MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED OCTOBER 3, 2025

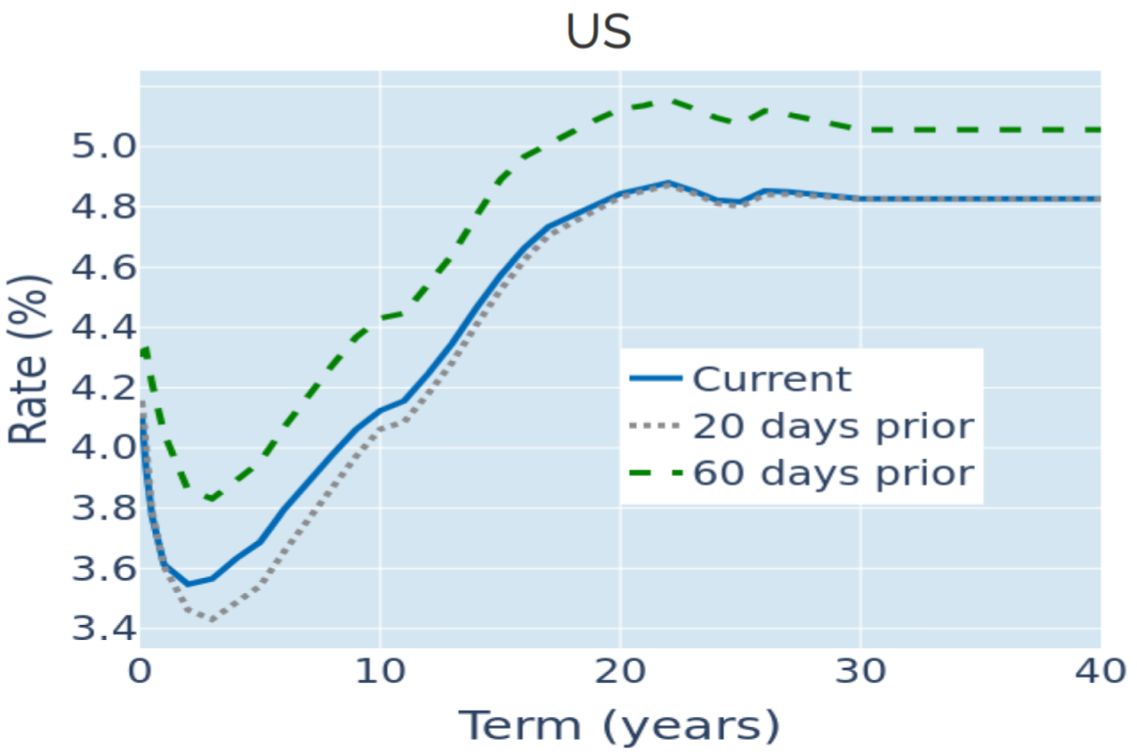

Cooling labor market depresses Treasury yields

US Treasury yields fell across all maturities in the week ending October 3, 2025, amid further indications of a cooling labor market. Under normal circumstances, the main focal point last week would have been the monthly non-farm payroll release on Friday, but no numbers were produced by the Bureau of Labor Statistics this month due to the ongoing government shutdown. This meant that traders paid more attention to a separately compiled report by payrolls processor ADP on Wednesday, which showed that private businesses in the United States shed 32,000 jobs in September. The number marked the steepest decline in employment since March 2023 and defied analyst forecasts of an increase of 50,000 new positions.

The dire jobs report reinvigorated hopes for more monetary easing, with the projected average federal funds rate for December 2026 falling back below 3%. The monetary policy-sensitive 2-year yield recorded the steepest decline of 8 basis points, while the 10-year benchmark ended the week 0.06% lower.

In accordance with the prevailing sentiment that “bad news is good news”, the prospect of lower interest rates once again boosted share prices despite the underlying concerns over the health of the American economy.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated October 3, 2025) for further details.

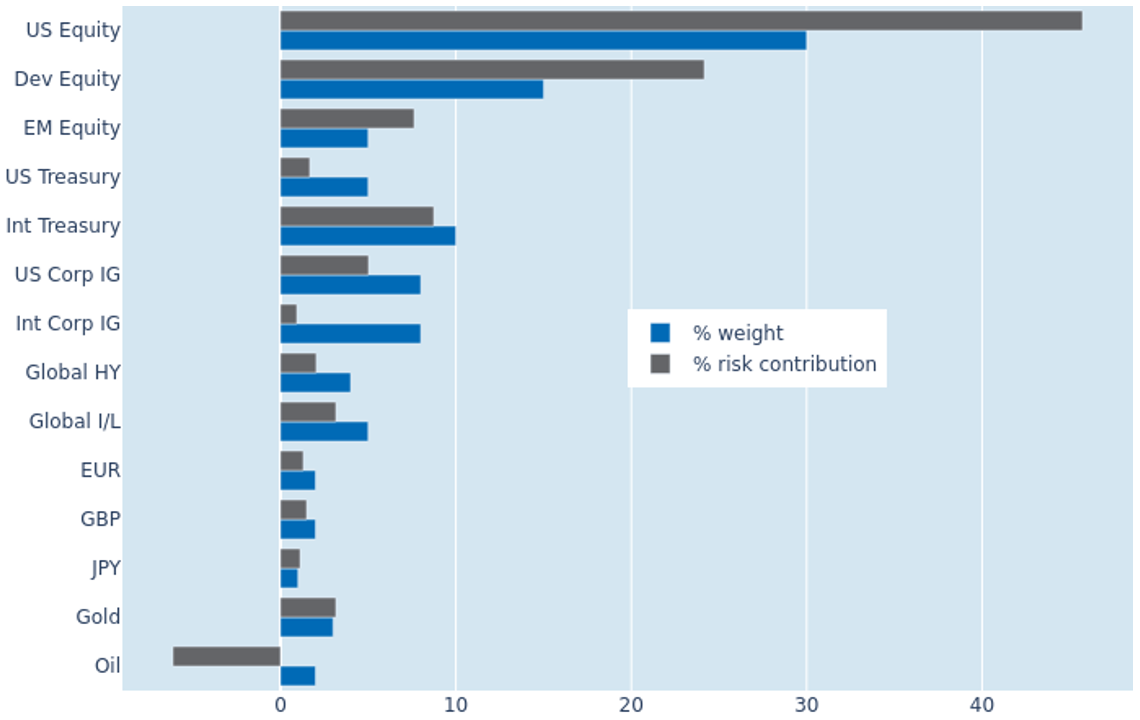

Portfolio risk eases slightly as change in FX and equity volatilities balance each other

The predicted short-term risk of the Axioma global multi-asset class model portfolio eased slightly from 5.5% to 5.4% as of Friday, October 3, 2025, as the adverse effects of stronger stock market volatility were more than offset by weaker FX rate fluctuations and a more negative correlation between equity and commodity prices. Non-US developed and emerging market equities still recorded the biggest increases in their percentage risk contributions of 2.4% and 1.8%, respectively, while US shares also saw their share of total portfolio volatility expand from 44.2% to 45.8%. At the other end of the spectrum, oil again more than doubled its risk-reducing properties from -2.7% to -6.2%, due to an even more inverse relationship with stock prices. Non-USD sovereign bonds also added 1.4 percentage points less to overall risk, as gains from lower yields were dampened by weaker exchange rates against the US dollar.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated October 3, 2025) for further details.

You may also like