EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED JANUARY 30, 2026

Axioma Risk Monitor: Emerging Markets take the lead, powered by tech strength; US Energy emerges as the biggest winner in 2026; Canada hit hard by Metals sell-off

Emerging Markets take the lead, powered by tech strength

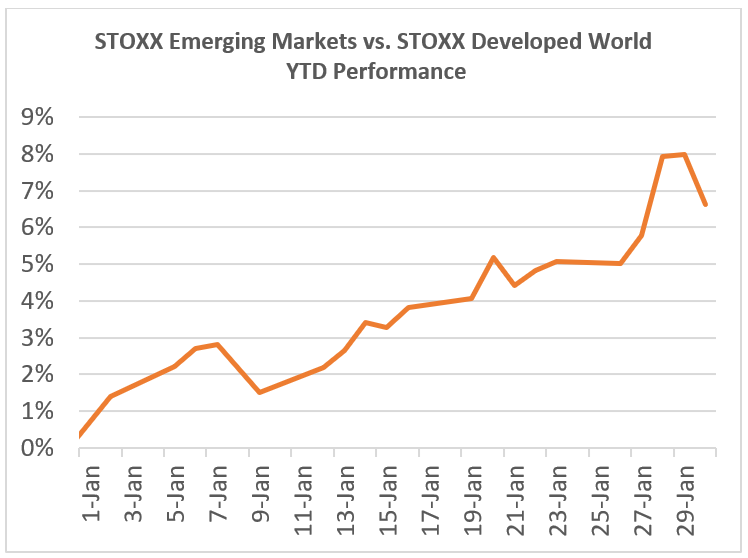

Emerging markets are building on last year’s strong momentum, decisively outpacing Developed Markets so far in 2026. Their leadership reflects a combination of supportive macroeconomic trends and sector specific strengths. While all major equity markets tracked by SimCorp’s Equity Risk Monitors ended January in positive territory, Emerging Markets stood out with a seven percentage point advantage over Developed Markets (both denominated in USD).

A significantly weaker US dollar has been a major catalyst, lifting returns across emerging economies after several years in which dollar strength acted as a headwind. At the same time, companies in these regions have benefited disproportionately from the global surge in AI related investment. Their central roles in semiconductor manufacturing and supply chain realignment have propelled earnings growth that has surpassed that of their developed market peers.

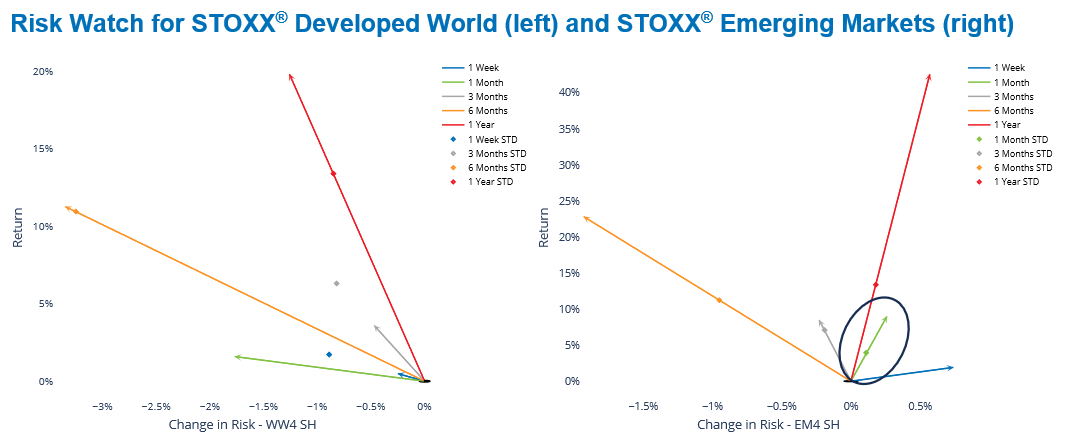

Together, these dynamics have positioned Emerging Markets for continued relative strength as the year unfolds. The STOXX Emerging Markets Index has advanced 9% year to date—more than two standard deviations above expectations based on the risk forecast at the beginning of the year—whereas the STOXX Developed Markets Index rose roughly 2%, a move that remained within its anticipated range at the start of the year, based on Axioma’s EM4 and WW4 fundamental short horizon models.

