MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED SEPTEMBER 12, 2025

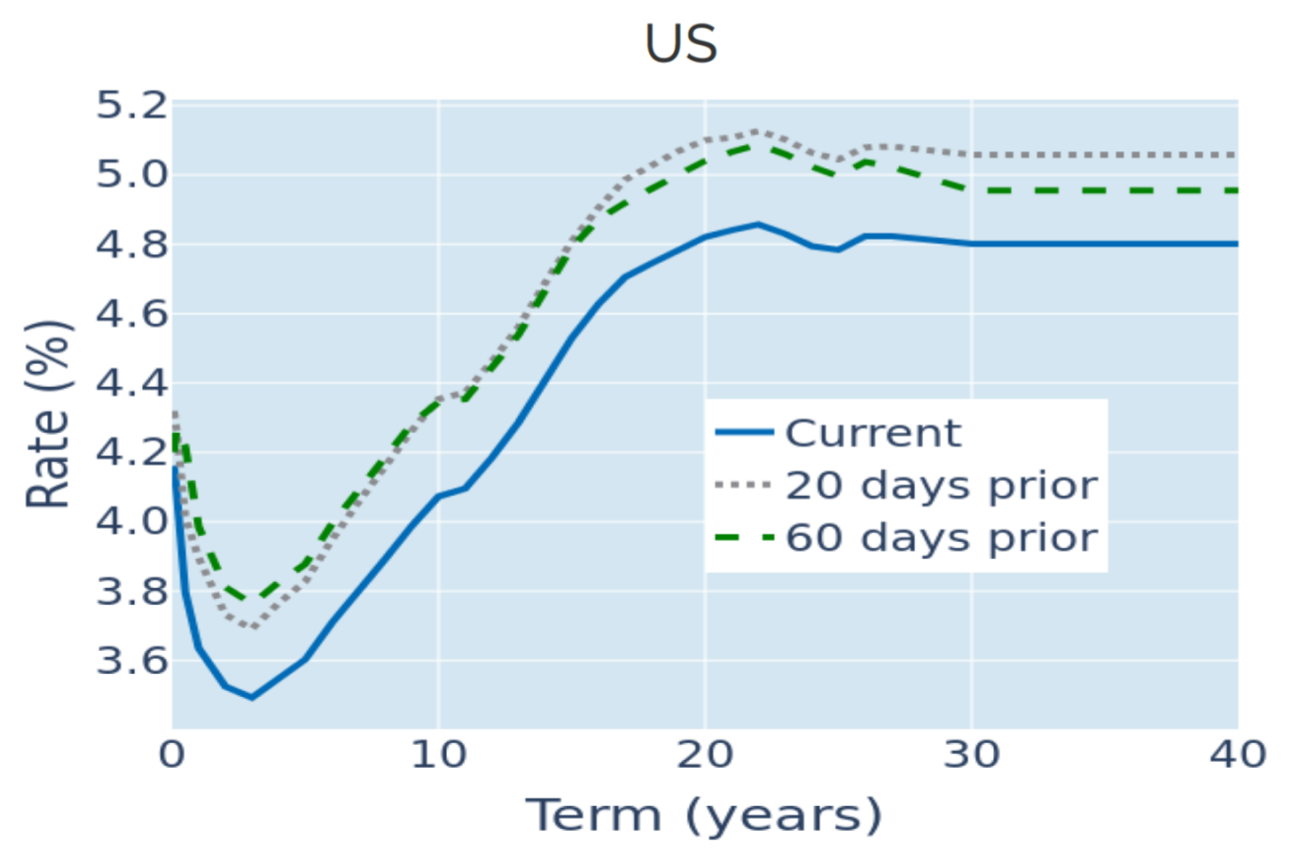

Treasury curve flattens over growing stagflation fears

The term premium of long over short-term Treasury yields narrowed to its tightest level in six weeks in the week ending September 12, 2025, amid growing concerns over a potential stagflation scenario.

The Bureau of Labor Statistics (BLS) reported on Thursday that US headline consumer price growth increased from 2.7% in July to 2.9% in August, while core inflation remained stable at 3.1%. Both numbers were in line with analyst predictions, and the monetary policy-sensitive 2-year yield initially fell after the news was released, but still ended the week 5 basis points higher.

