MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED SEPTEMBER 19, 2025

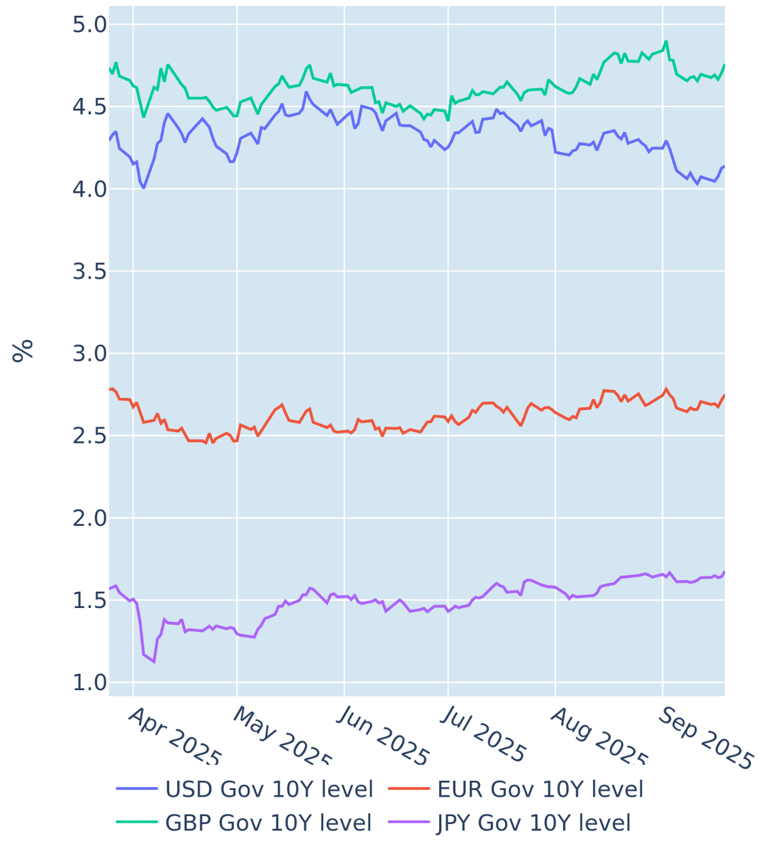

US Treasury yields rise despite Fed rate cut

US Treasury yields rose across most maturities in the week ending September 19, 2025, despite the Federal Reserve lowering interest rates for the first time this year and signaling further easing to support a weakening labor market. In the press conference following Wednesday’s decision, Fed chair Jerome Powell reiterated the “shift in the balance of risks” from a “one-time shift in the price level” toward “downside risk in employment.”

FOMC members also adjusted their interest rate projections accordingly, with 10 of the 19 rate setters now agreeing with market predictions of two more cuts this year, compared with only two participants at the previous update in June. But traders appeared to be much more optimistic for next year, as only five central bank governors seemed to share the market projection of a federal funds rate under 3% by the end of 2026.

The seemingly paradoxical reaction of the bond market to the latest Fed rate cut appears to indicate that investors are more concerned about the long-term impact of tariffs and increased fiscal spending on inflation and borrowing costs than the immediate damage to the American economy. If the White House keeps pressuring the central bank to ease monetary conditions by more than what is currently priced in, the market response is likely to be even more severe, as modeled in our recent paper on Stress Testing the Loss of Fed Independence.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated September 19, 2025) for further details.