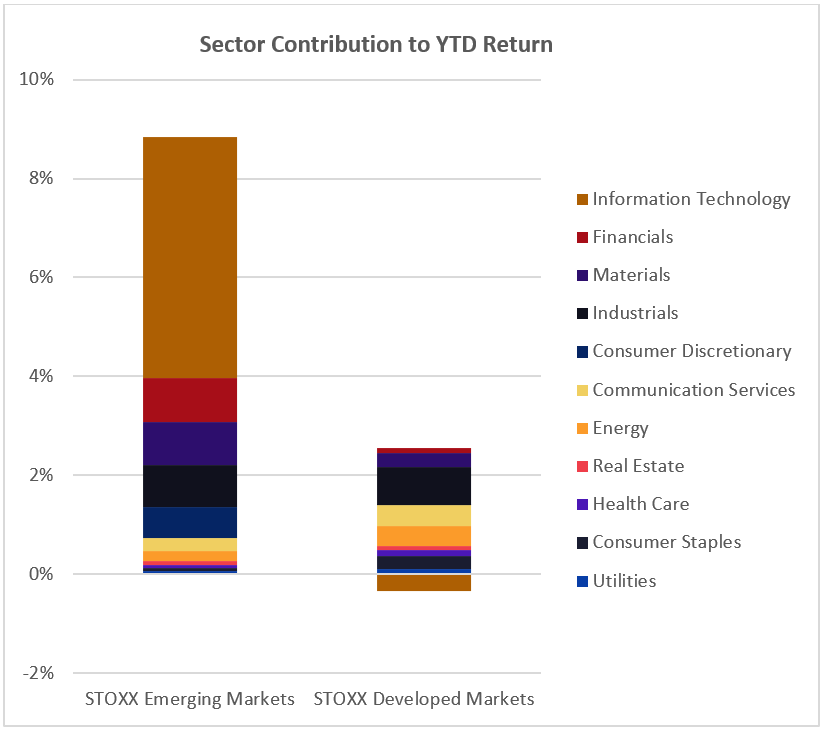

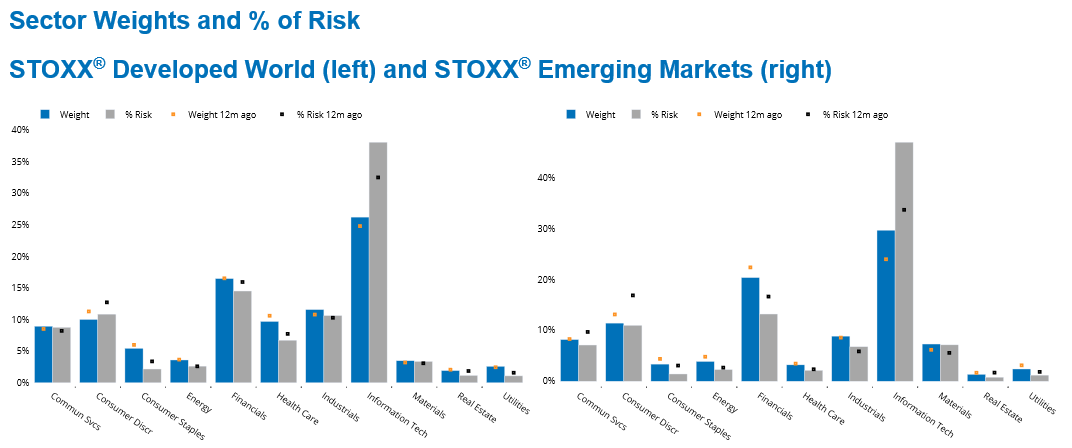

Sector composition continues to shape performance meaningfully. Information Technology remains the largest sector in both Emerging Markets (26% weight) and Developed Markets (29% weight) , yet its impact diverged substantially. In Emerging Markets, the sector contributed more than half of the year to date gain. In contrast, it was the sole laggard in Developed Markets.

Nearly 80% of the tech sector’s five percentage point contribution to STOXX Emerging Markets’ advance came from its three biggest constituents—Taiwan Semiconductor, Samsung Electronics, and SK Hynix.

