MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED AUGUST 29, 2025

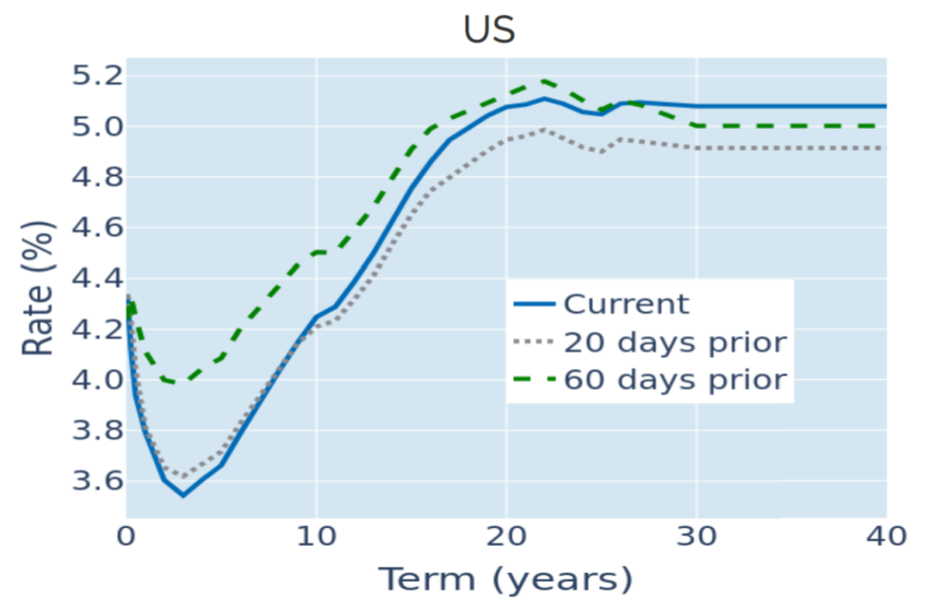

Steeper Treasury curve confirms Fed pivot from inflation to labor market

The term premium between long and short-dated Treasury yields rose to its widest margin in four months in the week ending August 29, 2025, as market participants priced in the greatest amount of monetary easing since so-called Liberation Day. The monetary policy-sensitive 2-year borrowing rate fell 8 basis points to its lowest level in 17 weeks, with the projected federal funds for the end of 2026 dipping below 2.96% for the first time since early April. However, the 10-year benchmark yield was only marginally lower, as long-term inflation expectations stayed slightly elevated at 2.4%, resulting in the tightest real yield since April 3.

The steepening yield curve can be seen as an indicator that markets expect the Federal Reserve to continue its pivot from fighting inflation toward supporting the labor market and the economy, as hinted at by Jerome Powell in his Jackson Hole speech. The 125 to 150 basis points of predicted monetary easing over the next 16 months is greater than the median FOMC projection 0.75% from the latest dot plot. But the latter was published in June, with the next update due at the upcoming rate setting meeting on September 17.

The projected rate path is still based on the assumption of an independent central bank that gradually relaxes monetary conditions amid decelerating consumer prices and a cooling economy, which explains the relaxed reaction from financial markets so far. But if the White House administration were to succeed in its agenda to take control of monetary policy, it could ultimately lead to higher long-term inflation expectations and Treasury yields, as well as a weaker dollar and tumbling share prices. Download our latest whitepaper on Stress Testing the Loss of Fed Independence for a more detailed analysis.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated August 29, 2025) for further details.

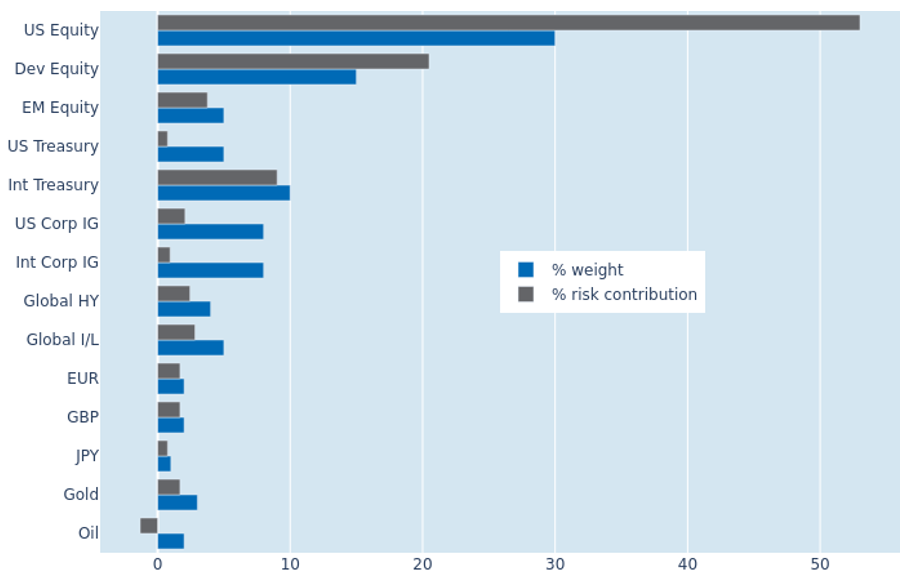

Portfolio risk remains stable as less negative correlations offset lower volatility

The predicted short-term risk of the Axioma global multi-asset class model portfolio eased marginally to 5.3% as of Friday, August 29, 2025, as the benefits of lower share price volatility were largely offset by less negative correlations of stocks with bonds and commodities. Oil and gold recorded the biggest increases in their percentage risk contributions of 2.6% and 1.7%, respectively, but these were balanced out by similar decreases for non-US developed (-2.6%) and emerging market (-1.5%) equities. Oil continued to actively reduced overall portfolio volatility due its continued negative correlation with exchange rates against the US dollar, though to a lesser extent than in previous weeks. US Treasury bonds remained uncoupled from share prices, neither adding to nor subtracting from overall risk. This was in contrast to their counterparts from other parts of the world, which showed a percentage risk contribution similar to their monetary weight, due to strong positive correlations with their respective currencies.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated August 29, 2025) for further details.

You may also like