MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED JANUARY 30, 2026

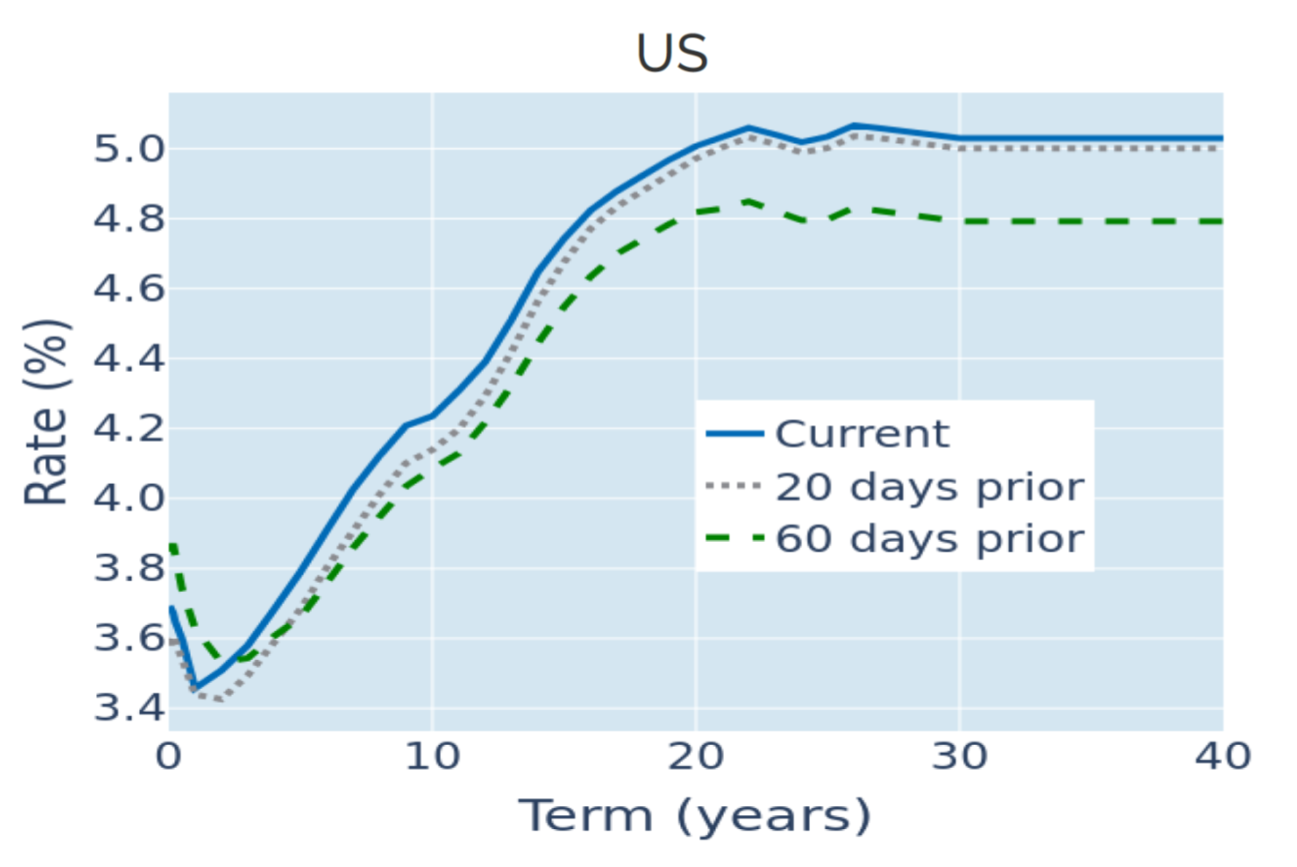

Treasury curve steepens after Warsh’s Fed chair nomination

The term premium of long over short US Treasury yields climbed to a 3-year high on Friday, January 30, 2026, following President Trump’s nomination of Kevin Warsh to succeed Jerome Powell as Federal Reserve chair when the latter’s term expires in May. Warsh was a Fed governor from 2006 to 2011 and became a prominent critic of the quantitative easing measures introduced by the central bank on the wake of the 2008 global financial crisis. The rise in long-term borrowing costs reflects Warsh’s long-standing preference for a smaller Fed balance sheet, which means that the central bank is less likely to absorb future debt issuance. But at the short end of the curve, traders still expected two more rate cuts over the remainder of this year, resulting in slightly lower rates at the 2-year point.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated January 30, 2026) for further details.