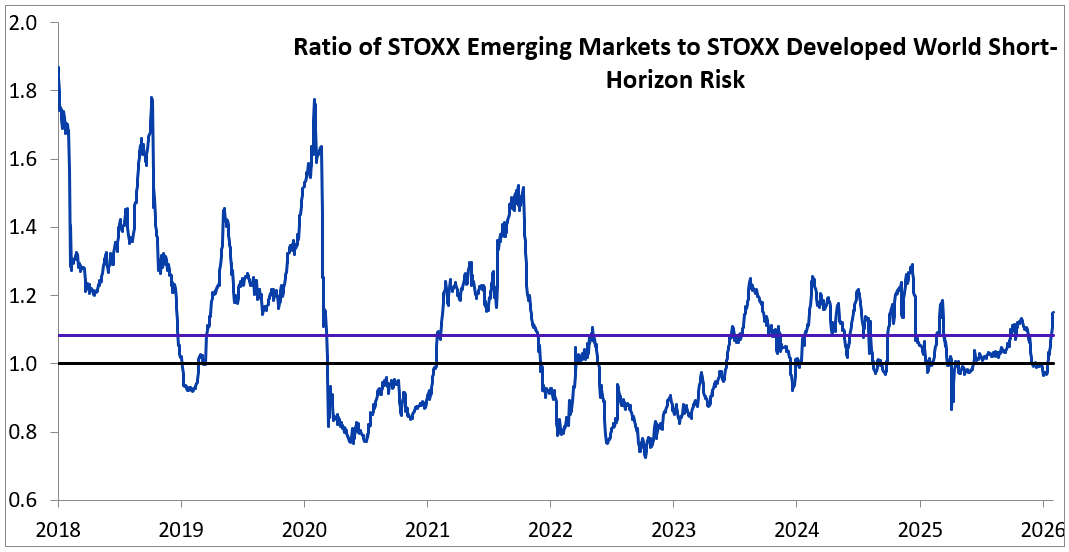

Risk dynamics have also shifted. After beginning the year at parity, predicted risk for Emerging and Developed Markets diverged: Emerging Markets’ predicted volatility increased, whereas risk estimates for Developed Markets declined. As a result, Emerging Markets’ relative riskiness now sits above its long term median of 8%.

In both regions, Information Technology’s benchmark weight and risk contribution have risen compared with a year ago. Although Info Tech’s contribution to benchmark risk exceeds its index weight in each region, the imbalance is more pronounced in Emerging Markets, where the sector accounts for 47% of benchmark risk versus 38% in Developed Markets.

See charts from the STOXX Developed World and STOXX Emerging Markets Equity Risk Monitors as of January 30, 2026:

The charts below are not included in the Equity Risk Monitors but are available upon request:

See charts from the STOXX Developed World and STOXX Emerging Markets Equity Risk Monitors as of January 30, 2026:

US Energy emerges as the biggest winner in 2026

US equities began the week on an upswing, lifting major indices to record levels by Wednesday, before losing steam on Friday and ending the week relatively flat. On Friday, President Trump nominated Kevin Warsh to succeed Jerome Powell when Powell’s term as Fed Chair concludes in mid May. The announcement followed the Federal Reserve’s anticipated decision two days earlier to hold rates steady, pausing after three straight cuts.

Overall, the Russell 1000 posted a modest 1% return in January and ranked among the weakest performers—and the third riskiest index, trailing only STOXX Japan and STOXX Emerging Markets—among all geographies tracked by SimCorp’s Equity Risk Monitors.