Long rates, on the other hand, recorded a fourth weekly decline of 0.04%, as the BLS revised downward the number of jobs created in the twelve months to March by 911,000 in a separate report, roughly halving the number of new positions previously reported for that period. The downward adjustment marks the biggest revision on record, indicating that the American economy might be even weaker than originally thought.

The data and the market reaction highlight the Federal Reserve’s conundrum of balancing its mandates of achieving price stability and maximum employment. Traders appear to betting on the latter, despite the uptick in short Treasury yields, with three rate cuts still expected before the year is out. The projected federal funds rate for December 2026 rose slightly from 2.85% to 2.93%, but still remained below 3%.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated September 12, 2025) for further details.

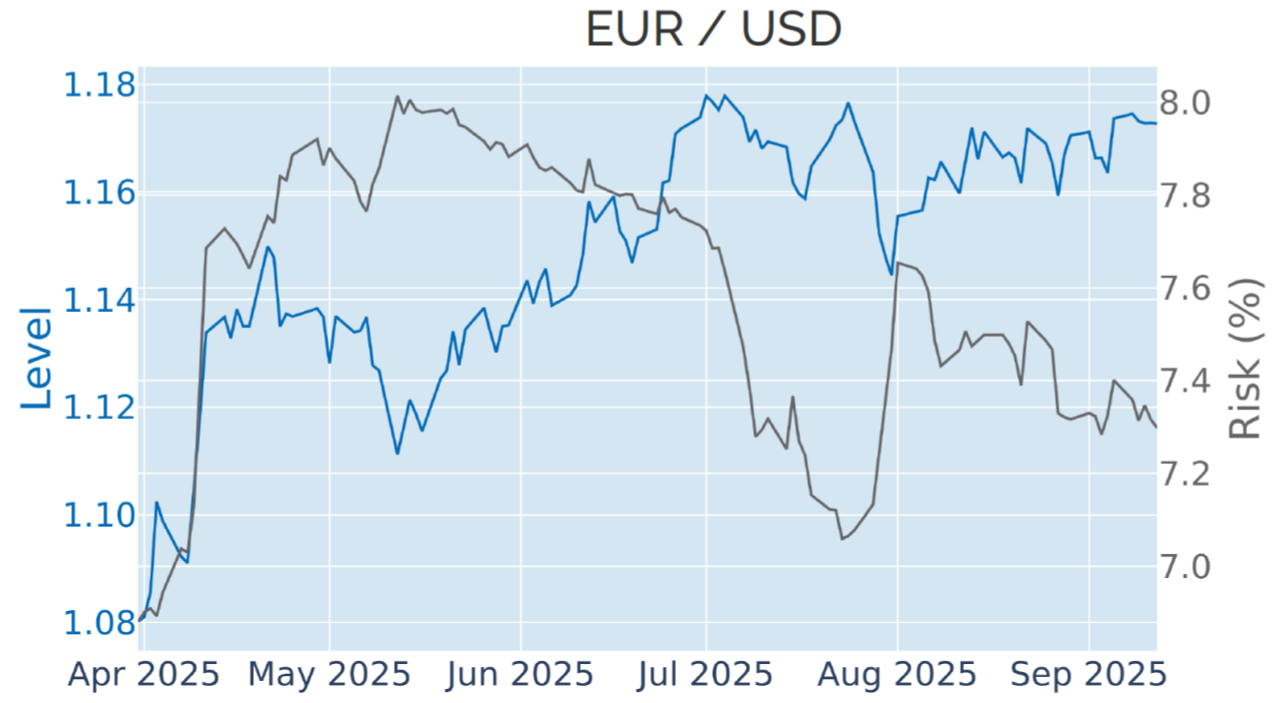

Euro holds steady amid French government turmoil

The euro held steady against the US dollar in the wake of last week's no-confidence vote against the French prime minister Francois Bayrou, as markets had already priced in the outcome three weeks earlier.

