EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED JANUARY 2, 2026

In this edition we focus on market returns and risk drivers in 2025

- Market performance showed strength across the globe

- Sector impact varied widely by region

- Currency risk low as dollar remains weak

Note that a video presentation reviewing the risk and return environment in 2025 will be available later this week. Look for an email with the links shortly. Below are a few of the topics we will cover.

Market performance showed strength across the globe

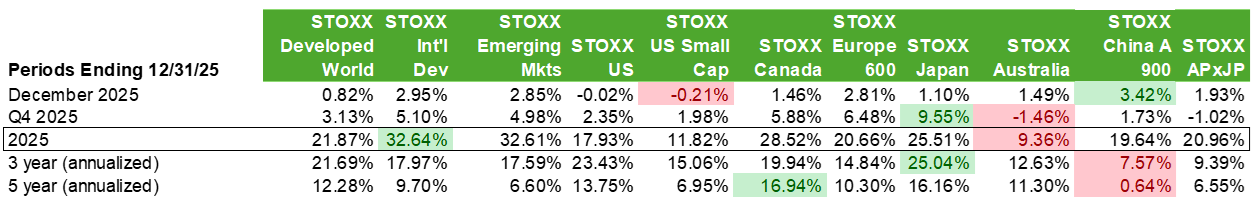

All of the markets tracked closely by the Equity Risk Monitors fared extremely well last year, despite much geopolitical sturm und drang. (See our weekly ROOF highlights for more on this.) The STOXX US index turned in a higher-than-average return of almost 18%, driving a three-year annualized return of well over 20%. However, Developed Markets ex-US (as defined by the STOXX International Developed Markets Index) almost doubled that, gaining more than 32% (in USD). The relative laggards were US Small Cap and Australia (in AUD), but even those markets produced positive returns that only pale on a relative basis. Japan was the “winner” in the fourth quarter, when only Australia and Asia ex-Japan turned in negative returns.

Overall, it was a great year for equity investors, but we fear that after three years of strong gains 2026 may be disappointing. We wrote a post on LinkedIn that looked at historical returns and concluded that while the US market may not be down, it is likely to have a lower-than-average return this year. See here for more details.

The following table does not appear in the Equity Risk Monitors but is available on request:

Note: Country/region with the lowest return for the period is highlighted in pink, and the highest return is highlighted in green.