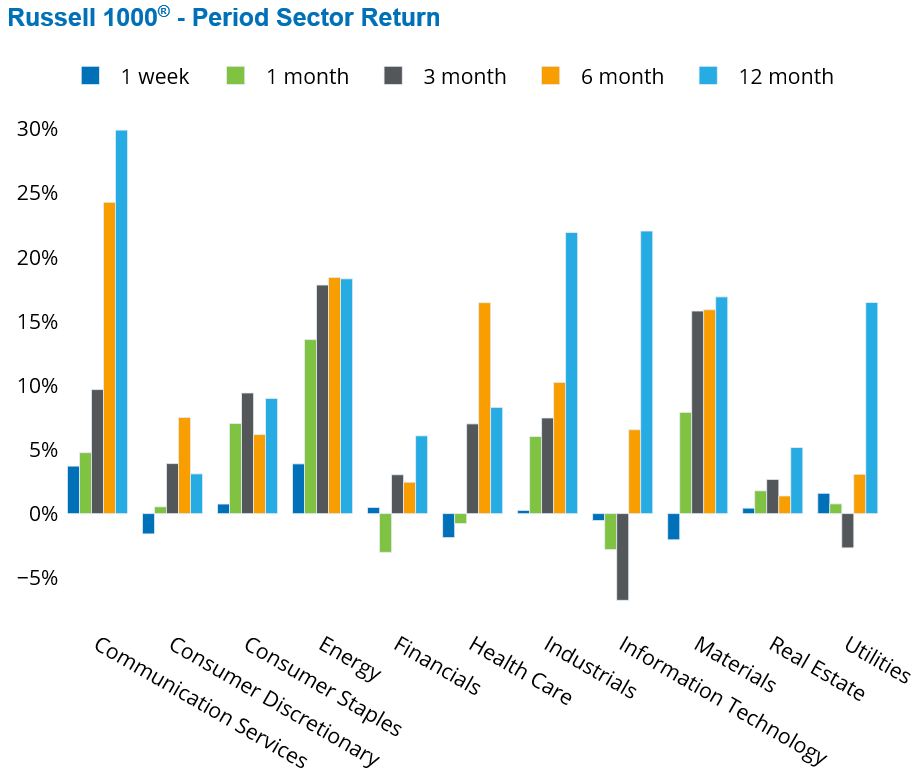

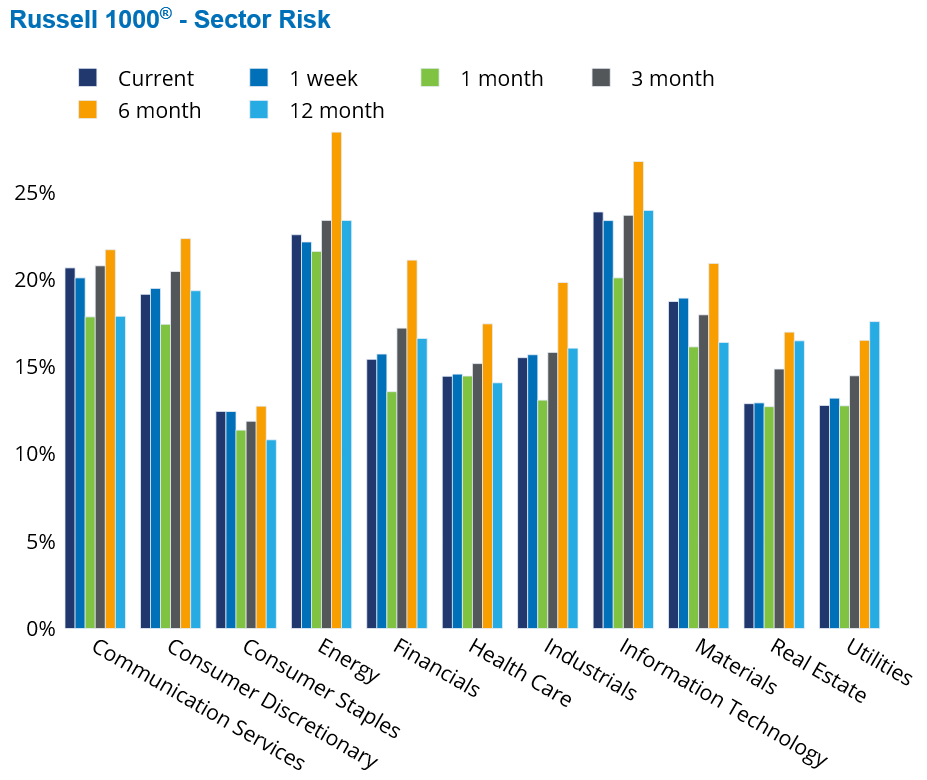

Energy has been the standout performer both last week and year to date among the Russell 1000’s 11 GICS sectors, delivering a one month return near 15%. The surge was driven by rising oil prices amid heightened geopolitical tensions surrounding Iran, unexpected supply disruptions, and bouts of severe winter weather that tightened near term availability and added a risk premium to the market. Energy outpaced the next strongest sector, Materials (9%), by five percentage points. By contrast, Financials (-2.25%) and Information Technology (-1.94%) have been the weakest US sectors so far in 2026.

