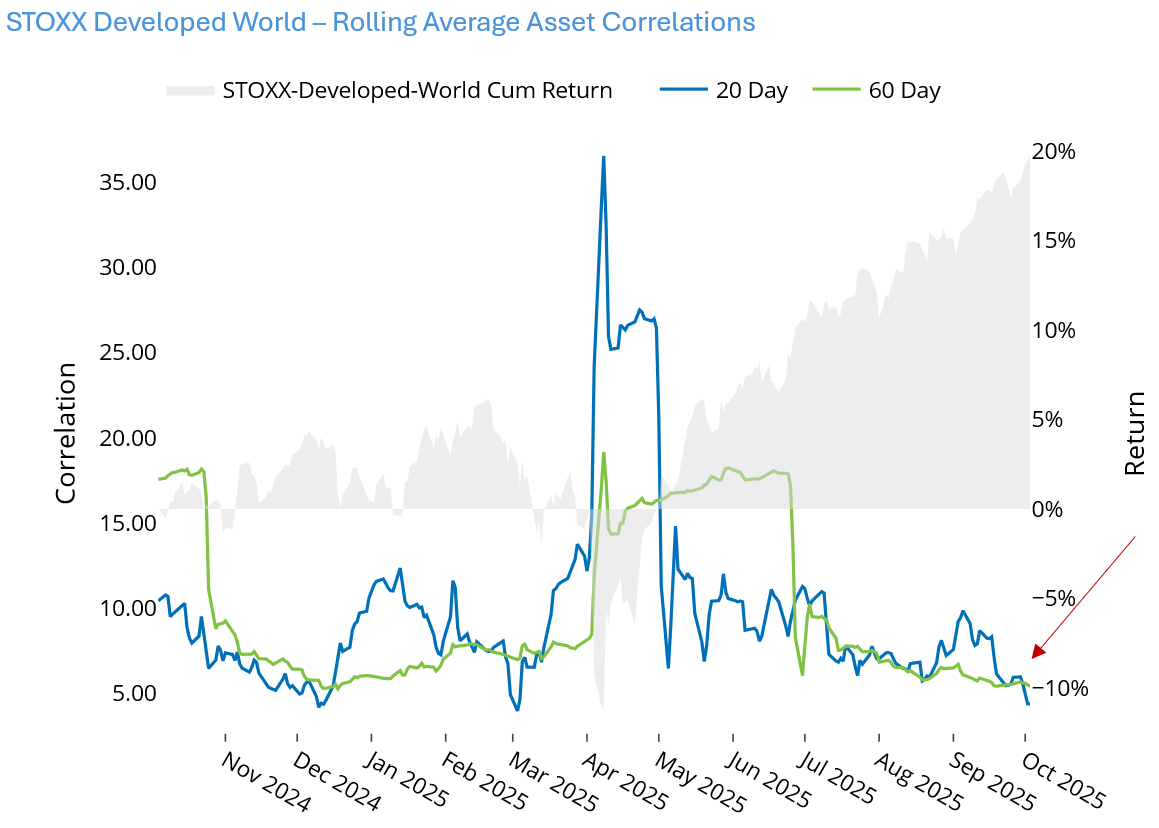

See chart from the STOXX Developed World (WW4) Equity Risk Monitor of October 3, 2025

Note that the 60-day correlation is just above the 1st percentile of values since 2018, and the 20-day is in the 5th percentile.

Source: ISS STOXX

The following charts are not included in the Equity Risk Monitors, but are available on request.

Note: Number above or below the chart is the normalized return (i.e. current – long-term average/standard deviation of long-term average quarterly return). Patterned bars indicate a third-quarter return in the opposite direction of the long-term average.

Conclusions

- In the short term, markets are likely to continue to be focused on the Fed, as the geopolitical and economic situation is particularly difficult to navigate

- As long as volatility remains low, equity markets will continue to draw in investors, but that situation could change quickly if – for example, investors decide the AI theme is overdone, inflation surges and drives long rates higher, the economy proves to be less resilient than expected, Q3 earnings are disappointing

- Of course an unknown unknown could derail the markets as well

- The issues above are largely issues for the US market, but Europe and Asia may also face headwinds from tariffs, election results, internal political instability and other threats

- Valuations are high, so if there is a catalyst that drives stocks to reverse course the decline could be large

You may also like