MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED AUGUST 22, 2025

Stocks and bonds rally as focus shifts from inflation to labor market

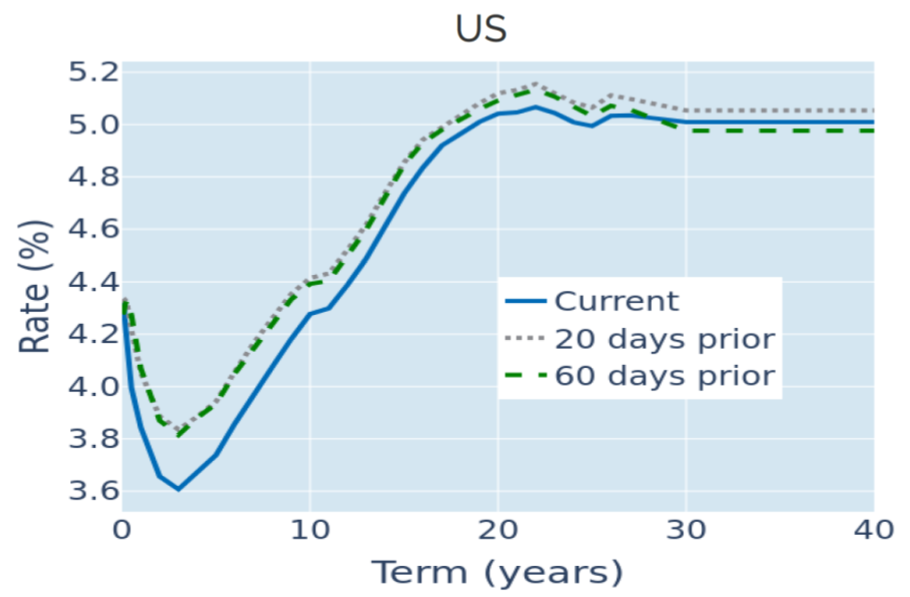

American stocks and bonds rallied together in the week ending August 22, 2025, as Federal Reserve Chair Jerome Powell seemingly paved the way for a September rate cut.

In his highly anticipated Jackson Hole speech on Friday, Powell noted that even though the labor market appeared to be in balance on the surface, it was the result of a simultaneous decline in both supply and demand for workers. He went on to emphasize the downside risk from slower job growth, which was reflected in the average pace of 35,000 new positions over the past three months, compared with 168,000 per month in 2024. At the same time, real GDP grew by only 1.2% per annum in the first half of this year—less than half the 2.5% recorded the previous year.

The inflationary effects of higher tariffs, on the other hand, were regarded as transitory, although Powell avoided this slightly loaded term this time round, calling it a “one-time shift in the price level” instead. The bond market appeared to agree with his assessment, with long-term breakeven inflation rates, remaining “well anchored” just above the 2% target. The positive stock market reaction is also consistent with the notion that the Fed will ultimately get consumer price growth under control.

But it is still worth noting that Powell merely confirmed the market expectation of further easing next month, with the implied probability of a rate cut simply increasing from 75% on Thursday to 85% on Friday. Projections of a federal funds rate just above 3% by the end of next year also remained unchanged, though the 2-year Treasury yield ended the week 7 basis points lower near recent lows.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated August 22, 2025) for further details.

