Government shutdowns

Wall Street hasn't blinked since 1982

Authors

Investment Decision Research

Diana Baechle, Olivier d’Assier, Christoph Schon

Source: S&P Dow Jones Indices, Axioma by SimCorp

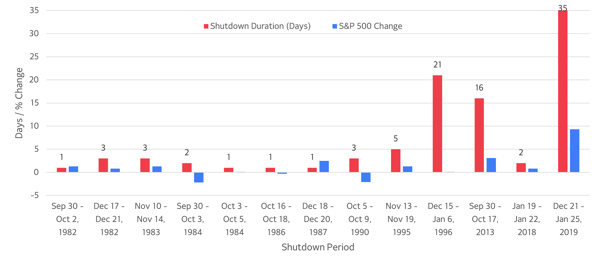

This equity market resilience can be attributed to the fact that government shutdowns typically result in only a temporary halt to certain federal expenditures, without significantly disrupting the broader economy or corporate earnings, highlighting that markets tend to react more to economic fundamentals than political gridlock.

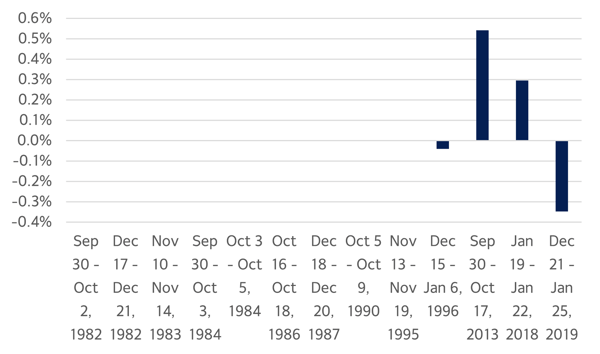

The stock market’s relative calm was also evident in the minimal changes to the short-term risk forecast for the S&P 500 index, as measured by the Axioma US5.1 fundamental model. Notably, the shutdowns between 1982 and 1995 showed no change in risk. During the longest shutdown, forecast risk actually declined the most (by 35 basis points), while the largest increase in risk was a modest 54 basis points during the 2013 shutdown (Figure 2).

Figure 2: Short-Horizon Predicted Risk Changes for the S&P 500

Source: S&P Dow Jones Indices, Axioma US5.1 Fundamental Short-Horizon Risk Model

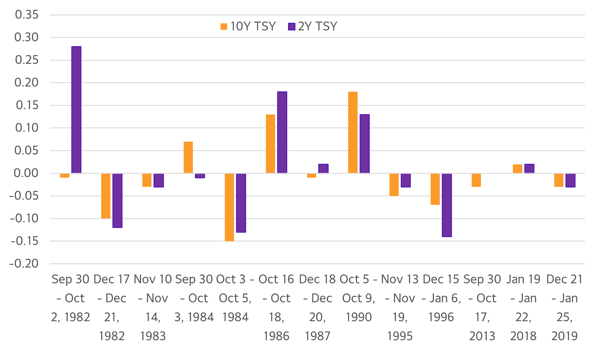

Treasury markets have shown a similar pattern of calm during government shutdowns. These events typically lead to mixed and modest fluctuations in bond yields. For instance, both 2-year and 10-year Treasury yields rose during the 1986 and 1990 shutdowns, but declined in about half of the cases overall (Figure 3).

Importantly, Treasury payments continue uninterrupted, as shutdowns do not impact the government's debt obligations, except in cases linked to separate debt ceiling crises. For bondholders, the key concern is receiving their payments on time, not whether federal employees are getting paid.

Figure 3: Changes in 10-Year and 2-Year Treasury Yields

Source: S&P Dow Jones Indices, Axioma

The clear takeaway is that government shutdowns rarely have a meaningful impact on markets. They are primarily political events with limited influence on economic fundamentals. As shutdowns become more frequent, maintaining a long-term perspective, rather than reacting to short-term political noise, remains the most effective strategy for navigating uncertainty.

Related Content