MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED OCTOBER 10, 2025

Returning trade worries trigger flight to safety

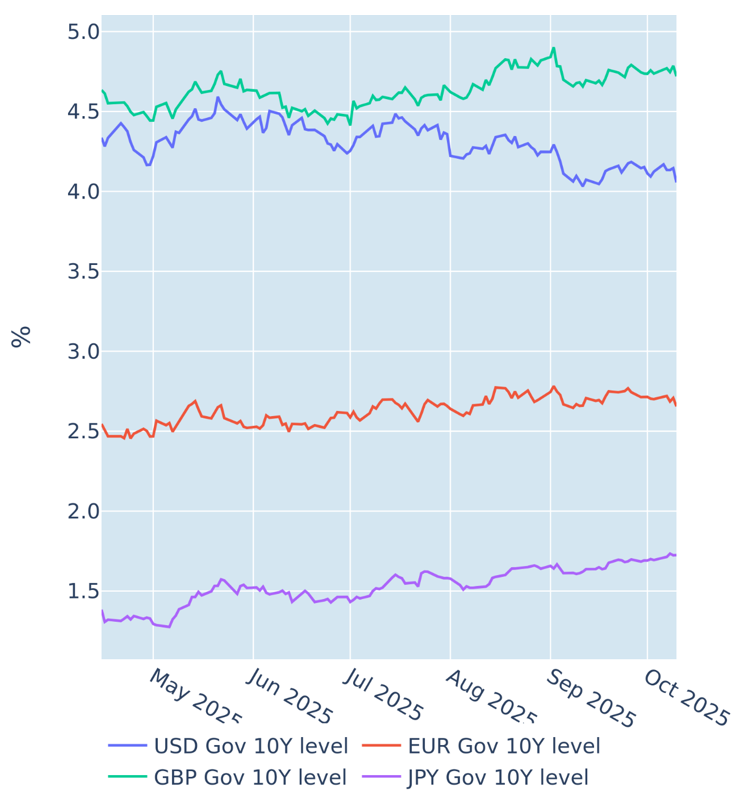

Treasury yields fell for a second consecutive week to a 4-week low on October 10, 2025, after Donald Trump threatened to announce retaliatory tariffs of 100% on Chinese goods in response to China’s decision to tighten export controls on critical minerals. The 10-year benchmark rate plummeted 9 basis on Friday, which marks its biggest daily drop since August 1, when a weaker-than-expected jobs report sent the bond market bellwether into a -0.14% tailspin.

Share prices also tumbled in response to the news, marking their steepest daily selloff since the aftermath of the Liberation Day tariffs in early April, despite short-term interest rate futures pricing in more monetary easing from the Federal Reserve. This marks a notable break away from the “bad news is good news” pattern prevailing in September and shows that unlike a weakening labor market, the damage inflicted on the American economy by trade barriers cannot be as remedied by lower interest rates.

Please refer to Figures 4 & 6 of the current Multi-Asset Class Risk Monitor (dated October 10, 2025) for further details.

Yen tumbles and JGB curve steepens after Takaichi election win

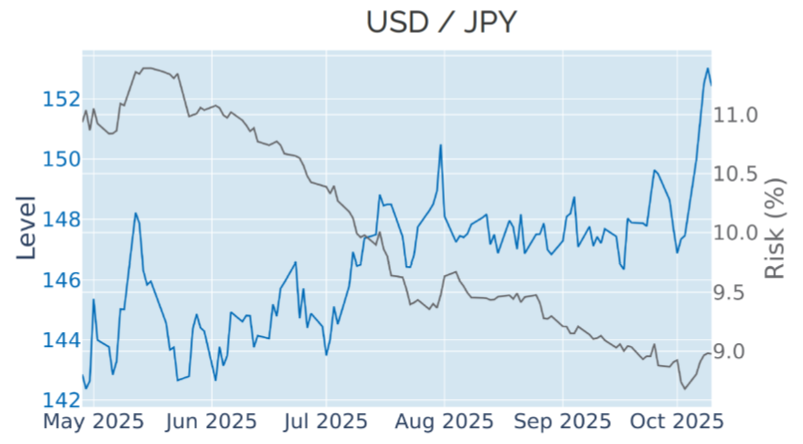

The yen depreciated 3.3% against the US dollar last week in its steepest weekly decline in over a year in response to Sanae Takaichi’s surprise victory in the LDP leadership election. Her success in the contest puts Takaichi on track to become Japan’s first female prime minister later this month, with her administration expected to expand fiscal spending and to try to delay further monetary tightening from the Bank of Japan.

The JGB curve steepened accordingly, as the monetary policy-sensitive 2-year rate ended the week 2 basis points lower, while fiscal concerns propelled the 10-year benchmark to its highest level since June 2008. Yield increases were even bigger at the 30-year point, which rose to nearly 3.3% for the first time in its history.

Please refer to Figures 3, 4, & 6 of the current Multi-Asset Class Risk Monitor (dated October 10, 2025) for further details.

Portfolio risk eases as bond gains dampen equity and FX losses

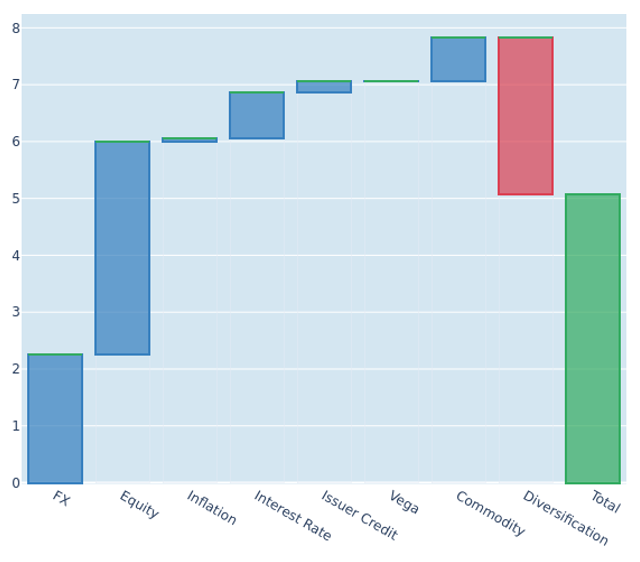

The predicted short-term risk of the Axioma global multi-asset class model portfolio eased further from 5.4% to 5.1% as of Friday, October 10, 2025, as last week’s sharp stock market losses were dampened by price gains for fixed income instruments. The concurrent strengthening of the dollar also meant that exchange rates were less positively correlated with bond returns, which further increased diversification benefits for USD-denominated portfolios from being invested across asset classes and regions.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated October 10, 2025) for further details.

You may also like