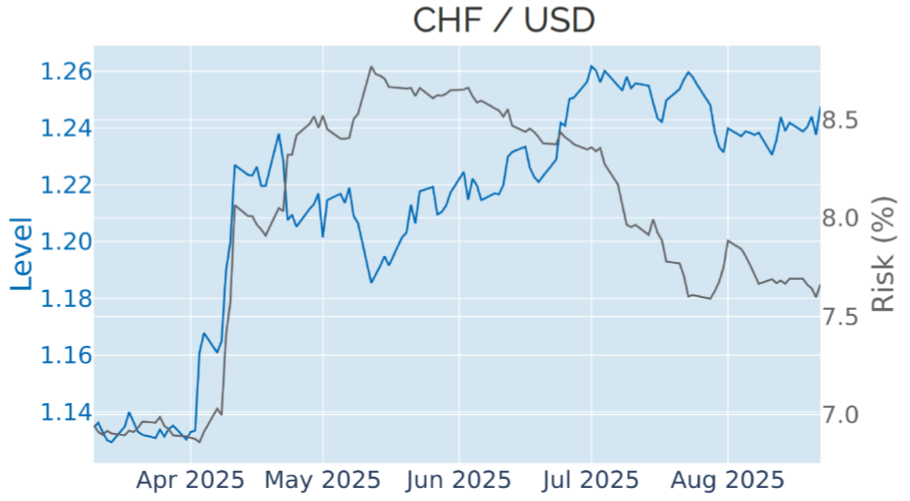

Lower yields weigh on the dollar

The US dollar resumed its co-movement with Treasury yields last week, following three weeks of moving in the opposite direction of interest rates. The Dollar Index ended the week marginally lower after dropping almost a percentage point in the wake of Jerome Powell’s Jackson Hole speech on Friday. The losses were mostly against the euro and the Swiss franc, which gained 0.1% and 0.5%, respectively. The renewed focus on inflation and monetary policy also means that the greenback is once again inversely correlated with the American stock market, having moved against share prices in eight out of the last nine weeks.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated August 22, 2025) for further details.

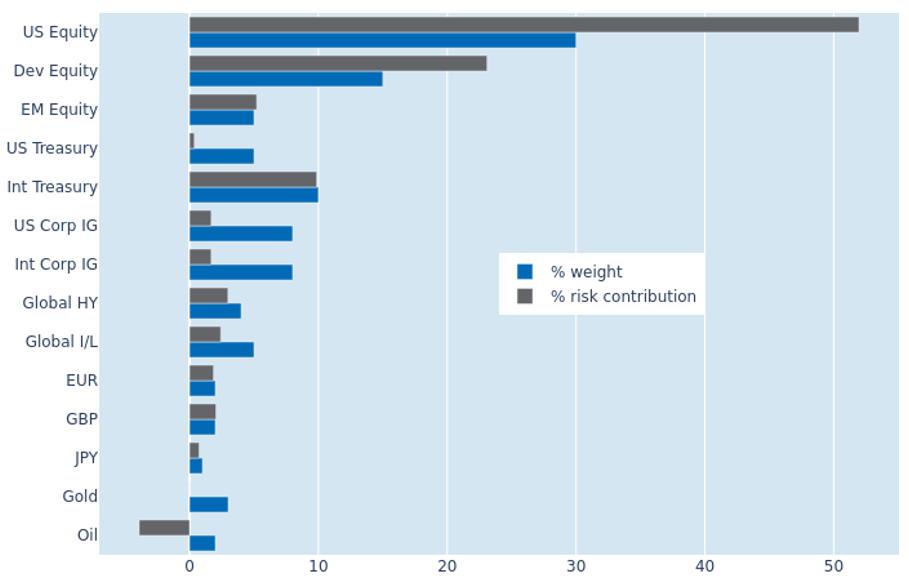

Ongoing stock market recovery pushes portfolio risk to 10-month low

A third consecutive week of global stock market gains depressed the predicted short-term risk of the Axioma global multi-asset class model portfolio to 5.4% as of Friday, August 22, 2025, marking its lowest level since the end of October last year. The risk reduction occurred across all equities, as their combined share of total portfolio volatility shrank from 83.2% to 80.2%. US Treasury bonds remained uncoupled from share prices, neither adding to nor subtracting from overall risk. This was in contrast to their counterparts from other parts of the world, which showed a percentage risk contribution equal to their monetary weight, due to strong positive correlations with their respective currencies.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated August 22, 2025) for further details.

You may also like