Despite comprising only 3% of the US equity market, Energy was responsible for 30% of the Russell 1000’s year to date advance. Although it ranks as the second riskiest sector, trailing only Technology, its small weight meant Energy contributed little to the Russell 1000’s risk.

See charts from the STOXX Russell 1000 Equity Risk Monitor as of January 30, 2026:

Canada hit hard by Metals sell-off

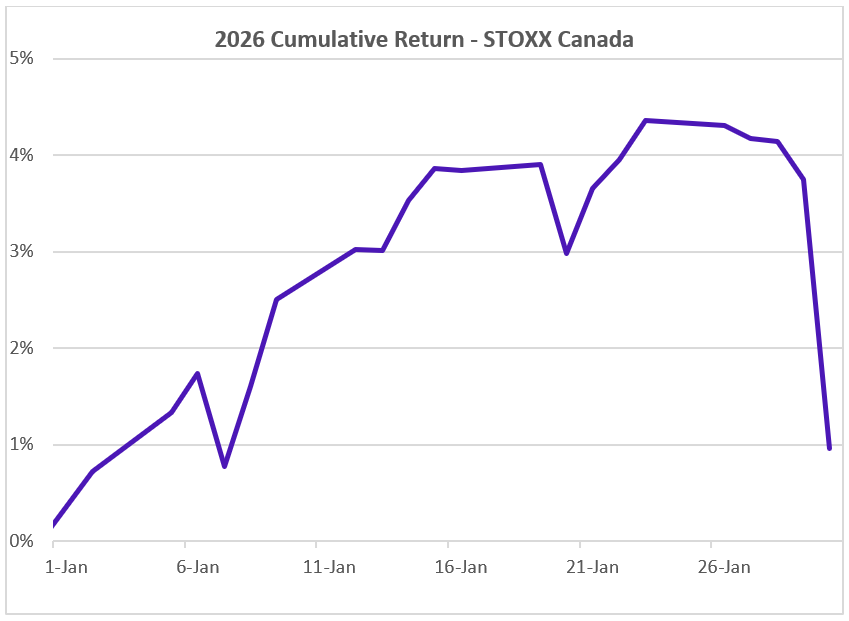

Canadian equities fell sharply last week, driven by a steep correction in precious metals and mining stocks, alongside mounting concerns about economic uncertainty and geopolitical tensions.

A heavy sell off on Friday sent precious metals sharply lower. Investors who had sought metals as a hedge against a weakening dollar and elevated inflation reversed course after Kevin Warsh’s nomination—given his historically strong focus on combating inflation—which helped the dollar register its strongest daily gain in months.

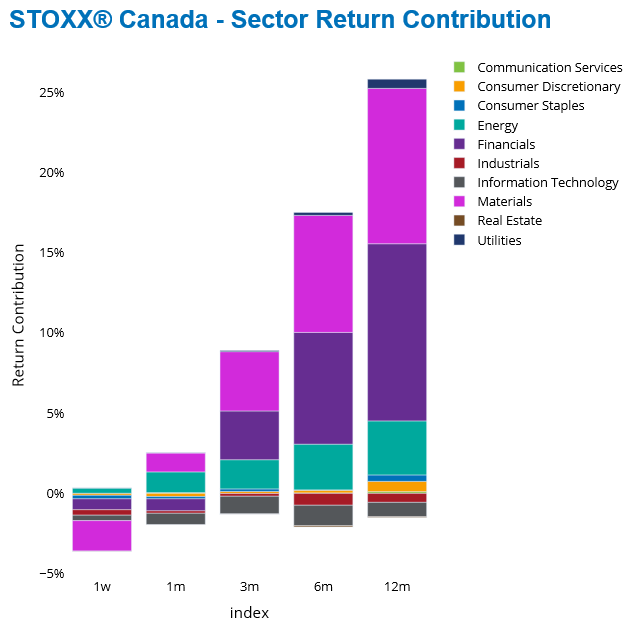

The nearly 3% decline on the final trading day of January erased most earlier advances, leaving the STOXX Canada Index up only about 1% for the month. For much of this year, Canada’s performance had been middle of the pack, but last week’s downturn pushed it to the bottom of all regions covered by SimCorp’s Equity Risk Monitors.