Source: ISS-STOXX, Axioma risk models

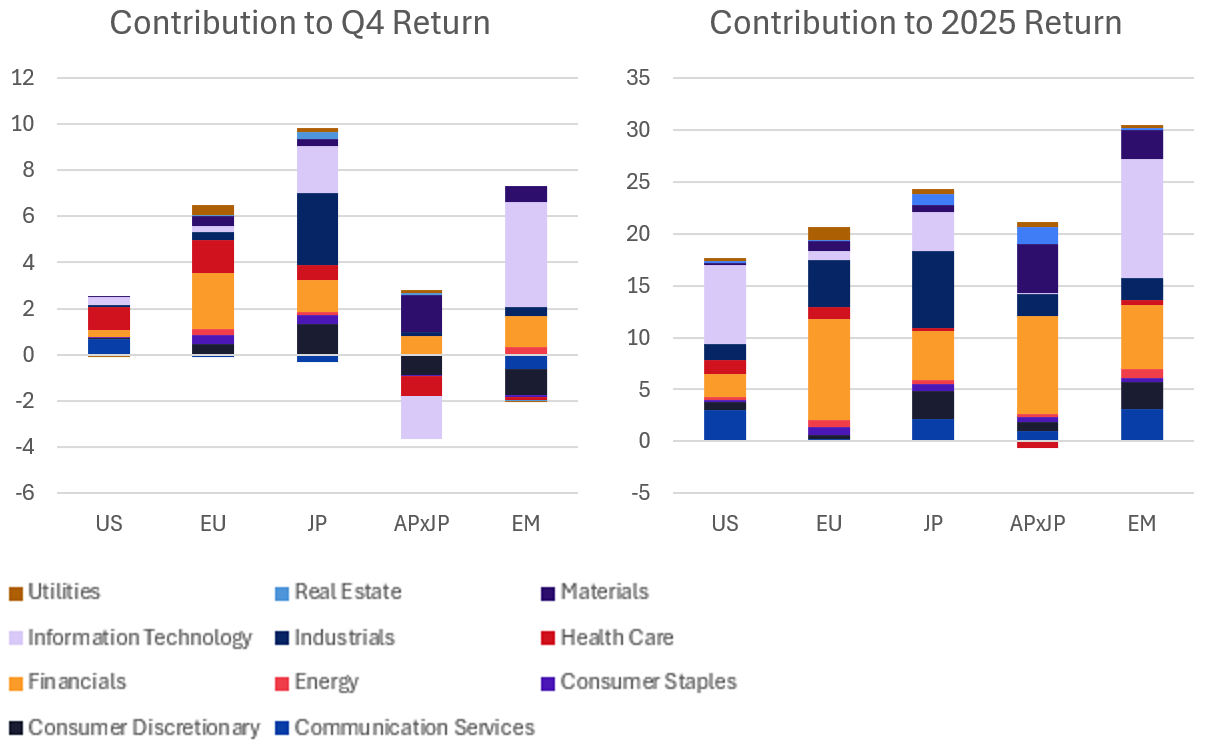

Major index drivers varied widely by region

While one of the main return drivers in the US was the AI trade – and Information Technology therefore dominated overall gains by virtue of its high weight combined with strong performance, in Europe, Japan and Asia ex-Japan other sectors were the main contributors. About half the return for the STOXX Europe 600 came from Financials, with Industrials providing another boost to returns. Similarly, Industrials were the main contributor to Japan’s gains, with additional support from Financials and even Consumer Discretionary. Materials and Financials drove Asia ex-Japan. As in the US, Information Technology was a major player in Emerging Markets, where Financials stood out as well.

Of all the sectors in all these markets, however, only one – Health Care in Asia ex-Japan – produced a negative return in 2026! In the fourth quarter Health Care was a major contributor to the US market, which lagged the others except Asia ex-Japan in overall return. Information Technology was the major source of Emerging Markets’ quarterly return, but provided a drag on Asia ex-Japan over the same period.

Although most sectors in most markets drove markets higher in 2025, we started to see a few cracks in the fourth quarter, as investors started to question whether the AI trade was looking a bit long in the tooth, and prospects for additional rate cuts, especially in the US, faded. We believe the bull case for this year is that the AI trade broadens out as more and more companies adopt AI strategies that will lower costs and improve margins. However, the bear case could be made that as the biggest stocks in the US take a breather, they pull down the rest of the market. At 35% of the US market capitalization (and 50% of the total risk), it may be inevitable that a correction in the Technology sector would drag down the US market, and ripple through the rest of the world, even if global economies remain on solid ground.

The following charts appear by individual region in the Equity Risk Monitors:

Note: Data as of December 31, 2025

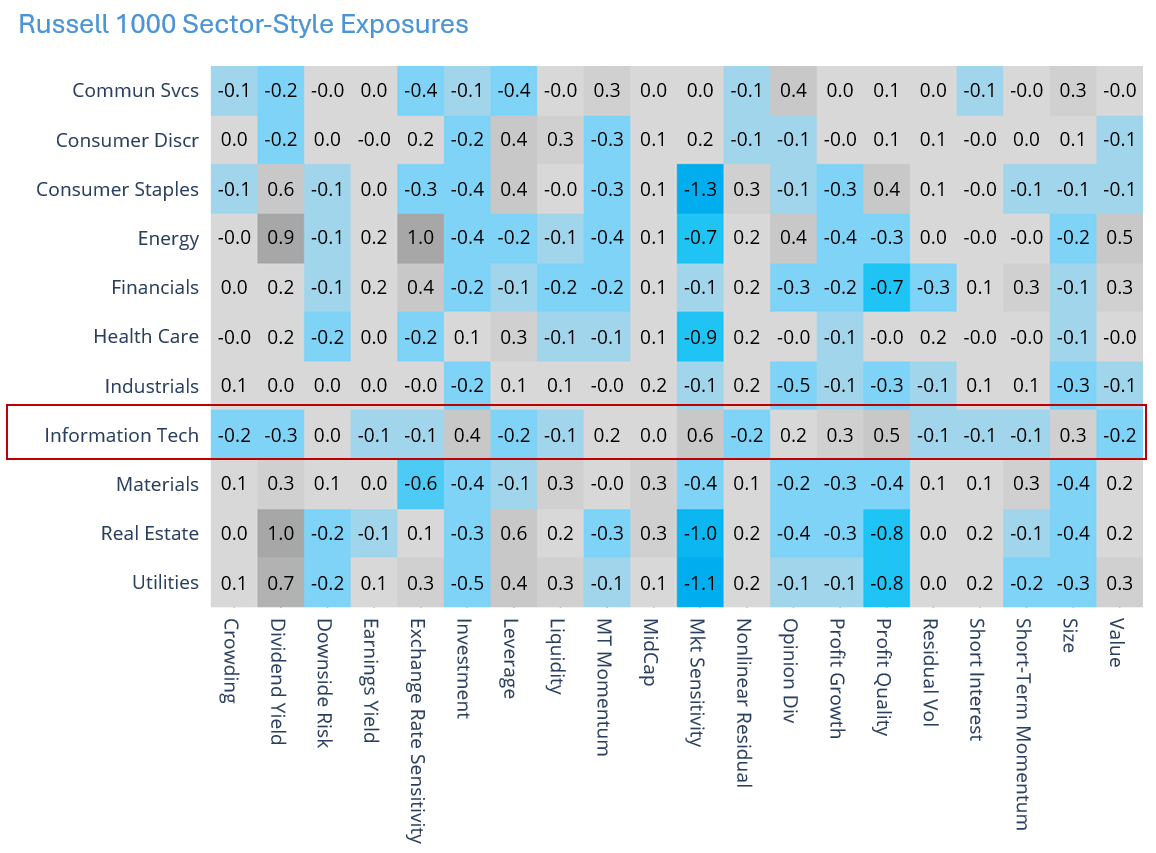

Even if we see a correction in the US Technology sector we may not see a corresponding “failure” in factor returns. Interestingly, the sector has a relatively low magnitude of exposures to many of the Axioma US5.1 risk model factors. We note that the exposure to Crowding at the end of the year was slightly negative, suggesting the sector is not overly crowded at this point in time (that is, hedge funds do not hold unusually large positions in Tech according to 13F filings). There is also a tiny negative exposure to Short Interest, so the sector as a whole is not highly shorted at this time. The biggest factor loading is, not surprisingly, a positive exposure to Market Sensitivity. A sector decline would contribute negatively to the factor return, although that could be offset by better relative returns in more defensive sectors that currently have negative factor exposures.

See chart from the December 31, 2025 Russell 1000 Equity Risk Monitor:

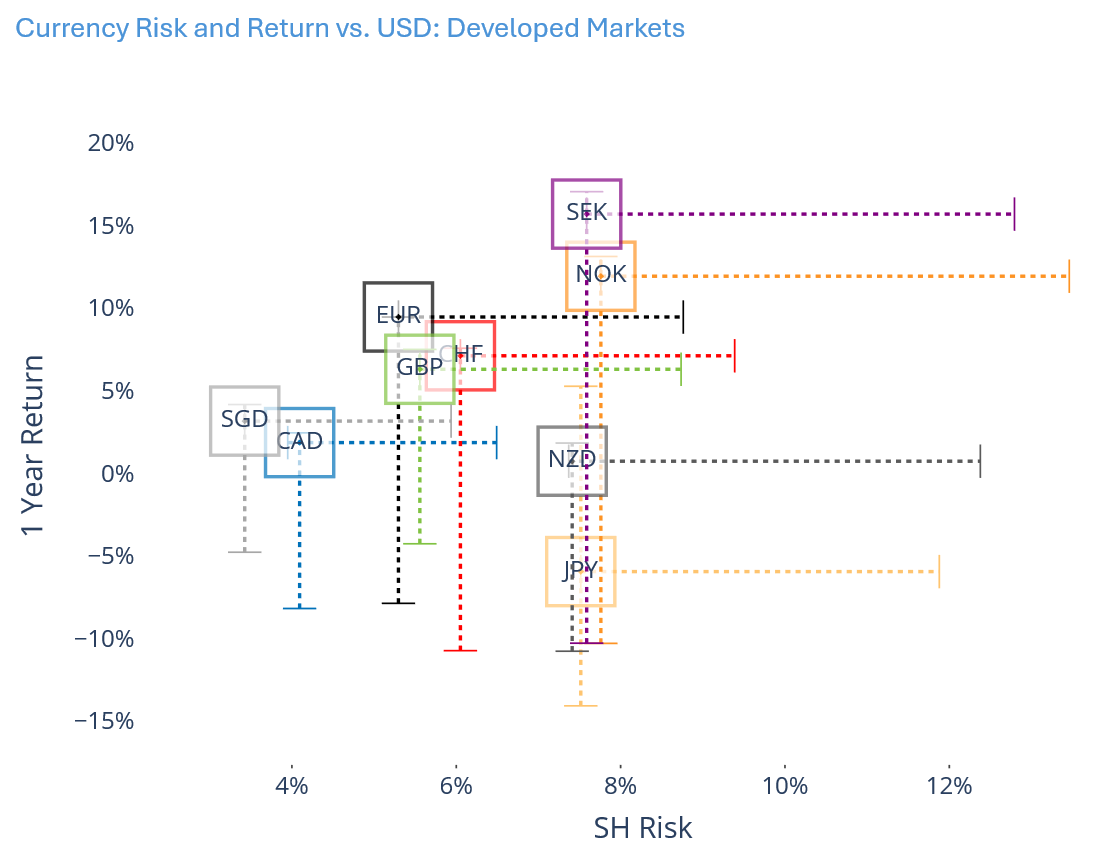

Currency risk low as dollar remains weak

The above-mentioned ROOF highlights also touched on the weakness of the US dollar last year. From the perspective of the Axioma risk models this also meant that other developed market currencies ended last year at the low end of their 12-month volatility ranges when stated in USD. At the same time, by year-end they were all at the high end of their relative return ranges.

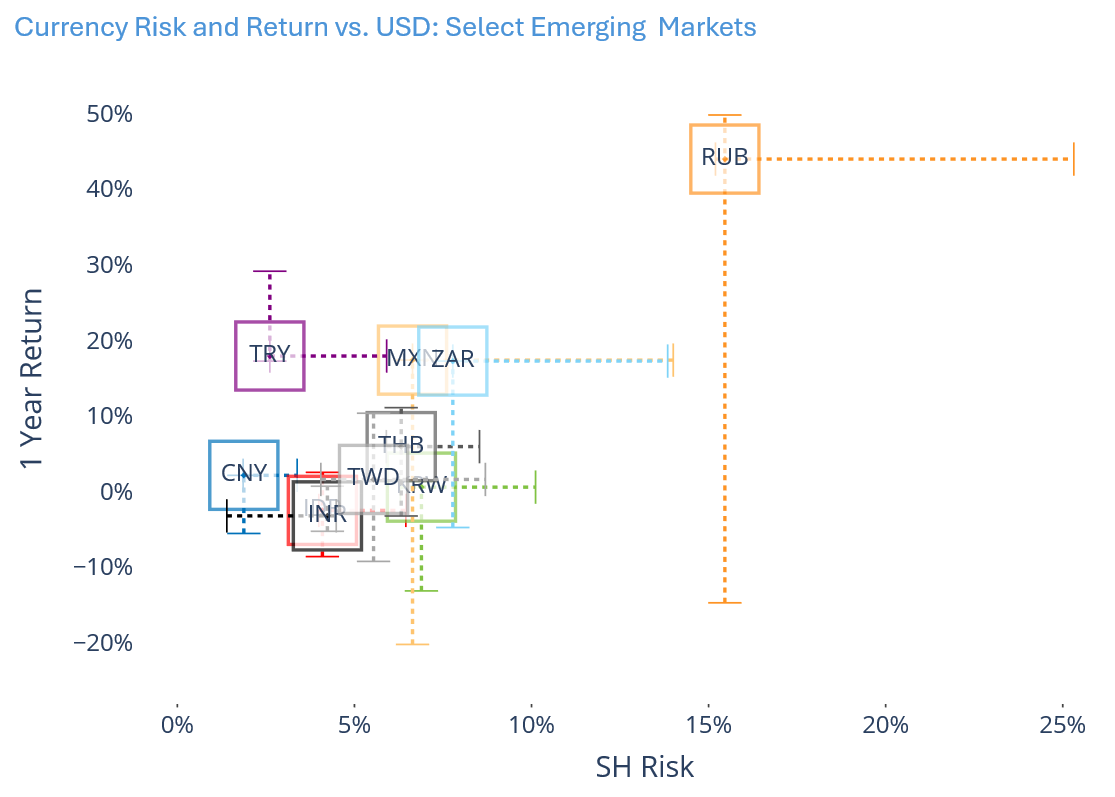

Most major Emerging Markets currencies ended 2025 with risk higher than the low end of the 12-month volatility range, although still well below the high end (note that it is a bit difficult to see all the currencies but the underlying data is available on request). In addition, many have pulled back from their strongest gains relative to the dollar, most notably TRY and TWD.

As we also note in the ROOF Highlights, 2025 trade wars drove dollar weakness, and that is likely to continue into 2026. We suspect that currency volatility could rise, however, as investors digest and evaluate the continuing storms likely to hit them.

See charts from the December 31, 2025 Equity Risk Monitors:

You may also like