MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED SEPTEMBER 26, 2025

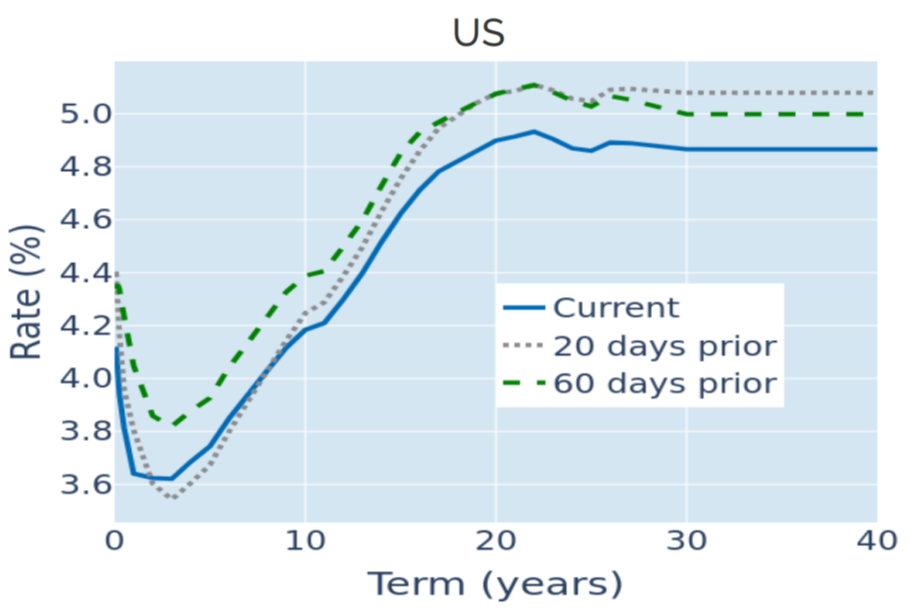

US Treasury yields continue to climb over stronger GDP growth

US Treasury yields continued to climb in the week ending September 26, 2025, as traders revised their monetary policy expectations upward in the light of stronger-than-expected GDP data. According to an updated estimate from the Bureau of Economic Analysis on Thursday, the American economy expanded at an annualized rate of 3.8% from April to June, which represents the strongest growth since Q3 2023. It is also half a percentage point higher than the previous reading from August, mostly on the back of a sharp upward revision in consumer spending.

In response, the projected average federal funds rate for December 2026 surged by 14 basis points to 3.1%, which represents only another 100 basis points worth of further monetary easing from current levels. The rate increase propagated across the entire Treasury curve, with the biggest increase of 0.1% at the 3-year point, while the 10-year benchmark ended the week 5 basis points higher.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated September 26, 2025) for further details.

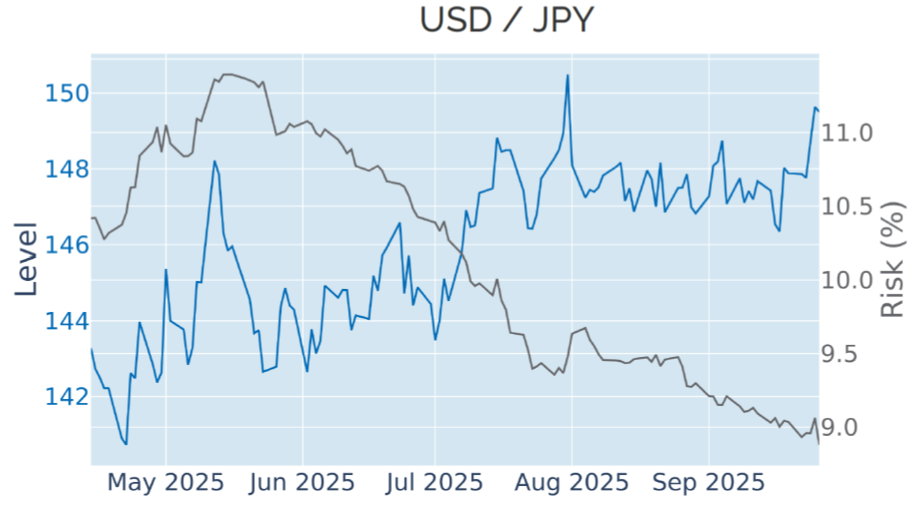

Dollar rises with rates as investor focus is back on Fed

Last week’s rise in US interest rates also boosted the dollar against all its major trading partners, marking the fourth consecutive week in which the two market indicators have moved together. This indicated that the focus is very much back on monetary policy, which was further underpinned by how the stock market behaved over the same period. The weaker-than-expected labor market report for August and the revisions of earlier jobs data in the first two weeks of this month as well as the subsequent Fed rate cut the week after were all accompanied by rising share prices. This “bad news is good news” sentiment suggests that investors overweight the perceived benefits of lower rates against the potential economic woes signaled by weaker jobs reports. The reverse logic also held last week when a stronger-than-expected GDP release resulted in a stock market downturn, as the central bank may no longer ease monetary conditions as much as previously expected.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated September 26, 2025) for further details.

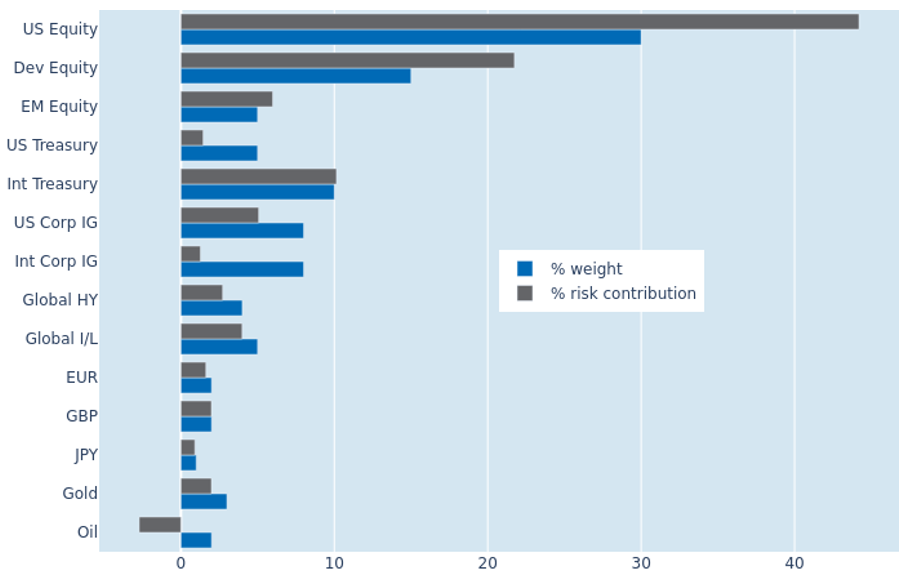

Stronger FX-equity co-movement cancels out lower volatility

The predicted short-term risk of the Axioma global multi-asset class model portfolio held steady at 5.5% on Friday, September 26, 2025, as the benefits of lower stock market volatility were canceled out by a slightly stronger co-movement of share prices and exchange rates against the USD. This meant that US equities saw their share of total portfolio risk decline by one percentage point to 44.2%, while the percentage risk contribution of non-US developed stocks held steady just under 22%. Non-USD government bonds, on the other hand, appeared riskier, as their local losses from higher yields were amplified by weakening currencies. Meanwhile, oil more than doubled its risk-reducing capabilities from -1.2% to -2.7%, due to a more negative correlation with share prices.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated September 26, 2025) for further details.

You may also like