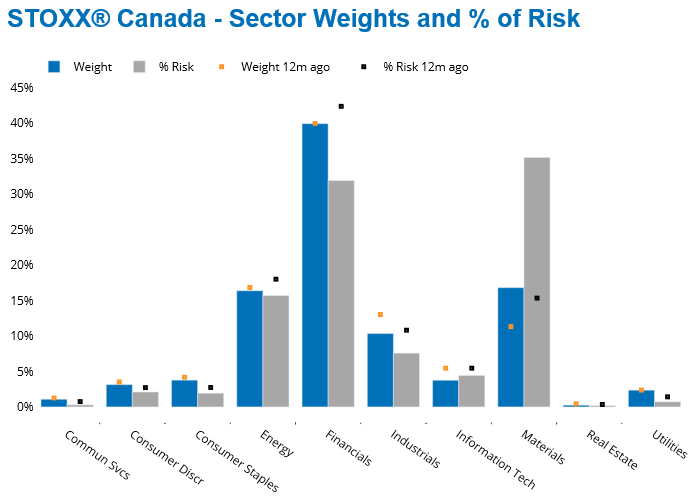

Most Canadian sectors declined last week, with the exception of Energy, Communication Services, and Utilities. Materials suffered a severe drop of nearly 10%, while Information Technology fell 8%. Materials alone accounted for almost 60% of the Canadian market’s weekly decline. Although it is the second largest sector in STOXX Canada (at 17% weight)—less than half the weight of Financials (40%)—its contribution to benchmark risk (35%) exceeds that of Financials (32%), underscoring its outsized influence on both risk and returns.

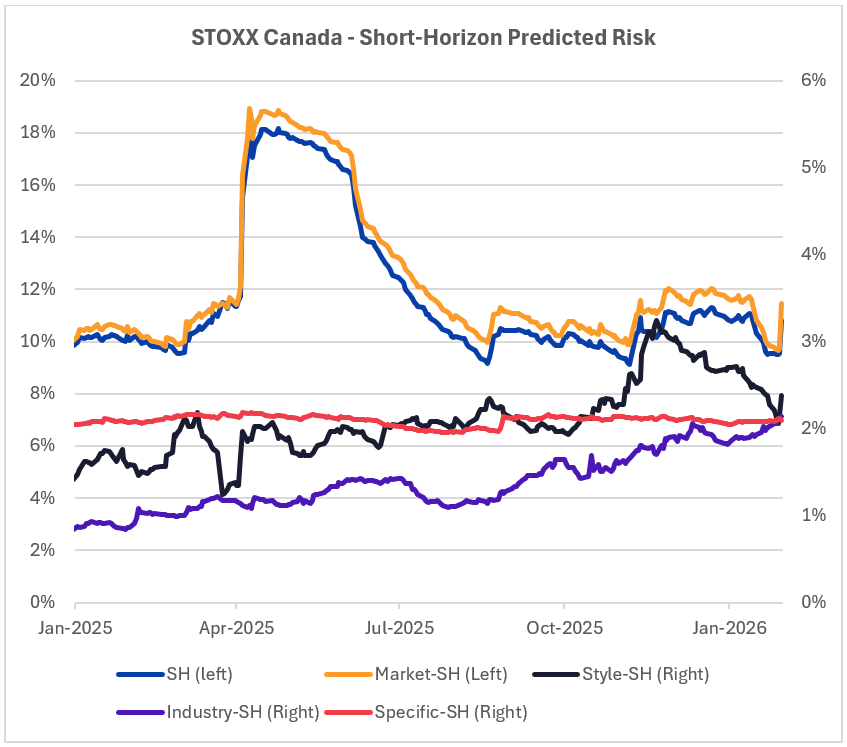

STOXX Canada experienced the sharpest rise in risk among major regions last week, increasing 13%, as measured by the Axioma Canada fundamental short-horizon model. While Market Risk drove the overall jump in Total Risk, Style Risk also climbed. Notably, Industry Risk did not spike abruptly; rather, it has been rising steadily over the past six months. Specific Risk, which represents only a small proportion of index risk, remained steady.

The charts below are not included in the Equity Risk Monitors but are available upon request:

See graphs from the STOXX Canada Equity Risk Monitor as of January 30, 2026:

You may also like