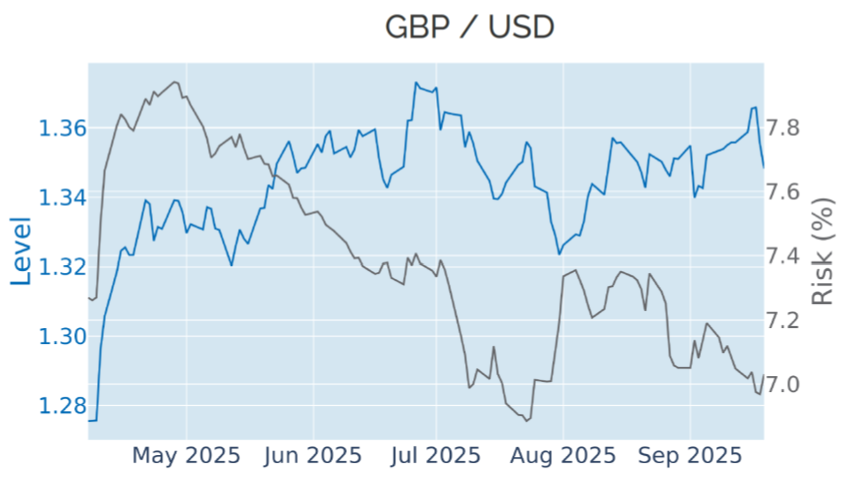

Pound drops as BoE hold rates steady

The pound sterling lost 0.6% against the US dollar and 0.8% against the euro in the week ending September 19, 2025, as the Bank of England left its policy rate unchanged on Thursday, after inflation held steady a day earlier. The Office for National Statistics reported on Wednesday that British headline consumer prices grew by 3.8% in the twelve months to August—stable from the previous month and in line with analyst predictions. Consequently, Monetary Policy Committee members voted 7-2 to keep the base rate at 4%, noting that “upside risks around medium-term inflationary pressures remain prominent.”

The 10-year benchmark Gilt yield ended the week 6 basis points higher in response, while the FTSE 100 index was down 0.7%. The simultaneous fall of stock and bond prices together with a weakening exchange is consistent with the behavior observed over the past four years and is an indication that market participants remain concerned about persistent inflation and tight monetary conditions in the UK.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated September 19, 2025) for further details.

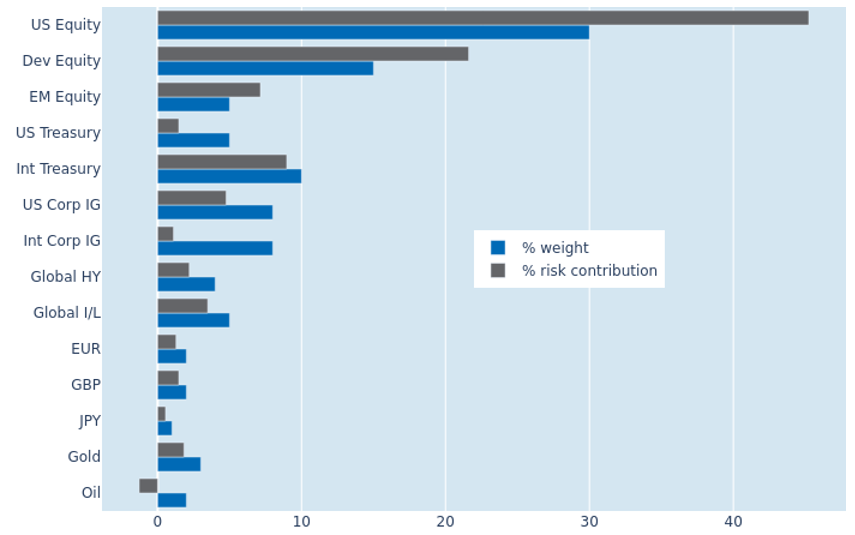

Portfolio risk eases as stocks decouple from FX and interest rates

The predicted short-term risk of the Axioma global multi-asset class model portfolio eased back to 5.5% as of Friday, September 19, 2025, down from 6.2% the week before. The risk reduction was mostly due to a decoupling of share prices from sovereign bond returns and exchange rates against the US dollar. US equities recorded the biggest decline of 3.3% in their percentage risk contribution to 45.2%, as they appeared less positively correlated with their counterparts from other developed nations. Oil, on the other hand, saw its risk-reducing effect more than half from -2.6% to -1.2%, with its price becoming less inversely related with FX returns.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated September 19, 2025) for further details.

You may also like