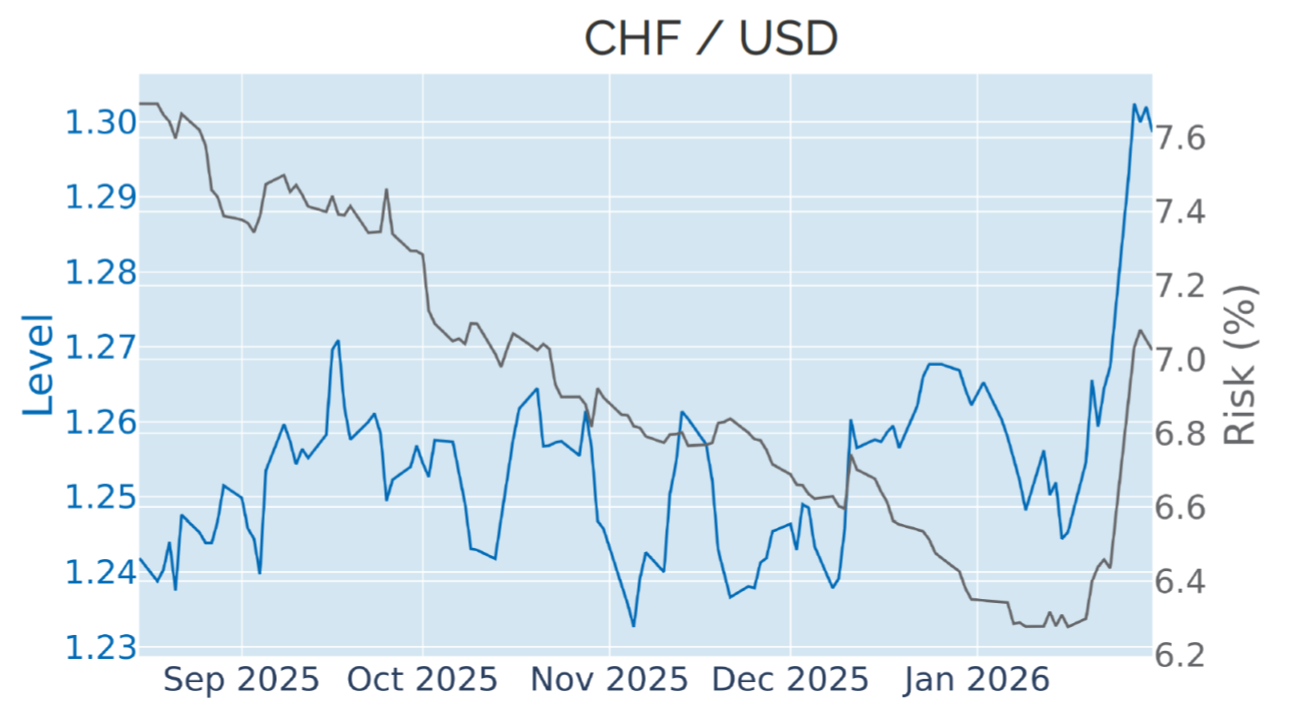

Dollar plummets as Trump remains unconcerned

The dollar plummeted to its weakest level in almost four years against a basket of major trading partners in the week ending January 30, 2026, after President Trump publicly dismissed concerns about the currency’s decline on Tuesday. Since Trump took office a little more than a year ago, the Dollar Index has depreciated by more than 12%, with European currencies as the biggest beneficiaries of the “sell America” trade. The euro and the pound both climbed to their strongest values since 2021, having gained 17% and 13%, respectively, against their American rival over the past twelve months. The Swiss franc even soared to heights last recorded when S&P downgraded US government debt in August 2011, taking its total 1-year gain to nearly 20%.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated January 30, 2026) for further details.

