MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED SEPTEMBER 5, 2025

Ongoing labor market weakness depresses yields to 5-month lows

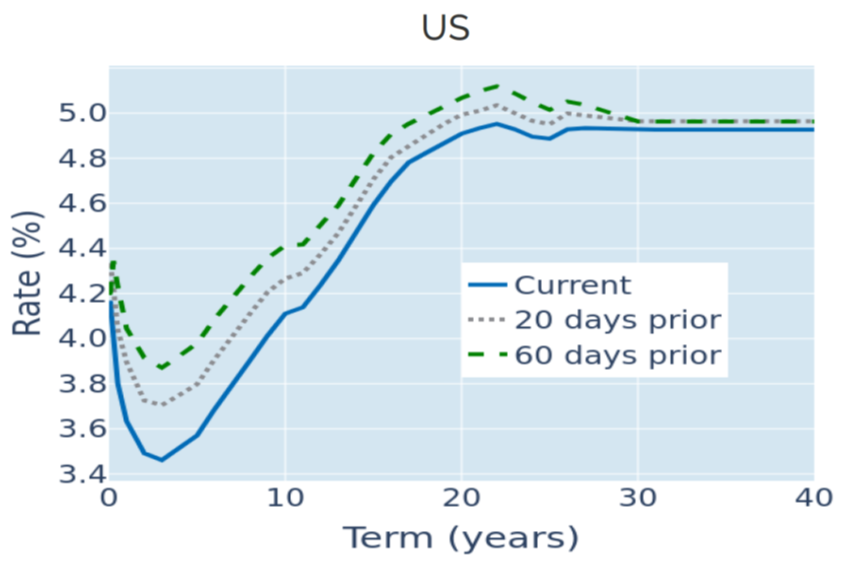

Another disappointing labor market report pushed US Treasury yields to their lowest levels since Liberation Day in the week ending September 9, 2025, as traders revised their monetary policy expectations to 12-month lows. The Bureau of Labor Statistics reported on Friday that the American economy added 22,000 jobs in August, down from an upwardly revised 79,000 in July and significantly below the consensus forecast of 75,000.

In response, short-term interest rates futures markets upped the implied probability that the Federal Reserve will cut interest rates at all three remaining meetings this year instead of only in September and December from 46% on Thursday to 73% on Friday. The projected average federal funds rate for the end of 2026 also dropped to 2.84%, which constitutes its lowest level since September 2024, when a similar flurry of weaker-than-expected non-farm payroll reports had triggered a comparable market reaction.

The revisions in monetary policy expectations were propagated along the entire Treasury yield curve, with 2-year rate also dropping to a 12-month low, while long yields descended to levels last seen following the tariff announcements in early April.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated September 5, 2025) for further details.