When Bayrou announced his intention of asking parliament to back his controversial austerity budget on August 25, the risk premium of French OATs over German Bunds soared by more than 10 basis points, while the euro lost over 1% against its American rival. France’s CAC 40 bluechip index also fell by more than 3% in two days, with banks bearing the biggest losses of 8-10%. Financial institutions are particularly vulnerable to widening sovereign risk premia, as they tend to hold large amounts of domestic government debt for regulatory and funding purposes.

In our recent study on the French government crisis, we found that the current behavior of the local bond and stock markets is consistent with past episodes of political uncertainty in France, such as the snap parliamentary election last June and the two previous presidential votes in 2022 and 2017.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated September 12, 2025) for further details.

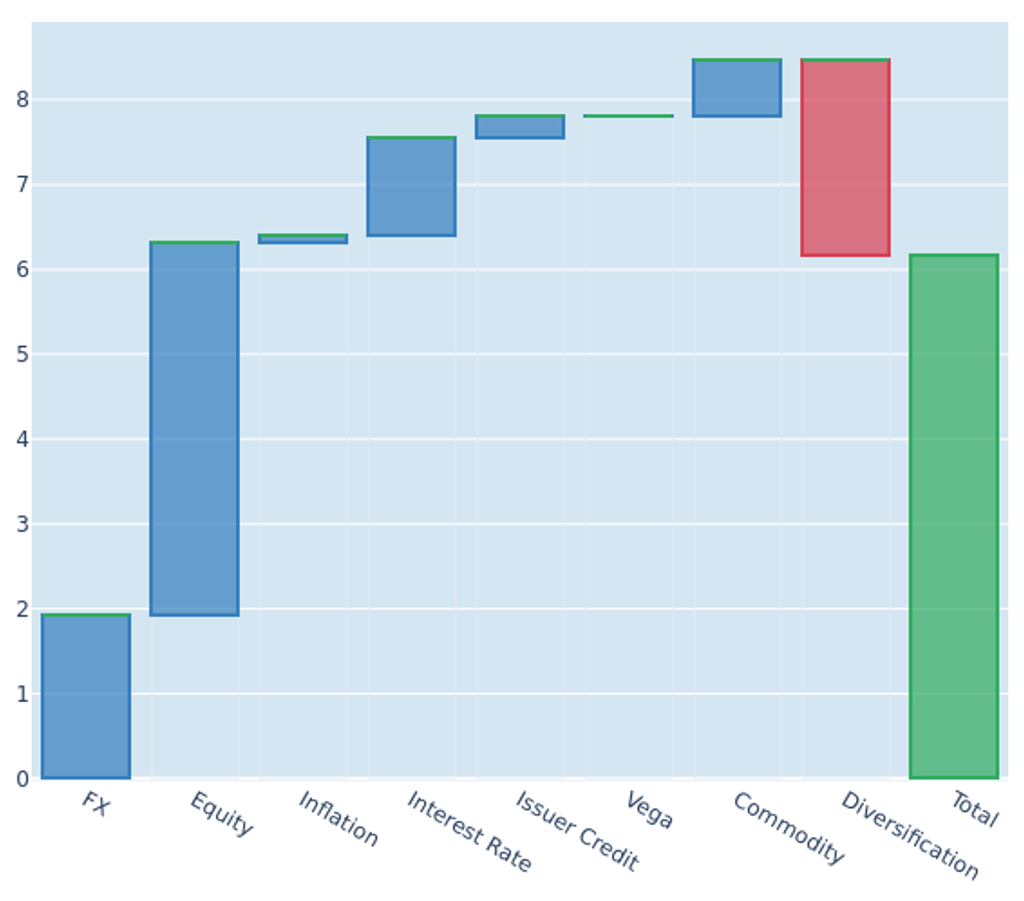

Renewed equity-bond co-movement limits portfolio diversification

The predicted short-term risk of the Axioma global multi-asset class model portfolio resurged by 1.2 percentage points to 6.2% as of Friday, September 12, 2025, as US stocks and bonds rose together for the second week in a row. The renewed focus on monetary policy means that the two major asset classes move in tandem once more, while the dollar is again inversely related to share prices. The resulting co-movement of equity and fixed income securities as well as exchange rates against the USD severely limits diversification opportunities, with oil now the only asset that actively reduces total portfolio volatility.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated September 5, 2025) for further details.

You may also like