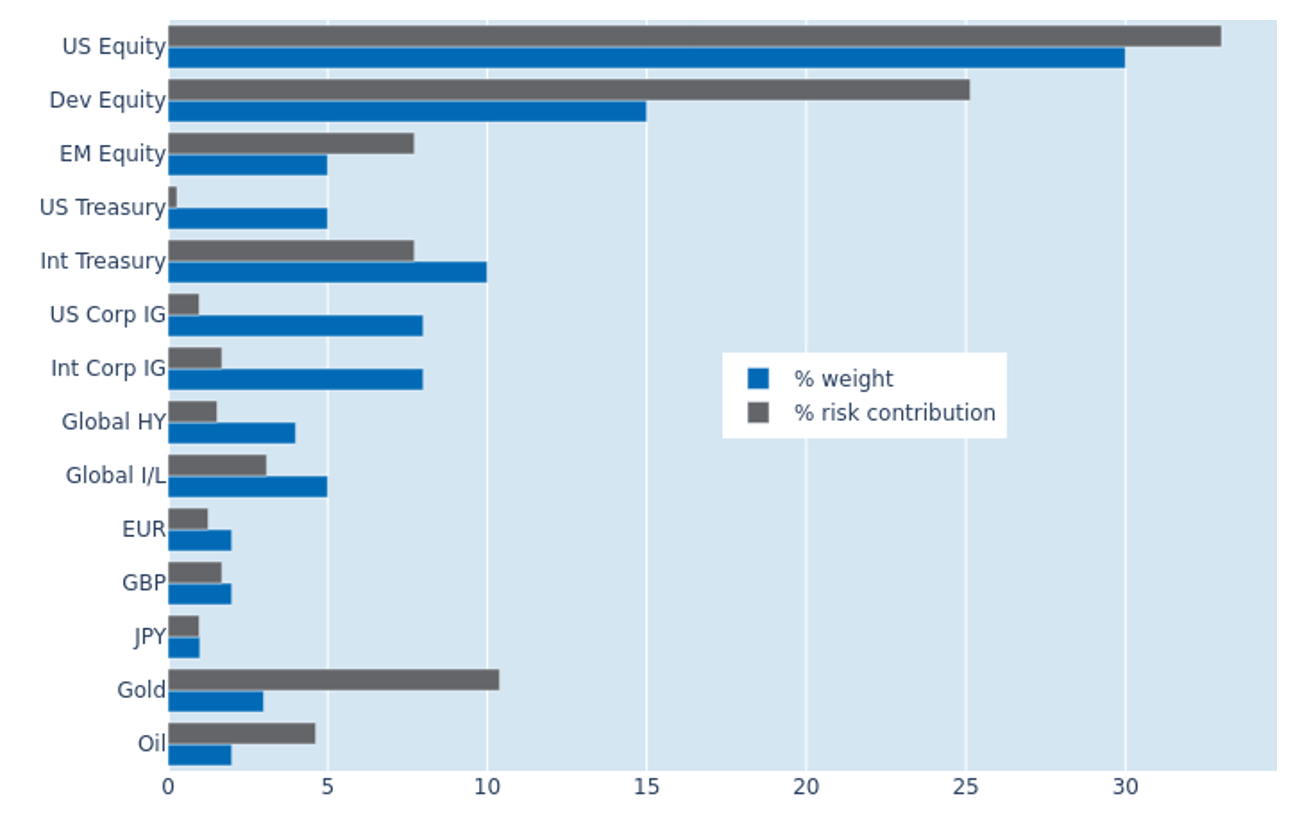

Portfolio risk resurges over doubling FX volatility

The predicted short-term risk of the Axioma global multi-asset class model portfolio resurged to 7.1% as of Friday, January 30, 2026, as average FX volatility doubled from 3% to 6%. The greater exchange rate fluctuations affected all non-USD assets, with international sovereign bonds and developed equities seeing their percentage risk contributions expand by 4.8% and 4.2%, respectively. The three foreign currency cash holdings (EUR, GBP, JPY) also each recorded a 1-percentage point increase in its share of overall volatility. The weaker dollar boosted the gold price as well, and the precious metal now accounts for 10.4% of total portfolio risk—3.5 times its monetary weight and its biggest risk contribution since the inception of the model portfolio in 2017. On the other side of the ledger, US equities were no longer the biggest source of risk relative to their market value weight, as their percentage risk contribution dwindled from more than half to just one third.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated January 30, 2026) for further details.

You may also like