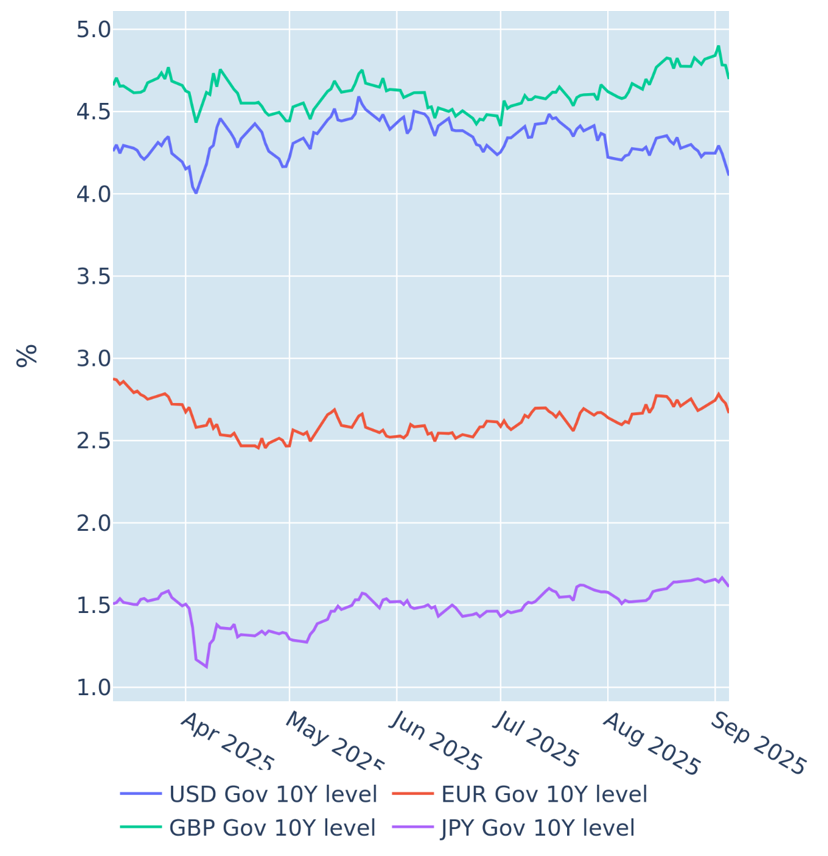

Budget concerns push Gilt yields to multi-decade highs

Last week’s drop in Treasury yields also pulled British Gilt rates into the red, despite ultra-long yields having soared to 27-year highs earlier in the week. The 30-year benchmark rate climbed to 5.9% for the first time since 1998 on Tuesday, amid concerns over the sustainability of Rachel Reeves’ fiscal strategy. The rise in borrowing costs makes it increasingly harder for the British chancellor to stay within her self-imposed boundaries of covering day-to-day spending from revenues alone—without raising income taxes—and to only borrow for investment.

Despite Friday’s decline, Britain still faces the highest financing costs among the G7 nations, as the country battles with persistent inflation, which is partially self-inflicted through higher corporate taxes and minimum wages. This in turn restrains the Bank of England’s ability to ease monetary conditions, with SONIA forwards implying a maximum of two rate cuts to 3.5% over the next 12 months. This compares to the European Central Bank having already concluded its easing cycle at 2% and a ‘terminal’ rate of under 3% projected for the Federal Reserve.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated September 5, 2025) for further details.

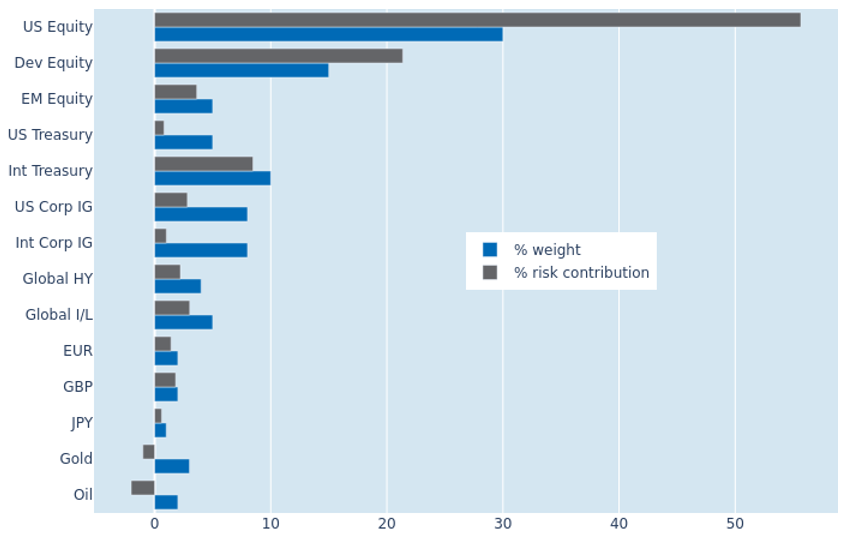

Negative commodity correlation reduces portfolio risk

The predicted short-term risk of the Axioma global multi-asset class model portfolio eased by another 0.3% to 5% as of Friday, September 5, 2025, as exchange rates against the US dollar became less correlated with stock markets and commodity prices. Gold was the biggest beneficiary, with its percentage risk contribution flipping from +1.8% to -1%, while oil also expanded its risk-reducing capabilities from -1.3% to -2.1%. US equities, on the other hand, recorded a 2.6% increase in their share of overall volatility to 55.6%. Developed non-US stocks also added more risk, but the increase of 0.9% was smaller, due to the weaker co-movement with FX rates.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated September 5, 2025) for further details.

You may also like